Concept explainers

Cost Concepts

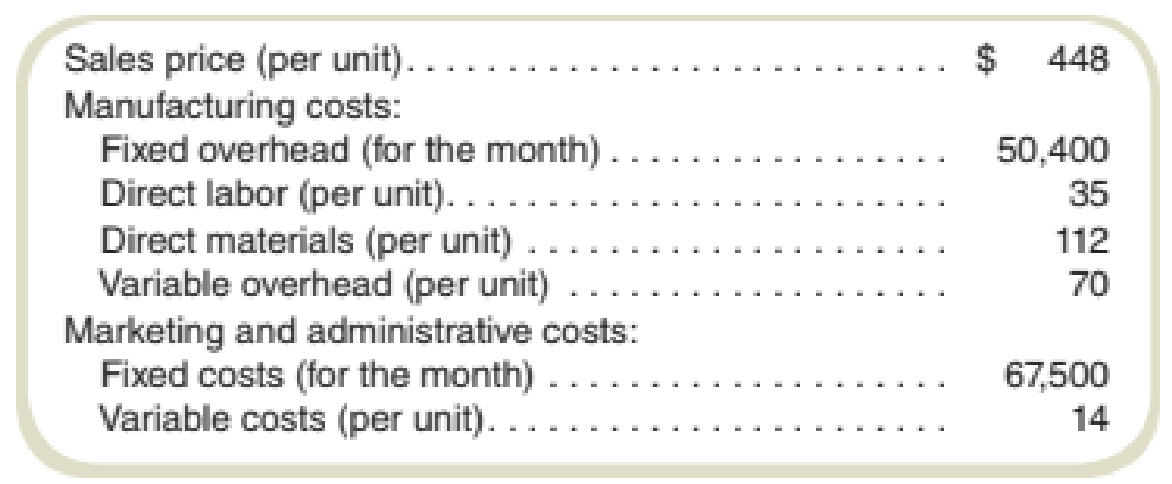

Columbia Products produced and sold 900 units of the company’s only product in March. You have collected the following information from the accounting records:

Required

- a. Compute:

- 1. Variable

manufacturing cost per unit. - 2. Full cost per unit.

- 3. Variable cost per unit.

- 4. Full absorption cost per unit.

- 5. Prime cost per unit.

- 6. Conversion cost per unit.

- 7. Profit margin per unit.

- 8. Contribution margin per unit.

- 9. Gross margin per unit.

- 1. Variable

- b. If the number of units produced increases from 900 to 1,200, which is within the relevant range, cost per unit will decrease (you can check this by redoing requirement [a] above). Therefore, we should recommend that Columbia Products increase its production to reduce its costs. Do you agree? Explain.

a.

Calculate the given values.

Explanation of Solution

1.

Variable manufacturing cost per unit:

Variable manufacturing cost is the manufacturing cost that varies with the change in the output of the production. It includes direct material, direct labor, and all the variable manufacturing overheads.

Calculate the variable manufacturing cost per unit:

Thus, the variable manufacturing cost per unit is $217.

2.

Full cost per unit:

The full cost of the product includes the fixed and variable cost of the production. It includes all the cost that was occurred in the process of the production.

Calculate the full cost per unit:

Thus, the full cost per unit is $362.

Working note 1:

Calculate the total fixed cost:

Working note 2:

Calculate the total fixed cost ($):

| Particulars | Amount |

| Fixed manufacturing costs | $50,400 |

| Fixed marketing and administrative costs | $67,500 |

| Total fixed costs | $117,900 |

Table: (1)

Working note 3:

Calculate the total variable cost:

| Particulars | Amount |

| Direct labor (per unit) | $35 |

| Direct materials (per unit) | $112 |

| Variable overhead (per unit) | $70 |

| Variable Marketing and administrative costs (per unit) | $14 |

| Total variable cost per unit | $231 |

Table: (2)

3.

Variable cost per unit:

Variable cost is the cost that varies with the change in the output of the production. It includes all the direct and indirect cost of the production that varies with the production.

Calculate the variable cost per unit:

| Particulars | Amount |

| Direct labor (per unit) | $35 |

| Direct materials (per unit) | $112 |

| Variable overhead (per unit) | $70 |

| Variable Marketing and administrative costs (per unit) | $14 |

| Total variable cost per unit | $231 |

Table: (3)

Thus, the total variable cost per unit is $231.

4.

Full absorption cost per unit:

Full absorption cost is the total cost that occurs in the process of production. It includes all the fixed and variable cost of the production. It includes the total manufacturing overhead and direct labor and direct material used in the production.

Calculate the Full absorption cost per unit:

Thus, the full absorption cost is $273.

Working note 4:

Calculate the fixed manufacturing overhead:

5.

Prime cost per unit:

Prime cost is the direct cost of producing the goods. It includes the material cost and labor cost of the production. The material and labor included in prime cost are direct.

Calculate the prime cost per unit:

Thus, the prime cost per unit is $147.

6.

Conversion cost:

Total conversion cost is the cost of converting the raw material into finished goods. It includes the labor required to covert the finished goods and other manufacturing overheads.

Calculate the conversion cost per unit:

Thus, the conversion cost per unit is $161.

7.

Profit margin:

Profit margin the net profit made by the business in a financial year. It is calculated by subtracting the total cost of the business from the sales of the business.

Calculate the profit margin:

Thus, the profit margin is $86.

8.

Contribution margin:

Contribution margin is the amount left from the sales for profit and fixed cost of the business. It is calculated by subtracting the variable cost from the sales of the business.

Calculate the contribution margin:

Thus, the contribution margin is $217.

9.

Gross margin:

Gross margin is the gross profit of the business. It shows the efficiency of the production process of the business. It is calculated by subtracting the direct cost of the production from the sales of the business.

Calculate the gross margin:

Thus, the gross margin is $175.

b.

Comment on the given statement.

Explanation of Solution

The suggestion of Company C:

The fixed cost per unit decreases as the production increases. The decrease in fixed cost per unit will result in the decreased overall cost of production.

The company should look for the profit variables instead of costing variables. Company C should look for contribution margin, gross margin and profit margin to decide whether they should increase the production or not.

Thus, the company should not consider the cost variables, but it should consider the profit variables to decide the increment in the volume.

Want to see more full solutions like this?

Chapter 2 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Estimated income statements, using absorption and variable costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 50,000 units instead of 40,000 units, thus creating an ending inventory of 10,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. Prepare an estimated income statement, comparing operating results if 40,000 and 50,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement?arrow_forwardTotal and Unit Product Cost Martinez Manufacturing Inc. showed the following costs for last month: Last month, 4,000 units were produced and sold. Required: 1. Classify each of the costs as product cost or period cost. 2. What is the total product cost for last month? 3. What is the unit product cost for last month?arrow_forwardHart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and C. The labor-hour requirements, by department, are as follows: During the next production period the labor-hours available are 450 in department A, 350 in department B, and 50 in department C. The profit contributions per unit are 25 for product 1, 28 for product 2, and 30 for product 3. a. Formulate a linear programming model for maximizing total profit contribution. b. Solve the linear program formulated in part (a). How much of each product should be produced, and what is the projected total profit contribution? c. After evaluating the solution obtained in part (b), one of the production supervisors noted that production setup costs had not been taken into account. She noted that setup costs are 400 for product 1, 550 for product 2, and 600 for product 3. If the solution developed in part (b) is to be used, what is the total profit contribution after taking into account the setup costs? d. Management realized that the optimal product mix, taking setup costs into account, might be different from the one recommended in part (b). Formulate a mixed-integer linear program that takes setup costs provided in part (c) into account. Management also stated that we should not consider making more than 175 units of product 1, 150 units of product 2, or 140 units of product 3. e. Solve the mixed-integer linear program formulated in part (d). How much of each product should be produced and what is the projected total profit contribution? Compare this profit contribution to that obtained in part (c).arrow_forward

- Variable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardA company sells mulch by the cubic yard. Grade A much sells for $150 per cubic yard and has variable costs of $65 per cubic yard. The company has fixed expenses of $15,000 per month. In August, the company sold 240 cubic yards of Grade A mulch. A. Calculate the contribution margin per unit for Grade A mulch. B. Calculate the contribution margin ratio of the Grade A mulch. C. Prepare a contribution margin income statement for the month of August.arrow_forward

- High-low method The manufacturing costs of Rosenthal Industries for the first three months of the year follow: Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.arrow_forwardScattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forwardAppendix Absorption costing income statement On June 30, the end of the first month of operations, Tudor Manufacturing Co. prepared the following income statement, based on the variable existing concept: Sales (420,000 units) 7,450,000 Variable cost of goods sold: Variable cost of goods manufactured (500,000 units x 14 per unit) 7,000,000 Less ending inventory (80,000 units x 14 per unit) 1,120,000 Variable cost of goods sold 5,880,000 Manufacturing margin 1,570,000 Variable selling and administrative expenses 80,000 Contribution margin 1,490,000 Fixed costs: Fixed manufacturing costs 160,000 Fixed selling and administrative expenses 75,000 235,000 Income from operations 1,255,000 a. Prepare an absorption costing income statement. b. Reconcile the variable costing income from operations of 1,255,000 with the absorption costing income from operations determined in (a).arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning