a.

Record the events in the

a.

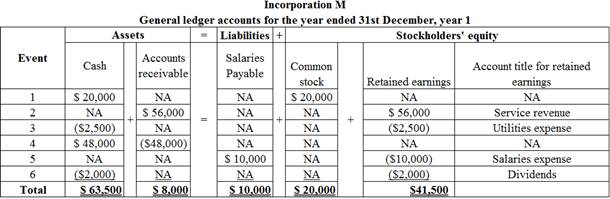

Explanation of Solution

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below.

Record the effect of the event in the accounting equation.

Table (1)

b.

Prepare the income statement, statement of changes in

b.

Explanation of Solution

Income statement:

This is a financial statement that shows the net income earned or net loss suffered by Incorporation through reporting all the revenues earned and expenses incurred by the company over a specific period of time. An income statement is also known as an operations statement, an earnings statement, a revenue statement, or a

Prepare the income statement to calculate the net income.

| Incorporation M | ||

| Income statement | ||

| For the year ended 31st December, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue | $56,000 | |

| Total revenue (A) | $56,000 | |

| Less: Expenses | ||

| Utility expense | $2,500 | |

| Salaries expense | $10,000 | |

| Total expenses (B) | $12,500 | |

| Net income |

$43,500 | |

Table (2)

Stockholders’ equity statement:

Stockholders’ equity statement shows the events and transaction that cause changes in the stockholders’ equity account during the accounting period. Stockholders’ equity statement starts with the beginning balances, shows the changes that occurred during the accounting year and end with the ending balances of the components of the stockholders’ equity account.

Statement of changes in the stockholders’ equity:

This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Prepare the statement of changes in the stockholders’ equity.

| Incorporation M | ||

| Statement of changes in stockholders’ equity | ||

| For the year ended 31st December, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning common stock | $0 | |

| Add: Issued common stock | $20,000 | |

| Ending common stock | $20,000 | |

| Beginning retained earnings | $0 | |

| Add: Net income | $43,500 | |

| Less: Dividends | ($2,000) | |

| Ending retained earnings | $41,500 | |

| Total stockholders’ equity | $61,500 | |

Table (3)

Cash Flow Statement:

Cash Flow Statement is a fundamental financial statement that renders valuable information regarding the

Prepare the statement of cash flows.

| Incorporation M | ||

| Statement of cash flows | ||

| For the year ended 31st December, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash Flow From Operating Activities | ||

| Cash Received from Customers | $48,000 | |

| Cash Paid for Expenses | ($2,500) | |

| Net Cash Flow from Operating Activities | $45,500 | |

| Cash Flow From Investing Activities | $0 | |

| Cash flows from investing activities | ||

| Issue of stocks | $20,000 | |

| Dividends paid | ($2,000) | |

| Net cash flow from financing activities | $18,000 | |

| Net change in cash | $63,500 | |

| Add: Beginning cash balance | $0 | |

| Ending cash balance | $63,500 | |

Table (4)

Balance sheet:

This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors..

Prepare the year 1 balance sheet as of 31st December.

| Incorporation M | ||

| Balance sheet | ||

| As of 31st December, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | $63,500 | |

| Accounts receivable | $8,000 | |

| Total assets | $71,500 | |

| Liabilities | ||

| salaries payable | $10,000 | |

| Total liabilities | $10,000 | |

| Stockholders’ equity | ||

| Common stock | $20,000 | |

| Retained earnings | $41,500 | |

| Total stockholders' equity | $61,500 | |

| Total liabilities and stockholders' equity | $71,500 | |

Table (5)

c.

Explain the reason for the difference in the net income and the amount of net cash flow from the operating activities.

c.

Explanation of Solution

Reason for the difference:

Net income is the difference between the revenue and expenses incurred, irrespective of the cash received or paid. Cash flow from operating activities is the difference between the cash received and the payment of cash made for the operating activities. The amount revenue earned is $56,000, whereas only $48,000 is received in cash. Similarly, $12,500 is the amount of expenses incurred, out of which payment is made for the only $2,500. This causes the difference in the amount of net income and cash flow from operating activities.

Want to see more full solutions like this?

Chapter 2 Solutions

FUND. OF FINANCIAL ACCT. /MISS STATE

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education