1.

Statement of

To Determine: The missing amounts.

1.

Explanation of Solution

a.

Determine the amount of beginning balance cash:

b.

Determine the amount of ending balance of accounts receivable:

c.

Calculate the amount of beginningbalance inventory:

Step 1: Calculate the amount of purchase.

Step 2: Calculate the amount of beginning balance inventory.

d.

Calculate the amount of beginning balance

e.

Calculate the amount of beginning balance of income tax payable:

f.

Calculate the amount of ending balance of

The balance sheet of D Industries is recreated using the deduced figures.

| D Industries | ||

| Comparative balance sheet | ||

| At December 31 | ||

| Assets: | 2016 (all $ in millions) | 2015 (all $ in millions) |

| Cash | 360 |

|

| Accounts receivable (net) |

|

252 |

| Inventory | 180 |

|

| Property, plant, and equipment | 450 | 600 |

| Less: Accumulated depreciation | (120) |

|

| Total assets | $1,149 | $1,020 |

| Liabilities and shareholders’ equity: | ||

| Accounts payable | 120 | 90 |

| General and administrative expenses payable | 27 | 27 |

| Income taxes payable | 66 |

|

| Common stock | 720 | 690 |

| Retained earnings |

|

141 |

| Total liabilities and shareholders’ equity | $1,149 | $1,020 |

Table (1)

2.

To Prepare: A Statement of Cash flow from operating activities for D Industries for the year December 31, 2016.

2.

Explanation of Solution

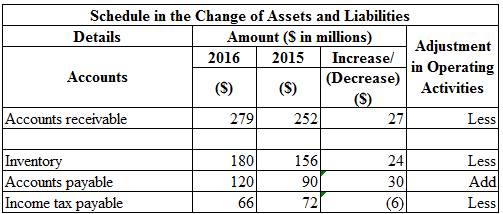

Step 1: Prepare the schedule in the changes of current assets and liabilities.

Figure (1)

Step2: Prepare a Statement of Cash flow from operating activities for D Industries for the year December 31, 2016:

| D Industries | ||

| Statement of cash flows (Partial) | ||

| For the year ended December 31, 2016 | ||

| Cash flows from operating activities | Amount (All $ in millions) | Amount (All $ in millions) |

| Net income | 84 | |

| Adjustments to reconcile net income to net cash from operating activities: | ||

| 30 | ||

| Gain on sale of equipment | (45) | (15) |

| Changes in operating assets and liabilities: | ||

| Increase in accounts receivable | (27) | |

| Increase in inventory | (24) | |

| Increase in accounts payable | 30 | |

| Decrease in income taxes payable | (6) | (27) |

| Net cash provided from operating activities | $42 | |

Table (2)

The statement of cash flow of D Industries shows the cash flows from operating activities to be $42 million

Want to see more full solutions like this?

Chapter 21 Solutions

INTERMEDIATE ACCOUNTING

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education