Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 1P

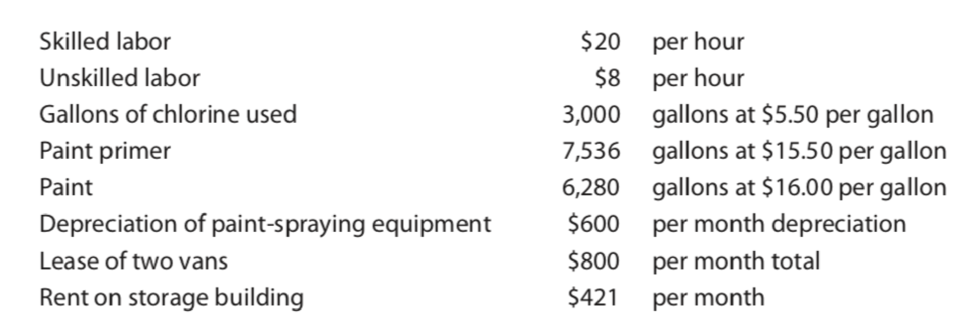

Wabash Company specializes in refurbishing exterior painted surfaces that have been hard hit by humidity and insect debris. It uses a special technique, called pressure cleaning, before priming and painting the surface. The refurbishing process involves the following steps:

- 1. Unskilled laborers trim all trees and bushes within two feet of the structure.

- 2. Skilled laborers clean the building with a high-pressure cleaning machine, using about 6 gallons of chlorine per job.

- 3. Unskilled laborers apply a coat of primer.

- 4. Skilled laborers apply oil-based exterior paint to the entire surface.

On average, skilled laborers work 12 hours per job, and unskilled laborers work 8 hours. The refurbishing process generated the following operating results during the year on 500 jobs:

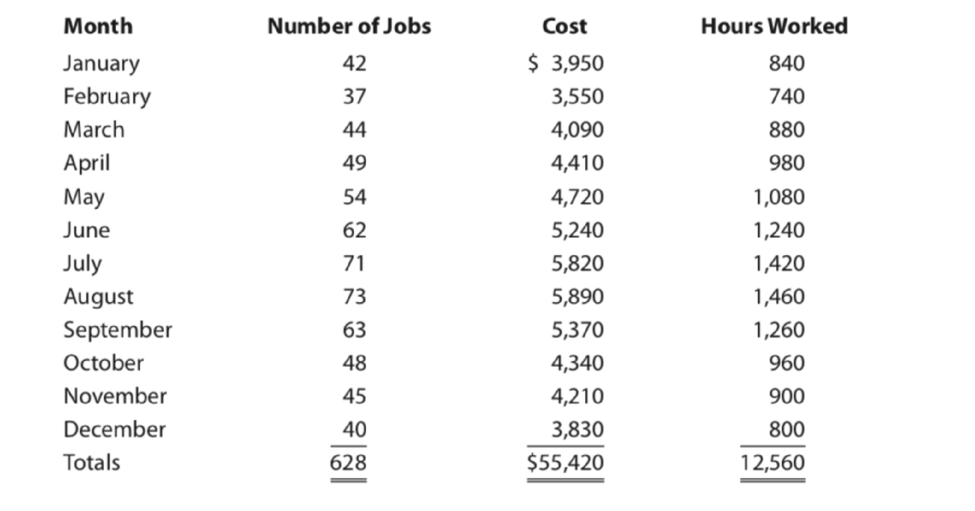

Data on utilities for the year follow:

REQUIRED

- 1. Classify the costs as variable, fixed, or mixed.

- 2. Using the high-low method, separate mixed costs into their variable and fixed components. Use total hours worked as the basis.

- 3. Compute the average cost per job for the year. (Hint: Divide the total of all costs for the year by the number of jobs completed.) Use estimated hours to determine utilities costs. (Round to two decimal places.)

- 4. BUSINESS APPLICATION Project the average cost per job for next year if variable-costs per job increase 20 percent. (Round to two decimal places.)

- 5. ACCOUNTING CONNECTION Why can actual utilities costs vary from the amount computed using the utilities cost formula?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Frieling Company installs granite countertops in customers' homes. First, the customer chooses the particular granite slab, and then Frieling measures the countertop area at the customer's home, cuts the granite to that shape, and installs it. The Tramel job calls for direct materials of $2,200 and direct labor of $700. Overhead is applied at the rate of 110 percent of direct labor cost. Unfortunately, one small countertop breaks during installation and Frieling must cut another piece and install it to properly complete the job. The additional rework required direct materials costing $700 and direct labor costing $400. Assume that the spoilage was due to carelessness by a Frieling worker and it is considered to be normal spoilage.

2. Make any needed journal entry to the overhead control account. If an amount box does not require an entry, leave it blank.

3. What if the additional rework required $800 of direct labor? What would be the effect on the cost of the Tramel job?

The Seattle Recycling Company (SRC) purchases old water and soda bottles and recycles them to produce plastic covers for outdoor furniture. The company processes the bottles in a special piece of equipment that first melts, then reforms the plastic into large sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filler is considered a byproduct. SRC can produce 25 table covers, 75 chair covers, and 5 pounds of package filler from 100 pounds of bottles. In June, SRC had no beginning inventory. It purchased and processed 120,000 pounds of bottles at a cost of $600,000. SRC sold 25,000 table covers for $12 each, 80,000 chair covers for $8 each, and 5,000 pounds of package filler at $1 per pound.

Q. Assume that SRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the sales method. What is the ending inventory cost for each product and gross margin for SRC?

The Seattle Recycling Company (SRC) purchases old water and soda bottles and recycles them to produce plastic covers for outdoor furniture. The company processes the bottles in a special piece of equipment that first melts, then reforms the plastic into large sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filler is considered a byproduct. SRC can produce 25 table covers, 75 chair covers, and 5 pounds of package filler from 100 pounds of bottles. In June, SRC had no beginning inventory. It purchased and processed 120,000 pounds of bottles at a cost of $600,000. SRC sold 25,000 table covers for $12 each, 80,000 chair covers for $8 each, and 5,000 pounds of package filler at $1 per pound.

Q. Assume that SRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the production method. What is the ending inventory cost for each product and gross margin for SRC?

Chapter 21 Solutions

Principles of Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Seattle Recycling Company (SRC) purchases old water and soda bottles and recycles them to produce plastic covers for outdoor furniture. The company processes the bottles in a special piece of equipment that first melts, then reforms the plastic into large sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filler is considered a byproduct. SRC can produce 25 table covers, 75 chair covers, and 5 pounds of package filler from 100 pounds of bottles. In June, SRC had no beginning inventory. It purchased and processed 120,000 pounds of bottles at a cost of $600,000. SRC sold 25,000 table covers for $12 each, 80,000 chair covers for $8 each, and 5,000 pounds of package filler at $1 per pound. The accountant for SRC needs to record the information about the joint and byproducts in the general journal, but is not sure what the entries should be. The company has hired you as a consultant to help its accountant. QShow journal entries at the…arrow_forwardThe Seattle Recycling Company (SRC) purchases old water and soda bottles and recycles them to produce plastic covers for outdoor furniture. The company processes the bottles in a special piece of equipment that first melts, then reforms the plastic into large sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filler is considered a byproduct. SRC can produce 25 table covers, 75 chair covers, and 5 pounds of package filler from 100 pounds of bottles. In June, SRC had no beginning inventory. It purchased and processed 120,000 pounds of bottles at a cost of $600,000. SRC sold 25,000 table covers for $12 each, 80,000 chair covers for $8 each, and 5,000 pounds of package filler at $1 per pound. The accountant for SRC needs to record the information about the joint and byproducts in the general journal, but is not sure what the entries should be. The company has hired you as a consultant to help its accountant. QShow journal entries at the…arrow_forwardDuring your first month as an employee at Greenfield Industries (a large drill-bit manufacturer), you are asked to evaluate alternatives for producing a newly designed drill bit on a turning machine. Your boss' memorandum to you has practically no information about what the alternatives and what criteria should be used. The same task was posed to a previous employee who could not finish the analysis, but she has given you the following information: An old turning machine valued at $350,000 exists (in the warehouse) that can be modified for the new drill bit. The in-house technicians have given an estimate of $40,000 to modify this machine, and they assure you that they will have the machine ready before the projected start date (although they have never done any modifications of this type). It is hoped that the old turning machine will be able to meet production requirements at full capacity. An outside company, McDonald Inc., made the machine seven years ago and can…arrow_forward

- During your first month as an employee at Greenfield Industries (a large drill-bit manufacturer), you are asked to evaluate alternatives for producing a newly designed drill bit on a turning machine. Your boss' memorandum to you has practically no information about what the alternatives are and what criteria should be used. The same task was posed to a previous employee who could not finish the analysis, but she has given you the following information: An old turning machine valued at $350,000 exists (in the warehouse) that can be modified for the new drill bit. The in-house technicians have given an estimate of $40,000 to modify this machi, and they assure you that they will have the machine ready before the projected start date (although they have never done any modifications of this type). It is hoped that the old turning machine will be able to meet production requirements at full capacity. An outside company, McDonald Inc., made the machine seven years ago and can easily do the…arrow_forwardFrieling Company installs granite countertops in customers' homes.First, the customer chooses the particular granite slab, and then Frielingmeasures the countertop area at the customer's home, cuts the granite tothat shape, and installs it. The Tramel job calls for direct materials of$1,900 and direct labor of $500. Overhead is applied at the rate of 140 percent of direct labor cost. Unfortunately, one small countertop breaksduring installation and Frieling must cut another piece and install it toproperly complete the job. The additional rework required directmaterials costing $400 and direct labor costing $100. Assume that thespoilage was due to carelessness by a Frieling worker and it isconsidered to be normal spoilage. Refer to the data in Cornerstone Exercise 5.4. Now assume that thespoilage was due to the inherently fragile nature of the piece of stonepicked out by the Tramels. Frieling had warned them that the chosenpiece could require much more care and potentially additional…arrow_forwardParadise Bay Shop is a manufacturer of golf carts. Peter Cranston, the plant manager of Paradise Bay, obtains the following information for Job #22 in August 2020. A total of 23 units were started, and 3 spoiled units were detected and rejected at final inspection, yielding 20 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,300 per unit. Assume that the 3 spoiled units of Paradise Bay Shop's Job #22 can be reworked for a total cost of $2,200. A total cost of $3,900 associated with these units has already been assigned to Job #22 before the rework. Requirements: Prepare the journal entries for the rework, assuming the following: a. The rework is related to a specific job. b. The rework is common to all jobs. c. The rework is considered to be abnormal.arrow_forward

- The Pittsburgh division of Vermont Machinery, Inc., manufactures drill bits.One of the production processes for a drill bit requires tipping, whereby carbide tips are inserted into the bit to make it stronger and more durable. This tipping process usually requires four or five operators, depending on the weekly workload. The same operators are also assigned to the stamping operation, where the size of the drill bit and the company's logo is imprinted on the bit. Vermont is considering acquiring three automatic tipping machines to replace the manual tipping and stamping operations. If the tipping process is automated, the division's engineers will have to redesign the shapes of the carbide tips to be used in the machine. The new design requires less carbide, resulting in savings on materials. The following financial data have been compiled: Project life: six years. Expected annual savings: reduced labor, $56,000; reduced material, $75,000; other benefits (reduced carpal tunnel syndrome…arrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. . Assume that Job #10 of Jellyfish Machine Shop generates normal scrap with a total sales value of $700 (it is assumed that the scrap returned to the storeroom is sold quickly). Prepare the journal entries for the recognition of scrap, assuming The value of scrap is material, and scrap is recognized as inventory at the time of production and is recorded at its net realizable valuearrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. Assume that the 6 spoiled units of Jellyfish Machine Shop’s Job #10 can be reworked for a total cost of $1,800. A total cost of $6,600 associated with these units has already been assigned to Job #10 before the rework. Prepare the journal entries for the rework, assuming the following: a. The rework is related to a specific job. b. The rework is common to all jobs. c. The rework is considered to be…arrow_forward

- Jellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. Q. What is the normal spoilage rate?arrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. . Assume that Job #10 of Jellyfish Machine Shop generates normal scrap with a total sales value of $700 (it is assumed that the scrap returned to the storeroom is sold quickly). Prepare the journal entries for the recognition of scrap, assuming The value of scrap is immaterial and scrap is recognized at the time of salearrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. . Assume that Job #10 of Jellyfish Machine Shop generates normal scrap with a total sales value of $700 (it is assumed that the scrap returned to the storeroom is sold quickly). Prepare the journal entries for the recognition of scrap, assuming The value of scrap is material, is related to a specific job, and is recognized at the time of sale.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:9781305224414

Author:JENNINGS

Publisher:Cengage

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY