MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting

12th Edition

ISBN: 9780134489728

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

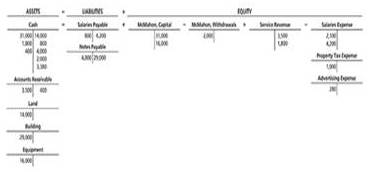

Chapter 2, Problem E2.23E

Preparing a

Learning Ojective 4

Total Debits $80,700

The T-accounts of McMahon Farm Equipment Repair follow as of May 31, 2018,

Prepare McMahon Farm Equipment Repair’s trial balance as of May 31, 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Preparing a trial balance from T-accounts

The T-accounts of McMahon Farm Equipment Repair follow as of May 31, 2018.

Prepare McMahon Farm Equipment Repair’s trial balance as of Way 31, 2018.

Using the ledger bal & addtl data given, do the following for Callahan Lumber for the yr ended December 31, 2019:

Account Balances for Callahan Lumber

Account No.

110 Cash $1,140

111 Accounts Receivable 1,270

112 Merch Inv 5,600

113 Lumber Supplies 260

114 Prepaid Insurance 117

121 Lumber Equip 2,600

122 Accu Depreciation, Lumber Equip 340

220 Accs Payable 1,330

221 Wages Payable -

330 L. Callahan, Cap 7,562

331 L. Callahan, Withdrawals 3,500

332 Income Summary -

440 Sales 23,000

441 Sales Returns and Allowances 400

550 Cost of Goods Sold 13,175

660 Wages Exp 2,390

661 Advertising Exp 940

662 Rent Exp840

663 Dep Exp, Lumber Equip -

664 Lumber Supplies Exp-

665 Ins Exp -

Addtl Data

a.

Physical count of inv, Dec 31

$4,700

b.

Lumber supp on hand, Dec 31

80

c.

Insurance expd

70

d.

Dep for the yr

460

e.

Accrued wages on Dec 31

165

d.

Prepare a post-closing trial balance.

e.

Journalize the reversing entry for…

The adjusted trial balance columns of the worksheet for Carla Vista Company are as follows.

CARLA VISTA COMPANYWorksheet (partial)For the Month Ended April 30, 2020

Adjusted Trial Balance

Account Titles

Dr.

Cr.

Cash

11,600

Accounts Receivable

7,700

Prepaid Rent

2,500

Equipment

23,300

Accumulated Depreciation—Equip.

5,500

Notes Payable

5,600

Accounts Payable

4,800

Owner’s Capital

29,740

Owner’s Drawings

3,800

Service Revenue

15,400

Salaries and Wages Expense

10,500

Rent Expense

900

Depreciation Expense

740

Interest Expense

90

Interest Payable

90

Totals

61,130

61,130

Chapter 2 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting

Ch. 2 - The detailed record of the changes in a particular...Ch. 2 - Which of the following accounts is a liability?...Ch. 2 - The left side of an account is used to record...Ch. 2 - Which of the following statements is correct?...Ch. 2 - Your business purchased office supplies of $2,500...Ch. 2 - Sedlor Properties puchased office supplies on...Ch. 2 - Posting a $2,500 purchase of office supplies on...Ch. 2 - Pixel Copies recorded a cash collection on account...Ch. 2 - Which sequence correctly summarizes the accounting...Ch. 2 - Nathvile Laundry reported assets of $800 and...

Ch. 2 - Identify the three categones of the accounting...Ch. 2 - What is the purpose of the chart of accounts?...Ch. 2 - What does a ledger show? What’s the difference...Ch. 2 - Accounng uses a double-entry system. Explain what...Ch. 2 - What is T-account? On which side is the debit? On...Ch. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Identify which types of accounts have a normal...Ch. 2 - What are source documents? Provide examples of...Ch. 2 - Prob. 10RQCh. 2 - Explain the five steps in journalizing and posting...Ch. 2 - What are the four parts of a journal entry?Ch. 2 - What is involved in the posting process?Ch. 2 - What is the purpose of the trial balance?Ch. 2 - What is the differnce between the trial balance...Ch. 2 - If total debits equal total credits on the trial...Ch. 2 - What is the calculation for the debt ratio?...Ch. 2 - Identifying accounts Learning Objective 1 Consider...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying normal balances Learning Objective 2...Ch. 2 - Prob. S2.4SECh. 2 - Journalizing transactions Learning Objective 3...Ch. 2 - S2-6 Journalizing transactions

Learning...Ch. 2 - Journalizing transactions and posting to...Ch. 2 - Prob. S2.8SECh. 2 - Prob. S2.9SECh. 2 - Using accounting vocabulary Learning Objectives 1,...Ch. 2 - Creating a chart of accounts Learning Objective 1...Ch. 2 - Identifying accounts, increases in accounts, and...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying source documents Learning Objective 3...Ch. 2 - Analyzing and journalizing transactions Learing...Ch. 2 - Analyzing and journalizing transactions Leaning...Ch. 2 - Posting journal entries to T-accounts Learning...Ch. 2 - Analyzing and journalizing transactions Learning...Ch. 2 - Posting journal entries to four-column accounts...Ch. 2 - Analyzing transactions from T-accounts Learning...Ch. 2 - Journalizing transactions from T-accounts Learning...Ch. 2 - Preparing a trial balance Learning Objective 4...Ch. 2 - Preparing a trial balance from T-accounts Learning...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Analyzing accounting errors Learning Ojective 4...Ch. 2 - Prob. E2.26ECh. 2 - E2-27 Correcting errors in a trial...Ch. 2 - Prob. E2.28ECh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.34APGACh. 2 - Prob. P2.35BPGBCh. 2 - Prob. P2.36BPGBCh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. P2.38BPGBCh. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.40BPGBCh. 2 - Prob. P2.41CTCh. 2 - P2-42 Journalizing transactions, posting to...Ch. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Before you begin this assignment, renew the Tymg...Ch. 2 - Prob. 2.1DCCh. 2 - Prob. 2.1EICh. 2 - Prob. 2.1FCCh. 2 - Prob. 2.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000. A. February 2, purchased an asset, merchandise inventory, on account, $30,000 B. March 10, paid creditor for part of February purchase, $12,000arrow_forwardOffice Supplies Somerville Corp. purchases office supplies once a month and prepares monthly financial statements. The asset account Office Supplies on Hand has a balance of $1,450 on May 1. Purchases of supplies during May amount to $1,100. Supplies on hand at May 31 amount to $920. Prepare the necessary adjusting entry on Somervilles books on May 31. What will be the effect on net income for May if this entry is not recorded?arrow_forwardEXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Ryans Fish House purchased supplies costing 3,000 for cash. This amount was debited to the supplies expense account. At the end of the year, December 31, 20--, an inventory showed that supplies costing 500 remained. Prepare the adjusting entry.arrow_forward

- ANALYSIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze each situation and indicate the correct dollar amount for the adjusting entry. (Trial balance is abbreviated as TB.) 1. Ending inventory of supplies is 260. 2. Amount of supplies used is 230.arrow_forwardJournalizing and posting On February 11, 20Y9, Quick Fix Company purchased 2,250 of supplies on account. In Quick Fixs chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. a. Journalize the February 11, 20Y9, transaction on page 73 of Quick Fix Companys two-column journal. Include an explanation of the entry. b. Prepare a four-column account for Supplies. Enter a debit balance of 400 as of February 1, 20Y9. Place a check mark () in the Posting Reference column. c. Prepare a four-column account for Accounts Payable. Enter a credit balance of 18,300 as of February 1, 20Y9. Place a check mark () in the Posting Reference column. d. Post the February 11, 20Y9, transaction to the accounts. e. Do the rules of debit and credit apply to all companies?arrow_forwardUnearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1, 2019, to provide plant watering services for Lola Inc.s office buildings. Jennifers received 4 months' service fees in advance on signing the contract. Required: 1. Prepare Jennifers journal entry to record the cash receipt for the first 4 months. 2. Prepare Jennifers adjusting entry at December 31, 2019. 3. CONCEPTUAL CONNECTION How would the advance payment (account(s) and amounts(s)] be reported in Jennifers December 31, 2019, balance sheet? How would the advance payment [account(s) and amount(s)] be reported in Lolas December 31, 2019, balance sheet?arrow_forward

- Prepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and calculate the ending balance for the account. Assume an Accounts Payable beginning balance of $7,500. A. May 12, purchased merchandise inventory on account. $9,200 B. June 10, paid creditor for part of previous months purchase, $11,350arrow_forwardThe trial balance columns of the worksheet for Acer service Co.LLC, are as follows. Acer service Co.LLC, Worksheet (partial) for the Month Ended January 31, 2020 Account Title/Ledger Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit Debit Credit Cash 4,400 Accounts receivable 2,600 Prepaid Rent 1200 Supplies 900 Equipment 8,400 Notes Payable 2,000 0 Accounts payable 1,450 Unearned revenue 1,500 Capital 8,600 Drawings 1,400 Service revenue 6,700 Salaries expenses 800 Interest expenses 250 Advertising expenses 300 20,250 20,250 Other data: At the end…arrow_forwardPlease prepare Journals & T Accts for: 2019 December Transactions Amount a. Issued common stock for cash 2,000 b. Paid cash for three month's rent: December 2019, January and February 2020 2,400 c. Purchased a used truck on credit (recorded as an account payable) 13,000 d. Purchased supplies on credit. These are expected to be used during the month (recorded as expense) 1,600 e. Paid for a one-year truck insurance policy, effective December 1 2,280 f. Billed a customer for work completed to date 6,000 g. Collected cash for work completed to date 4,000 h. Paid the following expenses in cash: Advertising 700 Interest 700 Telephone 800 Truck operating 600 Wages 5,000 i. Collected part of the amount billed in…arrow_forward

- The adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200$412 340 $412 340Profit for the periodRequired:a) Complete the worksheet. (6 marks)b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of theentity’s accounting period. (4 marks)arrow_forwardThe adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200Profit for the period_ debit is $412340 and credit is $412340Required:a) Complete the worksheet. b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of the entity’s accounting period.arrow_forwardThe adjusted trial balance columns in the worksheet of Elliot Painting Services are as follows.ELLIOT PAINTING SERVICESWorksheet (Partial)for the year ended 30 June 2019Adjusted trial balance Income statement Balance sheetAccount Debit Credit Debit Credit Debit CreditCash at Bank 1 230Accounts Receivable 75 600Prepaid Rent 1 800Office Supplies 8 320Equipment 160 000Accum. Depr. Equip’t 25 000Accounts Payable 54 000Salaries Payable 8 760Unearned Revenue 3 430F. Elliot, Capital 101 500F. Elliot, Drawings 22 000Painting Revenue 219 650Salaries Expense 106 000Rent Expense 6 050Depreciation Expense 8 040Telephone Expense 4 020Office Supplies Used 10 080Sundry Expenses 9 200$412 340 $412 340Profit for the periodRequired:a) Complete the worksheet.b) Prepare the closing entries necessary at 30 June 2019, assuming that this date is the end of theentity’s accounting period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License