Concept explainers

Cash versus accrual accounting;

• LO2–4, LO2–5, LO2–8

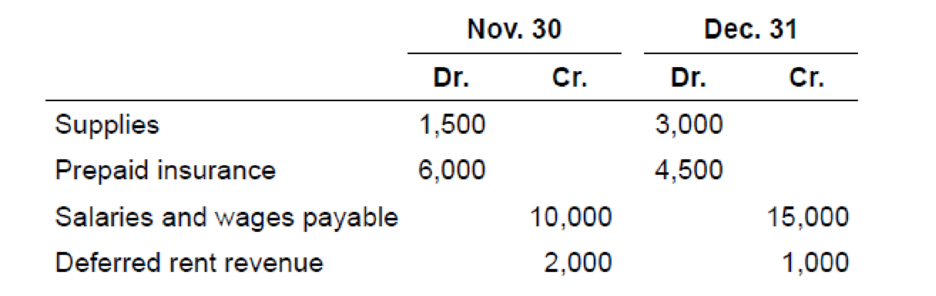

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2018,

The following information also is known:

a. The December income statement reported $2,000 in supplies expense.

b. No insurance payments were made in December.

c. $10,000 was paid to employees during December for salaries and wages.

d. On November 1, 2018, a tenant paid Righter $3,000 in advance rent for the period November through January. Deferred rent revenue was credited.

Required:

1. What was the cost of supplies purchased during December?

2. What was the adjusting entry recorded at the end of December for prepaid insurance?

3. What was the adjusting entry recorded at the end of December for accrued salaries and wages?

4. What was the amount of rent revenue recognized in December? What adjusting entry was recorded at the end of December for deferred rent revenue?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

INTER.ACC (LL)-W/CONNECT PKG

- QUESTION 3 On December 31 , 2018, Ava Company had an ending balance of $9,323 in its accounts receivable account and an unadjusted (current) balance in its allowance for doubtful accounts account of $165 Ava estimates uncollectible accounts expense to be 9% of receivables. .Based on this information, the amount of net realizable accounts receivable shown on the 2018 balance sheet is $arrow_forwardProblem 7. Single-entry bookkeeping (sales revenue during the year) The December 31, 2020 statement of financial position of YOYO Company showed accounts receivable of P50,270. During 2021, accounts were written off in the amount of P6,200 and an account for P4,200, which was written off in 2020, was collected and recorded as a regular collection of accounts receivable in 2021. Unpaid sales slips showed that the customers owed P64,320 as of December 31, 2021. Sales returns from charge sales during the year amounting to P750. Also, YOYO received P584,190 from customers after deducting P3,630 discounts. How much is YOYO’s net sales for the year ended December 31, 2021?arrow_forwardBrief Exercise 8-03 a-b At the end of 2021, Larkspur Co. has accounts receivable of $675,100 and an allowance for doubtful accounts of $24,370. On January 24, 2022, it is learned that the company’s receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,127.(a)Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Enter an account title Enter a debit amount Enter a credit amount Enter an account title Enter a debit amount Enter a credit amount (b)What is the cash realizable value of the accounts receivable before the write-off and after the write-off? Before Write-Off After Write-Off Cash realizable value $Enter a dollar amount $Enter a dollar amountarrow_forward

- Question 2a The following data apply to ABC Quality Goods for May Year 1: • Balance per the bank on May 31: $11,220 and book balance, May 31, Year 1 $ 11,718 ● Deposits in transit not recorded by the bank: $2,470. • Bank error, cheque written by Best Beauty Supply was charged to ABC Quality Goods's account: $800. The following cheques written and recorded by ABC Quality Goods were not included in the bank statement: Ch No. Amount 3013 165 3054 510 3056 1,780 Note collected by the bank: $750. Service charge for collection of note: $21. • The bookkeeper recorded a cheque written for $634 to pay for the May utilities expense as $544 in the cash disbursements journal. Bank service charge in addition to the note collection fee: $45. Customer cheques returned by the bank as NSF: $177. Prepare a bank reconciliation statement for ABC Quality Goods as on 31 May..arrow_forwardProblem 6-4: The Northrock Corporation The Northrock Corporation produced the following summary of its historical experience of write offs of Accounts Receivable (A/R) on October 31, 2021: Year A/R at Year end Uncollectible and written off in subsequent years 2018 14000 700 2019 10000 1000 2020 12000 600 2021 4000 200 Required 1. Calculate the percentage loss on Accounts Receivable for the period 2018 to 2021 by calculating total write offs over the period as a % of total A/R. Round your calculation to two decimal places. 2. Compute the balance for the Allowance for Doubtful accounts (rounded to the nearest $) on October 31, 2021 if Accounts Receivable on that date were 16000. Apply the % ending A/R method using the percentage calculated in part 1. 3. Scenario A: On October 31, 2021 the unadjusted Allowance for Doubtful Accounts was 160 credit. Prepare an adjusting entry to obtain the amount that you calculated in part 2. 4. Scenario B: On October 31, 2021 the unadjusted Allowance for…arrow_forwardPLEASE ANSWER ASAP Problem No. 3 You are auditing the accounts receivable and the related allowance for bad debts account of AACA Company. The following data are available: General Ledger Accounts Receivable 2022 Dec. 31 381,600 Allowance for Bad Debts 2022 2022 Jul. 31 GJ Write-off 7,200 Jan. 1 Balance 9,000 Dec. 31 GJ - Provision 21,600 Summary of Aging Schedule The summary of the subsidiary ledger balances as of December 31, 2022, is shown below: Debit balances Under one month P 162,000 One to six months 165,600 Over six months 68,400 P 396,000 Credit balances Mark Co. P 3,600 OK; additional billing in Jan. 2023 Lady Co. 6,300 Should have been credited to Ivan Co.* 8,100 Advance on a sales contract P 18,000 *Account is in “one to six months” classification. The…arrow_forward

- LO 7.3Catherine’s Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger? EA6. LO 7.3Record the following transactions in the sales journal: Jan. 15 Invoice # 325, sold goods on credit for $2,400, to Maroon 4, account # 4501 Jan. 22 Invoice #326, sold goods on credit for $3,500 to BTS, account # 5032 Jan. 27 Invoice #327, sold goods on credit for $1,250 to Imagine Fireflies, account # 3896arrow_forwardOn January 1, Year 1, the general ledger of a company includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Debit Credit $ 25,600 47,200 $ 4,700 Inventory Land 20,500 51,000 17,500 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, Year 2) Common Stock Retained Earnings 2,000 29,000 55,000 40,000 31,100 $161,800 Totals $161,800 During January Year 1, the following transactions occur: 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date. January January 6 Purchase additional inventory on account, $152,000. January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on account. The cost of the units sold is $76,300. January 23 Receive $125,900 from customers on accounts receivable. January 25 Pay $95,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as…arrow_forwardProblems on Bank Reconciliation Q4 Bank Pass book of Al Noor Industries LLC showed a credit balance of RO 27,350 on July 31,2018. The following differences were found on that date between the cash book and the pass book: -Cheques issued before July 31,2018, amounting to RO19,000 had not been presented for payment. -Two cheques of RO 5,000 and RO 3,500 were deposited into bank on July 31, but the bank gives credit for the same in August. -Insurance premium directly paid by bank RO 5,000. -RO 2,000 wrongly debited to the firm account by the bank. -Prepare Bank Reconciliation Statement as on July 31,2018.arrow_forward

- 1 Find the new balance, assuming that the bank charges 2-% per month on the unpaid balance. 2 Previous New Balance Payment Purchases $592.88 $81.26 A. $575.61 B. $572.61 C. $576.51 O D. $574.41 $50.00arrow_forwardQS 9-7 (Algo) Reporting allowance for doubtful accounts LO P2 On December 31 of Swift Company’s first year, $51,000 of accounts receivable was not yet collected. Swift estimated that $2,100 of its accounts receivable was uncollectible and recorded the year-end adjusting entry.1. Compute the realizable value of accounts receivable reported on Swift’s year-end balance sheet.2. On January 1 of Swift’s second year, it writes off a customer’s account for $400. Compute the realizable value of accounts receivable on January 1 after the write-off.arrow_forwardCHPT#8_5 At December 31, the Azuza Company had a balance of $754,000 in its Accounts Receivable account and a credit balance of $9,000 in the Allowance for Doubtful Accounts account. The company aged its accounts as follows: Current $608,000 0–60 days past due 88,000 61–180 days past due 40,000 Over 180 days past due 18,000 $754,000 In the past, the company has experienced credit losses as follows: one percent of current balances, five percent of balances 0–60 days past due, 20 percent of balances 61–180 days past due, and 40 percent of balances over six months past due. The company bases its allowance for doubtful accounts on an aging analysis of accounts receivable.Requireda. Prepare the adjusting entry to record the allowance for doubtful accounts for the year. b. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the December 31 balance sheet.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning