a.

To discuss: The

Introduction:

Stock is a type of security in a company that denotes ownership. The company can raise the capital by issuing stocks.

a.

Explanation of Solution

The preferred stock differs from debt and common equity is as follows:

Preferred stock can be termed as hybrid stock because it is similar characteristically with common equity and debt. The preferred payments made to the investors remain contractually stable resembling debt whereas like common equity the non-payment of dividend does amount to default and bankruptcy.

Even most preferred stock prohibits paying common dividends when there are arrears in preferred. Moreover, their dividends are cumulative until a level. The dividend on common stock is not paid just in case of non-payment of dividend on preferred stock.

b.

To discuss: The meaning of adjustable-rate preferred.

b.

Explanation of Solution

The meaning of adjustable-rate preferred is as follows:

A particular form of preferred stock wherein the dividends issued varies with a benchmark such as Treasury-bill rate is termed as adjustable-rate preferred. This is the best short-term corporate investment since only 30 percent of the dividends are taxable to corporations and even the floating rate keeps the issue trading at the par value. Moreover, the adjustable-rate preferred stock will have price instability mostly for the liquid portfolios of numerous corporate investors.

c.

To discuss: The knowledge of call options helps people to understand convertibles and warrants.

Introduction:

Option is a contract to purchase a financial asset from one party and sell it to another party on an agreed price for a future date. There are two types of options, which are as follows:

- An option that buys an asset called call option

- An option that sells an asset called put option

c.

Explanation of Solution

The knowledge of call options helps people to understand convertibles and warrants is as follows:

Both the convertibles and warrants are two forms of call options. The understanding of options will help a company’s financial managers to make decision on convertible and warrant issues.

d.1.

To determine: The coupon rate that is set on the bond with warrants.

Introduction:

A warrant is securities that give the bondholder the right, yet not the obligation, to purchase a specific number of securities at a specific cost before a particular period.

d.1.

Explanation of Solution

Given information:

Person M (

The formula to compute the value of package is as follows:

Compute the value of warrant:

Note: Assume the entire package is to sell for the price of $1,000.

Hence, the value of warrant is $75.

Compute the

Hence, the value of bond is $925.

Compute the PTM

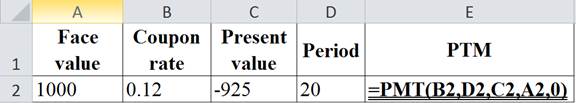

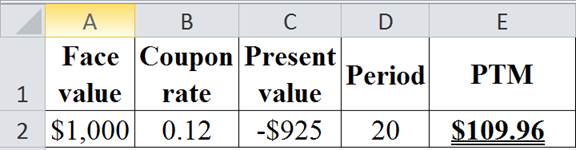

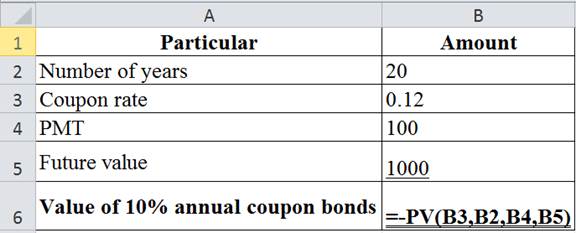

The table below shows the Excel formula to compute the PTM:

The table below shows the calculated value of PTM:

Hence, the PTM is $109.96. The bonds will have a value of $925 and the package of one bond plus 50 warrants will cost $1,000 at 12 percent coupon rate.

d.2.

To discuss: The implication of terms of issues and whether the company loses or wins.

d.2.

Explanation of Solution

The implication of terms of issues and determine whether the company loses or wins are as follows:

The company issues bonds and warrants directly trade for $2.50 each for 50 warrants. The total worth of 50 warrants will be $125

d.3.

To discuss: The expected period when the warrants to be exercised.

d.3.

Explanation of Solution

The expected time when the warrant to be exercised is discussed below:

A warrant is sold for premium beyond exercise value in an open market. Every investor will sell warrants in specific place than exercising it; on stock selling at price more than exercise price. However, few warrants comprise of step-up provisions of exercise price in which exercise price raises than warrant’s life period. It is because the warrant value drops when the exercise price increases.

As a result, the step-up provision will support holders for exercising their warrants. Therefore, the warrants holder would voluntarily exercise when there is higher dividend. Moreover, the higher dividends will raise the attraction of stock from warrants.

d.4.

To discuss: Whether the warrants will bring in additional capital when exercised and determine the type of capital.

d.4.

Explanation of Solution

Determine whether the warrants will bring in additional capital when exercised and determine the types of capital are as follows:

At the time when a warrant is exercised, it will bring in exercise price or additional capital of $12.50 (equity capital). As a result, the holder will receive a share of common stock per warrant. Here, let assume that the exercise price is set at 10 percent to 30 percent above the current price of stock. In this case, a higher-growth company will set the exercise price to a higher-end range and vice-versa.

d.5.

To discuss: Whether all the debt been issued with warrants when the warrants lower the cost of debt and determine the expected cost of the bond with warrants.

d.5.

Explanation of Solution

Determine whether all the debt been issued with warrants when the warrants lower the cost of debt and determine the expected cost of the bond with warrants are as follows:

The overall cost of the issue will be higher than straight debt even though the coupon rate on the debt is lower. Few returns are contractual in nature for the investors while the remaining return is related to price of stock movements. As a result, the cost will be much higher as compared to the debt. Therefore, the overall cost and risk is greater as compared to the cost of debt.

At the time when the warrants are exercised in 5-years, then the price of stock will be $17.50. Then the F Company will exchange stock worth $17.50 for one warrant plus $12.50. Therefore, the company will realize an

To discuss: The comparison on the cost of bond with warrants by the cost of straight debt and cost of common stock.

Explanation of Solution

Given information:

Person M (financial manager) of the F Company decided to issue a bond with warrants. The current stock price of the company is $10 and cost of 20-years annual coupon debt is 12 percent without warrants. Later, the banker has recommends to assign 50 warrants for every bond of the company. The exercise price of the warrant is $12.50 and the value of every warrant when detached and trade separately is $1.50.

Note: The F Company will make interest payments over the 20-year life of bonds and repay the principal after 20-years.

