1.

Calculate the valuation of Company BPP using the market value method for the year 2019.

1.

Explanation of Solution

Valuation of Company BPP using the market value method for the year 2019.

2.

State the valuation of Company BPP using the book value method for the year 2019.

2.

Explanation of Solution

Valuation of Company BPP using the book value method for the year 2019 is $125,941,338 (amount of shareholder’s equity for the year 2019).

3.

Calculate the valuation of BPP using the multiple-based methods for sales, earnings, and

3.

Explanation of Solution

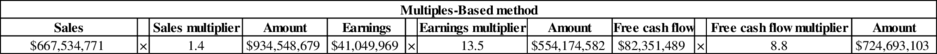

Calculate the valuation of BPP using the multiple-based methods for sales, earnings, and free cash flow for the year 2019.

Figure (1)

4.

Calculate the estimated value for BPP using the discounted free cash flow method, by assuming that the 2019’s amount of free cash flow continues indefinitely.

4.

Explanation of Solution

Calculate the estimated value for BPP using the discounted free cash flow method:

5.

Recommend a method that could be used.

5.

Explanation of Solution

- For the discounted cash flow method, the six measures provide valuations in broad range, that is from a low of $125,941,338 for the equity at book value to a high of $1,551,685,117.

- The discounted cash flow method is comparatively greater due to the considerable increase in cash flow during 2019 as a result of increase in earnings and to the developed management of receivables and inventory, decreasing both of these account balances from 2018. Moreover, the discounted flow method is delicate to the selection of the discount rate, in this context a comparatively low 5.2%.

- The multiples-based measures range from $554,174,582 to $934,548,679 depending on current earnings, cash flows, and sales comparative to the industry average multiples. Placing the endpoints of the range away, a conservative evaluation of the company’s value must be nearer to $919,172,242, the market value of the firm deepening on the current market share price.

6.

State whether GSI offer is a good one.

6.

Explanation of Solution

- Approximately, If the valuation of company is $919,172,242, this reflects an expected share price nearer to its current market value of $35.78. Therefore, the $38 offer looks better.

- Conversely, if one plans a constant high level of free cash flow in the upcoming years, then as the discounted value of the firm is much greater, the selling price of the company must be slightly higher than $38 per share.

- For instance, the implied stock value is approximately $60 per share, at a discounted cash flow value of $1.6 billion. Now the $38 offer does not look good.

7.

Identify the effect of sustainability issues during the acquisition of BPP by GSI.

7.

Explanation of Solution

- There might be issues related to Sustainability rise in the acquisition as both GSI and BPP function in environmentally sensitive industries.

- GSI, a retailer of gardening supplies, should be attentive regarding both the manufacturing practices of its suppliers (to reduce harmful waste products dumping into the environment) and also about the management of the materials within GSI’s stores and in its transportation of these materials. Fertilizers, Insecticides, weed killers and other products could have poisonous and/or damaging chemicals.

- Moreover, the usage of BPP’s plumbing expertise and materials is having a sustainability dimension. The systems should be developed to use water as competently as possible, so that little quantity of water is wasted, if these products are used for the supply of home or commercial lawn and garden watering systems for the measure of sustainability.

- Additionally, if the BPP organization uses its knowledge and materials to develop drainage systems for commercial property and homes, then these drainage systems should be in such a manner that the harmful waste materials are not permitted to contaminate fields and streams that are nearby.

- Majority of the investors now consider sustainability as a significant part of a company’s strategic planning; valuation is also influenced by whether or not a company such as GSI or BPP have a sustainability plan.

- Sustainability efforts are also frequently tied to cost reduction, as the company’s efforts to develop sustainability decrease compliance costs and operating costs.

- Companies with an efficient plan for sustainability will probably attain greater valuations, as investors and analysts see the sustainability plan and effort as both a sign of an environmentally responsible company and also a company that uses sustainability to become more profitable.

Want to see more full solutions like this?

Chapter 20 Solutions

COST MANAGEMENT: A STRATEGIC EMPHASIS E

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education