Exercise 2-27A Effect of accounting events on the income statement and statement of cash flows

Required

Explain how each of the following events or series of events and the related

- a. Paid $9,000 cash on October 1 to purchase a one-year insurance policy.

- b. Purchased $2,000 of supplies on account. Paid $500 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300.

- c. Provided services for $10,000 cash.

- d. Collected $2,400 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year

- e. Accrued salaries amounting to $5,600.

- f. Sold land that cost $3,000 for $3,000 cash.

- g. Acquired $15,000 cash from the issue of common stock.

- h. Earned $12,000 of revenue on account. Collected $8,000 cash from

accounts receivable . - i. Paid cash operating expenses of $4,500.

Explain the way each of the given events or series of events and the related adjusting entry will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease, or NA) and the amount of the change. If an event does not have a related adjusting entry, then record only the effects of the event.

Explanation of Solution

Net income: Net income is the excess amount of revenue which arises after deducting all the expenses of a company. In simple terms, it is the difference between total revenue and total expenses of the company.

Cash flows from operating activities: These refer to the cash received or cash paid in day-to-day operating activities of a company.

Explain the way that the given events are affecting net income and cash flows from operating activities.

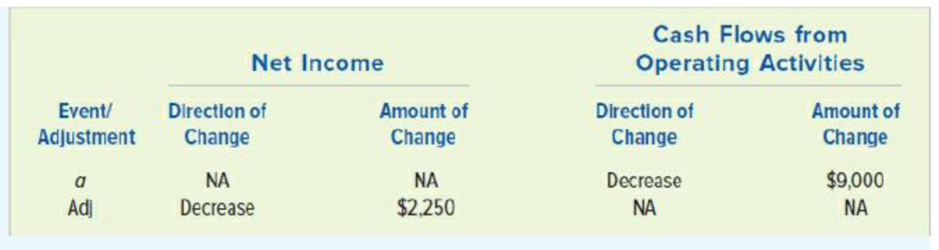

- a. Purchased one year insurance policy on October 1st for $9,000. It decreases the cash flows from the operating activities by $9,000, because there is a cash outflow of $9,000. On December 31st, three months amount is recognized as an expense through an adjusting entry. It decreases the net income in the income statement by $2,250 (1) (for three months).

- b. Purchased supplies for $2,000 on account. $500 paid on accounts payable. This will decrease the cash flows from operating activities, but not affect the net income. During the year $1,700 (2) supplies are used. Adjusting the supplies account will decrease supplies account and increase supplies expense account. Increase in expense decreases the net income in the income statement.

- c. $10,000 Services provided for cash. It increases the net income in the income statement and cash flows from the operating activities in the statement of cash flows by $10,000.

- d. Cash collected $2,400 in advance to render a service, which starts from May 1st and continued for one year. This increases the cash flows from operating activities, but not affected the net income. Till the end of December 31, total 8 months services are rendered. This will increase the net income in the income statement by $1,600 (3).

- e. Accrued salaries amounting to $5,600. This will decrease the net income by $5,600. Since there is no cash out flow, there is no change in the cash flow from operating activities.

- f. Sold land that cost $3,000 for $3,000 cash. It does not affect the net income and cash flows from operating activities. Because land and cash are the balance sheet items and sale of land is an investing activity in the statement of cash flows.

- g. Acquired $15,000 cash from the issue of common stock. It does not affect the net income and cash flows from operating activities. Because common stock and cash are the balance sheet items and issuing common stock is a financing activity in the statement of cash flows.

- h. Earned $12,000 revenue on account. It increases the net income in the income statement. Collected $8,000 cash from the accounts receivable. It increases the cash flows from the operating activities.

- i. Cash paid for operating expenses $4,500. It decreases the net income in the income statement and cash flows from operating activities.

Identify the direction of change (increase, decrease, or NA) and the amount of the change for the given events.

| Event/Adjustment | Net Income |

Cash Flow from Operating Activities |

|||

| Direction of Change | Amount of Change | Direction of Change | Amount of Change | ||

| a |

Event Adjustment |

NA Decrease |

NA (1)$2,250 |

Decrease NA |

$9,000 NA |

| b |

Event Adjustment |

NA Decrease |

NA (2)1,700 |

Decrease NA |

500 NA |

| c |

Event No adjustment |

Increase | 10,000 | Increase | 10,000 |

| d |

Event Adjustment |

NA Increase |

NA (3)1,600 |

Increase NA |

2,400 NA |

| e |

Event No adjustment |

Decrease | 5,600 | NA | NA |

| f |

Event No adjustment |

NA | NA | NA | NA |

| g |

Event No adjustment |

NA | NA | NA | NA |

| h |

Event No adjustment |

Increase | 12,000 | Increase | 8,000 |

| i |

Event No adjustment |

Decrease | 4,500 | Decrease | 4,500 |

Table (1)

Working notes:

Calculate the adjustment amount for insurance policy (event a).

Purchased an insurance policy on October 1, and paid $9,000 cash. The year ending adjustment amount is calculated for 3 months (October 1st to December 31st).

Calculate the amount for supplies used during the year.

The supplies are purchased for $2,000. At the end of the year after adjustment, the balance amount of supplies is $300.

Calculate the amount of services performed during the year.

Cash collected $2,400 in advance to provide the service from May 1, and continued for one year.

Want to see more full solutions like this?

Chapter 2 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Case 2-64 Analysis of the Effects of Current Asset and Current Liability Changes on Cash Flows You have the following data for Cable Companys accounts receivable and accounts payable for 2019: Required: 3. How much cash did Cable pay for wages during 26-19?arrow_forwardCornerstone Exercise 1-16 Financial Statements Listed below are elements of the financial statements. a. Liabilities b. Net change in cash c. Assets d. Revenue Required: e. Cash flow from operating activities f. Expenses g. Stockholders' equity h. Dividends Match each financial statement item with its financial statement: balance sheet (B), income statement (I), retained earnings statement (RE), or statement of cash flows (CF).arrow_forwardFinancial statements Jose Loder established Bronco Consulting on August 1, 2016. The effect of each transaction and the balances after each transaction for August follow: Instructions 1. Prepare an income statement for the month ended August 31, 2016. 2. Prepare a retained earnings statement for the month ended August 31, 2016. 3. Prepare a balance sheet as of August 31, 2016. 4. (Optional) Prepare a statement of cash flows for the month ending August 31, 2016.arrow_forward

- Exercise 2-42 Inferring Transactions from Balance Sheet Changes Each of the following balance sheet changes is associated with a particular transaction: Cash decreases by $32,000 and land increases by $22,000. Cash decreases by $9,000 and retained earnings decreases by $9,000. Cash increases by $100,000 and common stock increases by $100,000. Cash increases by $15,000 and notes payable increases by $15,000. Required: CONCEPTUAL CONNECTION Describe each transaction listed above.arrow_forwardFinancial statements Jose Loder established Bronco Consulting on August 1, 2018. The effect of each transaction and the balances after each transaction for August follow: Instructions 1. Prepare an income statement for the month ended August 31, 2018. 2. Prepare a retained earnings statement for the month ended August 31, 2018. 3. Prepare a balance sheet as of August 31, 2018. 4. (Optional) Prepare a statement of cash flows for the month ending August 31, 2018.arrow_forwardTransactions and Financial statements James Nesbitt established Up-Date Computer Services on August 1, 20Y4. The effect of each transaction and the balances after each transaction for August are shown below in the integrated financial statement framework. Instructions 4. Prepare a statement of cash flows for the month ended August 31, 20Y4.arrow_forward

- Brief 1-28 Statement of Cash Flows Listed are items that would on a Statement of cash flows. Cash received from customers Cash paid for dividends Cash received from a bank loan Cash paid to suppliers Cash paid to purchase Required: Indicate in which part of the statement of cash flows each of the items would appear: operating activities (O), investing activities (I), or financing activities (F).arrow_forwardFinancial statements Seth Feye established Reliance Financial Services on July 1, 2018. Reliance Financial Services offers financial planning advice to its clients. The effect of each transaction and the balances after each transaction for July follow: Instructions 1. Prepare an income statement for the month ended July 31, 2018. 2. Prepare a retained earnings statement for the month ended July 31, 2018. 3. Prepare a balance sheet as of July 31, 2018. 4. (Optional) Prepare a statement of cash flows for the month ending July 31, 2018.arrow_forwardExercise 1-50 Statement of Cash Flows OBJECTIVE o Walters Inc. began operations on January I. 2019. The following information relates to Walters cash flows during 2019. Required: 1. Calculate the cash provided/fused for each cash flow category. 2. CONCEPTUAL CONNECTION Comment on Walters creditworthiness.arrow_forward

- Financial statements Padget Home Services began its operations on January 1, 20Y7 (see Problem 2-3). After its second year of operations. the following amounts were taken from the accounting records of Padget Home Services, Inc., as of December 31, 20Y8. Instructions Prepare a statement of cash flows for the year ending December 31, 20Y8. (Hint: You should compare the asset and liability amounts of December 31. 20Y8, with those of December 31, 20Y7, to determine cash used in investing and financing activities. See Problem 2-3 for the December 31, 20Y7, balance sheet amounts.)arrow_forwardSERIES A EXERCISES IDENTIFICATION OF OPERATING, INVESTING, AND FINANCING ACTIVITIES The following activities took place during the current year. Indicate whether each activity is a cash inflow (+) or cash outflow (), and whether it is an operating activity (O), an investing activity (I), or a financing activity (F). (a) Proceeds from collection of principal amount of loans made to borrowers (b) Cash receipts from the sale of goods (c) Payments for interest on loans (d) Payments of dividends to stockholders (e) Payments to acquire investments in debt securities (f) Dividends received on investments made in the stock of other corporations (g) Repayment of the principal on loans (h) Interest received on loans made to outside entities (i) Salaries paid to employees (j) Payments to acquire property, plant, and equipment and other productive assets (k) Payments to purchase treasury stock (l) Proceeds from the sale of common stockarrow_forward

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning