FUNDAMENTALS OF FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260823875

Author: PHILLIPS

Publisher: MCGRAW-HILL CUSTOM PUBLISHING

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 1SDC

Finding and Analyzing Financial Information

Refer to the financial statements of The Home Depot in Appendix A at the end of this book. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. See S1-1 for further explanation of its fiscal periods.)

Required:

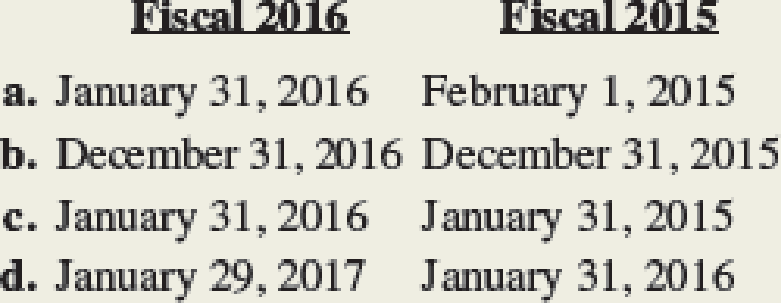

- 1. What were the year-end dates for the “Fiscal 2016” and “Fiscal 2015” periods?

- 2. Which of the following are the amounts in the company’s

accounting equation (A = L + SE) for the 2016 fiscal year-end?- a. $94,595 = $62,282 + $32,313

- b. $42,966 = $38,633 + $4,333

- c. $41,973 = $35,657 + $6,316

- d. $81,599 = $38,633 + $42,966

- 3. What is the company’s

current ratio at January 29, 2017?- a. 0.80

- b. 1.25

- c. 0.41

- d. 1.11

- 4. What does the company’s current ratio in requirement 3 indicate?

- a. The company has more than one dollar of current assets for every dollar of current liabilities due in the next year.

- b. The company has less than one dollar of current assets for every dollar of current liabilities due in the next year.

- c. Less than half of the company’s assets are current.

- d. Less than half of the company’s liabilities are current.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Selected T-account balances for Bloomfield Company are shown below as of January 31, 2017; accounting adjustments have already been posted. The firm uses a calendar-year accounting period but prepares monthly adjustments.

The following balances are extracted from the books of Happy-go Lucky Stores for the year ended 30June 2018.Prepare the Statement of Comprehensive Income of Happy-go-Lucky Stores for the mostrecent accounting period.

Prepare the Statement of Financial Position of Happy-go-Lucky Stores on 30 June 2018

During the course of your examination of the financial statements of the Hales Corporation for the year endedDecember 31, 2016, you discover the following:a. An insurance policy covering three years was purchased on January 1, 2016, for $6,000. The entire amountwas debited to insurance expense and no adjusting entry was recorded for this item.b. During 2016, the company received a $1,000 cash advance from a customer for merchandise to be manufacturedand shipped in 2017. The $1,000 was credited to sales revenue. No entry was recorded for the cost ofmerchandise.c. There were no supplies listed in the balance sheet under assets. However, you discover that supplies costing$750 were on hand at December 31.d. Hales borrowed $20,000 from a local bank on October 1, 2016. Principal and interest at 12% will be paid onSeptember 30, 2017. No accrual was recorded for interest.e. Net income reported in the 2016 income statement is $30,000 before reflecting any of the above items.Required:Determine…

Chapter 2 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 1MECh. 2 - Prob. 2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 4MECh. 2 - Prob. 5MECh. 2 - Prob. 6MECh. 2 - Prob. 7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 13MECh. 2 - Prob. 14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 16MECh. 2 - Prob. 17MECh. 2 - Prob. 18MECh. 2 - Prob. 19MECh. 2 - Prob. 20MECh. 2 - Prob. 21MECh. 2 - Prob. 22MECh. 2 - Prob. 23MECh. 2 - Prob. 24MECh. 2 - Prob. 25MECh. 2 - Prob. 1ECh. 2 - Identifying Account Titles The following are...Ch. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 6ECh. 2 - Recording Journal Entries Refer to E2-6. Required:...Ch. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Calculating and Evaluating the Current Ratio...Ch. 2 - Prob. 15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Prob. 1PACh. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2PBCh. 2 - Recording Transactions (in a Journal and...Ch. 2 - Finding and Analyzing Financial Information Refer...Ch. 2 - Finding and Analyzing Financial Information Refer...Ch. 2 - Prob. 4SDCCh. 2 - Prob. 5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardSelected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are presented in Problem 6-5B. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 7,000. 4. Prepare closing entries as of June 30, 2016.arrow_forwardSelected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are presented in Problem 6-5A. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Prepare closing entries as of May 31, 2016.arrow_forward

- Apex Systems Co. offers its services to residents in the Seattle area. Selected accounts from the ledger of Apex Systems Co. for the fiscal year ended December 31, 2016, are as follows: Prepare a statement of owners equity for the year.arrow_forwardReal-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2017, and May 31, 2016. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory' h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets, assuming interest expense is 82 million for the year ending May 31. 2017, and 33 million for the year ending May 31, 2016. k. k. Return on common stockholders equity l. Price-eamings ratio, assuming that the market price was 52.81 per share on May 31, 2017, and 54.35 per share on May 31, 2016. m. m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forwardReading and Interpreting Chipotles Financial Statements Refer to the financial statements for Chipotle reproduced in the chapter and answer the following questions. What was the companys net income for 2014? State Chipotles financial position on December 31, 2014, in terms of the accounting equation. By what amount did Leasehold improvements, property and equipment, net, increase during 2014? Explain what would cause an increase in this item.arrow_forward

- Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2016, are as follows: Prepare a statement of owners equity for the year.arrow_forwardThe revenues and expenses of Sentinel Travel Service for the year ended August 31, 2016, follow: Prepare an income statement for the year ended August 31, 2016.arrow_forwardIncome Statement, Statement of Retained Earnings, and Balance Sheet The following list, in alphabetical order, shows the various items that regularly appear on the financial statements of Sterns Audio Book Rental Corp. The amounts shown for balance sheet items are balances as of December 31, 2016 (with the exception of retained earnings, which is the balance on January 1, 2016), and the amounts shown for income statement items are balances for the year ended December 31, 2016. Required Prepare an income statement for the year ended December 31, 2016. Prepare a statement of retained earnings for the year ended December 31, 2016. Prepare a balance sheet at December 31, 2016. You have $1,000 to invest. On the basis of the statements you prepared, would you use it to buy stock in this company? Explain. What other information would you want before deciding?arrow_forward

- The transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardAdjusting Entries Kretz Corporation prepares monthly financial statements and therefore adjusts its accounts at the end of every month. The following information is available for March 2016: Kretz Corporation takes out a 90-day, 8%, $15,000 note on March 1, 2016, with interest and principal to be paid at maturity. The asset account Office Supplies on Hand has a balance of $1,280 on March 1, 2016. During March, Kretz adds $750 to the account for purchases during the period. A count of the supplies on hand at the end of March indicates a balance of $1,370. The company purchased office equipment last year for $62,600. The equipment has an estimated useful life of six years and an estimated salvage value of $5,000. The companys plant operates seven days per week with a daily payroll of $950. Wage earners are paid every Sunday. The last day of the month is Thursday, March 31. The company rented an idle warehouse to a neighboring business on February 1, 2016, at a rate of $2,500 per month. On this date, Kretz Corporation credited Rent Collected in Advance for six months rent received in advance. On March 1, 2016, Kretz Corporation credited a liability account, Customer Deposits, for $4,800. This sum represents an amount that a customer paid in advance and that Kretz will earn evenly over a four-month period. Based on its income for the month, Kretz Corporation estimates that federal income taxes for March amount to $3,900. Required For each of the preceding situations, prepare in general journal form the appropriate adjusting entry to be recorded on March 31, 2016.arrow_forwardThe following revenue and expense account balances were taken from the ledger of Wholistic Health Services Co. after the accounts had been adjusted on February 29, 2016, the end of the fiscal year: Prepare an income statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License