FINANCIAL MANAGEMENT: THEORY AND PRACTIC

16th Edition

ISBN: 9780357691977

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 18P

Rhodes Corporation’s financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions.

- a. What is the

net operating profit after taxes (NOPAT) for 2020? - b. What are the amounts of net operating working capital for both years?

- c. What are the amounts of total net operating capital for both years?

- d. What is the

free cash flow for 2020? - e. What is the

ROIC for 2020? - f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.)

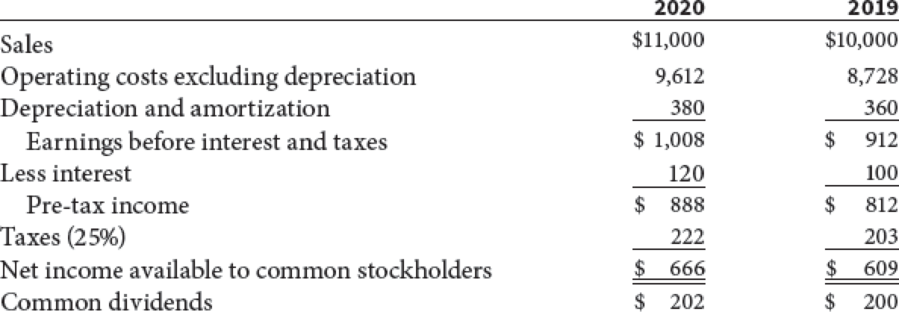

Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars)

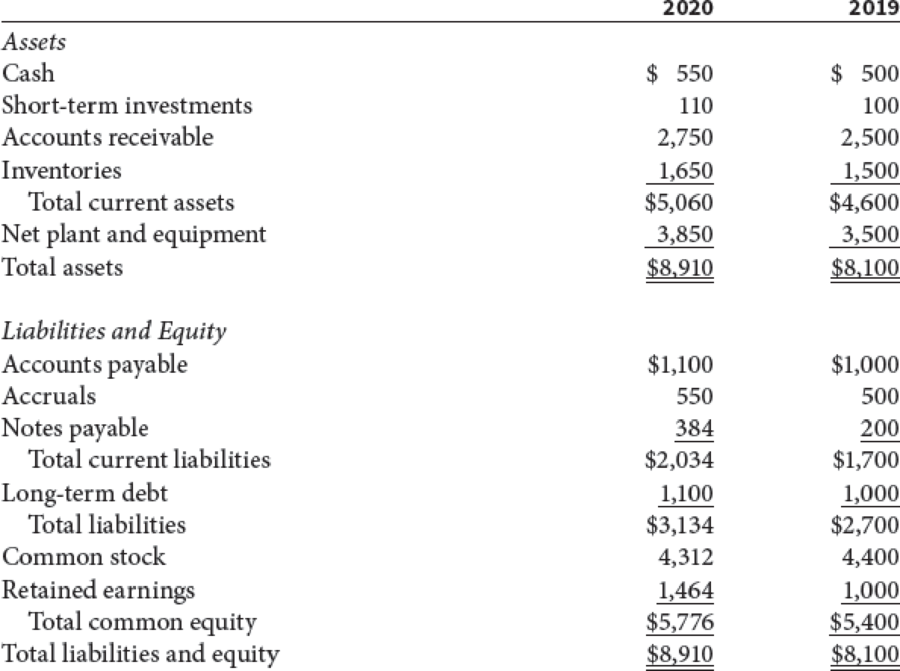

Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Rhodes Corporation’s financial statements are shown after part f. Suppose the federalplus- state tax corporate tax is 25%. Answer the following questions.a. What is the net operating profit after taxes (NOPAT) for 2020?b. What are the amounts of net operating working capital for both years?c. What are the amounts of total net operating capital for both years?d. What is the free cash flow for 2020?e. What is the ROIC for 2020?f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.)

Using the financial statements mentioned above estimate the annual rate of interest paid by the corporation (cost of debt). Also, find the tax rate and capitalization ratio (proportions among equity and debt). Using these values that you have found estimate the annual weighted cost of capital (WACC) of the corporation.

Income statement

PERIOD ENDING:

12/31/2019

Total Revenue

$20,972,000

Cost of Revenue

$17,755,000

Gross Profit

$3,217,000

OPERATING EXPENSES

Research and Development

$0

Sales, General and Admin.

$938,000

Non-Recurring Items

$138,000

Other Operating Items

$341,000

Operating Income

$1,800,000

Add'l income/expense items

$180,000

Earnings Before Interest and Tax

$1,993,000

Interest Expense

$394,000

Earnings Before Tax

$1,599,000

Income Tax

$326,000

Minority Interest

$13,000

Equity Earnings/Loss Unconsolidated Subsidiary

$0

Net Income-Cont. Operations

$1,286,000

Net Income

$1,273,000

Net Income Applicable to Common Shareholders…

Assume a corporation has earnings before depreciation and taxes of $100,000, depreciation of $50,000, and that it has a 30 percent tax bracket. Compute its cash flow using the format below.

Earnings before depreciation and taxes

Depreciation

Earnings before taxes

Taxes @ 30%

Earnings after taxes

Depreciation

Chapter 2 Solutions

FINANCIAL MANAGEMENT: THEORY AND PRACTIC

Ch. 2 - Define each of the following terms:

Annual report;...Ch. 2 - Prob. 2QCh. 2 - If a typical firm reports 20 million of retained...Ch. 2 - What is operating capital, and why is it...Ch. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - An investor recently purchased a corporate bond...Ch. 2 - Corporate bonds issued by Johnson Corporation...Ch. 2 - Hollys Art Galleries recently reported 7.9 million...

Ch. 2 - Nicholas Health Systems recently reported an...Ch. 2 - Kendall Corners Inc. recently reported net income...Ch. 2 - In its most recent financial statements,...Ch. 2 - Prob. 7PCh. 2 - Prob. 8PCh. 2 -

Carter Swimming Pools has $16 million in net...Ch. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - The Shrieves Corporation has 10,000 that it plans...Ch. 2 - The Moore Corporation has operating income (EBIT)...Ch. 2 - The Berndt Corporation expects to have sales of...Ch. 2 - Use the following income statement of Elliott Game...Ch. 2 - Prob. 16PCh. 2 - Athenian Venues Inc. just reported the following...Ch. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Begin with the partial model in the file Ch02 P20...Ch. 2 - Begin with the partial model in the file Ch02 P21...Ch. 2 -

Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What is Computrons net operating profit after...Ch. 2 - What is Computron’s free cash flow? What are...Ch. 2 - Calculate Computron’s return on invested capital...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What happened to Computron’s Market Value Added...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A4) Finance You estimate that the net income for a company next year is a uniform distribution with a minimum of $106 million and a maximum of $127 million. What is the probability that the company's net income is less than or equal to $117 million? Enter answer in percents, to two decimal places.arrow_forwardUse the following information for Ingersoll, Inc., (assume the tax rate is 23 percent): 2019 2020 Sales $ 15,073 $15,036 Depreciation 1,731 1,806 Cost of goods sold 4,329 4,777 Other expenses 981 859 Interest 830 961 Cash 6,172 6,676 Accounts receivable 8,110 9,637 Long-term debt 20,530 24,811 Net fixed assets 51,042 54,483 Accounts payable 5,736 6,071 Inventory 14,402 15,358 Dividends 1,300 1,688 Prepare a balance sheet for this company for 2019 and 2020. (Do not round intermediate calculations. Be sure to list the accounts in order of their liquidity.) INGERSOLL, INC. Assets Cash Accounts receivable Net fixed assets Inventory Current assets Balance Sheet as of Dec. 31 2019 2020 $ 6,172 $ 6,676 8,110 9,637 51,042 54,483 14,402 15,358 Total assets $ 86,654 $ 89,154 Liabilities Accounts payable $ 5,736 $ 6,071 Long-term debt 20,530 24,811arrow_forwardUse the following information for Taco Swell, Incorporated, (assume the tax rate is 23 percent): 2020 2021 Sales $ 18,049 $ 18,858 Depreciation 2,406 2,514 Cost of goods sold 5,840 6,761 Other expenses 1,364 1,193 Interest 1,125 1,340 Cash 8,691 9,337 Accounts receivable 11,518 13,572 Short-term notes payable 1,704 1,671 Long-term debt 29,150 35,304 Net fixed assets 72,838 77,700 Accounts payable 6,287 6,730 Inventory 20,475 21,892 Dividends 2,129 2,344 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- If the state tax rate is 20% and the federal tax rate is 30%, what is the total effective tax rate? a. 34% b. 50% c. 44% d. 37% 2. Holding all other variables constant, which of the following would increase return on equity? An increase in _____________. a. the tax rate b. the equity ratio (equity/total assets) c. total assets d. total asset turnoverarrow_forwardThe annual revenue, expenses, and depreciation for a company are $130,000; 32,000; and $11,000, respectively. What is the after-tax cashflow if the effective income tax rate is 23%? a.77990 b.66990 c. 75460 d. 64460 e. 20010arrow_forwardWhat is the amount of Taxes Owed for the period if the tax rate is 30%, if Earnings Before Taxes ( a.k.a. EBT, or pre-tax earnings) is 250,000?arrow_forward

- Assume a corporation has earnings before depreciation and taxes of $82,000, depreciation of $45,000, and that it has a 25% combined tax bracket. What are the after-tax cash flows for the company?arrow_forwardUse the following information for Taco Swell, Inc., for Problems 23 and 24 (assume the tax rate is 21 percent): 2020 2021 Sales $21,514 $24,047 Depreciation 3,089 3,229 Cost of goods sold 7,397 8,750 Other expenses 1,759 1,531 Interest 1,443 1,723 Cash 11,279 12,021 Accounts receivable 14,934 17,529 Short-term notes payable 2,176 2,133 Long-term debt 37,778 45,798 Net fixed assets 94,601 100,893 Accounts payable 8,150 8,632 Inventory 26,551 28,421 Dividends 2,573 3,008 Financial Statements [O LO1] Draw up an income statement and balance sheet for this company for 2020 and 2021.arrow_forwardUse the following information for Taco Swell, Incorporated, (assume the tax rate is 22 percent): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2020 $ 23,549 2,516 6,390 1,441 1,180 8,746 11,628 1,814 29,480 73,091 6,353 20,662 2,679 Cash flow from assets Cash flow to creditors Cash flow to stockholders 2021 $ 19,188 2,624 6,871 1,248 1,395 9,667 13,902 1,781 35,579 78,030 7,060 22,002 2,454 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- The annual revenue, expenses, and depreciation for a company are $130,000; 32,000; and $12,000, respectively. What is the after-tax cashflow if the effective income tax rate is 23%? O a. $75,460 O b. $66,220 O c. $63,460 O d. $78,220 O e. $19,780arrow_forwardSee attached, and may you kindly assist?arrow_forwardSuppose a firm's tax rate is 25%. a. What effect would a $9.05 million operating expense have on this year's earnings? What effect would it have on next year's earnings? b. What effect would a $10.2 million capital expense have on this year's earnings if the capital expenditure is depreciated at a rate of $2.04 million per year for five years? What effect would it have on next year's earnings? a. What effect would a $9.05 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices that apply.) A. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05 million. This would lead to a reduction in taxes of 25% x $9.05 million = $2.26 million. B. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05 million. This would lead to an increase in taxes of 25% × $9.05 million = $2.26 million. C. Earnings would decline by $9.05…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The Basics of Tax Preparation; Author: Roosevelt University;https://www.youtube.com/watch?v=EJpTwf9b82M;License: Standard Youtube License