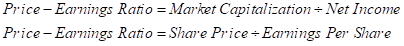

Price − Earnings (P/E) Ratio:

The Price − Earnings (P/E) Ratio is used to find out the market value of a firm. It helps to find out whether the stock is over-valued or under-valued considering the idea that the stock value should be proportionate to the earnings it generates for the shareholders of the firm. The firms that have high growth rate will have a higher price − earnings ratio as compared to those firms that grow at lower pace. It can be calculated either by dividing the market value of equity to earnings or by dividing the price of the shares to the earning per share of the firm. It can be demonstrated as under:

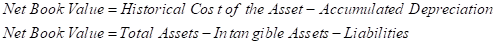

Book Value

The book value of an asset refers to that value at which the asset is posted in the company’s financial statement, the balance sheet to be more precise. There are two ways in which the book value of the assets can be calculated. They are mentioned as under:

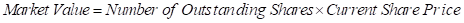

Market Value

The market keeps on changing every time. Market value refers to the value of the asset at which it is valued in the market at a particular time. The market value is also referred to as the market capitalization of those companies that are traded publically. It can be calculated as under:

To Identify:

The method to use the Price − Earnings (P/E) ratio to gauge the market value of a firm.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Fundamentals of Corporate Finance (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education