Concept explainers

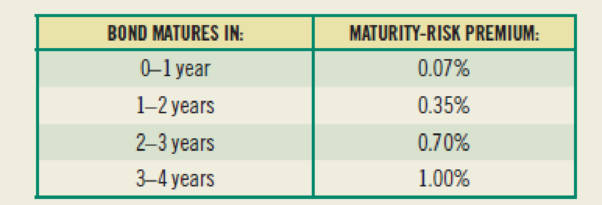

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to determine what the nominal interest rate should be on them. You have determined that the real risk-free interest rate is 3.0%, and this rate is expected to continue on into the future without any change. In addition, inflation is expected to be constant over the future at a rate of 3.0%. The default-risk premium is also expected to remain constant at a rate of 1.5%, and the liquidity-risk premium is very small for Ford bonds, only about 0.02%. The maturity-risk premium is dependent on how many years the bond has to maturity. The maturity-risk premiums are as follows:

Given this information, what should the nominal rate of interest on Ford bonds maturing in 0–1 year, 1–2 years, 2–3 years, and 3–4 years be?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

FOUNDATIONS OF FINANCE- MYFINANCELAB

Additional Business Textbook Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Corporate Finance

Financial Accounting, Student Value Edition (4th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education