Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 26CE

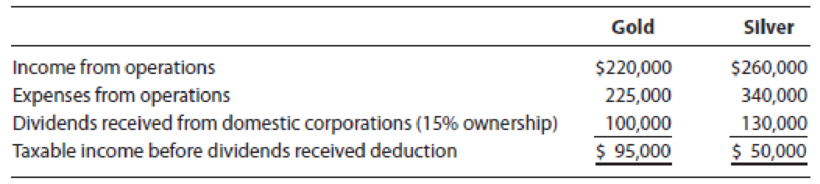

LO.4 Gold and Silver are two unrelated calendar year corporations. For the current year, both entities incurred the following transactions.

What is the dividends received deduction for:

- a. Gold Corporation?

- b. Silver Corporation?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Bilbeaux Corporation is a calendar year corporation that starts business on January 1, 20X1. Bibeaux files an election to be treated as a S corporation on April 2, 20X2, when it files its tax return for 20X1. Bilbeaux will be treated as an S corporation for 20X1.

True or False?

Four individuals form Chicka Corporation under § 351. Two of these individuals, Jane and Walt, made the following contributions:

Both Jane and Walt receive stock in Chicka Corporation equal to the value of their investments. Required:

a. What is Jane’s recognized income/loss b. What is Walt’s recognized gain/loss

Which of the following statements regarding income recognition is true?

A. Owners in a regular corporation realize entity level income at the time the income is earned.

B. Owners of an S corporation realize entity level income in the tax year in which the S corporation's year ends.

C. Partnership income is recognized in the year in which it is distributed to the partners.

D. Sole proprietorship income is recognized at the time the income is distributed to the owner.

Chapter 20 Solutions

Individual Income Taxes

Ch. 20 - Prob. 1DQCh. 20 - LO.1 Sylvia and Trang want to enter into business...Ch. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - LO.3, 4, 5 Contrast the income taxation of...Ch. 20 - LO.3, 8, 9 The taxpayer has generated excess...Ch. 20 - Prob. 8DQCh. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - LO.5 Beige Corporation has a fiscal year ending...Ch. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - Prob. 18DQCh. 20 - Prob. 19DQCh. 20 - Prob. 20DQCh. 20 - Prob. 21DQCh. 20 - Blaine, Cassie, and Kirstin are equal partners in...Ch. 20 - LO.3 Green Corporation, a calendar year taxpayer,...Ch. 20 - Prob. 24CECh. 20 - Prob. 25CECh. 20 - LO.4 Gold and Silver are two unrelated calendar...Ch. 20 - Prob. 27CECh. 20 - Prob. 28CECh. 20 - Prob. 29CECh. 20 - Prob. 30CECh. 20 - Prob. 31CECh. 20 - Prob. 32CECh. 20 - Prob. 33CECh. 20 - LO.3, 4, 5 Using the legend provided below,...Ch. 20 - LO.3 Garnet incurs the following capital asset...Ch. 20 - Prob. 36PCh. 20 - LO.3 Taupe, a calendar year taxpayer, has a...Ch. 20 - LO.3, 8 Robin incurred the following capital...Ch. 20 - Prob. 39PCh. 20 - Prob. 40PCh. 20 - Prob. 41PCh. 20 - Prob. 42PCh. 20 - Prob. 43PCh. 20 - Prob. 44PCh. 20 - Prob. 45PCh. 20 - Prob. 46PCh. 20 - Prob. 47PCh. 20 - Prob. 48PCh. 20 - Prob. 49PCh. 20 - Prob. 50PCh. 20 - During the current year, Thrasher (a calendar...Ch. 20 - Prob. 52PCh. 20 - Prob. 53PCh. 20 - Prob. 54PCh. 20 - Prob. 55PCh. 20 - LO.9 The Pheasant Partnership reported the...Ch. 20 - Prob. 57PCh. 20 - Prob. 58PCh. 20 - Prob. 59PCh. 20 - Prob. 1RPCh. 20 - Prob. 2RPCh. 20 - Prob. 3RPCh. 20 - Prob. 5RPCh. 20 - On January 1, year 5, Olinto Corp., an accrual...Ch. 20 - Prob. 2CPACh. 20 - Prob. 3CPACh. 20 - Prob. 4CPACh. 20 - Prob. 5CPACh. 20 - Prob. 6CPACh. 20 - Prob. 7CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License