FUND.ACCT.PRIN.

25th Edition

ISBN: 9781260247985

Author: Wild

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 7E

Exercise 19-7

Cost flows in a jab order costing system

P1 P2 P3 P4

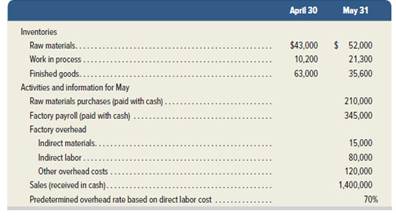

The following information is available for Lock-Tite Company, which produces special-order security products and uses a

Compute the following amounts for the month of May.

1. Cost of direct materials used.

2. Cost of direct labor used.

3. Cost of goods manufactured.

4. Cost of goods sold.*

5. Gross profit.

6. Overapplied or underapplied

*Do not consider any underapplied or overapplied overhead. Check (3) $626,400

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Exercise 5.19Journal Entries, T-AccountsObjective 4 - Describe the cost flows associated with job-order costing, andprepare the joumal entries.Kapoor Company uses job-order costing. During January, the following datawere reported:a. Materials purchased on account: direct materials, $98,500; indirectmaterials, S14,800.b. Materials issued: direct materials, S82,500; indirect materials, S8,800.c. Labor cost incurred: direct labor, $67,000; indirect labor, $18,750.d. Other manufacturing costs incurred ( all payables), S46,200.e, Overhead is applied on the basis of 110 percent of direct labor cost.f. Wark finished and transferred to Finished Goods Inventory cost$230,000.g. Finished goods costing S215,000 were sold on account for 140 percentof cost.h. Any over- or underapplied overhead is closed to Cost of Goods Sold.Required:1, Prepare journal entries to record these transactions.2. Prepare a T-account for Overhead Control. Post all relevant information to thisaccount. What is the ending…

Problem 22: Cost of Goods Sold Statement

Julius Inc. is employing normal costing for its job orders. The overhead is applied using a predetermined overhead rate. The following information relates to the Julius Inc. for the year ended December 31, 2020:

Job No. 101 Job No. 102 Job No. 103

Job in Process, January 1, 2020:

Direct Materials 40,000 30,000 0

Labor 60,000 40,000 0

Factory Overhead 30,000 20,000 0

Costs added during 2020

Materials 20,000 10,000 100,000

Labor 100,000…

S

Raw materials

Work in process

Finished goods

Beginning Inventory

$ 28,100

22,200

79,400

Raw materials purchases

Indirect materials used

Direct labor

Additional information for the month of March follows:

Manufacturing overhead applied

Selling, general, and administrative expenses

Sales revenue

Required 1 Required 2

Inventory

Required:

1. Based on the above information, prepare a cost of goods manufactured report.

2. Based on the above information, prepare an income statement for the month of March.

Complete this question by entering your answers in the tabs below.

$ 25,300

45,600

68,900

Sales Revenue

Less: Cost of Goods Sold

Beginning Finished Goods Inventory

Less: Ending Finished Goods Inventory

Cost of Goods Sold

Gross Profit

Based on the above information, prepare an income statement for the month of March.

Stor Smart Company

Income Statement

For the Month of March

Net Income (Loss) from Operations

$ 41,300

1,800

63,900

36,000

24,900

237,600

Chapter 19 Solutions

FUND.ACCT.PRIN.

Ch. 19 - Jobs and job lots C1 Determine which of the...Ch. 19 - Job cost sheets C2 Clemens Cars's job cost sheet...Ch. 19 - Documents in job order costing P1 P2 P3 The left...Ch. 19 - Raw materials journal entries P1 During the...Ch. 19 - Prob. 5QSCh. 19 - Prob. 6QSCh. 19 - Prob. 7QSCh. 19 - Prob. 8QSCh. 19 - Prob. 9QSCh. 19 - Prob. 10QS

Ch. 19 - Prob. 11QSCh. 19 - Prob. 12QSCh. 19 - Jab order costing of services A1 An advertising...Ch. 19 - Job order costing of services A1 An advertising...Ch. 19 - Job cost sheet C2 Eco Skate makes skateboards from...Ch. 19 - Prob. 16QSCh. 19 - Prob. 17QSCh. 19 - Prob. 18QSCh. 19 - Prob. 19QSCh. 19 - Prob. 20QSCh. 19 - Prob. 21QSCh. 19 - Prob. 22QSCh. 19 - Prob. 23QSCh. 19 - Prob. 24QSCh. 19 - Exercise 19-1 Job order production C1 Match each...Ch. 19 - Exercise 19-2 Job cost computation C2 The...Ch. 19 - Exercise 19-3 Analysis of cost flows C2 As of the...Ch. 19 - Exercise 19-4 Recording product costs P1 P2 P3...Ch. 19 - Exercise 19-5 Manufacturing cost flows P1 P2 P3...Ch. 19 - Exercise 19-6 Recording events in job order...Ch. 19 - Exercise 19-7 Cost flows in a jab order costing...Ch. 19 - Exercise 19-8 Journal entries for materials P1 Use...Ch. 19 - Exercise 19-9 Journal entries for labor P2 Use...Ch. 19 - Exercise 19-10 Journal entries for overhead P3 Use...Ch. 19 - Exercise 19-11 Overhead rate; costs assigned to...Ch. 19 - Exercise 19-12 Analyzing costs assigned to work in...Ch. 19 - Exercise 19-13 Adjusting factory overhead P4 Refer...Ch. 19 - Exercise 19-14 Adjusting factory overhead P4...Ch. 19 - Prob. 15ECh. 19 - Prob. 16ECh. 19 - Exercise 19-17 Overhead rate calculation,...Ch. 19 - Exercise 19-18 Job order costing for services A1...Ch. 19 - Exercise 19-19 Job order costing of services A1...Ch. 19 - Exercise 19-20 Direct materials journal entries P1...Ch. 19 - Prob. 21ECh. 19 - Prob. 22ECh. 19 - Prob. 23ECh. 19 - Prob. 24ECh. 19 - Prob. 25ECh. 19 - Prob. 26ECh. 19 - Prob. 27ECh. 19 - Prob. 28ECh. 19 - Prob. 29ECh. 19 - Prob. 30ECh. 19 - Prob. 31ECh. 19 - Problem 19-1A Production costs computed and...Ch. 19 - Problem 19-2 A Source documents, journal entries,...Ch. 19 - Prob. 3PSACh. 19 - Prob. 4PSACh. 19 - Problem 19-5A Production transactions, subsidiary...Ch. 19 - Problem 19-1B Production costs computed and...Ch. 19 - Prob. 2PSBCh. 19 - Prob. 3PSBCh. 19 - Problem 19-4B Overhead allocation and adjustment...Ch. 19 - Problem 19-5B Production transactions, subsidiary...Ch. 19 - The computer workstation furniture manufacturing...Ch. 19 - The General Ledger tool in Connect automates...Ch. 19 - Manufacturers and merchandisers can apply...Ch. 19 - Prob. 2AACh. 19 - Apple and Samsung compete in the global...Ch. 19 - Prob. 1DQCh. 19 - Some companies use labor cost to apply factory...Ch. 19 - Prob. 3DQCh. 19 - In a job order costing system, what records serve...Ch. 19 - What journal entry is recorded when a materials...Ch. 19 - Prob. 6DQCh. 19 - Google uses a "time ticket" for some employees....Ch. 19 - What events cause debits to be recorded in the...Ch. 19 - Prob. 9DQCh. 19 - Assume that Apple produces a batch of 1,000...Ch. 19 - 11. Why must a company use predetermined overhead...Ch. 19 - How would a hospital apply job order costing?...Ch. 19 - Harley-Davidson manufactures 30 custom-made,...Ch. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Assume that your company sells portable housing to...Ch. 19 - Assume that you are preparing for a second...Ch. 19 - Prob. 3BTNCh. 19 - Consider the activities undertaken by a medical...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identifying activity bases in an activity-based cost system Select Foods Inc. uses activity-based costing to determine product costs. For each activity listed in the left column, match an appropriate activity base from the right column. You may use items in the activity-base list more than once or not at all. Activity Activity Base Accounting reports Engineering change orders Customer return processing Kilowatt hours used Electric power Number of accounting reports Human resources Number of customers Inventory control Number of customer orders Invoice and collecting Number of customer returns Machine depreciation Number of employees Materials handling Number of inspections Order shipping Number of inventory transactions Payroll Number of machine hours Production control Number of material moves Production setup Number of payroll checks processed Purchasing Number of production orders Quality control Number of purchase orders Sales order processing Number of sales orders Number of setupsarrow_forwardIdentifying activity bases in an activity-based cost system Select Foods Inc. uses activity-based costing to determine product costs. For each activity listed in the left column, match an appropriate activity base from the right column. You may use items in the activity-base list more than once or not at all. Activity Activity Base Accounting reports Engineering change orders Customer return processing Kilowatt hours used Electric power Number of accounting reports Human resources Number of customers Inventory control Number of customer orders Invoice and collecting Number of customer returns Machine depreciation Number of employees Materials handling Number of inspections Order shipping Number of inventory transactions Payroll Number of machine hours Production control Number of material moves Production setup Number of payroll checks processed Purchasing Number of production orders Quality control Number of purchase orders Sales order processing Number of sales orders Number of setupsarrow_forward(Appendix 3A) Method of Least Squares Using Computer Spreadsheet Program The controller for Beckham Company believes that the number of direct labor hours is associated with overhead cost. He collected the following data on the number of direct labor hours and associated factory overhead cost for the months of January through August. Required: 1. Using a computer spreadsheet program such as Excel, run a regression on these data. Print out your results. 2. Using your results from Requirement 1, write the cost formula for overhead cost. (Note: Round the fixed cost to the nearest dollar and the variable rate to the nearest cent.) 3. CONCEPTUAL CONNECTION What is R2 based on your results? Do you think that the number of direct labor hours is a good predictor of factory overhead cost? 4. Assuming that expected September direct labor hours are 700, what is expected factory overhead cost using the cost formula in Requirement 2?arrow_forward

- Question 13All costs related to the manufacturing function in a company are:A. Prime costB. Conversion costC. Direct costD. Product cost Question 14In job-order cost system, the use of direct materials previously purchased usually is recorded as an increase in:A. Material accountB. Factor overhead appliedC. Factor overhead accountD. Work-in-process account Question 15The wages of factory janitorial staff should be classified as: A. Period costB. Factory overhead costC. Prime costD. Direct labor costarrow_forwardQuestion#6 For each item, identify all applicable cost labels. Use the following code in your answer:1 — Product Cost2 — Period Costa. Advertising _______b. Direct materials used _______c. Sales salaries _______d. Indirect factory labor _______e. Repairs to office equipment _______f. Factory manager's salary _______g. Direct labor _______h. Indirect materials _______arrow_forwardQuestion 4.1 For its overhead costs, the wholesale distributor Janz Company uses activity-based costing. In terms of the company's annual overhead costs and its activity-based costing system the following data has been provided: Overhead Costs: Wages and salaries $380,000 Non-wage expenses 90,000 Total $470,000 Distribution of Resource Consumption: Activity Cost Pools Filling Orders Product Support Other Total Wages and salaries 20% 65% 15% 100% Non-wage expenses 25% 15% 60% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. Shown below is the amount of activity for the year: Activity Cost Pool Filling orders Product support Annual Activity 3,100 orders 32 products Not applicable Other Instructions: Compute the activity rates for the Filling Orders and Product Support activity cost pools.arrow_forward

- Question 3 Teratoor Space provides interior design services in Bandar Teemor. It uses a job order costing system to accept orders from the customers. The manufacturing overhead cost is absorbed based on direct labour hour. The budgeted manufacturing overhead cost for the month of January is RM96,500. Management expects a total of 19,300 direct labour hours will be used. Prepare journal entries for the month of January: Jan Particular 13 19 22 26 30 Purchase 200 boxes of direct material from Bharatt on credit for RM4,200. 55 boxes of direct material was requested from the store for production. It was bought for RM11.50 per box. The decoration section has purchased 240 boxes indirect material which cost RM26.10 per box from Otara by cash. Direct labour cost paid for the month of January amounted to RM5,900. The depreciation cost of delivery van for the month of January is RM770. For the month of January, a total of 6,300 direct labour hours have been utilised.arrow_forwardProblem 4-18 Part 2 2. The expected activity for the year was distributed among the company's four products as follows: Activity Cost Pool Labor-related (DLHS) Purchase orders (orders) Materials receipts (receipts) Relay assembly (relays) General factory (MHS) Expected Activity Product A Product B Product C Product D 2,550 250 310 200 12,750 Product A Product B Product C Product D 650 500 176 200 8,300 3,400 1,750 414 1,000 8,200 1,900 1,000 0 1,100 11,750 Using the ABC data, determine the total amount of overhead cost assigned to each product. 1arrow_forward< Zoe Corporation has the following information for the month of March: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. Determine the cost of goods manufactured. $ b. Determine the cost of goods sold. $16,971 25,726 36,875 18,297 18,757 21,733 25,034arrow_forward

- Cost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $17,300 Direct labor 44,700 Factory overhead 28,800 Work in process inventory, May 1 72,100 Work in process inventory, May 31 76,400 Finished goods inventory, May 1 30,300 Finished goods inventory, May 31 34,600 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $- Select - $- Select - - Select - - Select - Total manufacturing costs incurred during May fill in the blank 22653a05d041061_9 Total manufacturing costs $fill in the blank 22653a05d041061_10 - Select - Cost of goods manufactured $fill in the blank 22653a05d041061_13 Question Content Area b. For May, using the data given, prepare a statement of Cost of Goods…arrow_forwardCost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $17,300 Direct labor 44,700 Factory overhead 28,800 Work in process inventory, May 1 72,100 Work in process inventory, May 31 76,400 Finished goods inventory, May 1 30,300 Finished goods inventory, May 31 34,600 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $Factory overhead $Cost of goods manufactured Direct labor Factory overhead Total manufacturing costs incurred during May fill in the blank 4bdba303aff9f91_9 Total manufacturing costs $fill in the blank 4bdba303aff9f91_10 Less factory overhead Cost of goods manufactured $fill in the blank 4bdba303aff9f91_13 b. For May, using the data given, prepare a…arrow_forwardProblem 23: COST OF GOODS SOLD (ACTUAL COSTING) Danica Corp. provided the following inventory balances and cost data for the month of June. Junel June 30 Direct Materials 30,000 40,000 Work in Process 15,000 20,000 Finished Goods 65,000 50,000 Production data for the month of June follows: Cost of goods manufactured Factory overhead applied Direct materials used 515,000 150,000 190,900 Actual factory overhead 144,000 Required: Compute the cost of goods sold under actual costingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License