Concept explainers

Pittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of itsown; rather, it relies completely on independent sales agents to market its products. These agents are paid a sales commission of15% for all items sold.

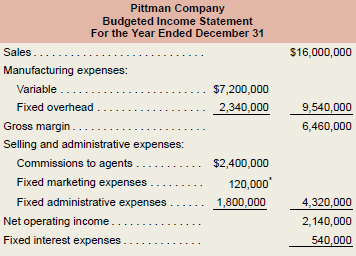

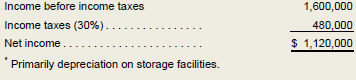

Barbara Cheney, Pittman’s controller, just prepared the company’s

As Barbara handed the statement to Karl Vecci, Pittman’s president, she commented, “I went ahead and used the agents’ 15%commission rate in completing these statements, but we’ve just learned that they refuse to handle our products next year unless we increase the commission rate to 20%.”

“That’s the last straw,” Karl replied angrily. “Those agents have been demanding more and more, and this time they’ve gone too far. How can they possibly defend a 20% commission rate?”

“They claim that after paying for advertising, travel, and the other costs of promotion, there’s nothing left over for profit,” replied Barbara.

“I say it’s just plain robbery,” retorted Karl. “And I also say it’s time we dumped those guys and got our own sales force. Can you get your people to work up some cost figures for us to look at?”

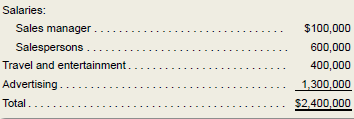

“We’ve already worked them up,” said Barbara. “Several companies we know about pay a 7.5% commission to their own sales people, along with a small salary. Of course, we would have to handle all promotion costs, too. We figure our fixed expenses would increase by $2,400,000 per year, but that would be more than offset by the $3,200,000 (20% Ă— $16,000,000) that we would avoid on agents’ commissions.”

The breakdown of the $2,400,000 cost follows:

“Super,” replied Karl. “And I noticed that the $2,400,000 equals what we’re paying the agents under the old 15% commission rate.”

“It’s even better than that,” explained Barbara. “We can actually save $75,000 a year because that’s what we’re paying our auditors to check out the agents’ reports. So our overall administrative expenses would be less.”

“Pull all of these numbers together and we’ll show them to the executive committee tomorrow,” said Karl. “With the approval of the committee, we can move on the matter immediately.”

Required:

- Compute Pittman Company’s break-even point in dollar sales for next year assuming:

- The agents’ commission rate remains unchanged at 15%.

- The agents’ commission rate is increased to 20%.

- The company employs its own sales force.

- Assume Pittman Company decides to continue selling through agents and pays the 20% commission rate. Determine the dollar sales required to generate the same net income as contained in the budgeted income statement for next year.

- Determine the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a20% commission rate) or employs its own sales force.

- Compute the degree of operating leverage the company would expect to have at the end of next year assuming:

- The agents’ commission rate remains unchanged at 15%.

- The agents’ commission rate is increased to 20%.

- The company employs its own sales force.

- Based on the data in (1) through (4) above, make a recommendation as to whether the company should continue to use sales agents (at a 20% commission rate) or employ its own sales force. Give reasons for your answer.

Use income before income taxes in your operating leverage computation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

CONNECT ONLINE ACCESS F/MANAGERIAL ACC.

- Frank Flynn is the payroll manager for Powlus Supply Company. During the budgeting process, Sam Kinder, director of finance, asked Flynn to arrive at a set percentage that could be applied to each budgeted salary figure to cover the additional cost that will be incurred by Powlus Supply for each employee. After some discussion, it was determined that the best way to compute this percentage would be to base these additional costs of payroll on the average salary paid by the company. Kinder wants this additional payroll cost percentage to cover payroll taxes (FICA, FUTA, and SUTA) and other payroll costs covered by the company (workers compensation expense, health insurance costs, and vacation pay). Flynn gathers the following information in order to complete the analysis: Compute the percentage that can be used in the budget.arrow_forwardThe salespeople at Ayayai, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large customers. Kenneth, the operations supervisor, leaked the $1.20 total unit cost to salespeople, who were thrilled, since that was slightly lower than the previous year's unit cost. Budgets were not yet finalized for the upcoming year, so it was unclear what the target unit cost would be. Kenneth knew the current year's operating capacity was two million notebooks, and Ayayai produced and sold just that many. The detailed breakdown of the $1.20 total unit cost is as follows. Direct material Direct labor Variable overhead Fixed overhead Total cost per unit (a) Total fixed costs Gross margin tA $ $0.10 What were Ayayai's total fixed costs? If the average selling price was $1.95, how much gross margin did the company generate? LA 0.25 0.05 0.80 $1.20arrow_forwardThe salespeople at Metlock, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large customers. Richard, the operations supervisor, leaked the $0.65 total unit cost to salespeople, who were thrilled, since that was slightly lower than the previous year's unit cost. Budgets were not yet finalized for the upcoming year, so it was unclear what the target unit cost would be. Richard knew the current year's operating capacity was two million notebooks, and Metlock produced and sold just that many. The detailed breakdown of the $0.65 total unit cost is as follows. Direct material Direct labor Variable overhead Fixed overhead Total cost per unit (a) (b) Total fixed costs Gross margin Your answer is correct. What were Metlock's total fixed costs? If the average selling price was $2.10, how much gross margin did the company generate? $0.15 Fixed costs 0.15 Total cost per unit 0.15 Gross margin 0.20 $0.65 Save for…arrow_forward

- The salespeople at Larkspur, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large customers. David, the operations supervisor, leaked the $0.80 total unit cost to salespeople, who were thrilled, since that was slightly lower than the previous year's unit cost. Budgets were not yet finalized for the upcoming year, so it was unclear what the target unit cost would be. David knew the current year's operating capacity was two million notebooks, and Larkspur produced and sold just that many. The detailed breakdown of the $0.80 total unit cost is as follows. Direct material Direct labor Variable overhead Fixed overhead Total cost per unit $0.05 0.20 0.15 0.40 $0.80arrow_forwardBarfield Corporation prepares business plans and marketing analyses for start-up companies in the Cleveland area. Barfield has been very successful In recent years in providing effective service to a growing number of clients. The company provides its service from a single office building in Cleveland and is organized into two main client-service groups: one for market research and the other for financial analysis. The two groups have budgeted annual costs of $530,000 and $800,000, respectively. In addition, Barfield has a support staff that is organized into two main functions: one for clerical, facilities, and logistical support (called the CFL group) and another for computer-related support. The CFL group has budgeted annual costs of $108,000, while the annual costs of the computer group are $630,000. Tom Brady, CFO of Barfield, plans to prepare a departmental cost allocation for his four groups, and he assembles the following Information: Percentage of estimated dollars of work and…arrow_forwardClassical Furniture is a manufacturer of reproduction antique furniture. It is owned by Helen Sutton as a sole trader business. There are four employees and annual sales revenue is approximately £200,000 per year. You are required to: (a) Explain two benefits of budgetary control to Helen Sutton. (b) Suggest three budgets which Helen could use in the business to provide an adequate system of budgetary control. (c) Advise Helen of the relevant factors to consider when implementing budgetary control.arrow_forward

- Calabria Healthcare supplies prescription drugs to pharmacies. As the management accountant,you are required to analyze the financial statements for this quarter. You already have analyzedthe company’s two divisions, Name Brand and Generic, and your supervisor wants an analysis ofthe comparable profitability of the SBUs. The contribution margins are $500,000 and $200,000,respectively; the controllable fixed costs are $200,000 and $50,000; and the noncontrollable fixedcosts are $50,000 and $100,000. Assume there are no nontraceable fixed costs.What are the total contributions by profit center (CPC) for the Name Brand and Genericdivisions, respectively?a. Name Brand: $300,000; Generic: $150,000b. Name Brand: $250,000; Generic: $50,000c. Name Brand: $200,000; Generic: $50,000d. Name Brand: $500,000; Generic: 200,000arrow_forwardR.M. Lilly Security, Inc. offers security services to professional athletes and entertainers. Each type of service offered is considered to be a separate department. Anita Lilly, the vice president of operations and daughter of the owner, is compensated partially on the basis of departmental performance. Performance is measured by whether the departments are able to operate within their respective budgets. She often revises operations in order to allow the departments to stay within budget. Says Anita, "I will not go over budget even if it means slightly compromising the level and quality of service we provide. These are minor compromises that don't significantly affect the safety of my clients, at least not in the short term." Answer the following: 1. Is there an ethical concern in this case? If so, explain the concern. 2. What parties are affected by these "minor compromises"? 3. Can Anita Lilly take action to eliminate any ethical concerns? Explain. 4. What is R.M. Lilly…arrow_forwardR.M. Lilly Security, Inc. offers security services to professional athletes and entertainers. Each type of service offered is considered to be a separate department. Anita Lilly, the vice president of operations and daughter of the owner, is compensated partially on the basis of departmental performance. Performance is measured by whether the departments are able to operate within their respective budgets. She often revises operations in order to allow the departments to stay within budget. Says Anita, "I will not go over budget even if it means slightly compromising the level and quality of service we provide. These are minor compromises that don't significantly affect the safety of my clients, at least not in the short term." 1. Is there an ethical concern in this case? If so, explain the concern. 2. What parties are affected by these "minor compromises"? 3. Can Anita Lilly take action to eliminate any ethical concerns? Explain. 4. What is R.M. Lilly Securities, Inc.'s…arrow_forward

- R.M. Lilly Security, Inc. offers security services to professional athletes and entertainers. Each type of service offered is considered to be a separate department. Anita Lilly, the vice president of operations and daughter of the owner, is compensated partially on the basis of departmental performance. Performance is measured by whether the departments are able to operate within their respective budgets. She often revises operations in order to allow the departments to stay within budget. Says Anita, "I will not go over budget even if it means slightly compromising the level and quality of service we provide. These are minor compromises that don't significantly affect the safety of my clients, at least not in the short term." Write a summary explaining the following: 1. Is there an ethical concern in this case? If so, explain the concern. 2. What parties are affected by these "minor compromises"? 3. Can Anita Lilly take action to eliminate any ethical concerns? Explain. 4.…arrow_forwardSuper Security Co. offers a range of security services for athletes and entertainers. Each type of service is considered within a separate department. Marc Pincus, the overall manager, is compensated partly on the basis of departmental performance by staying within the quarterly cost budget. He often revises operations to make sure departments stay within budget. Says Pincus, “I will not go over budget even if it means slightly compromising the level and quality of service. These are minor compromises that don’t significantly affect my clients, at least in the short term.” Required 1. Is there an ethical concern in this situation? If so, which parties are affected? Explain. 2. Can Pincus take action to eliminate or reduce any ethical concerns? Explain. 3. What is Super Security’s ethical responsibility in offering professional services?arrow_forwardLamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in implementing a new costing system in its public works department. The division's head approached the head of Business Division about using one of its associates. Corporate Division charges clients $780 per hour for associate services, the same rate other consulting companies charge. The Civic Division head complained that it could hire its own associate at an estimated variable cost of $380 per hour, which is what Business pays its associates. Suppose that Civic Division will charge the client interested in implementing a costing system by the hour based on cost plus a fixed fee, where the cost is primarily the consultant's hourly pay. Assume also that Civic Division cannot hire additional consultants. That is, if it is to do this job, it will need…arrow_forward