Concept explainers

P 20-2

Change in principle; change in method of accounting for long-term construction

• LO20–2

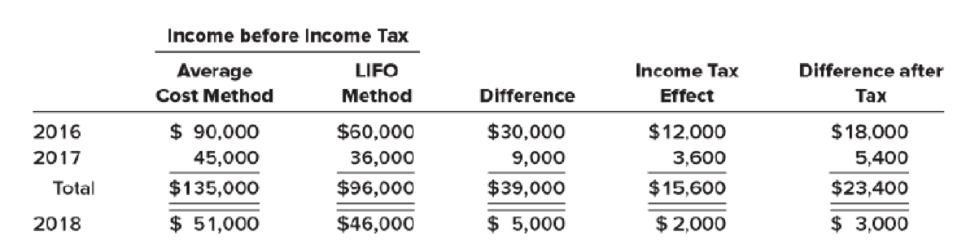

The Pyramid Company has used the LIFO method of accounting for inventory during its first two years of operation, 2016 and 2017. At the beginning of 2018, Pyramid decided to change to the average cost method for both tax and financial reporting purposes. The following table presents information concerning the change for 2016–2018. The income tax rate for all years is 40%.

Pyramid issued 50,000 $1 par, common shares for $230,000 when the business began, and there have been no changes in paid-in capital since then. Dividends were not paid the first year, but $10,000 cash dividends were paid in both 2017 and 2018.

Required:

- 1. Prepare the

journal entry to record the change in accounting principle. - 2. Prepare the 2018–2017 comparative income statements beginning with income before income taxes.

- 3. Prepare the 2018–2017 comparative statements of shareholders’ equity. [Hint: The 2016 statements reported

retained earnings of $36,000. This is $60,000 − ($60,000 × 40%).]

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

INTERMEDIATE ACCOUNTING (LL)-W/CONNECT+

- 13 Mactan Company’s statements for 2018 and 2019 included the following errors: 12/31/18 inventory understated P2,000,000 12/31/19 inventory overstated 1,000,000 Depreciation for 2018 understated 400,000 Depreciation for 2019 overstated 800,000 How much should retained earnings be retroactively adjusted on January 1, 2020? Group of answer choices 1,400,000 decrease 600,000 increase 600,000 decrease 1,400,000 increasearrow_forwardProblem 8-07 The management of Tritt Company has asked its accounting department to describe the effect upon the company’s financial position and its income statements of accounting for inventories on the LIFO rather than the FIFO basis during 2020 and 2021. The accounting department is to assume that the change to LIFO would have been effective on January 1, 2020, and that the initial LIFO base would have been the inventory value on December 31, 2019. The following are the company’s financial statements and other data for the years 2020 and 2021 when the FIFO method was employed. Financial Position as of 12/31/19 12/31/20 12/31/21 Cash $ 90,000 $130,000 $154,000 Accounts receivable 80,000 100,000 120,000 Inventory 120,000 140,000 176,000 Other assets 160,000 170,000 200,000 Total assets $450,000 $540,000 $650,000 Accounts payable $ 40,000 $ 60,000 $ 80,000 Other liabilities 70,000 80,000 110,000…arrow_forwardDuring 2019, DGP Company decided to change from the FIFO inventory valuation to the weighted average method. The income tax rate is 30%. FIFO Weighted Average January 1, inventory P7,100,000 P7,700,000 December 31, inventory 7,900,000 8,200,000 What amount should be reported in the cumulative effect of the change in accounting policy for 2019? A P600,000 decrease in retained earnings B P420,000 decrease in retained earnings P420,000 increase in retained earnings (D) P600,000 increase in retained earningsarrow_forward

- On December 31, 2020 Mega Nhon Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2020 beginning inventory to increase by ₱630,000. The cumulative effect of this accounting change to be reported for the year ended 12/31/13, assuming a 40% tax rate, is ₱630,000 ₱252,000 ₱378,000 ₱0arrow_forwardtudent question Time to preview question: 00:09:07 Company is subject to an income tax rate of 30%. It has the provided the following data on December 31, 2021: Income Statement Items for 2021: Net sales P3,600,000Cost of goods sold 1,100,000Operating expenses including depreciation 840,000Depreciation expense 60,000Interest expense 100,000Income tax expense ? Other information for 2021: Payment of bank loan 300,000 Dividends paid to stockholders P250,000 Balance Sheet Items December 31, 2021 December 31, 2020Cash and cash equivalents 2,000,000 P1,750,000Accounts receivable 670,000 410,000Inventory 430,000 220,000Supplies 18,000 12,000Accounts payable 520,000 380,000Accrued liabilities 72,000 53,000Property and equipment, net 1,700,000 2,100,000Loans payable 1,000,000 1,500,000Share capital 1,000,000 1,000,000Retained earnings ? ? Based on the above, answer the following questions for 2021: (Round answers to whole numbers for monetary amounts while for percentages,…arrow_forward5 of 18 Petra Company uses the average-cost inventory method. Its 2020 ending inventory was $80,000, but it would have been $120,000 if FIFO had been used. Thus, if FIFO had been used, Petra's income before income taxes would have been O $40,000 greater. O $40,000 less. O the same. not determinable without the tax rate. Assessment Navigator Questionmark Perception licensed to Yarmouk University MERT P Type here to scarch Delete ※一 F11 Insert PriSc + C F5 F7 FB F9 F10 F12 F6 F4 F2 * 23 24 Backspace 2. 3. 48 7 V 8. 9. T YlY ! u P COarrow_forward

- 3. How much is the cumulative effect of this change that should be reported in the income statement for the year ended December 31, 2021? On December 31, 2021, BLACK MAMBA Company appropriately changed its inventory valuation method to average cost method from FIFO for financial statement and income tax purposes. The change will result in a $180,000 increase in the beginning inventory at January 1, 2021. Assume an income tax rate of 30%. Your answerarrow_forwardA. Devine and Vicky are partners dealing in cosmetics and other assorted goods. They share profit and losses in ratio 3:2. The trial balance below was extracted from the books of the partners as at 31“ December, 2020. DR CR Rent Expenses 400,000 Bank overdraft 100,000 Discount 50,000 100,000 Turnover 2,100,000 Cost of Sales 700,000 Receivable 400,000 Patent 400,000 Stocks (31/12/2019) 150,000 Loan from Devine at 15% per annum 200,000 Land 900,000 Motor vehicle 600,000 Equipment 400,000 Provision for depreciation:arrow_forward38 An entity reported current receivables on December 31, 2020 which consisted of the following: Trade accounts receivable 930,000 Allowance for uncollectible accounts 20,000 Claim against shipper for goods lost in transit in November 2020 30,000 Selling price of unsold goods sent by the entity on consignment at 130% of cost and not included in the ending inventory 260,000 Security deposit on lease of warehouse used for storing inventories 300,000 What is the correct total of current net receivables on December 31, 2020?arrow_forward

- Question Content Area On January 1, 2016, Bedrock Company began recognizing revenues from all sales under the accrual method for financial reporting purposes and under the installment sales method for income tax purposes. Bedrock reported the following gross margin on sales for 2016 and 2017: Accrual Installment Year Method Sales Method 2016 $1,200,000 $1,000,000 2017 1,800,000 1,400,000 The enacted tax rate for both 2016 and 2017 was 30%. Assuming there are no other temporary differences, 2017 what is the amount of deferred tax liability that Bedrock should report on its December 31, 2017 balance sheet? $120,000 $450,000 $60,000 $180,000arrow_forward56. Harper Inc. incurred an inventory loss from market decline of P840,000 on June 30, 2019. What amount of the inventory loss should be recognized in the quarterly income statement for the three months ended June 30, 2019? a. 210,000 b. 280,000 c. 420,000 d. 840,000arrow_forwardExercise 22-03 Cheyenne Co. decides at the beginning of 2020 to adopt the FIFO method of inventory valuation. Cheyenne had used the LIFO method for financial reporting since its inception on January 1, 2018, and had maintained records adequate to apply the FIFO method retrospectively. Cheyenne concluded that FIFO is the preferable inventory method because it reflects the current cost of inventory on the balance sheet. The following table presents the effects of the change in accounting principles on inventory and cost of goods sold. Income taxes are ignored. Inventory Determined by Cost of Goods Sold Determined by Date LIFO Method FIFO Method LIFO Method FIFO Method January 1, 2018 $ 0 $ 0 $ 0 $ 0 December 31, 2018 100 8 850 942 December 31, 2019 180 250 990 828 December 31, 2020 310 400 1,230 1,210 Retained earnings reported under LIFO are as follows. Retained Earnings Balance December 31,…arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT