a)

To determine: Value of one month call option with $40 as an exercise price.

a)

Explanation of Solution

Given information:

Company H stock prices changes once in a month either by increase in 20% or decreases by 16.7%.

Current price level is $40 and interest rate is 1% per month.

Calculation of value of option:

First, it is necessary to find out the probabilities by using risk-neutral method.

Therefore, the value of p is 48% and,

Therefore, there is 48% of chances that price of stock will rise by 20% and a 52% chances that option will worth of $0 when it matures.

Therefore, the value of call is $3.82

b)

To determine: Value of delta.

b)

Explanation of Solution

Calculation of value of delta:

Hence, the value of option delta is 0.545

c)

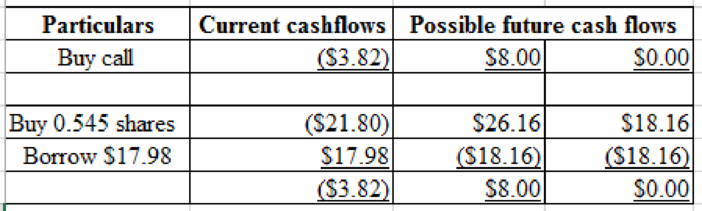

To determine: The way payoffs of this call option be replicated based on replicated portfolio method.

c)

Explanation of Solution

Calculation of value of call by using replicating portfolio method:

Hence, the value of call is $3.82

d)

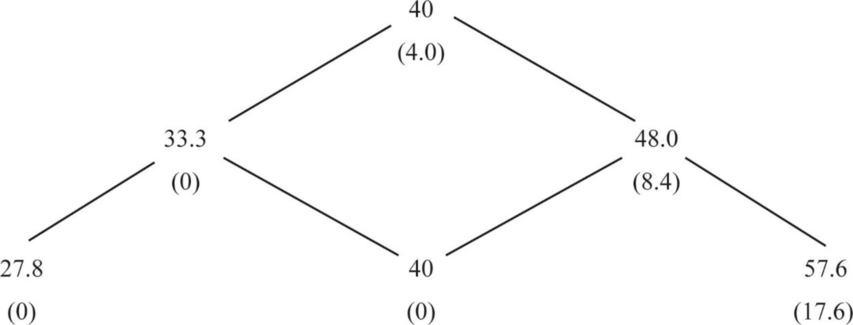

To determine: Value of two month call option with $40 as an exercise price.

d)

Explanation of Solution

Calculation of value of option:

The following option possibilities are as follows,

Month 1-a:

Hence the value of call under month 1-a is ‘0’

Month 1-b:

Therefore, value of the call under month 1-b is $8.4

Month 0:

Therefore, value of the call under month 0 is $4.0

e)

To determine: Value of delta.

e)

Explanation of Solution

Calculation of delta:

Hence, the delta value is 0.572

Want to see more full solutions like this?

Chapter 21 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Binomial Model The current price of a stock is 20. In 1 year, the price will be either 26 or 16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of 21 and that expires in 1 year. (Hint: Use daily compounding.)arrow_forwardPut–Call Parity The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of $6.56. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option?arrow_forwardThe current price of a non-dividend paying stock is $30. Use a two-step tree to value a put option on the stock with a strike price of $32 that expires in 6 months. Each step is 3 months, and in each step the stock price either moves up by 10% or moves down by 10%. Suppose that the risk free rate is 8% per annum with continuous compounding. 1) What should be the EUROPEAN put option price today? 2) If the option was an AMERICAN put option, what should be the price today? 3) If the volatility was given as 30%, how would the AMERICAN put option price change? Volatility is 30%,arrow_forward

- Estimate the "Vega" of the following option. Assume that there are 252 days in a trading year and thus exactly 6-months until expiration means 126 trading days until expiration. The option is a call option. The stock is trading at $1,000. The option has exactly 6-months until expiration. The option strike price is $1,050. The risk-free rate is 3%. The stock pays no dividends. Our best estimate of the stock's volatility is 40% annualized. Group of answer choices $.26 $1.12 $2.82 $15.73arrow_forwardA stock priced at $65 has three-month calls and puts with an exercise price of $55 available. The calls have a premium of $3.91, and the puts cost $1.6. The risk-free rate is 1.6%. If the put options are mispriced, what is the profit per option assuming no transaction costs? Bring out 4 decimal placesarrow_forwardConsider an American Put option with time to expiry of 5 months and a strike price of 82. The current price of the underlying stock is 80. Divide the time to expiry into five 1-month intervals. In each interval, the stock price can either rise by 6, or fall by 6, with unknown probability. The risk-free rate is 4.2% per annum, continuously compounded. Use Binomial Model. What is the value of the option. Please provide necessary calculations.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT