ADVANCED FINANCIAL ACCOUNTING IA

12th Edition

ISBN: 9781260545081

Author: Christensen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.4E

Chapter 7 Liquidation

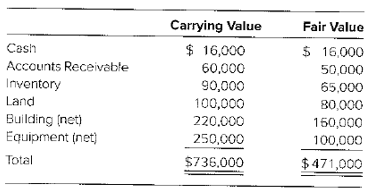

Penn Inc.'s assets have the carrying values and estimated fair values as follows:

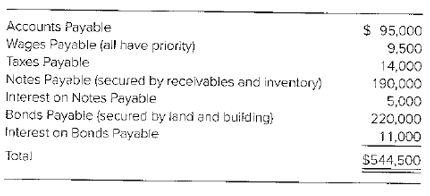

Penn's debts follow:

Required

a. Prepare a schedule to calculate the net estimated amount available for general unsecured creditors.

b. Compute the percentage dividend to general unsecured creditors.

c. Prepare a schedule showing the amount to be paid each of the creditors groups upon distribution of the $471,000 estimated to be realizable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024:

Sales revenue

Interest revenue.

Gain on sale of investments

Gain on debt securities

Loss on projected benefit obligation

Cost of goods sold

Selling expense

Goodwill impairment loss.

Interest expense

General and administrative expense

Debits

$ 165,000

6,050,000

650,000

475,000

35,000

550,000

Credits

$ 8,250,000

65,000

125,000

142,500

The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other

comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been

recorded. The effective tax rate is 25%.

Required:

Prepare a 2024 single, continuous statement of comprehensive income for Kroeger Incorporated. Use a multiple-step income

statement format.

The following data were taken from the Statement of Affairs of Greenfield Corporation:

What is the estimated amount the holders of the notes payable will receive in the event of liquidation?

QUESTION : "

The balance sheet of Lara Ltd are as follows:

31/12/2019

Non-Current Assets

RM

RM

RM

Equipment (Cost)

Less: Accumulated depreciation

28,500

(11,450)

17,050

Current Assets

18,570

Inventory

Account receivable

8,470

Less: Provision doubtful debts

(420)

8,050

4,060

30,680

Cash and bank

Total Assets

Current Liabilities

Account Payable

4,140

Non-Current Liabilities

Loan

10,000

Total Liabilities

(14,140)

16,540

Net Assets

33,590

Capital

Opening

Add: Net profit

35,760

10,240

Cash introduced

Less: Drawing

Total Capital

(12,410)

33,590

31/12/2020

Non-Current Assets

RM

RM

RM

Equipment (Cost)

Less: Accumulated depreciation

26,100

(13,010)

13,090

Current Assets

16,250

Inventory

Account receivable

14,190

Less: Provision doubtful debts

(800)

13,390

3,700

33,340

Cash and bank

Total Assets

Current Liabilities

Account Payable

5,730

Non-Current Liabilities

Loan

4,000

23,610

36,700

Total Liabilities

(9,730)

Net Assets

Chapter 20 Solutions

ADVANCED FINANCIAL ACCOUNTING IA

Ch. 20 - What are the nonjudicial actions available to a...Ch. 20 - What is the difference between a Chapter 7 action...Ch. 20 - Prob. 20.3QCh. 20 - What is usually included in the plan of...Ch. 20 - Prob. 20.5QCh. 20 - Prob. 20.6QCh. 20 - Prob. 20.7QCh. 20 - Prob. 20.8QCh. 20 - How is the statement of affairs used in planning...Ch. 20 - What are the financial reporting responsibilities...

Ch. 20 - Prob. 20.11QCh. 20 - Creditors' Alternatives The creditors of Lost Hope...Ch. 20 - Prob. 20.3CCh. 20 - Prob. 20.1.1ECh. 20 - Prob. 20.1.2ECh. 20 - Prob. 20.1.3ECh. 20 - Prob. 20.1.4ECh. 20 - Prob. 20.1.5ECh. 20 - Prob. 20.2ECh. 20 - Prob. 20.3.1ECh. 20 - Prob. 20.3.2ECh. 20 - Prob. 20.3.3ECh. 20 - Prob. 20.3.4ECh. 20 - Prob. 20.3.5ECh. 20 - Chapter 7 Liquidation Penn Inc.'s assets have the...Ch. 20 - Prob. 20.5ECh. 20 - Chapter 11 Reorganization During the recent...Ch. 20 - Prob. 20.7PCh. 20 - Chapter 7 Liquidation, Statements of Affairs...Ch. 20 - Prob. 20.9P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The estimated recovery percentage or dividend to unsecured creditors is calculated by which of the following formulas? -Estimated amount available for unsecured creditors with/without priority divided by total claims of all unsecured creditors with/without priority -Net free assets divided by the total claims of unsecured creditors with/without priority -Estimated gain/loss on liquidation divided try total estimated net realizable value of debtor assetsa -Net estimated proceeds available to general unsecured creditors divided by total claims of general unsecured creditorsarrow_forwardVeltri Incorporated has the following assets and liabilities (assets are stated at net realizable value): Assets pledged with secured creditors $ 80,000 Assets pledged with partially secured creditors 70,000 Other assets 180,000 Secured liabilities 40,000 Partially secured liabilities 95,000 Liabilities with priority 55,000 Unsecured liabilities 225,000 In a liquidation, what is the amount of free assets after payment of liabilities with priority?arrow_forwardThe trial balance of Rollins Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense Debits $20,000 Show Transcribed Text 145,000 4,310,000 390,000 175,000 10,000 290,000 Credits $5,800,000 39,500 255,000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a 2024 income statement for Rollins Incorporated with earnings per share disclosure. Write out the process of solving the problem step by step, how each data is calculated should be written clearly, be detailed and accurate, thank you!arrow_forward

- Coop Incorporated has the following assets and liabilities (assets are stated at net realizable value): Assets pledged with secured creditors $ 80,000 Assets pledged with partially secured creditors 70,000 Other assets 180,000 Secured liabilities 40,000 Partially secured liabilities 95,000 Liabilities with priority 55,000 Unsecured liabilities 225,000 In a liquidation, what is the amount of free assets after payment of liabilities with priority? A. $180,000 B. $165, 000 C. $70,000 D. $95,000 E. $160,000arrow_forwardVeltri Incorporated has the following assets and liabilities (assets are stated at net realizable value): $ 80,000 70,000 180,000 40,000 95,000 55,000 225,000 Assets pledged with secured creditors Assets pledged with partially secured creditors Other assets Secured liabilities Partially secured liabilities Liabilities with priority Unsecured liabilities In a liquidation, what is the amount of free assets after payment of liabilities with priority? Multiple Choice $180,000 $165,000 $70,000 $95,000 $160,000arrow_forwardA statement of financial affairs created for an insolvent corporation that was beginning the liquidation process disclosed the following data (assets were shown at net realizable values): Assets pledged with fully secured creditors. Fully secured liabilities... Assets pledged with partially secured creditors.. Partially secured liabilities.. Free assets. Unsecured liabilities with priority. Unsecured liabilities. P 260,000 195,000 494,000 637,000 390,000 208,000 650,000 How much money appears to be available for unsecured creditors without priority?arrow_forward

- You have partial information from an entity financial statements as follows: Accounts receivable Allowance for doubtful accounts Inventory FV-NI Investments Accounts payable Unearned revenues Equipment Accumulated depreciation - equipment Sales Cost of goods sold Depreciation expense Bad debt expense Loss on sale of equipment Loss on sale of FV-NI investments Holding gain- FV-NI investments Note also the following: Accounts written off that were recoved during 2024: $ $ $ $ $ 2024 4,450,000 $ (198,000) $ 3,820,000 $ 1020000 2,740,000 $ 365,000 $ 200,000 -98,000 $ $ $ $ $ 2023 3,690,000 (165,000) 4,490,000 925000 2,630,000 430,000 189,000 -89,000 20,560,000 9,250,000 10,000 356,000 5,500 5000 33000 25,000 Required 1) Calculate the cash collected from customers in 2024. 2) Calculate the cash paid to suppliers for purchase of inventory. 3) One FV-NI investment was sold during the year. Its carrying value at the beginning of the year was: $ 125,000 Calculate the NET cash generated/used up…arrow_forwardLugi Ka Na Company has been forced into bankruptcy as of April 30 because of its inability to pay its debts. The statement of financial position on that date shows: ASSETS LIABILITIES & EQUITY Cash Accounts Receivable Note Receivable Inventory Prepaid Expenses Land and Building Equipment, net P5,400 78,700 37,000 175,700 1,900 122,500 97,600 Accounts Payable Notes Payable – PNB Notes Payable - suppliers Accruedwages Accruedtaxes P105,000 30,000 102,500 3,700 9,300 180,000 150,000 (61,700) P518,800 Mortgage Bonds Payable Common stock-P100 par Retained Earnings Total Liabilities & Equity Total Assets P518,800 Additional information: a. Accounts receivable of P32,220 and notes receivable of P25,000 are expected to be collectible. The good notes are pledged to PhilippineNational Bank. b. Inventories are expectedto bring in P90,200when soldunder bankruptcyconditions. Landand buildingshave an appraised value of P190,000. They serveas security on the bonds. d. The currentvalue of the…arrow_forwardThe trial balance of Rollins Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense Debits $ 15,000 126,000 3,860,000 340,000 150,000 15,000 240,000 Credits $ 5,300,000 37,000 230,000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. ROLLINS INCORPORATED Statement of Comprehensive Income Required: Prepare a 2024 single, continuous statement of comprehensive income for Rollins Incorporated. Use a multiple-step income statement format. Note: Round Earnings per share answer to 2 decimal places.arrow_forward

- The following data were taken from the statement of realization and liquidation of ABC Corp. for the quarter ended June 30: Assets to be realized ₱515,625Supplementary credits 796,875Liabilities to be liquidated 843,750Supplementary charges 731,250Liabilities liquidated 562,500Assets acquired 562,500Assets realized 656,250Liabilities assumed 281,250Assets not realized 234,375 The ending capital balances of capital stock and retained earnings are ₱468,750 and ₱187,500, respectively. A net loss of ₱262,500 was reported for the period. How much is the ending balance of cash?arrow_forwardThe following data were taken from the statement of realization and liquidation of Rise Heart Company for the quarter ended September 30, 2021. 000.0 Liabilities to be liquidated Supplementary credits Liabilities not liquidated Supplementary debits Assets acquired Liabilities assumed P1,825,000 845,000 1,000,000 620,500 880,500 770,000 8- 737,500 Assets to be realized lopiJ bas noitesilso wolad ew 875,000 1,595,000 Assets realized Liabilities liquidated The beginning balances of ordinary shares and retained earnings are P520,000 and P(148,000), respectively. The net income for the period is P104,500. How much is the ending cash balance? 000,.08 botslarrow_forwardThe summarized trial balance of XYZ Corporation includes the following accounts on December 31,2022: Debit Credit Cash P 239,738 9,800 31,386 Accounts receivable Dividend receivable Interest receivable Investments at FVPL 956 136,910 Investments at FVOCI 3,760,944 1,310 Deferred tax asset Accounts payable P 20,506 Interest payable 560 Other payables 166 Income tax payable 484 Provision for employee benefits 1,504 Deferred tax liability 112,828 Share capital 2,736,048 Share premium 752,180 Retained Earnings 556,768 P4,181,044 P4,181,044 The provision for employee benefits includes P1,050 payable in the subsequent year. Required: 1. Prepare Statement of Financial Positionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License