Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 3R

The

Information for the

- a. Cleaning supplies on hand on December 31, 2012, $18,750.

- b. Insurance premiums expired during the year, $1,800.

- c.

Depreciation on equipment during the year, $21,600. - d. Wages accrued but not paid at December 31, 2012, $1,830.

Complete the income statement and

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Excel Applications for Accounting Principles

Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

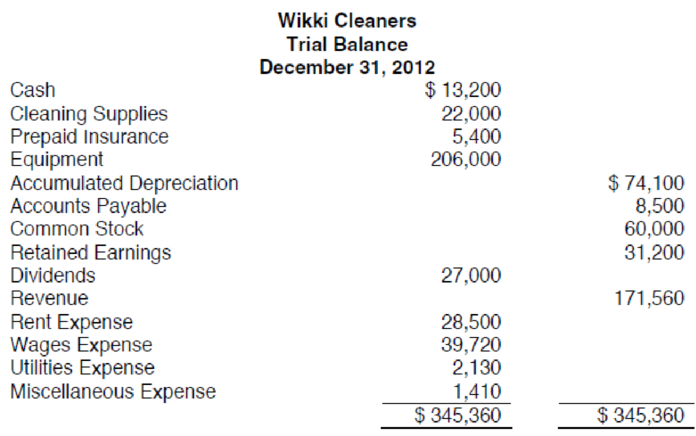

- The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardThe unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forward

- Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2016, the end of the current year, the accountant for Good Note Company prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardThe trial balance of Sports Connection at June 30, 2013, the end of the current fiscal year, is as follows: Adjustment information is as follows: a. Supplies on hand as of June 30, 2013, 450. b. Insurance premiums that expired during the year, 2,420. c. Depreciation on equipment during the year, 1,500. d. Included in the rent expense of 30,000 is 1,200 that is prepaid for July 2013. e. Salaries accrued but not paid at June 30, 2013, 1,440. f. Merchandise inventory on June 30, 2013, 68,864. Open the file P2WORK from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then enter the adjusting amounts in columns E and G. Also, in column D or F, insert the letter corresponding to the adjusting entry (ae). (Note: Not all textbooks handle the change in inventory as an adjustment. Use the method for handling inventory that is prescribed in your textbook.) Column A is frozen on the screen to assist you in completing requirement 3.arrow_forwardThe trial balance of Sports Connection at June 30, 2013, the end of the current fiscal year, is as follows: Adjustment information is as follows: a. Supplies on hand as of June 30, 2013, 450. b. Insurance premiums that expired during the year, 2,420. c. Depreciation on equipment during the year, 1,500. d. Included in the rent expense of 30,000 is 1,200 that is prepaid for July 2013. e. Salaries accrued but not paid at June 30, 2013, 1,440. f. Merchandise inventory on June 30, 2013, 68,864. As the accountant for Sports Connection, you have been asked to prepare adjusting entries and financial statements to complete the accounting cycle for the year. A worksheet called P2WORK has been provided to assist you in this assignment. As you review this worksheet, it should be noted that columns H and I will automatically change when you enter values in columns E and G.arrow_forward

- The trial balance of Sports Connection at June 30, 2013, the end of the current fiscal year, is as follows: Adjustment information is as follows: a. Supplies on hand as of June 30, 2013, 450. b. Insurance premiums that expired during the year, 2,420. c. Depreciation on equipment during the year, 1,500. d. Included in the rent expense of 30,000 is 1,200 that is prepaid for July 2013. e. Salaries accrued but not paid at June 30, 2013, 1,440. f. Merchandise inventory on June 30, 2013, 68,864. Complete the income statement and balance sheet by entering formulas in columns J, K, L, and M that reference the appropriate cells in column H or I. Net income will be automatically calculated at the bottom of the income statement and balance sheet columns. Check to be sure that these numbers are the same. Enter your name in cell A1. Save the completed file as P2WORK3. Print the worksheet. Also print your formulas using landscape orientation and fit-to-1 page scaling. Check figure: Net income (cell J34), 37,902.arrow_forwardThe trial balance of Sports Connection at June 30, 2013, the end of the current fiscal year, is as follows: Adjustment information is as follows: a. Supplies on hand as of June 30, 2013, 450. b. Insurance premiums that expired during the year, 2,420. c. Depreciation on equipment during the year, 1,500. d. Included in the rent expense of 30,000 is 1,200 that is prepaid for July 2013. e. Salaries accrued but not paid at June 30, 2013, 1,440. f. Merchandise inventory on June 30, 2013, 68,864. In the space provided below, prepare an income statement, a capital statement (statement of owners equity), and a balance sheet. Use the corrected worksheet (P2WORK4) as a basis for your work. Assume no additional owner investments were made during the year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY