Concept explainers

Using transactions from the following assignments, record

Based on Serial Problem SP 2

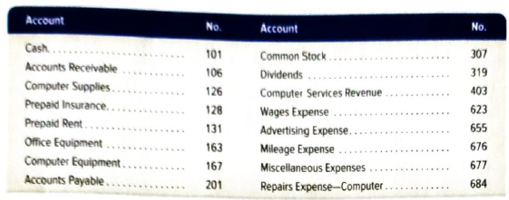

On October 1, 2018, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. Rey adopts the calendar year for reporting purposes and expects to prepare the company’s first set of financial statements on December 31, 2018. The company’s initial chart of accounts follows.

Required

- Prepare journal entries to record each of the following transactions for Business Solutions.

| Oct. |

1.

Introduction: Journal entry is a technique of booking and recording financial transactions on any company. Ledger is used to record all economic transactions of the account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

To prepare: The general journal entries for the following transaction.

Explanation of Solution

Journal entries of KT for the month of April are shown below.

| Date | Particular | PR | Dr. | Cr. |

| Oct 1 | Cash | 20,000 | ||

| Office equipment | 45,000 | |||

| Computer equipment | 8,000 | |||

| To Common stock | 73,000 | |||

| (Owner’s investment) | ||||

| 2 Oct | Prepaid rent | 3,300 | ||

| cash | 3,300 | |||

| (rent paid in advance) | ||||

| 3 Oct | Computer supplies | 1,420 | ||

| Account payable company H | 1,420 | |||

| (purchase of supplies on credit from company H) | ||||

| 5 Oct | Prepaid insurance | 2,220 | ||

| Cash | 2,220 | |||

| (payment of insurance) | ||||

| 6 Oct | Account receivable company E | 4,800 | ||

| Service revenue | 4,800 | |||

| (service provided on credit) | ||||

| 8 Oct | Account payable company H | 1,420 | ||

| Cash | 1,420 | |||

| (cash to company H) | ||||

| 12 Oct | Account receivable company E | 1,400 | ||

| Service revenue | 1,400 | |||

| (service provided on credit) | ||||

| 15 Oct | Cash | 4,800 | ||

| Account receivable company E | 4,800 | |||

| (cash received from company E) | ||||

| 17 Oct | Repair computer equipment | 805 | ||

| Cash | 805 | |||

| (cash paid for repair of computer equipment) | ||||

| 20 Oct | Advertisement | 1,728 | ||

| Cash | 1,728 | |||

| (cash paid for advertisement ) | ||||

| 22 Oct | Cash | 1,400 | ||

| Account receivable company E | 1,400 | |||

| (cash received from company E) | ||||

| 28 Oct | Account receivable | 5,208 | ||

| Service revenue | 5,208 | |||

| 31 Oct | Wages expense | 875 | ||

| Cash | 875 | |||

| (Cash paid for wages) | ||||

| 31 Oct | Dividend cash | 3600 | ||

| (dividend paid in cash) | 3600 | |||

| 1 Nov | Miscellaneous expense | 320 | ||

| Cash | 320 | |||

| (cash paid for miscellaneous expense) | ||||

| 2 Nov | Cash | 4,633 | ||

| Service revenue | 4,633 | |||

| (cash received for provided revenue) | ||||

| 5 Nov | Computer supplies | 1,125 | ||

| Cash | 1125 | |||

| (purchase of computer supplies on cash) | ||||

| 8 Nov | Account receivable Company G | 5,668 | ||

| Service revenue | 5,668 | |||

| (service provided on credit) | ||||

| 18 Nov | Cash | 2,208 | ||

| Account receivable company I | 2,208 | |||

| (cash received from company I) | ||||

| 22 Nov | Donation | 250 | ||

| Cash | 250 | |||

| (cash given as donation) | ||||

| 24 Nov | Account receivable Company A | 3950 | ||

| Computer service revenue | 3950 | |||

| (to record service revenue) | ||||

| 28 Nov | Miscellaneous expense | 384 | ||

| Cash | 384 | |||

| (cash paid for miscellaneous expense) | ||||

| 30 Nov | Wages expense | 1750 | ||

| Cash | 1750 | |||

| (cash paid for wages) | ||||

| 30 Nov | Dividend | 2000 | ||

| Cash | 2000 | |||

| (Dividend paid) | ||||

2.

Introduction: Journal entry is a technique of booking and recording financial transactions on any company. Ledger is used to record all economic transactions of the account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

To prepare: T account for the following transactions.

Explanation of Solution

| Cash Account No.101 | ||||

| Date | PR | Debit | Credit | Balance |

| 1 Oct | 45000 | 45,000 | ||

| 2 Oct | 3300 | 41,700 | ||

| 3 Oct | 2220 | 39,480 | ||

| 5 Oct | 1420 | 38,060 | ||

| 6 Oct | 4800 | 42,860 | ||

| 8 Oct | 875 | 41,985 | ||

| 12 Oct | 805 | 41,180 | ||

| 15 Oct | 1728 | 39,452 | ||

| 17 Oct | 1400 | 40,850 | ||

| 20 Oct | 3600 | 37,252 | ||

| 22 Oct | 320 | 36,932 | ||

| 28 Oct | 4633 | 41,565 | ||

| 31 Oct | 1125 | 40,440 | ||

| 31 Oct | 2208 | 42,648 | ||

| 15 Nov | 250 | 42,398 | ||

| 1 Nov | 3841 | 42,014 | ||

| 2 Nov | 1750 | 40,264 | ||

| 30 Nov | 2000 | 38,264 | ||

| Accounts Receivable company E | Account no. 106 | |||

| Date | PR | Debit | Credit | Balance |

| 6 Oct | 4800 | 4800 | ||

| 12 Oct | 1400 | 6200 | ||

| 15 Oct | 4800 | 1400 | ||

| 22 Oct | 1400 | 0 |

| Account receivable company E | Account no.108 | |||

| Date | PR | Debit | Credit | Balance |

| 8 Oct | 5668 | 5668 | ||

| Account receivable company I | Account no. 108 | |||

| Date | PR | Debit | Credit | Balance |

| 6 Oct | 5208 | 5208 | ||

| 15 Oct | 2208 | 3000 | ||

| Account payable | Account no.201 | |||

| Date | PR | Debit | Credit | Balance |

| 6 Oct | 1420 | 1420 | ||

| 15 Oct | 1420 | 0 | ||

| Supplies | Account no. 126 | |||

| Date | PR | Debit | Credit | Balance |

| 3 Oct | 1420 | 1420 | ||

| 5 Nov | 1125 | 2545 | ||

| Equipment | Account no. 163 | |||

| Date | PR | Debit | Credit | Balance |

| 1 Oct | 8000 | 8000 | ||

| Prepaid insurance | Account no.128 | |||

| Date | PR | Debit | Credit | Balance |

| 2 oct | 2220 | 2220 |

| Prepaid rent | Account no. 131 | |||

| Date | PR | Debit | Credit | Balance |

| 1 oct | 3300 | 3300 |

| Computer supplies | Account no. 167 | |||

| Date | PR | Debit | Credit | Balance |

| 1 Oct | 20000 | 20000 |

| Common stock | Account no. 307 | |||

| Date | PR | Debit | Credit | Balance |

| 1 oct | 45000 | 45000 | ||

| 1 Oct | 20000 | 65000 | ||

| 1 Oct | 8000 | 73000 |

| Dividend | Account no. 319 | |||

| Date | PR | Debit | Credit | Balance |

| 31 oct | 2000 | 2000 | ||

| 31 oct | 3600 | 5600 |

| Computer Service revenue | Account no. 403 | |||

| Date | PR | Debit | Credit | Balance |

| 24 Nov | 3950 | 3950 | ||

| 6 Oct | 4800 | 8750 | ||

| 12 Oct | 1400 | 10150 | ||

| 28 Oct | 5208 | 15358 | ||

| 8 Nov | 5668 | 21026 |

3.

Introduction: Journal entry is a technique of booking and recording financial transactions on any company. Ledger is used to record all economic transactions of the account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

To prepare: Trail balance.

Answer to Problem 8GLP

Total of trail balance is $98,659

Explanation of Solution

| S Trail balance | ||

| Particular | Dr. | Cr. |

| Cash | 38,264 | |

| Account receivable | 12,618 | |

| Equipment | 8,000 | |

| Supplies | 2,545 | |

| Prepaid insurance | 2,220 | |

| Prepaid rent | 3,300 | |

| Account payable | 0 | |

| Wages expense | 2,625 | |

| Common stock | 73,000 | |

| Divided | 5,600 | |

| Service revenue | 21,709 | |

| Computer service revenue | 3950 | |

| Donation | 250 | |

| Computer equipment | 20,000 | |

| Repair expense | 805 | |

| Advertisement | 1728 | |

| Mileage expense | 320 | |

| Miscellaneous expense | 384 | |

| Total | 98,659 | 98,659 |

Want to see more full solutions like this?

Chapter 2 Solutions

Connect Access Card for Financial Accounting: Information and Decisions

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closingtrial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a twocolumn journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardThe financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forward

- You are the accountant for Kamal Fabricating, Inc. and you oversee the preparation of financial statements for the year just ended 6/30/2020. You have the following information from the companys general ledger and other financial reports (all balances are end-of-year except for those noted otherwise: Prepare the companys Statement of Retained Earnings.arrow_forwardFollowing is the chart of accounts of Sanchez Realty Company: Sanchez completed the following transactions during April (the first month of business): Required 1. Journalize the transactions for April in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of April 30, 20. 4. Prepare an income statement for the month ended April 30, 20. 5. Prepare a statement of owners equity for the month ended April 30, 20. 6. Prepare a balance sheet as of April 30, 20. If you we using CLGL, use the year 2020 when preparing all reports.arrow_forwardFollowing is the chart of accounts of Smith Financial Services: Smith completed the following transactions during June (the first month of business): Required 1. Journalize the transactions for June in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of June 30, 20. 4. Prepare an income statement for the month ended June 30, 20. 5. Prepare a statement of owners equity for the month ended June 30, 20. 6. Prepare a balance sheet as of June 30, 20.arrow_forward

- This problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,000. b. Depreciation of pool structure for the month, 715. c. Depreciation of fan system for the month, 260. d. Depreciation of sailboats for the month, 900. e. Wages accrued at June 30, 810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance 8. Prepare the income statement 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-dosing trial balance. Check Figure Trial balance total, 281,858; net income, 7,143; post-dosing trial balance total, 263,341arrow_forwardTransactions Reconstructed from Financial Statements The following financial statements are available for Elm Corporation for its first month of operations: Required Using the format illustrated in Exhibit 3-1, prepare a table to summarize the transactions entered into by Elm Corporation during its first month of business. State any assumptions you believe are necessary in reconstructing the transactions.arrow_forwardPrepare journal entries to record the following transactions for the month of July: A. on first day of the month, paid rent for current month, $2,000 B. on tenth day of month, paid prior month balance due on accounts, $3,100 C. on twelfth day of month, collected cash for services provided, $5,500 D. on twenty-first day of month, paid salaries to employees, $3,600 E. on thirty-first day of month, paid for dividends to shareholders, $800arrow_forward

- What Do You Think? You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the clients bank statement, the clients tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owners equity, and a balance sheet for the month of July for Winston Company.arrow_forwardElite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardFor the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud Consulting entered into the following transactions during April: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during April is 350. b. Supplies on hand on April 30 are 1,225. c. Depreciation of office equipment for April is 400. d. Accrued receptionist salary on April 30 is 275. e. Rent expired during April is 2,000. f. Unearned fees on April 30 are 2,350. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning