Concept explainers

Journal entries and

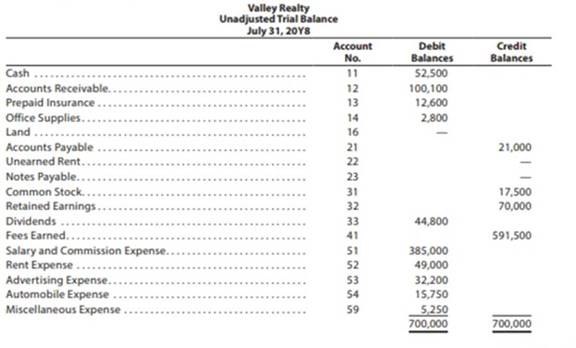

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 20Y8, follows:

The following I hi sine vs transactions were completed by Valley Realty during August 20Y8:

Aug. 1. Purchased office supplies on account, $3,150.

2. Paid rent on office for month, $7,200.

3. Received cash from clients on account, $83,900.

5. Paid insurance premiums, $ 12.000.

9. Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, $400.

17. Paid advertising expense, $8,000.

23. Paid creditors on account, $ 13,750.

Enter the following transactions on Page 19 of the two-column journal:

29. Paid miscellaneous expenses, $ 1,700.

30. Paid automobile expense (including rental charges for an automobile), $2,500.

31. Discovered an error in computing a commission during Ally; received cash from the salesperson for the overpayment, $2,000.

31. Paid salaries and commissions for the month, $53,000.

31. Recorded revenue earned and billed to clients during the month, $183,500.

31. Purchased land for a future building site for $75,000, paying $7,500 in cash and giving a note payable for the remainder.

31. Paid dividends, $1,000.

31. Rented land purchased on August 31 to a local university for use as a parking lot during football season (September. October, and November); received advance payment of $5,000.

Instructions

1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in item section, and place a check mark (»O in the Posting Reference column.

2. Journalize the transactions for August in a two-column journal beginning on Page 18.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of August 31. 20Y8.

5. Assume that the August 31 transaction for dividends should have been $10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry, (c) Is this error a transposition or slide?

(2) and (3)

To journalize: The transactions of August in a two column journal beginning on page 18.

Explanation of Solution

Journal:

Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Rules of debit and credit:

“An increase in an asset account, an increase in an expense account, a decrease in liability account, and a decrease in a revenue account should be debited.

Similarly, an increase in liability account, an increase in a revenue account and a decrease in an asset account, a decrease in an expenses account should be credited”.

Journalize the transactions of August in a two column journal beginning on page 18.

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y8 | Office supplies | 14 | 3,150 | ||

| August | 1 | Accounts payable | 21 | 3,150 | |

| (To record the purchase of supplies of account) | |||||

| 2. | Rent expense | 52 | 7,200 | ||

| Cash | 11 | 7,200 | |||

| (To record the payment of rent) | |||||

| 3 | Cash | 11 | 83,900 | ||

| Accounts receivable | 12 | 83,900 | |||

| (To record the receipt of cash from clients) | |||||

| 5 | Prepaid insurance | 13 | 12,000 | ||

| Cash | 11 | 12,000 | |||

| (To record the payment of insurance premium) | |||||

| 9 | Accounts payable | 21 | 400 | ||

| Office supplies | 14 | 400 | |||

| (To record the payment made to creditors on account) | |||||

| 17 | Advertising expense | 53 | 8,000 | ||

| Cash | 11 | 8,000 | |||

| (To record the payment of advertising expense) | |||||

| 23 | Accounts payable | 21 | 13,750 | ||

| Cash | 11 | 13,750 | |||

| (To record the payment made to creditors on account) | |||||

Table (1)

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y8 | 29 | Miscellaneous expense | 59 | 1,700 | |

| August | Cash | 11 | 1,700 | ||

| (To record the payment made for Miscellaneous expense) | |||||

| 30 | Automobile expense | 54 | 2,500 | ||

| Cash | 11 | 2,500 | |||

| (To record the payment made for automobile expense) | |||||

| 31 | Cash | 11 | 2,000 | ||

| Salary and commission expense | 51 | 2,000 | |||

| (To record the receipt of cash) | |||||

| 31 | Salary and commission expense | 51 | 53,000 | ||

| Cash | 11 | 53,000 | |||

| (To record the payment made for salary and commission expense) | |||||

| 31 | Accounts receivable | 12 | 183,500 | ||

| Fees earned | 41 | 183,500 | |||

| (To record the revenue earned and billed) | |||||

| 31 | Land | 16 | 75,000 | ||

| Cash | 11 | 7,500 | |||

| Notes payable | 23 | 67,500 | |||

| (To record the purchase of land party for cash and party on signing a note) | |||||

| 31 | Dividends | 33 | 1,000 | ||

| Cash | 11 | 1,000 | |||

| (To record the drawing made for personal use) | |||||

| 31 | Cash | 11 | 5,000 | ||

| Unearned rent | 22 | 5,000 | |||

| (To record the cash received for the service yet to be provide) | |||||

Table (2)

(1) and (3)

To record: The beginning balances of each accounts in the appropriate balance column of a four-column account, and post them to the ledger extending the account balance to the appropriate balance column after each posting.

Explanation of Solution

T-account:

An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account

- The left or debit side

- The right or credit side

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 52,500 | |||

| 2 | 18 | 7,200 | 45,300 | ||||

| 3 | 18 | 83,900 | 129,200 | ||||

| 5 | 18 | 12,000 | 117,200 | ||||

| 17 | 18 | 8,000 | 109,200 | ||||

| 23 | 18 | 13,750 | 95,450 | ||||

| 29 | 19 | 1,700 | 93,750 | ||||

| 30 | 19 | 2,500 | 91,250 | ||||

| 31 | 19 | 2,000 | 93,250 | ||||

| 31 | 19 | 53,000 | 40,250 | ||||

| 31 | 19 | 7,500 | 32,750 | ||||

| 31 | 19 | 1,000 | 31,750 | ||||

| 31 | 19 | 5,000 | 36,750 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 100,100 | |||

| 3 | 18 | 83,900 | 16,200 | ||||

| 31 | 19 | 183,500 | 199,700 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 12,600 | |||

| 5 | 18 | 12,000 | 24,600 | ||||

Table (5)

| Account: Office Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 2,800 | |||

| 1 | 18 | 3,150 | 5,950 | ||||

| 9 | 18 | 400 | 5,550 | ||||

Table (6)

| Account: Land Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 31 | 19 | 75,000 | 75,000 | |||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 21,000 | |||

| 1 | 18 | 3,150 | 24,150 | ||||

| 9 | 18 | 400 | 23,750 | ||||

| 23 | 18 | 13,750 | 10,000 | ||||

Table (8)

| Account: Unearned Rent Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 31 | 19 | 5,000 | 5,000 | |||

Table (9)

| Account: Notes Payable Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 31 | 19 | 67,500 | 67,500 | |||

Table (11)

| Account: Common stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 17,500 | |||

Table (12)

| Account: Retained earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 70,000 | |||

Table (13)

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 44,800 | |||

| 31 | 19 | 1,000 | 45,800 | ||||

Table (13)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 591,500 | |||

| 31 | 19 | 183,500 | 775,000 | ||||

Table (14)

| Account: Salary and commission expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 385,000 | |||

| 31 | 19 | 2,000 | 383,000 | ||||

| 31 | 19 | 53,000 | 436,000 | ||||

Table (15)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 49,000 | |||

| 2 | 18 | 7,200 | 56,200 | ||||

Table (16)

| Account: Advertising expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 32,200 | |||

| 17 | 18 | 8,000 | 40,200 | ||||

Table (17)

| Account: Automobile expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 15,750 | |||

| 30 | 19 | 2,500 | 18,250 | ||||

Table (19)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 5,250 | |||

| 29 | 19 | 1,700 | 6,950 | ||||

Table (20)

(4)

To prepare: An unadjusted trial balance of Company V at August 31, 20Y8.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance of Company V at August 31, 20Y8 as follows:

|

Company V Unadjusted Trial Balance August 31, 20Y8 | |||

| Particulars | Account No. |

Debit $ | Credit $ |

| Cash | 11 | 36,750 | |

| Accounts receivable | 12 | 199,700 | |

| Prepaid insurance | 13 | 24,600 | |

| Office supplies | 14 | 5,550 | |

| Land | 16 | 75,000 | |

| Accounts payable | 21 | 10,000 | |

| Unearned rent | 22 | 5,000 | |

| Notes payable | 23 | 67,500 | |

| Common stock | 31 | 17,500 | |

| Retained earnings | 32 | 70,000 | |

| Dividends | 33 | 45,800 | |

| Fees earned | 41 | 775,000 | |

| Salaries and commission expense | 51 | 436,000 | |

| Rent expense | 52 | 56,200 | |

| Advertising expense | 53 | 40,200 | |

| Automobile expense | 54 | 18,250 | |

| Miscellaneous expense | 59 | 6,950 | |

| Total | 945,000 | 945,000 | |

Table (20)

(5) a.

To explain: Whether the unadjusted trial balance in (4) balance

Explanation of Solution

The unadjusted trial balance in (4) would still balance, since the debit equalized the credit in the original journal entry.

b.

To journalize: The correcting entry

Explanation of Solution

The Correcting entry is as follows:

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y8 | Dividends | 33 | 9,000 | ||

| August | 31 | Cash | 11 | 9,000 | |

| (To record the correcting entry) | |||||

Table (21)

Working notes:

c.

To identify: Whether the error made is a slide or transposition.

Explanation of Solution

Slide error:

A slide error occurs, when the decimal point of an amount has been misplaced.

The drawings account balance recorded as $10,000 instead of $1,000 is a slide error. Since, the decimal point of the amount has been misplaced.

Want to see more full solutions like this?

Chapter 2 Solutions

Corporate Financial Accounting

- Journal entries and trial balance Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 20Y3, follows: The following business transactions were completed by Elite Realty during April 20Y3: Apr. 1. Paid rent on office for month, 6,500. 2. Purchased office supplies on account, 2,300. 5. Paid insurance premiums, 6,000. 10. Received cash from clients on account, 52,300. 15. Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17. Paid creditors on account, 6,450. 20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23. Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27. Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28. Paid automobile expense (including rental charges for an automobile), 1,500. 29. Paid miscellaneous expenses, 1,400. 30. Recorded revenue earned and billed to clients during the month, 57,000. 30. Paid salaries and commissions for the month, 11,900. 30. Paid dividends, 4,000. 30. Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 20Y3, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 20Y3. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide? The following business transactions were completed by Elite Realty during April 20Y3: Apr. 1. Paid rent on office for month, 6,500. 2. Purchased office supplies on account, 2,300. 5. Paid insurance premiums, 6,000. 10. Received cash from clients on account, 52,300. 15. Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17. Paid creditors on account, 6,450. 20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23. Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27. Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28. Paid automobile expense (including rental charges for an automobile), 1,500. 29. Paid miscellaneous expenses, 1,400. 30. Recorded revenue earned and billed to clients during the month, 57,000. 30. Paid salaries and commissions for the month, 11,900. 30. Paid dividends, 4,000. 30. Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 20Y3, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 20Y3. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forwardJournal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 40,000. b. Paid rent on office and equipment for the month, 4,800. c. Purchased supplies on account, 2,150. d. Paid creditor on account, 1,100. e. Earned sales commissions, receiving cash, 18,750. f. Paid automobile expenses (including rental charge) for month, 1,580, and miscellaneous expenses, 800. g. Paid office salaries, 3,500. h. Determined that the cost of supplies used was 1,300. i. Paid dividends, 1,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.arrow_forward

- Journal entries and trial balance On October 1, 20Y4, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 18,000. 4. Paid rent for period of October 4 to end of month, 3,000. 10. Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13. Purchased equipment on account, 10,500. 14. Purchased supplies for cash, 2,100. Oct. 15. Paid annual premiums on property and casualty insurance, 3,600. 15. Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21. Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24. Recorded jobs completed on account and sent invoices to customers, 14,150. 26. Received an invoice for truck expenses, to be paid in November, 700. 27. Paid utilities expense, 2,240. 27. Paid miscellaneous expenses, 1,100. 29. Received cash from customers on account, 7,600. 30. Paid wages of employees, 4,800. 31. Paid dividends, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 16 Equipment 18 Truck 21 Notes Payable 22 Accounts Payable 31 Common Stock 33 Dividends 41 Fees Earned 51 Wages Expense 53 Rent Expense 54 Utilities Expense 55 Truck Expense 59 Miscellaneous Expense 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 20Y4. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forwardEntries into T accounts and trial balance Marjorie Knaus, an architect, organized Knaus Architects on January 1, 20Y4. During the month, Knaus Architects completed the following transactions: a. Issued common stock to Marjorie Knaus in exchange for 30,000. b. Paid January rent for office and workroom, 2,500. c. Purchased used automobile for 28,500, paying 6,000 cash and giving a note payable for the remainder. d. Purchased office and computer equipment on account, 8,000. e. Paid cash for supplies, 2,100. f. Paid cash for annual insurance policies, 3,600. g. Received cash from client for plans delivered, 9,000. h. Paid cash for miscellaneous expenses, 2,600. i. Paid cash to creditors on account, 4,000. j. Paid installment due on note payable, 1,875. k. Received invoice for blueprint service, due in February, 5,500. l. Recorded fees earned on plans delivered, payment to be received in February, 31,400. m. Paid salary of assistants, 6,000. n. Paid gas, oil, and repairs on automobile for January, 1,300. Instructions 1. Record these transactions directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Salary Expense, Blueprint Expense, Rent Expense, Automobile Expense, Miscellaneous Expense. To the left of the amount entered in the accounts, place the appropriate letter to identify the transaction. 2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance. 3. Prepare an unadjusted trial balance for Knaus Architects as of January 31, 20Y4. 4. Determine the net income or net loss for January.arrow_forwardValley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forward

- Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2019, follows: The following business transactions were completed by Elite Realty during April 2019: Apr. 1. Paid rent on office for month, 6,500. 2.Purchased office supplies on account, 2,300. 5.Paid insurance premiums, 6,000. 10.Received cash from clients on account, 52,300. 15.Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17.Paid creditors on account, 6,450. 20.Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23.Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27.Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28.Paid automobile expense (including rental charges for an automobile), 1,500. 29.Paid miscellaneous expenses, 1,400. 30.Recorded revenue earned and billed to clients during the month, 57,000. 30.Paid salaries and commissions for the month, 11,900. 30.Withdrew cash for personal use, 4,000. 30.Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardEFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.arrow_forwardJournal Entries, Trial Balance, and Financial Statements Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred during the first month of business: June 2: Received contributions of $10,000 from each of the three owners of the business in exchange for shares of stock. June 5: Purchased a computer system for $12,000. The agreement with the vendor requires a down payment of $2,500 with the balance due in 60 days. June 8: Signed a two-year promissory note at the bank and received cash of $20,000. June 15: Billed $12,350 to clients for the first half of June. Clients are billed twice a month for services performed during the month, and the bills are payable within ten days. June 17: Paid a $900 bill from the local newspaper for advertising for the month of June. June 23: Received the amounts billed to clients for services performed during the first half of the month. June 28: Received and paid gas, electric, and water bills. The total amount is $2,700. June 29: Received the landlords bill for $2,200 for rent on the office space that Neveranerror leases. The bill is payable by the 10th of the following month. June 30: Paid salaries and wages for June. The total amount is $5,670. June 30: Billed $18,400 to clients for the second half of June. June 30: Declared and paid dividends in the amount of $6,000. Required Prepare journal entries on the books of Neveranerror Inc. to record the transactions entered into during the month. Ignore depreciation expense and interest expense. Prepare a trial balance at June 30. Prepare the following financial statements: Income statement for the month of June Statement of retained earnings for the month of June Classified balance sheet at June 30 Assume that you have just graduated from college and have been approached to join this company as an accountant. From your reading of the financial statements for the first month, would you consider joining the company? Explain your answer. Limit your answer to financial considerations only.arrow_forward

- Complete accounting cycle For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 20Y2, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond entered into the following transactions during July: Record the following transactions on Page 2 of the journal: Instructions 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a) Insurance expired during July is 375. (b) Supplies on hand on July 31 are 1,525. (c) Depreciation of office equipment for July is 750. (d) Accrued receptionist salary on July 31 is 175. (e) Rent expired during July is 2,400. (f) Unearned fees on July 31 are 2,750. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardComplete accounting cycle For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 20Y6, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud entered into the following transactions during April: Record the following transactions on Page 2 of the journal: Instructions 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a) Insurance expired during April is 350. (b) Supplies on hand on April 30 are 1,225. (c) Depreciation of office equipment for April is 400. (d) Accrued receptionist salary on April 30 is 275. (e) Rent expired during April is 2,000. (f) Unearned fees on April 30 are 2,350. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardProvided below is a trial balance for Juanitas Delivery Service. Use this trial balance for Exercises 3-10A, 3-11A, and 3-12A. STATEMENT OF OWNERS EQUITY From the information in the trial balance presented above, prepare a statement of owners equity for Juanitas Delivery Service for the month ended September 30, 20--. Assume this is not the first month of operations and the owner did not invest in the business during September.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage