Concept explainers

a.

To Determine: The exercise value of Company PII’s warrants if the common stock sells at $18, $21, $25 and $70.

Introduction: A warrant is securities that give the bondholder the right, yet not the obligation, to purchase a specific number of securities at a specific cost before a specific time. Warrants are not the equivalent as the call options or purchase rights of the stock.

a.

Answer to Problem 6P

The exercise value of Company PII’s warrants if the common stock sells at $18 is -$3, $21 is $0, $25 is $4 and $70 is $49.

Explanation of Solution

Determine the exercise value of company PII’s warrants

If the common stock sells at $18

If the common stock sells at $21

If the common stock sells at $25

If the common stock sells at $70

Therefore the exercise value of Company PII’s warrants if the common stock sells at $18 is -$3, $21 is $0, $25 is $4 and $70 is $49.

b.

To Determine: The approximate price and the premium implied the warrants to sell under each condition from part (a) based on guess or reasonable assumption.

b.

Explanation of Solution

Determine the approximate price, premium and warrant for each stock

Since there is no exact or approximate solutions are possible the below are the price, premium and warrant for each stock price which are purely based on reasonable assumption.

If the common stock sells at $18:

The approximate price will be $18, the premium will be $4.50 and the warrant will be $1.50.

If the common stock sells at $21:

The approximate price will be $21, the premium will be $3 and the warrant will be $3.

If the common stock sells at $25

The approximate price will be $25, the premium will be $1.50 and the warrant will be $5.50.

If the common stock sells at $70:

The approximate price will be $70, the premium will be $1 and the warrant will be $50.

c1.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the life of warrant in lengthened.

c1.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the life of warrant in lengthened is as follows:

The higher the value of warrant, the lengthier the life of the warrant.

c2.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the expected variability in stock's price decrease.

c2.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the expected variability in stock's price decrease is as follows:

The lesser the value of warrant, the lesser the variable of the stock price.

c3.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the growth rate in the stock's EPS increase.

c3.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the growth rate in the stock's EPS increase is as follows:

The greater the price of warrant, the greater the expected EPS growth rate.

c4.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the company paid no dividends and will pay out all earnings as dividends.

c4.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the company paid no dividends and will pay out all earnings as dividends is as follows:

Beginning from 0 to 100% payout would have two conceivable impacts. To start with, it may influence the price of stock creating an variation in the exercise value of the warrant, nonetheless, it is not certain that the price of stock would change, not to mention what the variations possible.

The expansion in the payout ratio would significantly bring down the expected growth rate. This would decrease the probability of the stock's cost expanding in the future. This would bring down the expected value of the warrant, consequently bring down the premium and the cost of the warrant.

d.

To Determine: The annual coupon interest rate and annual dollar coupon on the bonds.

d.

Answer to Problem 6P

The annual coupon interest rate is 9.11% and annual dollar coupon on the bonds is $91.19.

Explanation of Solution

Determine the

Therefore the value of bond is $925.

Determine the annual dollar coupon on the bonds

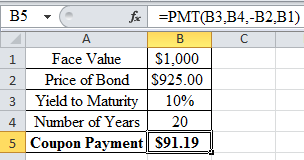

Using an excel spreadsheet and excel function =PMT, the annual dollar coupon on the bonds is calculated as $91.19.

Excel Spreadsheet:

Therefore the annual dollar coupon on the bonds is $91.19

Determine the annual coupon interest rate on the bonds

Therefore the annual coupon interest rate on the bonds is 9.11%.

Want to see more full solutions like this?

Chapter 20 Solutions

MindTap Finance, 2 terms (12 months) Printed Access Card for Brigham/Houston's Fundamentals of Financial Management, 14th (Finance Titles in the Brigham Family)

- On january 1, 2022, a company issued P2,000,000, 16% bonds at 102. Each P1,000 bonds has one detachable warrant that allows the holder to purchase ten shares of P50 par value stock at P70 per share. The bonds would have been sold at 99 without the warrants. In 2023, 800 warrants were exercised. How much is the credit to share premium when the warrants were exercised?arrow_forwardA company issues 1,000 bonds, each with a face value of $1,000, for $1.1 million. Each bond has a detachable warrant that allows the holder to purchase common stock for $20 per share. The market value of the bonds without the warrants is $950,000. The fair market value of the warrants is $50,000.How much should the company record as the value of the warrants?arrow_forwardAcme stock price is currently $10 per share. Acme's warrants have a price of $7 per warrant. Each warrant enables the holder to purchase three shares of Acme's common stock for $8 per share. What is the speculative premium on the warrant? and Suppose that an investor buys a 100-share call option for $250. It has an exercise price of $60. The underlying price per share of the stock at expiration is $66. What then is the amount of profit or loss, ignoring brokerage fees?arrow_forward

