Contemporary Engineering Economics Plus MyLab Engineering with eText -- Access Card Package (6th Edition)

6th Edition

ISBN: 9780134162690

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2P

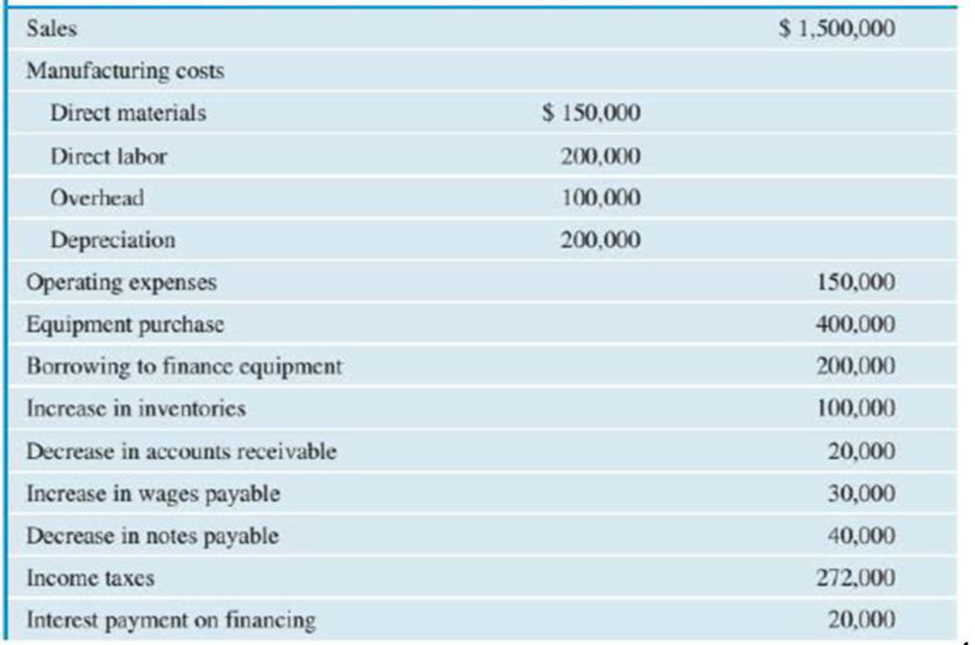

A chemical processing firm is planning on adding a duplicate polyethylene plant at another location. The financial information for the first project year is shown in Table P2.2.

- (a) Compute the working-capital requirement during the project period.

- (b) What is the taxable income during the project period?

- (c) What is the net income during the project period?

- (d) Compute the net cash flow from the project during the first year.

TABLE P2.2 Financial Information for First Project Year

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Omar Shipping Company bought a tugboat for $75,000 (year 0) and expected to use it for five years after which it will be sold for $12,000. Suppose the company estimates the following revenues and expenses from the tugboat investment for the first operating year:

If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?

(a) $28,700(b)$81,200(c) $78,400(d) $25,900

Hydro Systems Engineering Associates, Inc., provides consulting services to city water authorities. The consulting firm’s contribution-margin ratio is 15 percent, and its annual fixed expenses are $245,000. The firm’s income-tax rate is 30 percent.

Required:1. Calculate the firm’s break-even volume of service revenue.2. How much before-tax income must the firm earn to make an after-tax net income of $138,000?3. What level of revenue for consulting services must the firm generate to earn an after-tax net income of $138,000?4. Suppose the firm’s income-tax rate changes to 20 percent. What will happen to the break-even level of consulting service revenue?

Calculate the firm’s break-even volume of service revenue. How much before-tax income must the firm earn to make an after-tax net income of $138,000? What level of revenue for consulting services must the firm generate to earn an after-tax net income of $138,000? (Do not round intermediate calculations. Round your final answers to the…

Certain new machinery used in manufacturing of motor vehicles, when placed in service, is estimated to cost $275,000. It is expected to reduce net annual operating expenses by $56,000 per year for 10 years and to have a $41,000 MV at the end of the 10th year. Assume that the firm is in the federal taxable income bracket of $335,000 to $10,000,000 and that the state income tax rate is 7.5%. State income taxes are deductible from federal taxable income. This machinery is to be depreciated using the MACRS (GDS). Develop the BTCFs and ATCFs and compute for the respective PWs at EOY 0 using an MARR of 12%.

Chapter 2 Solutions

Contemporary Engineering Economics Plus MyLab Engineering with eText -- Access Card Package (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- When determining the present worth of the after-tax cash flows of an investment purchased using borrowed funds, which of the following are required? I. Principal and interest component for each loan payment II. Tax rate applied to the taxable income generated by the investment III. Depreciation deductions for the investment IV. Before-tax and loan cash flows for the investment V. MARR. a. I, III, IV, and V only b. II, III, IV, and V only c. IV and V only d. All items (I, II, III, IV, and V).arrow_forwardEFG Corporation ("EFG") is a Canadian-controlled private corporation and has correctly calculated its net income for tax purposes to be $857,000 for the year ending December 31, 2019, as shown below: Business income $710,000 Taxable capital gains $80,000 Taxable dividends from Canadian public corporations $32,000 Taxable dividends from XYZ Inc. $5,000 Interest on five-year bonds $30,000 Net income for tax purposes $857,000 EFG owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income. Additional information: • EFG made charitable donations of $45,000 during the year • Net capital losses were $35,000 as of January 1, 2019 • Non-capital losses were $50,000 as of January 1, 2019 • At the end of the previous year, EFG had a balance in its non-eligible refundable dividend tax on hand (RDTOH) account of $18,000 and GRIP of $2,000. XYZ received a dividend refund of $1,917 from its non-eligible RDTOH when it paid…arrow_forwardThe tax rates for a particular year are shown below: Taxable Income Tax Rate $0 – 50,000 15 % 50,001 – 75,000 25 % 75,001 – 100,000 34 % 100,001 – 335,000 39 % What is the average tax rate for a firm with taxable income of $124,513?arrow_forward

- Cori's Meats is looking at a new sausage system with an installed cost of $495,000. This cost will be depreciated straight-line to zero over the project’s five-year life, at the end of which the sausage system can be scrapped for $73,000. The sausage system will save the firm $175,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $32,000. If the tax rate is 23 percent and the discount rate is 10 percent, what is the NPV of this project?arrow_forwardBarbara Thompson is considering the purchase of a piece of business rental property containing stores and offices at a cost of $350,000. Barbara estimates that annual receipts from rentals will be $55,000 and that annual disbursements. other than income taxes, will be about $18,000. The property is expected to appreciate at the annual rate of 5%. Barbara expects to retain the property for 20 years once it is acquired. Then it will be depreciated on the basis of the 39-year real-property class (MACRS), assuming that the property would be placed in service on January 1. Barbara's marginal tax rate is 30%, and her MARR is 10%. What would be the minimum annual total of rental receipts that would make the investment break even?arrow_forwardLynn Construction Company had a gross income of $34,000,000 in tax-year 1,$5,000,000 in salaries, $4,000,000 in wages, $1,000,000 in depreciation expenses, a loan principal payment of $200,000, and a loan interest payment of $210,000.(a) What is the marginal tax rate for Lynn Construction in tax-year 1?(b) What is the average tax rate in tax-year 1?(c) Determine the net income of the company in tax-year 1.arrow_forward

- A firm is considering of an investment of $1 million, with a WACC of 10% in a project. Given the project is able to generate net operating profit after tax of $200,000. Calculate the Economic Value Added of the investment. Question 6 options: 1) - $100,000 2) $100,000 3) $200,000 4) None of the abovearrow_forwardA corporation in 2018 expects a gross income of $680,000, total operating expenses of $480,000, and capital investments of $29,000. In addition the corporation is able to declare $53,000 of depreciation charges for the year. The federal income tax rate is 21%. What is the expected taxable income and total federal income taxes owed for the year 2018?arrow_forwardPerfection Corp earned $250 million before tax in 2022. Its combined Federal and State tax rate was 26%, and the company paid $60 million in dividends. Given a dividend tax rate of 20%, what were total taxes paid from Perfection’s earnings?arrow_forward

- Quigley Inc. is considering two financial plans for the coming year. Management expects sales to be $300,000, operating costs to be $265,000, assets (which is equal to its total invested capital) to be $200,000, and its tax rate to be 35%. Under Plan A it would finance the firm using 25% debt and 75% common equity. The interest rate on the debt would be 8.8%, but under a contract with existing bondholders the TIE ratio would have to be maintained at or above 5.5. Under Plan B, the maximum debt that met the TIE constraint would be employed. Assuming that sales, operating costs, assets, total invested capital, the interest rate, and the tax rate would all remain constant, by how much would the ROE change in response to the change in the capital structure? Do not round your intermediate calculations.arrow_forwardSGS Golf Academy is evaluating different golf practice equipment. The "Dimple-Max" equipment costs $149,000, has a 4-year life, and costs $9,300 per year to operate. The relevant discount rate is 14 percent. Assume that the straight-line depreciation method is used and that the equipment is fully depreciated to zero. Furthermore, assume the equipment has a salvage value of $21,500 at the end of the project’s life. The relevant tax rate is 22 percent. All cash flows occur at the end of the year. What is the EAC of this equipment? Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardPrinting World thinks it may need a new colour printing press. The press will cost $540,000 but will substantially reduce annual operating costs by $216,000 a year, before tax. The press has a 30% CCA rate and will be in its own asset pool. The first CCA deduction is made in year 0. The press will operate for 4 years and then be worthless. The cost of equity for Printing World is 10%, the cost of debt is 9%, and the company’s target debt-equity ratio is 0.50. The company’s tax rate is 30%. a. What is the NPV of buying the press?.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License