a.

Identify the two additional

a.

Answer to Problem 35P

The additional two transactions requiring adjusting entries are prepaid rent on April 1 and unearned revenue on September 1.

Explanation of Solution

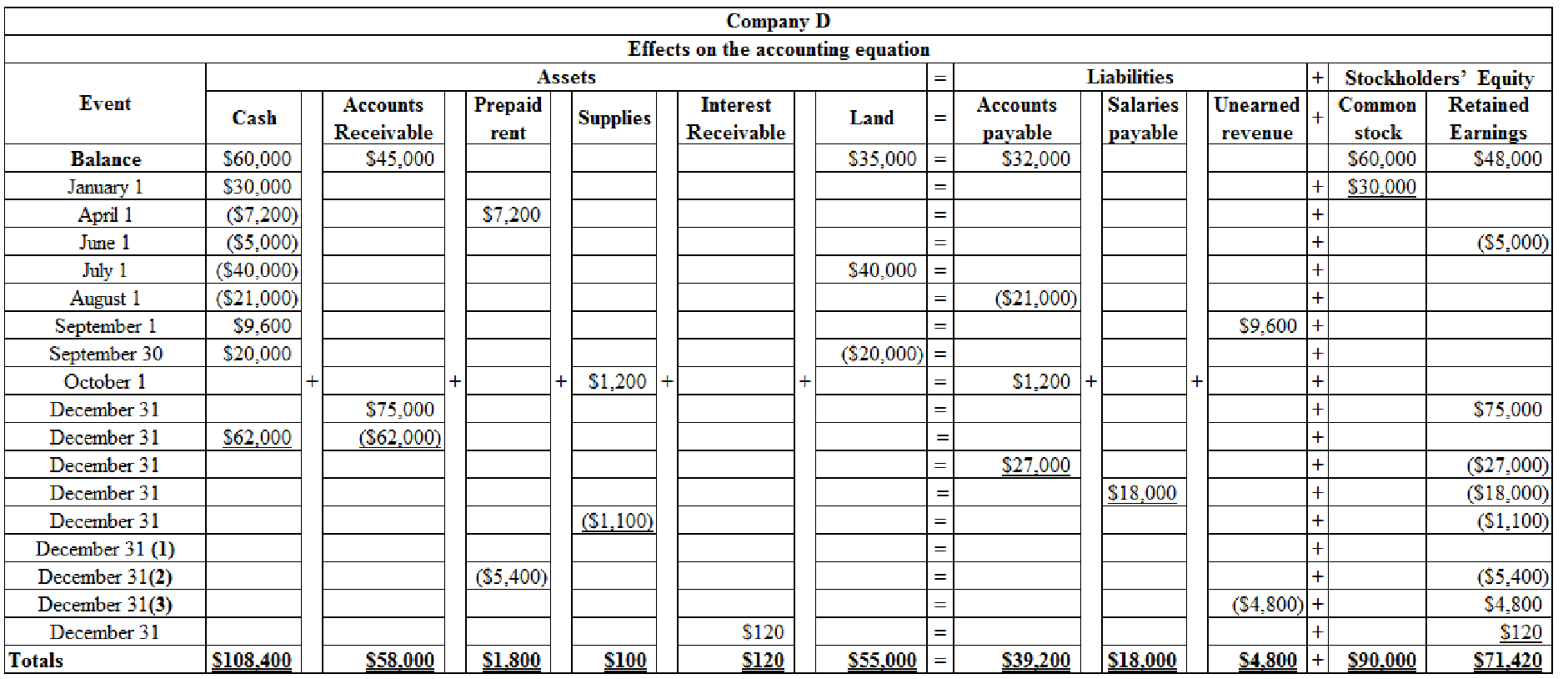

Prepare general ledger accounts under the accounting equation as given below:

Table (1)

Note 1: Entry is not recorded in the books when there is a change in the value of land.

Working Note 2: Determine the amount of prepaid rent.

Working note 3: Determine the amount of unearned revenue.

b.

Determine the amount of land that would be reported for on the balance sheet?

b.

Explanation of Solution

Assets: Assets are those items that provide value for money and future economic benefit for an organization. In simple, it can be referred to as resources possess by a business.

Company W’s reported value of land on its balance sheet is $55,000 (Refer Table (1)).

c.

Determine the amount of cash flows from investing activities would be reported on the statement of cash flows.

c.

Explanation of Solution

Cash flows from operating activities: This section of cash flow statement provides information about the cash received or cash paid in day-to-day operating activities of a company.

Determine the amount of net cash flow from operating activities.

Thus, the net cash flow from operating activities that would be reported on the statement of cash flows is $43,400.

d.

Determine the amount of rent expense that would be reported on the income statement.

d.

Explanation of Solution

The amount of rent expense would be reported on the income statement is $5,400 (Refer working note 2).

e.

Determine the amount of total liabilities would be reported on the balance sheet.

e.

Explanation of Solution

Liabilities: The claims creditors have over assets or resources of a company are referred to as liabilities. These are the debt obligations owed by company to creditors. Liabilities are classified on the balance sheet as current liabilities and long-term liabilities.

Determine the amount of total liabilities:

| Particulars | Amount |

| Accounts payable | $39,200 |

| Salaries payable | $18,000 |

| Unearned revenue | $4,800 |

| Total liabilities | $62,000 |

Table (2)

Thus, the amount of total liabilities that would be reported on the balance sheet is $62,000.

f.

Determine the amount of supplies expense would be reported on the income statement.

f.

Explanation of Solution

The amount of supplies expense that would be reported on the income statement is $1,100

g.

Determine the amount of unearned revenue would be reported on the balance sheet.

g.

Explanation of Solution

Unearned revenue: The revenue which is received in advance by the company for the services or goods to be delivered in future is referred to as unearned revenue. Since the revenue is received for the services not yet performed, the revenue is recorded as a liability until the services are performed. After the services are performed, the liability would be reduced and the revenue would be credited.

Hence, the amount of unearned revenue that would be reported on the balance sheet is $4,800 (Refer working note 3).

h.

Determine the amount of cash flows from investing activities would be reported on the statement of cash flows.

h.

Explanation of Solution

Cash flow from investing activities: This section of cash flows statement provides information concerning about the purchase and sale of capital assets by the company.

Determine the amount of cash flows from investing activities.

| Cash flows from investing activities | |

| Particulars | Amount |

| Proceeds from the sale of land | $20,000 |

| Less: Purchase of land | ($40,000) |

| ($20,000) | |

Table (3)

Thus, the net cash flow from investing activities that would be reported on the statement of cash flows is ($20,000).

i.

Determine the amount of total expenses would be reported on the income statement.

i.

Explanation of Solution

Expenses: Expenses are costs incurred for the operations of a business. The costs incurred for generating revenues are rent expense,

Calculate the amount of total expenses would be reported on the income statement:

| Particulars | Amount |

| Operating expense | $27,000 |

| Salaries revenue | $18,000 |

| Supplies expense | $1,100 |

| Prepaid rent expense | $5,400 |

| Total expenses | $51,500 |

Table (4)

Thus, the amount of total expenses that would be reported on the income statement is $51,500.

j.

Determine the amount of service revenue would be reported on the income statement.

j.

Explanation of Solution

Revenues: Revenues are earnings from operations of a business. The operating activities are sale of goods and services, and rent revenue.

Calculate the amount of service revenue would be reported on the income statement:

| Particulars | Amount |

| Service revenue | $75,000 |

| Add: Unearned revenue | $4,800 |

| Total revenue | $79,800 |

Table (5)

Thus, the amount of service revenue that would be reported on the income statement is $79,800.

k.

Determine the amount of cash flows from financing activities would be reported on the statement of cash flows.

k.

Explanation of Solution

Cash flow from financing activities: This section of cash flows statement provides information about the

Determine the amount of cash flows from financing activities.

| Cash flows from financing activities | |

| Particulars | Amount |

| Issuance from common stock | $30,000 |

| Less: Cash dividend | ($5,000) |

| Cash inflow from financing activities | $25,000 |

Table (6)

Thus, the net cash flow from financing activities that would be reported on the statement of cash flows is $25,000.

l.

Determine the amount of net income would be reported on the income statement.

l.

Explanation of Solution

Net income: Net income is the excess amount of revenue after deducting all the expenses of a company. In simple terms, it is the difference between total revenue and total expenses of the company.

Determine the net income:

| Income statement | |

| Particulars | Amount |

| Service Revenue (Requirement j) | $79,800 |

| Add: interest income | $120 |

| Total revenue | $79,920 |

| Less: Total expense (Requirement i) | ($51,500) |

| Net income | $28,420 |

Table (7)

Thus, the net income that would be reported on the income statement is $28,420.

m.

Determine the amount of

m.

Explanation of Solution

Retained earnings: Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

Determine the amount of retained earnings.

Hence, the retained earnings that would be reported on the balance sheet amounts to $71,420.

Want to see more full solutions like this?

Chapter 2 Solutions

Loose-Leaf for Survey of Accounting

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education