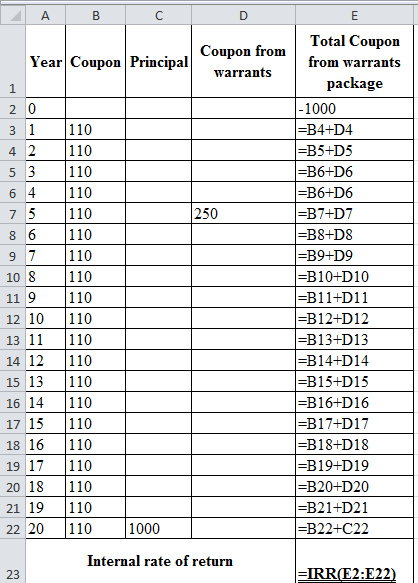

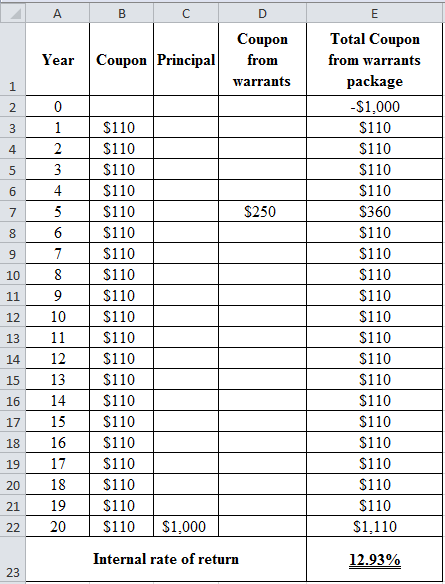

Compute the

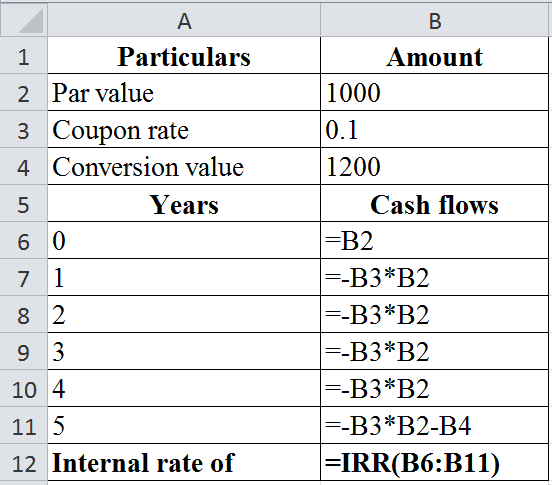

The table below shows the Excel formula to compute the IRR:

The table below shows the calculated value of IRR:

Hence, the IRR is 12.93%. The IRR from this cash flows stream is higher than the 12 percent cost of straight debt. It is because the issue is riskier as compared to the straight debt as per the investor point of view. However, the bonds with warrants will be less risky as compared to the common stock. Therefore, the bonds with warrants will have a lower cost than common stock.

e.1.

To determine: The conversion price and whether ot is implied in the convertible’s terms.

e.1.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula to compute the conversion price is as follows:

Compute the conversion price:

Hence, the conversion price is $12.50. Here, the conversion price can be assumed as the convertible’s exercise price, even though it has already paid out. Therefore, the conversion price is set at 20 percent to 30 percent above the prevailing stock price as with the warrants.

e.2.

To determine: The straight-debt value of the convertible and implied value of the convertibility.

e.2.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula to compute the value of convertibility is as follows:

The formula to compute per share value of convertibility is as follows:

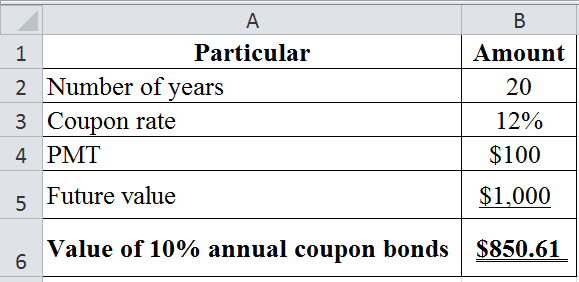

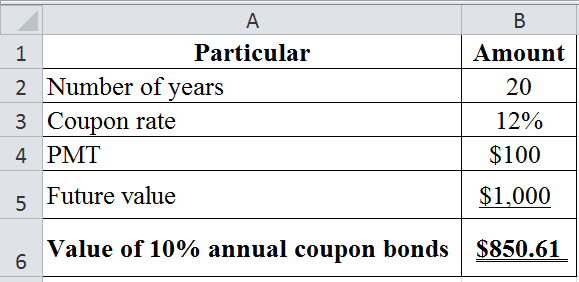

Compute the value of 10% annual coupon bonds (straight bond):

The table below shows the Excel formula to compute the value of 10% annual coupon bonds:

The table below shows the calculated value of 10% annual coupon bonds:

Hence, the value of 10% annual coupon bonds is $850.61.

Compute the value of convertibility:

Note: The convertible will sell at $1,000 (face value).

Hence, the value of convertibility is $149.39.

Compute the per share value of convertibility:

Hence, per share value of convertibility is $1.87.

e.3.

To determine: The formula for the conversion value of bond in any year and even compute the value of conversion at Year 0 and Year 10.

e.3.

Explanation of Solution

The formula for the conversion value of bond in any year is as follows:

The value of the stock which is obtained by converting is termed as conversion value in any year. In the case of F Company, the stock price is expected to increase by “g” every year since it has a constant growth stock. Therefore, the formula for the conversion value of bond in any year is given below:

Where,

Pt refers to the price at conversion of bonds

Po refers to the current stock price

g refers to the constant growth rate of stock

t refers to the number of years

Note: The value of converting at any year is denoted as CR(Pt). Here, CR refers to the number of share received.

Compute the value of conversion at Year 0:

Hence, the value of conversion at Year 0 is $800.

Compute the value of conversion at Year 10:

Hence, the value of conversion at Year 10 is $1,727.12.

e.4.

To discuss: The meaning of the term floor value of a convertible and compute the convertible’s expected floor value in the Year 0 and Year 10.

e.4.

Explanation of Solution

The meaning of term floor value of a convertible and even compute the convertible’s expected floor value in the Year 0 and Year 10 are as follows:

The higher of straight-debt value and higher value of conversion is termed as floor value of a convertible.

Compute the expected floor value of convertible in the Year 0:

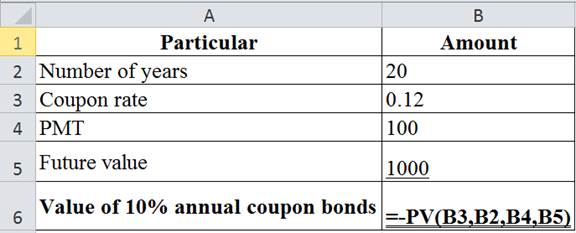

The table below shows the Excel formula to compute the value of 10% annual coupon bonds:

The table below shows the calculated value of 10% annual coupon bonds:

Hence, the value of 10% annual coupon bonds is $850.61. The straight-debt value in Year 0 is $850.61 when the conversion value is $800. Therefore, the floor value is $850.61.

The conversion value of $1,727.12 is higher than the straight-debt value at the Year 10. Therefore, the conversion value sets at the floor price. The convertible would sell above its floor value in any period before the date of maturity. It is because the convertibility option carries extra values.

e.5.

To determine: The number of year or period when the issue is expected to callable.

e.5.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula for the conversion value of bond in any year is given below:

Where,

Pt refers to the price at conversion of bonds

Po refers to the current stock price

g refers to the constant growth rate of stock

t refers to the number of years

Compute the number of years or period when the issue is expected to callable:

Hence, the number of year is 5.2678 years that is considered as 5-years.

e.6.

To determine: The expected cost of the convertible and whether the cost appears consistent with the risk of the issue.

e.6.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner. The conversion value in Year 5 is $1,200.

Compute the IRR:

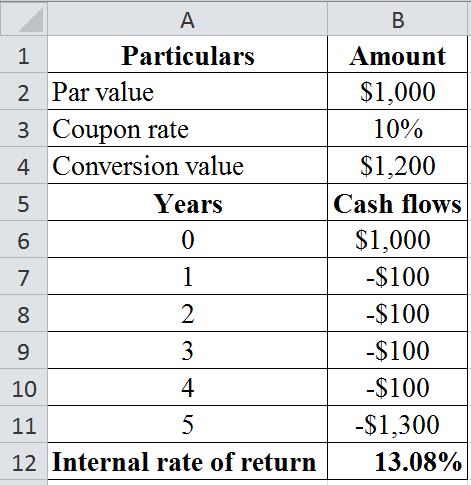

The table below shows the Excel formula to compute the IRR:

The table below shows the calculated value of IRR:

Hence, the IRR is 13.08% that is the cost of the convertible issue.

Compute the

Hence, the cost of equity is 0.15992 that is approximately is 16%. The convertible bond of firm has risk, which falls between the risk of its equity and debt. Therefore, the cost that appears consistent with the risk of the issue is 13.08 percent.

f.

To discuss: The factors that Person M as to consider on making decision between to securities.

f.

Explanation of Solution

The factors that Person M as to consider on making decision between to securities are as follows:

- The Person M has to consider the future need for capital of the company. The warrants must be favorable because their exercise can bring in extra equity capital without retirement of the low-cost debt when the company anticipates continues need for capital. On the contrary, the convertible issue cannot bring in new funds at conversion.

- The second factor that Person M must consider is whether the Company wants to commit towards 20-year of debt at this period. Here, the conversion can remove off the debt issue but it does not occur on the exercise of warrants. In case, the F Company cannot increase over the period, then neither the warrants nor the convertibles will be exercised and debt will remain outstanding in the both case.

Want to see more full solutions like this?

Chapter 20 Solutions

Fundamentals of Financial Management (MindTap Course List)

- (iii) Presently, your company’s Face Value of Equity Share RO 10 and Market Value of your Share in MSM is RO 25 per share. In order to increase the trading volume and market liquidity of your company stock, will you suggest the management to go for stock split? Explain your management about concept of stock slip with the advantage of splitting the stock of your company with the current scenario. (iv) Given the current scenario COVID 19 and its impact on Cement sector in the near future, what are the factors that you consider affecting the dividend policy of your company? Critically evaluate and justify.arrow_forwardPlease provide the correct solution. Previously it has been partially incorrect, so this is a repost. Please double-check the yes or no question and the calculations. Stocks that don't pay dividends yet Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $5.00000 dividend at that time (D₃ = $5.00000) and believes that the dividend will grow by 26.00000% for the following two years (D₄ and D₅). However, after the fifth year, she expects Goodwin’s dividend to grow at a constant rate of 4.26000% per year. Goodwin’s required return is 14.20000%. Fill in the following chart to determine Goodwin’s horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to…arrow_forwardYour company is rapidly growing and needs additional capital to expand the online retailing portion of its business model. One group of the board of directors proposes that the company issue $800,000 of additional common stock, while a separate group of the board is in favor of issuing the same amount of long-term bonds. As a possible compromise, the company’s investment banker suggests that the company issue convertible bonds. The board asks you to write a memo examining the advantages and disadvantages of convertible bonds. The company currently has 200,000 common shares outstanding, and the stock is currently trading at a price of $30 per share. The company’s effective interest rate is 10%; however, the investment banker believes that the convertible debt could be issued at a 6% interest rate. Write a memo to the board of directors detailing how convertible bonds work and the advantages and disadvantages of the security. In addition, provide details on how the issuance of the…arrow_forward

- 1, Whats the difference is between common and preferred stock. If you were an investor, which type of stock wouldyou prefer? why? 2. According to the information provided by S&P, share buybacks totaled $198.7 billion in Q1 2020, but then the process slowed down. Among the companies, there were Apple, T-Mobile, Alphabet, and Microsoft. In your opinion, what arethe reasons companies buy their shares back? Does the COVID-19 pandemic influence their decision?arrow_forward1)An all-equity firm has 9 million shares outstanding and each share is priced at $167. The firm announces that it will be issuing $260 million in permanent debt that they will use to repurchase shares. The market hears this news and assimilates the information immediately. What is the new share price? Assume the firm's tax rate is 21% and there are no financial distress costs. 2)A CEO, working on behalf of the equityholders, is choosing between two mutually-exclusive projects: A and B. A has a 100% probability of earning $150 million. B has an 80% probability of earning $200 million and a 20% probability of earning $0. Ignore discounting. The firm has debt to pay of $100 million. Solve for which project has the highest expected value for the equityholders. What is that value? 3) Your firm is evaluating a project that will generate the following cash flows next year with the following probabilities: Cash Flow at t=1 Probability Good Case $600M 0.75 Bad Case $200M 0.25 You…arrow_forwardQuantitative Problem 2: Carlysle Corporation has perpetual preferred stock outstanding that pays a constant annual dividend of $1.40 at the end of each year. If investors require an 8% return on the preferred stock, what is the price of the firm's perpetual preferred stock? Round your answer to the nearest cent.$ ? per share Nonconstant Growth Stocks: For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cycles where they experience different growth rates during different parts of the cycle. For valuing these firms, the generalized valuation and the constant growth equations are combined to arrive at the nonconstant growth valuation equation (see attached image):arrow_forward