- Cataloochee Inc. issues bonds, each with one detachable warrant, for $392,000. The bonds are 400, $1,000 6% bonds and they trade at 97 without the warrants. On the day of issue, the fair value of the stock is $45 and the par value is $1. The strike price of the warrants is $25. What is the amount of the entry to record the Stock Warrants?arrow_forward22 A dealer in securities has the following for the year 2018: Sale of securities held for sale in the ordinary course P4,000,000 Cost of securities held for sale in the ordinary course 2,500,000 Supplies expense, net of VAT 300,000 Rent expense, net of VAT 500,000 The Vat payable shall be:arrow_forwardNaomi, Inc. issues $8,000,000 of bonds with a coupon rate of 8%. To help the sale, detachable stock warrants are issued at the rate of ten warrants for each $1,000 bond sold. It is estimated that the value of the bonds without the warrants is $7,850,000 and the value of the warrants is $415,000. The bonds with the warrants sold at $8,150,000. Required: Prepare the journal entry Naomi, Inc. should make to record the bonds.arrow_forward

- Langdon & Co. issues bonds with a face value of $50,000 for $51,000. Each $1,000 bond carries 10 warrants, and each warrant allows the holder to acquire one share of $1 par common stock for $40 per share. Immediately after the issuance, the bonds are quoted at 99 ex rights and the warrants are quoted at $5 each. Calculate the value to be assigned to the bonds and to the warrants. Round your answers to two decimal places.arrow_forwardLangdon & Co. issues bonds with a face value of $50,000 for $51,000. Each $1,000 bond carries 10 warrants, and each warrant allows the holder to acquire one share of $1 par common stock for $40 per share. Immediately after the issuance, the bonds are quoted at 99 ex rights and the warrants are quoted at $5 each. Calculate the value to be assigned to the bonds and to the warrants. Round your answers to two decimal places. What is the value assigned to bonds and value assigned to warrantsarrow_forwardOn march 1 2023, Star corporation issue P500,000 of 10%, 7 year bonds with 1 taxable warrants attached to each P1,000 bond. each warrants provides for the right to purchase 20 shares of P15 ordinary shares for 20 each. The market value of the ordinary shares was P25 per share on july 1, 2023. the detachable warrants market price was P70 per warrant and the arket value of the bond without the warrants attached is P104. The bond was sold at 107. How much is the Premium or Discount on the issuance of bonds? P20,000 How much is the warrants outstanding? P15,000 Show full solutionarrow_forward

- 1.Gassy Stores sells $400,000 of 12% bonds on June 1, 2022. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2026. The market rate of similar investments is 10%. On December 1, 2024, Gassy Stores retired the bond for $400,000. The company closes its books on December 31. Requirements: (Show all workings) A.Calculate the proceeds from the sale of the bond. Clearly show the amount of the premium or discount and state two reasons which support the premium or discount calculated. B.Prepare a bond amortization schedule for the bond’s life C.Prepare all the journal entries for 2022, 2023 & 2024.arrow_forward13. An investor purchases bonds with a face value of $100,000. Payment for thebonds includes (a) a premium (b) accrued interest rate and (c) brokeragefees. How would each of these charges be recorded and what dispositionwould ultimately be made of each of these charges??arrow_forwardOn Monday March 6, 2023 you purchase a $1,000 Treasury bond that matures on May15, 2031 (settlement occurs one day after purchase, so you receive actual ownership of the bond on Tuesday March 7th, 2023). The coupon rate on the Treasury-note is 4.00 percent. The last coupon payment occurred on November 15, 2022, and the next coupon payment will be paid on May 15, 2023. The price that your dealer quotes you is $978.38 Yields on similar bonds are currently 4.5% Calculate the dirty price of this bond.arrow_forward

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning