PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 28PS

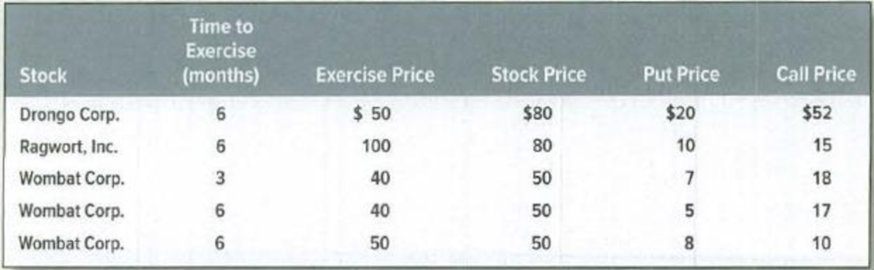

Option values* Table 20.4 lists some prices of options on common stocks (prices are quoted to the nearest dollar). The interest rate is 10% a year. Can you spot any mispricing? What would you do to take advantage of it?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The stock price of ABC changes only once a month: either it goes up by 20% or it falls by 16.7%. Its price now is £40. The interest rate is 12.7% per year, or about 1% per month.

Required:

i Suppose a one-month call option on this stock has an exercise price of £40, what is the option delta?

ii Show how the payoffs of this call option can be replicated by buying ABC’s stock and borrowing.

iii Using the risk-neutral method to calculate the value of a one-month call option with an exercise price of £40.

iv Construct a two-month binomial tree. What is the value of a two-month call option with an exercise price of £40?

v Use put-call parity, what is the price for a one-month put with the same exercise price? And a two-month put with the same exercise price?

Calculate the price of a put option on stock using a three-time-step binomial tree model. We know that the current stock price is $70, the strike price is $73, the volatility of the stock is 25%, the maturity of the option is 3 years, and the annual effective risk-free rate is 10%, yearly compounding. How much does this put option worth today if it is American? According to the Put-Call Parity, what should be the price of the European call option that is written on the same stock with the same expiration and the same strike price?

Assume you want to price a call on a stock that has the price of $35 today. The option matures in one year and has the strike price of $34. Assume the stock price is equally likely to go up by 10% or down by 10% in one year, and you plan to use a one-step binomial tree to price the call option.

What is the hedge ratio (in decimal format, use 5 decimal places)?

Chapter 20 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 20 - Vocabulary Complete the following passage: A _____...Ch. 20 - Option payoffs Note Figure 20.12 below. Match each...Ch. 20 - Option payoffs Look again at Figure 20.12. It...Ch. 20 - Option payoffs What is a call option worth at...Ch. 20 - Option payoffs The buyer of the call and the...Ch. 20 - Option combinations Suppose that you hold a share...Ch. 20 - Option combinations Dr. Livingstone 1. Presume...Ch. 20 - Option combinations Suppose you buy a one-year...Ch. 20 - Option combinations Suppose that Mr. Colleoni...Ch. 20 - Option combinations Option traders often refer to...

Ch. 20 - Prob. 11PSCh. 20 - Option combinations Discuss briefly the risks and...Ch. 20 - Put-call parity A European call and put option...Ch. 20 - Putcall parity a. If you cant sell a share short,...Ch. 20 - Putcall parity The common stock of Triangular File...Ch. 20 - Put-call parity What is put-call parity and why...Ch. 20 - Putcall parity There is another strategy involving...Ch. 20 - Putcall parity It is possible to buy three-month...Ch. 20 - Putcall parity In April 2017, Facebooks stock...Ch. 20 - Option bounds Pintails stock price is currently...Ch. 20 - Option values How does the price of a call option...Ch. 20 - Option values Respond to the following statements....Ch. 20 - Option values FX Bank has succeeded in hiring ace...Ch. 20 - Option values Is it more valuable to own an option...Ch. 20 - Option values Youve just completed a month-long...Ch. 20 - Option values Table 20.4 lists some prices of...Ch. 20 - Option bounds Problem 21 considered an arbitrage...Ch. 20 - Prob. 30PSCh. 20 - Prob. 31PSCh. 20 - Prob. 32PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Put–Call Parity The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of $6.56. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option?arrow_forwardBinomial Model The current price of a stock is 20. In 1 year, the price will be either 26 or 16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of 21 and that expires in 1 year. (Hint: Use daily compounding.)arrow_forwardEagletron’s current stock price is $10. Suppose that over the current year, the stock price will either increase by 100% or decrease by 50%. Also, the risk-free rate is 25% (EAR). a) What is the value today of a one-year at-the-money European put option on Eagletron stock?b) What is the value today of a one-year European put option on Eagletron stock with a strike price of $20?c) Suppose the put options in parts a and b could either be exercised immediately, or in one year. What would their values be in this case?arrow_forward

- Consider a stock in two periods (two years). The stock price goes up by 30% or down by 10%in each period. Current stock price is $100. There is a European put option on the stock withexercise price $110 and time to maturity of two years. The interest rate in each period is 6%. Inthe template, Date 0 denotes today, Date 1 denotes the end of year 1 and Date 2 denotes the endof year 2. Use the two-period binomial tree model and discrete discounting to find the put optionprice on Date 0.arrow_forwardThe level of the Syldavian market index is 23,000 at the start of the year and 27,500 at the end. The dividend yield on the index is 5.5%. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) If the interest rate is 8%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) If the inflation rate is 9%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardConsider the following information on a particular stock:Stock price = $88Exercise price = $84Risk-free rate = 5% per year, compounded continuouslyMaturity = 11 monthsStandard deviation =53% per year. What What is the delta of a put option?arrow_forward

- Suppose that a stock price is currently 51 dollars, and it is known that one month from now, the price will be either 6 percent higher or 6 percent lower. Find the value of an American call option on the stock that expires one month from now, and has a strike price of 49 dollars. Assume that no arbitrage opportunities exist, and a risk free interest rate of 10 percentarrow_forwardThe level of the Syldavian market index is 21,100 at the start of the year and 25,600 at the end. The dividend yield on the index is 4.3%. a. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. If the interest rate is 7%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. If the inflation rate is 9%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardSuppose the current stock price of JuJube Inc is ¥100, the risk-free interest rate is 5%, the standard deviation is 25%, the time to maturity is 4 months, the strike price is ¥85, and the price of a call option is ¥25.20. Using the put-call parity relationship, the put option price is closest to A. ¥25.20 B. ¥16.40 C. ¥5.20 D. ¥8.80 E. None of the abovearrow_forward

- A stock is currently priced at $74 and will move up by a factor of 1.20 or down by a factor of .80 over the next period. The risk-free rate of interest is 4.2 percent. What is the value of a call option with a strike price of $75?arrow_forwardSuppose that a stock price is currently 49 dollars, and it is known that one month from now, the price will be either 8 percent higher or 8 percent lower. Find the value of an American call option on the stock that expires one month from now, and has a strike price of 51 dollars. Assume that no arbitrage opportunities exist, and a risk-free interest rate of 7 percent.arrow_forwardGive typing answer with explanation and conclusion Stock A is currently traded at $55. Each year, the stock price can either go up by 20% or drop by 20%. Your manager asks you to price a European call option with a strike price of $51 and a maturity of two years from now. The YTM of a one-year zero Treasury bond is 2% and the forward rate from year one to year two is 3%. What is the call option premium as of now if you use the discount rates as given in the question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Derivatives Comprehensive Guide; Author: WallStreetMojo;https://www.youtube.com/watch?v=9D-0LoM4dy4;License: Standard YouTube License, CC-BY

Option Trading Basics-Simplest Explanation; Author: Sky View Trading;https://www.youtube.com/watch?v=joJ8mbwuYW8;License: Standard YouTube License, CC-BY