Concept explainers

Recording Transactions (in a Journal and T-Accounts); Preparing and Interpreting the

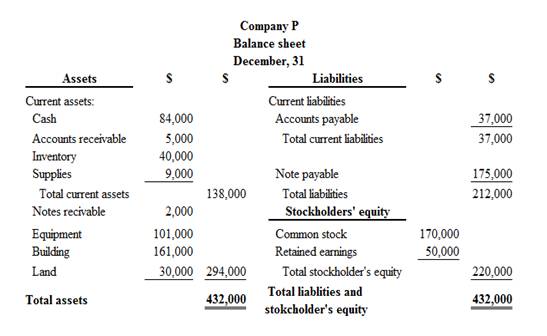

Performance Plastics Company (PPC) has been operating for three years. The beginning account balances are:

During the year, the company had the following summarized activities:

- a. Purchased equipment that cost $21,000: paid $5,000 cash and signed a two-year note for the balance.

- b. Issued an additional 2,000 shares of common stock for $20,000 cash.

- c. Borrowed $50,000 cash from a local bank, payable June 30, in two years.

- d. Purchased supplies for $4,000 cash.

- e. Built an addition to the factory buildings for $41,000; paid $12,000 in cash and signed a three- year note for the balance.

- f. Hired a new president to start January I of next year. The contract was for $95,000 for each full year worked.

Required:

- 1. Analyze transactions (a)-(f) to determine their effects on the

accounting equation. TIP: You won’t need new accounts to record the transactions described above, so have a quick look at the ones listed in the beginning of this question before you begin.

TIP: In transaction (e), three different accounts are affected.

TIP: In transaction (f), consider whether PPC owes anything to its new president for the current year ended December 31.

- 2. Record the transaction effects determined in requirement 1 using journal entries.

- 3. Summarize the

journal entry effects from requirement 2. Use T-accounts if this requirement is being completed manually; if you are using the GL tool in Connect, the journal entries will have been posted automatically to general ledger accounts that are similar in appearance to Exhibit 2.9. - 4. Explain your response to event (f).

- 5. Prepare a classified balance sheet at December 31.

- 6. As of December 31, has the financing for PPC’s. investment in assets primarily come from liabilities or stockholders’ equity?

Requirement – 1

To analyze: The given transaction, and explain their effect on the accounting equation.

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

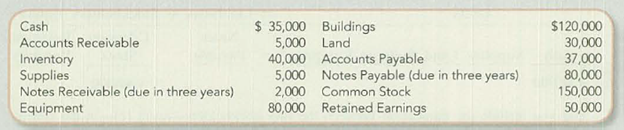

Accounting equation for each transaction is as follows:

Figure (1)

Figure (1)

Therefore, the total assets are equal to the liabilities and stockholder’s equity.

Requirement – 2

To record: The journal entries based on requirement 1.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journal entries of Company P are as follows:

a. Equipment purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Equipment (+A) | 21,000 | |||

| Cash (-A) | 5,000 | |||

| Notes payable (+L) | 16,000 | |||

| (To record purchase of equipment on account and in cash) |

Table (1)

- Equipment is an assets account and it increased the value of asset by $21,000. Hence, debit the equipment account for $21,000.

- Cash is an assets account and it decreased the value of asset by $5,000. Hence, credit the cash account for $5,000.

- Notes payable is a liability account, and it increased the value of liabilities by $16,000. Hence, credit the notes payable for $16,000.

b. Issuance of common stock:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 20,000 | |||

| Common stock (+SE) | 20,000 | |||

| (To record the issuance of common stock) |

Table (2)

- Cash is an assets account and it increased the value of asset by $20,000. Hence, debit the cash account for $20,000.

- Common stock is a component of stockholder’s equity and it increased the value of stockholder’s equity by $20,000, Hence, credit the common stock for $20,000.

c. Cash borrowed from bank (long term)

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 50,000 | |||

| Notes payable (+L) | 50,000 | |||

| (To record cash borrowed from bank) |

Table (3)

- Cash is an assets account and it increased the value of asset by $50,000. Hence, debit the cash account for $50,000.

- Notes payable is a liability account, and it increased the value of liabilities by $50,000. Hence, credit the notes payable for $50,000.

d. Supplies purchased in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Supplies (+A) | 4,000 | |||

| Cash (-A) | 4,000 | |||

| (To record purchase of supplies in cash) |

Table (4)

- Supplies are an assets account and it increased the value of asset by $4,000. Hence, debit the supplies account for $4,000.

- Cash is an assets account and it decreased the value of asset by $4,000. Hence, credit the cash account for $4,000.

e. Building purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Building (+A) | 41,000 | |||

| Cash (-A) | 12,000 | |||

| Notes payable (+L) | 29,000 | |||

| (To record purchase of building on account and in cash) |

Table (5)

- Building is an assets account and it increased the value of asset by $41,000. Hence, debit the building account for $41,000.

- Cash is an assets account and it decreased the value of asset by $12,000. Hence, credit the cash account for $12,000.

- Notes payable is a liability account, and it increased the value of liabilities by $29,000. Hence, credit the notes payable for $29,000.

f. Hired a new president:

In this case, no entry required, because it is not a business transaction.

Requirement – 3

To prepare: T-account for each account listed in the requirement 2.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increasesor decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of company P are as follows:

| Cash (A) | |||

| Beg. Bal. | 35,000 | ||

| (b) | 20,000 | 5,000 | (a) |

| (c) | 50,000 | 4,000 | (d) |

| 12,000 | (e) | ||

| End. Bal. | 84,000 | ||

| Accounts receivable (A) | |||

| Beg. Bal. | 5,000 | ||

| End. Bal. | 5,000 | ||

| Inventory (A) | |||

| Beg. Bal. | 40,000 | ||

| End. Bal. | 40,000 | ||

| Supplies (A) | |||

| Beg. Bal. | 5,000 | ||

| (d) | 4,000 | ||

| End. Bal. | 8,000 | ||

| Equipment (A) | |||

| Beg. Bal. | 80,000 | ||

| (a) | 21,000 | ||

| End. Bal. | 101,000 | ||

| Building (A) | |||

| Beg. Bal. | 120,000 | ||

| (e) | 41,000 | ||

| End. Bal. | 161,000 | ||

| Notes receivable (A) | |||

| Beg. Bal. | 2,000 | ||

| End. Bal. | 2,000 | ||

| Land (A) | |||

| Beg. Bal. | 30,000 | ||

| End. Bal. | 30,000 | ||

| Accounts payable (L) | |||

| 37,000 | Beg. Bal. | ||

| 37,000 | End. Bal. | ||

| Notes payable (L) | |||

| 80,000 | Beg. Bal. | ||

| 16,000 | (a) | ||

| 50,000 | (c) | ||

| 29,000 | (e) | ||

| 175,000 | End. Bal. | ||

| Common stock (SE) | |||

| 150,000 | Beg. Bal | ||

| 20,000 | (b) | ||

| 170,000 | End. Bal. | ||

| Retained earnings(SE) | |||

| 50,000 | Beg. Bal | ||

| 50,000 | End. Bal. | ||

Requirement – 4

To explain: The response for event (f).

Explanation of Solution

Business transaction:

Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the stockholder’s equities, of a business. Business transaction is also referred to as financial transaction.

In this case, hiring of new president is not creating any impact on assets, liabilities and stockholder’s equity of the business, because it is not a business transaction.

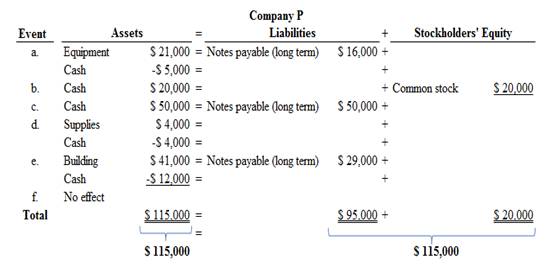

Requirement – 5

To prepare: The classified balance sheet of Company P at December 31.

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Classified balance sheet of Company P is as follows:

Figure (2)

Therefore, the total assets of Company P are$432,000, and the total liabilities and stockholders’ equity are $432,000.

Requirement – 6

Explanation of Solution

The invested amount of assets are primarily come from stockholder’s’ equity of Company P, because the stockholder’s equity (common stock) financed $220,000 of the Company P’s total assets, and liabilities financed $212,000.

Want to see more full solutions like this?

Chapter 2 Solutions

Loose-leaf for Fundamentals of Financial Accounting with Connect

- Journal Entries Following is a list of transactions entered into during the first month of operations of Gardener Corporation, a new landscape service. Prepare in journal form the entry to record each transaction. April 1: Articles of incorporation are filed with the state, and 100,000 shares of common stock are issued for $100,000 in cash. April 4: A six-month promissory note is signed at the bank. Interest at 9% per annum will be repaid in six months along with the principal amount of the loan of $50,000. April 8: Land and a storage shed are acquired for a lump sum of $80,000. On the basis of an appraisal, 25% of the value is assigned to the land and the remainder to the building. April 10: Mowing equipment is purchased from a supplier at a total cost of $25,000. A down payment of $10,000 is made, with the remainder due by the end of the month. April 18: Customers are billed for services provided during the first half of the month. The total amount billed of $5,500 is due within ten days. April 27: The remaining balance due on the mowing equipment is paid to the supplier. April 28: The total amount of $5,500 due from customers is received. April 30: Customers are billed for services provided during the second half of the month. The total amount billed is $9,850. April 30: Salaries and wages of $4,650 for the month of April are paid.arrow_forwardAnalyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.arrow_forwardPrepare journal entries to record the following transactions that occurred in April: A. on first day of the month, issued common stock for cash, $15,000 B. on eighth day of month, purchased supplies, on account, $1,800 C. on twentieth day of month, billed customer for services provided, $950 D. on twenty-fifth day of month, paid salaries to employees, $2,000 E. on thirtieth day of month, paid for dividends to shareholders, $500arrow_forward

- Prepare journal entries to record the following transactions for the month of November: A. on first day of the month, issued common stock for cash, $20,000 B. on third day of month, purchased equipment for cash, $10,500 C. on tenth day of month, received cash for accounting services, $14,250 D. on fifteenth day of month, paid miscellaneous expenses, $3,200 E. on last day of month, paid employee salaries, $8,600arrow_forwardTransaction Analysis and Financial Statements Expert Consulting Services Inc. was organized on March 1 by two former college roommates. The corporation provides computer consulting services to small businesses. The following transactions occurred during the first month of operations: March 2: Received contributions of $20,000 from each of the two principal owners of the new business in exchange for shares of stock. March 7: Signed a two-year promissory note at the bank and received cash of $15,000. Interest, along with the $15,000, will be repaid at the end of the two years. March 12: Purchased $700 in miscellaneous supplies on account. The company has 30 days to pay for the supplies. March 19: Billed a client $4,000 for services rendered by Expert in helping to install a new computer system. The client is to pay 25% of the bill upon its receipt and the remaining balance within 30 days. March 20: Paid $1,300 bill from the local newspaper for advertising for the month of March. March 22: Received 25% of the amount billed to the client on March 19. March 26: Received cash of $2,800 for services provided in assisting a client in selecting software for its computer. March 29: Purchased a computer system for $8,000 in cash. March 30: Paid $3,300 of salaries and wages for March. March 31: Received and paid $1,400 in gas, electric, and water bills. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with the date. Prepare an income statement for the month of March. Prepare a classified balance sheet at March 31. From reading the balance sheet you prepared in part (3), what events would you expect to take place in April? Explain your answer.arrow_forwardEntries Prepared from a Trial Balance and Proof of the Cash Balance Russell Company was incorporated on January 1 with the issuance of capital stock in return for $120,000 of cash contributed by the owners. The only other transaction entered into prior to beginning operations was the issuance of a $50,000 note payable in exchange for equipment and fixtures. The following trial balance was prepared at the end of the first month by the bookkeeper for Russell Company: Required Determine the balance in the Cash account. Identify all of the transactions that affected the Cash account during the month. Use a T account to prove what the balance in Cash will be after all transactions are recorded.arrow_forward

- Prepare journal entries to record the following transactions for the month of July: A. on first day of the month, paid rent for current month, $2,000 B. on tenth day of month, paid prior month balance due on accounts, $3,100 C. on twelfth day of month, collected cash for services provided, $5,500 D. on twenty-first day of month, paid salaries to employees, $3,600 E. on thirty-first day of month, paid for dividends to shareholders, $800arrow_forwardJournal Entries, Trial Balance, and Financial Statements Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred during the first month of business: June 2: Received contributions of $10,000 from each of the three owners of the business in exchange for shares of stock. June 5: Purchased a computer system for $12,000. The agreement with the vendor requires a down payment of $2,500 with the balance due in 60 days. June 8: Signed a two-year promissory note at the bank and received cash of $20,000. June 15: Billed $12,350 to clients for the first half of June. Clients are billed twice a month for services performed during the month, and the bills are payable within ten days. June 17: Paid a $900 bill from the local newspaper for advertising for the month of June. June 23: Received the amounts billed to clients for services performed during the first half of the month. June 28: Received and paid gas, electric, and water bills. The total amount is $2,700. June 29: Received the landlords bill for $2,200 for rent on the office space that Neveranerror leases. The bill is payable by the 10th of the following month. June 30: Paid salaries and wages for June. The total amount is $5,670. June 30: Billed $18,400 to clients for the second half of June. June 30: Declared and paid dividends in the amount of $6,000. Required Prepare journal entries on the books of Neveranerror Inc. to record the transactions entered into during the month. Ignore depreciation expense and interest expense. Prepare a trial balance at June 30. Prepare the following financial statements: Income statement for the month of June Statement of retained earnings for the month of June Classified balance sheet at June 30 Assume that you have just graduated from college and have been approached to join this company as an accountant. From your reading of the financial statements for the first month, would you consider joining the company? Explain your answer. Limit your answer to financial considerations only.arrow_forwardJournal Entries Overnight Delivery Inc. is incorporated on February 1 and enters into the following transactions during its first month of operations: February 15: Received $8,000 cash from customer accounts. February 26: Provided $16,800 of services on account during the month. February 27: Received a $3,400 bill from the local service station for gas and oil used during February. February 28: Paid $400 for wages earned by employees for the month. February 28: Paid $3,230 for February advertising. February 28: Declared and paid $2,000 cash dividends to stockholders. Required Prepare journal entries on the books of Overnight to record the transactions entered into during February. Explain why you agree or disagree with the following: The transactions on February 28 all represent expenses for the month of February because cash was paid. The transaction on February 27 does not represent an expense in February because cash has not yet been paid.arrow_forward

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardJournal Entries Castle Consulting Agency began business in February. The transactions entered into by Castle during its first month of operations are as follows: Acquired articles of incorporation from the state and issued 10,000 shares of capital stock in exchange for $150,000 in cash. Paid monthly rent of $400. Signed a five-year promissory note for $100,000 at the bank. Purchased software to be used on future jobs. The software costs $950 and is expected to be used on five to eight jobs over the next two years. Billed customers $12,500 for work performed during the month. Paid office personnel $3,000 for the month of February. Received a utility bill of $100. The total amount is due in 30 days. Required Prepare in journal form, the entry to record each transaction.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub