Concept explainers

Prepare journal entries and record the above transactions in T-accounts.

Explanation of Solution

General ledger:

General ledger is a book of original entry which records the accounting data in the accounting system of an organisation.

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Prepare the journal entry in the general journal on June 1:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 1 | Cash (A+) | 25,000 | |

| Common Stock (E+) | 25,000 | ||

| (To record the issuance of common stock) |

Table (1)

Prepare the journal entry in the general journal on June 2:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 2 | Office Furniture and Fixtures (A+) | 9,800 | |

| Accounts Payable (L+) | 5,000 | ||

| Cash (A–) | 4,800 | ||

| (To record the purchase of office furniture and fixtures) |

Table (2)

Prepare the journal entry in the general journal on June 3:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 3 | Tax Library (A+) | 6,700 | |

| Accounts Payable (L+) | 6,700 | ||

| (To record the purchase of Tax library items) |

Table (3)

Prepare the journal entry in the general journal on June 4:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 4 | Office Supplies (A+) | 660 | |

| Cash (A–) | 660 | ||

| (To record the purchase of office supplies on cash) |

Table (4)

Prepare the journal entry in the general journal on June 5:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 5 | Rent Expense (E–) | 850 | |

| Cash (A–) | 850 | ||

| (To record the payment of rent expense) |

Table (5)

Prepare the journal entry in the general journal on June 6:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 6 | Accounts Payable (L–) | 300 | |

| Tax Library (A–) | 300 | ||

| (To record the return of Tax library items) |

Table (6)

Prepare the journal entry in the general journal on June 7:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 7 | 18,600 | ||

| Service Revenue (E+) | 18,600 | ||

| (To record the revenues earned) |

Table (7)

Prepare the journal entry in the general journal on June 8:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 8 | Accounts Payable (L –) | 1,700 | |

| Cash (A–) | 1,700 | ||

| (To record the payment of cash) |

Table (8)

Prepare the journal entry in the general journal on June 9:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 9 | Cash (A+) | 15,900 | |

| Accounts Receivable (A–) | 15,900 | ||

| (To record the receipt of cash from revenues earned) |

Table (9)

Prepare the journal entry in the general journal on June 10:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 10 | Salaries Expense (E–) | 4,900 | |

| Cash (A–) | 4,900 | ||

| (To record the payment of salary expenses) |

Table (10)

Prepare the journal entry in the general journal on June 11:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 11 | Advertising Expenses (E–) | 400 | |

| Accounts Payable (L+) | 400 | ||

| (To record the advertising expenses on account) |

Table (11)

Prepare the journal entry in the general journal on June 12:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 12 | Dividends (E–) | 800 | |

| Cash (A–) | 800 | ||

| (To record the payment of cash dividends) |

Table (12)

Prepare the journal entry in the general journal on June 13:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 13 | Utilities expenses (E–) | 160 | |

| Cash (A–) | 160 | ||

| (To record the payment of utility expenses) |

Table (13)

Prepare the journal entry in the general journal on June 14:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| June 14 | Interest Expenses (E–) | 160 | |

| Cash (A–) | 160 | ||

| (To record the payment of interest expenses) |

Table (14)

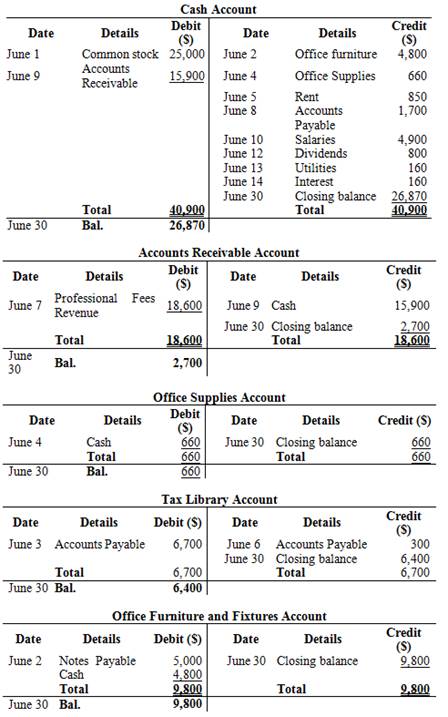

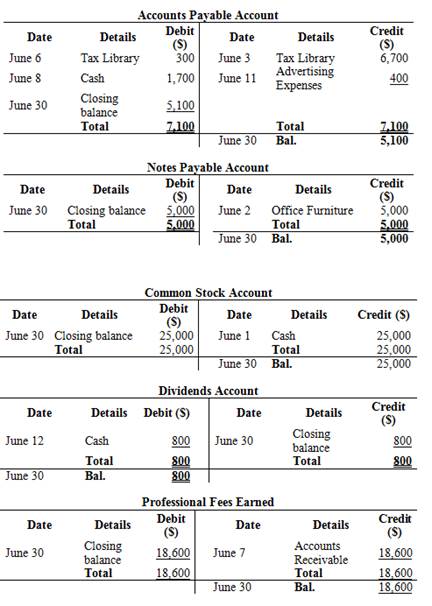

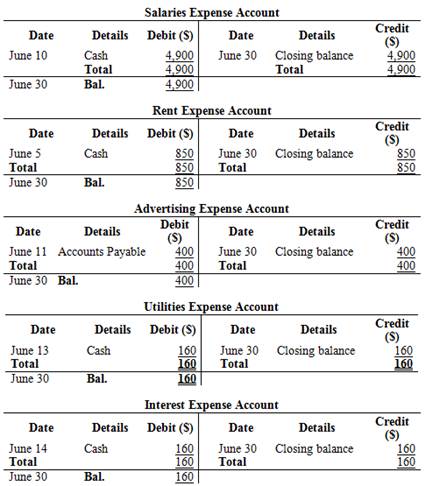

Prepare T-accounts to record the above transactions:

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

Figure (1)

Figure (2)

Figure (3)

b.

Prepare

b.

Explanation of Solution

Trial balance:

Trial balance is the summary of accounts, and their debit and credit balances at a given time. It is usually prepared at end of the accounting period. Debit balances are listed in left column and credit balances are listed in right column. The totals of debit and credit column should be equal. Trial balance is useful in the preparation of the financial statements.

| Person W | ||

| Trial Balance | ||

| As of June 30 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 26,870 | |

| Accounts Receivable | 2,700 | |

| Tax Library | 6,400 | |

| Office Supplies | 660 | |

| Office Furniture and Fixtures | 9,800 | |

| Accounts Payable | 5,100 | |

| Notes Payable | 5,000 | |

| Common Stock | 25,000 | |

| Dividends | 800 | |

| Professional Fees Earned | 18,600 | |

| Salaries Expense | 4,900 | |

| Rent Expense | 850 | |

| Utilities Expenses | 160 | |

| Advertising Expenses | 400 | |

| Interest Expenses | 160 | |

| Total | 53,700 | 53,700 |

Table (15)

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Accounting for Undergr. -Text Only (Instructor's)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education