- ConvertiBles In the summer of 2018, the Gallatin Company was planning to finance an expansion with a convertible security. It considered a convertible debenture but feared the burden of fixed interest charges if the common stock price did not rise enough to make conversion attractive. The firm decided on an issue of convertible preferred stock, which would pay a dividend of $1.07 per share. The common stock was selling for $21 a share at the time. Management projected earn- ings for 2018 at $1.40 a share and expected a future growth rate of 12% per year in 2019 and beyond. The investment bankers and management agreed that the common stock would continue to sell at 15 times earnings, the current price/earnings ratio. What conversion price should the issuer set? The conversion rate will be 1.0; thatis, each share of convertible preferred can be converted into 1 share of common. Therefore, the convertible’s par value (as well as the issue price) will be equal to the conversion price,…arrow_forwardHamlin Steel Company wishes to determine the value of Craft Foundry, a firm that it is considering acquiring for cash. Hamlin wishes to determine the applicable discount rate to use as an input to the constant-growth valuation model. Craft's stock is not publicly traded. After studying the required returns of firms similar to Craft that are publicly traded, Hamlin believes that an appropriate risk premium on Craft stock is about 9%.The risk-free rate is currently 4%. Craft's dividend per share for each of the past 6 years is shown in the following table: a. Given that Craft is expected to pay a dividend of $3.87 next year, determine the maximum cash price that Hamlin should pay for each share of Craft. (Hint: Round the growth rate to the nearest whole percent.) b. Describe the effect on the resulting value of Craft from: (1) A decrease in its dividend growth rate of 2% from that exhibited over the 2017-2022 period. (2) A decrease in its risk premium to 8%.arrow_forwardH3. An unlevered firm with 300,000 shares outstanding has net income of $625,000. The firm’s stock sells for $9.50 per share and the book value per share is $12.00. The firm is considering an investment that is expected to cost $1 million and increase net income by $125,000. The cost of the investment will be financed with the issue of new shares. Assume the firm’s price-earnings ratio will remain constant. Does accounting dilution and/or market value dilution take place? Why? Show proper step by step calculationarrow_forward

- Share repurchase proposal: Currently, the firm has available capital (cash and net income) of approximately $7,000,000. There is a large block of stock available at $35 a share. For the sake of this exercise let us disregard tax implications and effects. If the firm decides to spend this amount of excess cash on a share repurchase program, how many shares will be repurchased?? What are the benefits of repurchasing shares? How will this affect the capital structure of the company? How can this be interpreted in the marketplace? Suppose the market price of the shares is $35.75 a share. Why do you think the seller of the large block would agree to see at $35 a share? Suppose the assumptions of MM are true, then what would happen to the market price of shares once the purchase of the large block at $35 a share is completed? Would it rise above $35.75, remain unchanged or fall? Would a dividend be better? Please discuss the pros and cons of dividends and share buybacks. Make a…arrow_forwardA privately held corporation, is making plans for future investments that can increase growth. The company’s manager has recommended that the company “go public” by issuing common stock to raise the funds needed to support the growth. The current owners, who founded the firm, are worried that control of the firm will be diluted by this strategy. If the company undertakes an IPO, it is estimated that each share of stock will sell for $6.25, the investment banking fee will be 22 percent of the total value of the issue. If the founders must issue stock to finance the growth of the firm, what would you recommend they do to protect their controlling interest for at least a few years after the IPO?arrow_forwardA privately held corporation, is making plans for future investments that can increase growth. The company’s manager has recommended that the company “go public” by issuing common stock to raise the funds needed to support the growth. The current owners, who founded the firm, are worried that control of the firm will be diluted by this strategy. If the company undertakes an IPO, it is estimated that each share of stock will sell for $6.25, the investment banking fee will be 22 percent of the total value of the issue. The founders now hold all of the company’s stock: 8 million shares. If the company issues 8 million shares, what proportion of the stock will the founders own after the IPO?arrow_forward

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning