EBK PRINCIPLES OF CORPORATE FINANCE

12th Edition

ISBN: 9781259358487

Author: BREALEY

Publisher: MCGRAW HILL BOOK COMPANY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 1SQ

(FV) In 1880, five aboriginal trackers were each promised the equivalent of 100 Australian dollars for helping to capture the notorious outlaw Ned Kelly. One hundred and thirteen years later, the granddaughters of two of the trackers claimed that this reward had not been paid. If the interest rate over this period averaged about 4.5%, how much would the A$100 have accumulated to?

Expert Solution & Answer

Summary Introduction

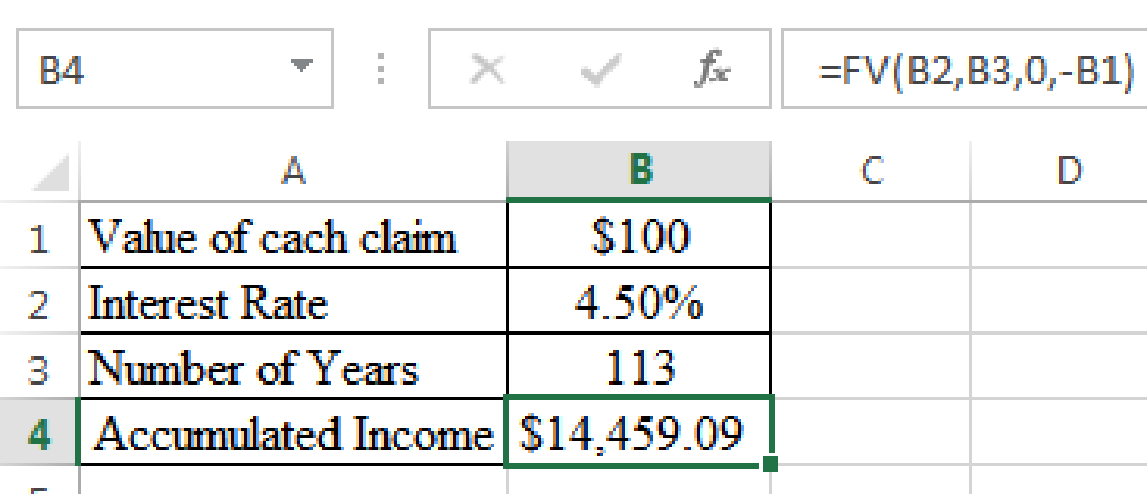

To determine: The accumulated income of $100 at 4.5%.

Answer to Problem 1SQ

The accumulated income of $100 at 4.5% is $14,459.09.

Explanation of Solution

Determine the accumulated income

Using a excel spreadsheet and excel function =FV, the accumulated income is determined as $14,459.09.

Excel Spreadsheet:

Therefore the accumulated income of $100 at 4.5% is $14,459.09.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

In 1880 five aboriginal trackers were each promised the equivalent of 100 Australian dollars for helping to capture the notorious outlaw Ned Kelly. In 1998 the granddaughters of two of the trackers claimed that this reward had not been paid. The Victorian prime minister stated that if this was true, the government would be happy to pay the $100. However, the granddaughters also claimed that they were entitled to compound interest. How much was each granddaughter entitled to if the interest rate was 3%?

n 1880 five aboriginal trackers were each promised the equivalent of 50 Australian dollars for helping to capture the notorious outlaw Ned Kelley. In 2003 the granddaughters of two of the trackers claimed that this reward had not been paid. The Victorian prime minister stated that if this was true, the government would be happy to pay the $50. However, the granddaughters also claimed that they were entitled to compound interest.

a. How much was each granddaughter entitled to if the interest rate was 4%? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

b. How much was each entitled to if the interest rate was 8%? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

n 1880 five aboriginal trackers were each promised the equivalent of 50 Australian dollars for helping to capture the notorious outlaw Ned Kelley. In 2003 the granddaughters of two of the trackers claimed that this reward had not been paid. The…

In1880 five aboriginal trackers were each promised the equivalent of 100 Australian dollars for helping to capture the notorious outlaw Ned Kelly. In 1998 the granddaughters of two of the trackers claimed that this reward had not been paid. The Victorian prime minister agreed to pay the $100. However, the granddaughters also claimed that they were entitled to compound interest. How much was each entitled to if the interest rate was 6%?

Chapter 2 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

Ch. 2 - (FV) In 1880, five aboriginal trackers were each...Ch. 2 - Prob. 2SQCh. 2 - (PV) Your company can lease a truck for 10,000 a...Ch. 2 - (RATE) Ford Motor stock was one of the victims of...Ch. 2 - Prob. 5SQCh. 2 - Prob. 6SQCh. 2 - Prob. 7SQCh. 2 - (NOMINAL) What monthly compounded interest rate...Ch. 2 - Opportunity cost of capital Which of the following...Ch. 2 - Opportunity cost of capital Explain why we refer...

Ch. 2 - Prob. 3PSCh. 2 - Compound interest New Savings Bank pays 4%...Ch. 2 - Compound interest In 2017, Leonardo da Vincis...Ch. 2 - Future values If you invest 100 at an interest...Ch. 2 - Prob. 7PSCh. 2 - Future values In the five years preceding the end...Ch. 2 - Discount factors a. If the present value of 139 is...Ch. 2 - Prob. 10PSCh. 2 - Prob. 11PSCh. 2 - Present values What is the PV of 100 received in:...Ch. 2 - Prob. 13PSCh. 2 - Present values A factory costs 800,000. You reckon...Ch. 2 - Present values Recalculate the NPV of the office...Ch. 2 - Present values and opportunity cost of capital...Ch. 2 - Perpetuities An investment costs 1,548 and pays...Ch. 2 - Perpetuities You have just read an advertisement...Ch. 2 - Growing perpetuities A common stock will pay a...Ch. 2 - Prob. 20PSCh. 2 - Prob. 21PSCh. 2 - Annuities Kangaroo Autos is offering free credit...Ch. 2 - Annuities David and Helen Zhang are saving to buy...Ch. 2 - Prob. 24PSCh. 2 - Annuities Several years ago, The Wall Street...Ch. 2 - Prob. 26PSCh. 2 - Prob. 27PSCh. 2 - Prob. 28PSCh. 2 - Prob. 29PSCh. 2 - Annuities due A store offers two payment plans....Ch. 2 - Amortizing loans A bank loan requires you to pay...Ch. 2 - Amortizing loans Suppose that you take out a...Ch. 2 - Future values and annuities a. The cost of a new...Ch. 2 - Prob. 34PSCh. 2 - Growing annuities You are contemplating membership...Ch. 2 - Prob. 36PSCh. 2 - Growing perpetuities and annuities Your firms...Ch. 2 - Compounding intervals A leasing contract calls for...Ch. 2 - Compounding intervals Which would you prefer? a....Ch. 2 - Compounding intervals You are quoted an interest...Ch. 2 - Prob. 41PSCh. 2 - Continuous compounding How much will you have at...Ch. 2 - Continuous compounding The continuously compounded...Ch. 2 - Prob. 44PSCh. 2 - Annuities Use Excel to construct your own set of...Ch. 2 - Declining perpetuities and annuities You own an...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Samuel Johnson invested in gold U.S. coins ten years ago, paying $216.53 for one-ounce gold "double eagle" coins. He could sell these coins for $734 today. What was his annual rate of return for this investment?arrow_forwardMr. Ceballos purchased a statue for Php 2,500. Ten years later, he sold this statue for Php 7,500. If the statue is viewed as an investment, what annual rate did he earn? 6. How many years will it take for an investment to be twice its value if it earns 8% compounded annually?arrow_forwardAccording to an old myth, Native Americans sold theisland of Manhattan about 400 years ago for $24. Ifthey had invested this amount at an interest rateof 7 percent per year, how much, approximately,would they have today?arrow_forward

- A man borrowed P75,000 on September 18,1898 and promised to pay on May 17,1904 at a simple interest of 12%. How much will be the total interest?arrow_forwardMichael won a lottery that will pay him $ 480000 at the end of each of the next twenty years. Blue Spruce has offered to purchase the payment stream for $ 5505600. What interest rate (to the nearest percent) was used to determine the amount of the payment? 9%. 8%. 7%. 6%arrow_forwardJohn borrowed a certain amount of money from Tebogo at a simple interest rate of 8,7% per year. After five years John owes Tebogo R10 000,00. Calculate how much money John initially borrowedarrow_forward

- Donna has Php35,000. She decided to buy a new gadget at Php30,000 and invested her remaining Php 5,000 in an instrument that offers 4.5 % rate per annum. After five years, the gadget was not anymore use and how much is the worth of the investment If she invested all her money to the instrument, how much money will she received after 5 years?arrow_forwardMiller invested P15,250 for 10 years and received P9,150 in simple interest. What was the rate of that investment? Nick borrowed P6000 at 9% simple interest fro 1 ½ years to repair his rice threshing-machine. Find the simple interest, future value, and equal monthly installments? Benjamin deposited P600 in a saving account that pays 4% simple interest. How long did it take for his deposit to earn an interest of P72. What amount was invested for 5 years at 2 ¼ % if it earned interest of P2,500? At what interest rate will P15,000 earn an interest of P2,500 at 1.8%?arrow_forwardAn investor who recently returned from overseas decided to invest in a venture proposed by leading investment company.The investor is expected to receive ten(10) sum payment of $5000 at the end of each year for ten(10)years.However payments increased by 5% on the second(2nd),10% on the fourth (4th),15% on the sixth(6th),20% on the eighth(8th) and 25% on the tenth(10th) payment. Calculate the sum that should be payed to him at an interest of 5%arrow_forward

- Abe Washington sold some property in Oregon and will receive $40,000 in 5 equal payments of $8,000 at the end of each year from today. What is the present value of these future payments at an interest rate of 9% compounded annually? Round answer to the nearest dollar. show in excel if possiblearrow_forwardCarl borrowed P101,466 from his friend to pay for remodeling work on his house. He repaid the loan 20 months and 12 days later with simple interest at 1.36%. His friend then invested the proceeds in a bank for 10 years paying 5.83% compounded monthly. How much will his friend have at the end of the 10 years?arrow_forwardRonald Gonzales, who recently sold his Bicycle, placed P10,000 in a savings account paying annual compound interest of 6 percent. a. Calculate the amount of money that will have accrued if he leaves the money in the bank for 1, 5, and 15 years. b. b. If he moves his money into an account that pays 8 percent or one that pays 10 percent, rework part (a) using these new interest rates. c. What conclusions can you draw about the relationship between interest rates, time, and future sums from the calculations you have done above?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Internal Rate of Return (IRR); Author: The Finance Storyteller;https://www.youtube.com/watch?v=aS8XHZ6NM3U;License: Standard Youtube License