Concept explainers

Statement of

• LO21–4, LO21–8

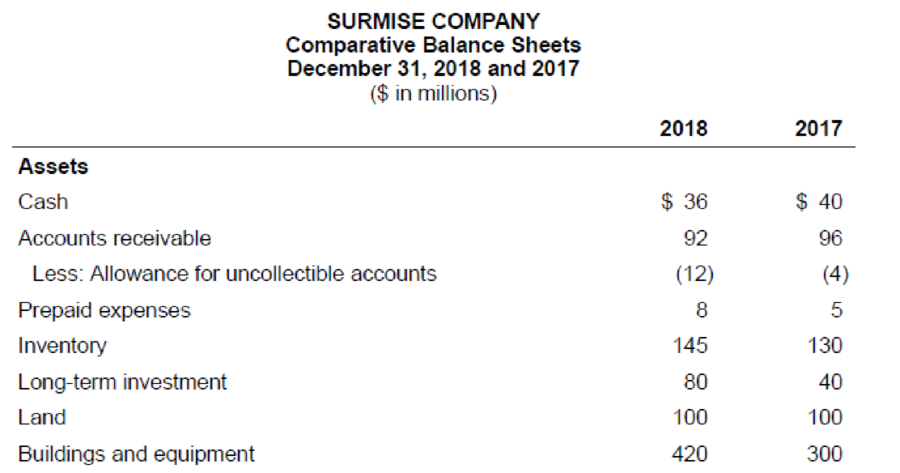

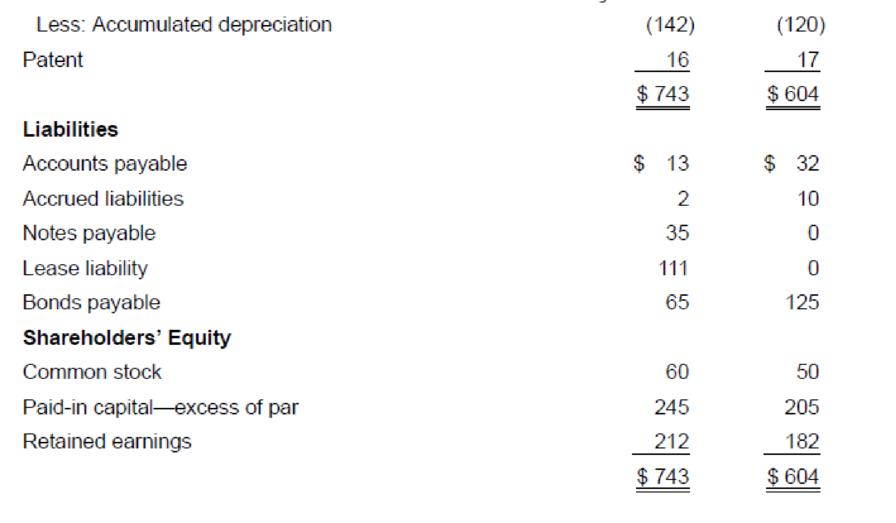

The comparative balance sheets for 2018 and 2017 are given below for Surmise Company. Net income for 2018 was $50 million.

Required:

Prepare the statement of cash flows of Surmise Company for the year ended December 31, 2018. Use the indirect method to present cash flows from operating activities because you do not have sufficient information to use the direct method. You will need to make reasonable assumptions concerning the reasons for changes in some account balances. A spreadsheet or T-account analysis will be helpful. (Hint: The right to use a building was acquired with a seven-year lease agreement. Annual lease payments of $9 million are paid at January 1 of each year starting in 2018.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

INTERMEDIATE ACCT VOL.2>CUSTOM<

- Problem 21-17 (Algo) Statement of cash flows; indirect method [LO21-4, 21-8] Comparative balance sheets for 2021 and 2020 and a statement of income for 2021 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided. METAGROBOLIZE INDUSTRIESComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 405 $ 245 Accounts receivable 350 190 Inventory 500 275 Land 500 450 Building 900 900 Less: Accumulated depreciation (200 ) (180 ) Equipment 2,500 2,150 Less: Accumulated depreciation (325 ) (300 ) Patent 1,000 1,150 $ 5,630 $ 4,880 Liabilities Accounts payable $ 600 $ 400 Accrued liabilities 150 130 Lease liability—land 130 0 Shareholders' Equity Common stock…arrow_forward(Appendix 21.1) Operating Cash Flows Refer to the information for Lamberson Company in P21-6. Required: 1. Using the direct method, prepare the operating activities section of the 2019 statement of cash flows for Lamberson. 2. (Optional). If you completed P21-6 earlier, prepare the remaining portion of the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardStatement of cash flows direct method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: Dec. 31, 20Y4 Dec. 31, 20Y3 Assets Cash 661,920 683,100 Accounts receivable (net) 992,640 914,400 Inventories 1,394,400 1,363,800 Investments 0 432,000 Land 960,000 0 Equipment 1,224,000 984,000 Accumulated depreciationequipment (481,500) (368,400) Total assets 4,751,460 4,008,900 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) 1,080,000 966,600 Accrued expenses payable (operating expenses) 67,800 79,200 Dividends payable 100,800 91,200 Common stock, 5 par 130,000 30,000 Paid in capital: Excess of issue price over parcommon stock 950,000 450,000 Retained earnings 2,422,860 2,391,900 Total liabilities and stockholders' equity 4,751,460 4,008,900 The income Statement for the year ended December 51. 20Y3. is as follows: Sales 4,512,000 Cost of goods sold 2,352,000 Gross profit 2,160,000 Operating expenses: Depredation expense 113,100 Other operating expenses 1,344,840 Total operating expenses 1,457,940 Operating income 702,060 Other income: Gain on sale of investments 156,000 Income before income tax 858,060 Income tax expense 299,100 Net income 558,960 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 588,000 cash. D. The common stock was issued for cash. E. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forward

- Exercise 21-27 (Algo) Statement of cash flows; direct method [LO21-3, 21-5, 21-6, 21-8] Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are provided below: RED, INCORPORATED Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash $ 26 $ 114 Accounts receivable 203 134 Prepaid insurance 11 6 Inventory 289 177 Buildings and equipment 384 352 Less: Accumulated depreciation (121) (242) $ 792 $ 541 Liabilities Accounts payable $ 90 $ 104 Accrued liabilities 10 15 Notes payable 52 0 Bonds payable 161 0 Shareholders’ Equity Common stock 402 402 Retained earnings 77 20 $ 792 $ 541 RED, INCORPORATED Statement of Income For Year Ended December 31, 2024 ($ in millions) Revenues Sales revenue $ 2,010 Expenses Cost of goods sold $ 1,439 Depreciation expense 41…arrow_forwardRequired information Exercise 21-13 (Static) Identifying cash flows from investing activities and financing activities [LO21-5, 21-6] Skip to question [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2023 40 Exercise 21-13 (Static) Part 2 2. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2024? Note: Cash outflows should be indicated…arrow_forwardProblem 11-4A Prepare a statement of cash flows—indirect method (LO11-2, 11-3, 11-4, 11-5) The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. VIDEO PHONES, INC. Income Statement For the Year Ended December 31, 2021 Net sales $ 2,636,000 Expenses: Cost of goods sold $ 1,600,000 Operating expenses 788,000 Depreciation expense 20,000 Loss on sale of land 7,300 Interest expense 11,500 Income tax expense 41,000 Total expenses 2,467,800 Net income $ 168,200 VIDEO PHONES, INC. Balance Sheets December 31 2021 2020 Assets Current assets: Cash $ 159,180 $ 85,940 Accounts receivable 73,300 53,000 Inventory 105,000 128,000 Prepaid rent 9,120 4,560 Long-term assets: Investments 98,000…arrow_forward

- Required information Exercise 21-13 (Static) Identifying cash flows from investing activities and financing activities [LO21-5, 21-6] [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2023 40 Exercise 21-13 (Static) Part 1 Required: 1. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2024? Note: Cash outflows should be indicated with a…arrow_forwardHow do proceeds from the sale of PPE impact Declan's Designs' 2022 Statement of Cash Flows? Question 24 options: The proceeds from the sale of PPE are added in Cash Flows from Financing The proceeds from the sale of PPE are added in Cash Flows from Operations The proceeds from the sale of PPE are subtracted in Cash Flows from Financing The proceeds from the sale of PPE are not included on the Statement of Cash Flows The proceeds from the sale of PPE are subtracted in Cash Flows from Investing The proceeds from the sale of PPE are added in Cash Flows from Investing The proceeds from the sale of PPE are subtracted in Cash Flows from Operationsarrow_forwardThe Foundational 15 [LO13-1, LO13-2] Skip to question [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 118,400 $ 142,300 Accounts receivable 93,900 101,200 Inventory 126,100 115,000 Total current assets 338,400 358,500 Property, plant, and equipment 333,000 322,000 Less accumulated depreciation 111,000 80,500 Net property, plant, and equipment 222,000 241,500 Total assets $ 560,400 $ 600,000 Accounts payable $ 73,600 $ 130,700 Income taxes payable 57,100 77,300 Bonds payable 138,000 115,000 Common stock 161,000 138,000 Retained earnings 130,700 139,000 Total liabilities and stockholders’ equity $…arrow_forward

- The Foundational 15 [LO13-1, LO13-2] Skip to question [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 118,400 $ 142,300 Accounts receivable 93,900 101,200 Inventory 126,100 115,000 Total current assets 338,400 358,500 Property, plant, and equipment 333,000 322,000 Less accumulated depreciation 111,000 80,500 Net property, plant, and equipment 222,000 241,500 Total assets $ 560,400 $ 600,000 Accounts payable $ 73,600 $ 130,700 Income taxes payable 57,100 77,300 Bonds payable 138,000 115,000 Common stock 161,000 138,000 Retained earnings 130,700 139,000 Total liabilities and stockholders’ equity $…arrow_forwardThe Foundational 15 [LO13-1, LO13-2] Skip to question [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 118,400 $ 142,300 Accounts receivable 93,900 101,200 Inventory 126,100 115,000 Total current assets 338,400 358,500 Property, plant, and equipment 333,000 322,000 Less accumulated depreciation 111,000 80,500 Net property, plant, and equipment 222,000 241,500 Total assets $ 560,400 $ 600,000 Accounts payable $ 73,600 $ 130,700 Income taxes payable 57,100 77,300 Bonds payable 138,000 115,000 Common stock 161,000 138,000 Retained earnings 130,700 139,000 Total liabilities and stockholders’ equity $…arrow_forwardThe Foundational 15 [LO13-1, LO13-2] Skip to question [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 118,400 $ 142,300 Accounts receivable 93,900 101,200 Inventory 126,100 115,000 Total current assets 338,400 358,500 Property, plant, and equipment 333,000 322,000 Less accumulated depreciation 111,000 80,500 Net property, plant, and equipment 222,000 241,500 Total assets $ 560,400 $ 600,000 Accounts payable $ 73,600 $ 130,700 Income taxes payable 57,100 77,300 Bonds payable 138,000 115,000 Common stock 161,000 138,000 Retained earnings 130,700 139,000 Total liabilities and stockholders’ equity $…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning