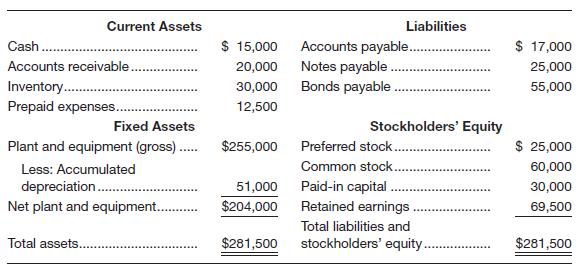

For December 31, 20X1, the

Sales for 20X2 were

During 20X2, the cash balance and prepaid expenses balances were unchanged. Accounts receivable and inventory increased by 10 percent. A new machine was purchased on December 31, 20X2, at a cost of

Accounts payable increased by 20 percent. Notes payable increased by

a. Prepare an income statement for 20X2.

b. Prepare a statement of

c. Prepare a balance sheet as of December 31, 20X2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

- The balance sheet for Revolution Clothiers is shown below. Sales for the year were $3,200,000, with 75 percent of sales sold on credit. Assets Cash Accounts receivable Inventory Plant and equipment Total assets REVOLUTION CLOTHIERS Balance Sheet 20X1 a. Current ratio b. Quick ratio c. Debt-to-total-assets ratio d. Asset turnover e. Average collection period $ 25,000 351,000 251,000 423,000 $ 1,050,000 Accounts payable Accrued taxes Liabilities and Equity times times % times days Bonds payable (long-term) Common stock Paid-in capital Retained earnings Total liabilities and equity $ 247,000 97,000 136,000 Compute the following ratios: Note: Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to- total assets answer as a percent rounded to 2 decimal places. 100,000 150,000 320,000 $ 1,050,000arrow_forwardCampbell Company has current assets of $3 million of which $750,000 are accounts receivable. Its current liabilities total $2 million of which $500,000 are accounts payable and $100,000 are wages payable. Campbell’s net credit is:arrow_forwardStale Bread Co. had net income in the current year of $700,000. Depreciation expense for the year was $80,000. Between the beginning and the end of the current year the company's accounts payable (all to suppliers of raw materials) increased $100,000 while accounts receivables from customer sales also increase by $150,000. The company also issued a long-term bond payable in exchange for receiving $300,000 cash. Compute the amount of cash provided or used for OPERATING ACTIVITIES, only, by the indirect method.arrow_forward

- Valero’s energy’s balance sheet showed total current assets of $3000 all of which were required in operations. It’s current liabilities consists of $905 of accounts payable $600 of 6% short term notes payable to the bank and $250 of acute wages and taxes. What was its net operating working capital?arrow_forwardViper Construction’s days sales outstanding is 50 days (on a 365-day basis). The company’s accounts receivable equal $100 million and its balance sheet shows inventory equal to $125 million. What is the average number of days that the receivables of Viper Construction remain outstanding before they are collected? *arrow_forwardNNR Inc.'s balance sheet showed total current assets of $1,812,000 plus $4,379,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $498,000 of accounts payable, $350,000 of 6% short-term notes payable to the bank, and $141,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total investor-provided operating capital? Group of answer choices $5,829,600 $5,552,000 $4,719,200 $4,996,800 $6,107,200arrow_forward

- Viper Construction’s days sales outstanding is 50 days (on a 365-day basis). The company’s accounts receivable equal $100 million and its balance sheet shows inventory equal to $125 million. How much is the Annual Sales? *arrow_forwardBay Plumbing's balance sheet shows operating current assets of $6,300. Its current liabilities consist of $810 of accounts payable, $800 of 8% short-term interest-bearing notes, and $3,200 of accrued wages. What is its net operating working capital?arrow_forwardNNR Inc.'s balance sheet showed total current assets of $1,875,000 plus $4,225,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $475,000 of accounts payable, $375,000 of 6% short-term notes payable to the bank, and $150,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total operating capital?arrow_forward

- The annual sales of a company are $235,000 including sales tax at 17.5%. Half of the sales are on credit terms, half are cash sales. The receivables in the statement of financial position are $23,500. What is the output tax?arrow_forwardRonald Company has current assets of $115,000 and current liabilities of $75,000 of which accounts payable are $65,000. Arnold's cost of goods sold is $420,000, its merchandise inventory increased by $20,000, and accounts payable were $45,000 the prior year. Calculate: (a) Ronald's working capital, (b) payables turnover, and (c) days' payable.arrow_forwardAt the beginning of the year, AlLmight had a receivable amounting to P 100,000. The recorded sales from the ledger were P 590,000 including P 390,000 cash sales. The collection from credit customers was 190,000. As of the year-end, the remaining balance of the receivable was estimated at 80% collectible. Prepare the journal entry for the transactions above.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning