Concept explainers

Statement of cash flows; direct method

• LO21–3, LO21–8

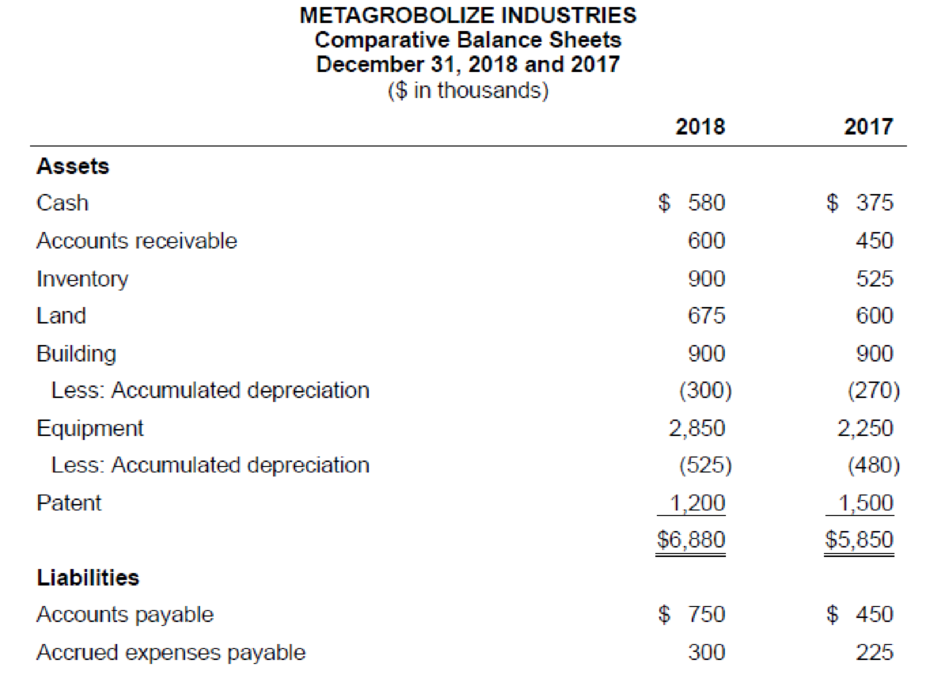

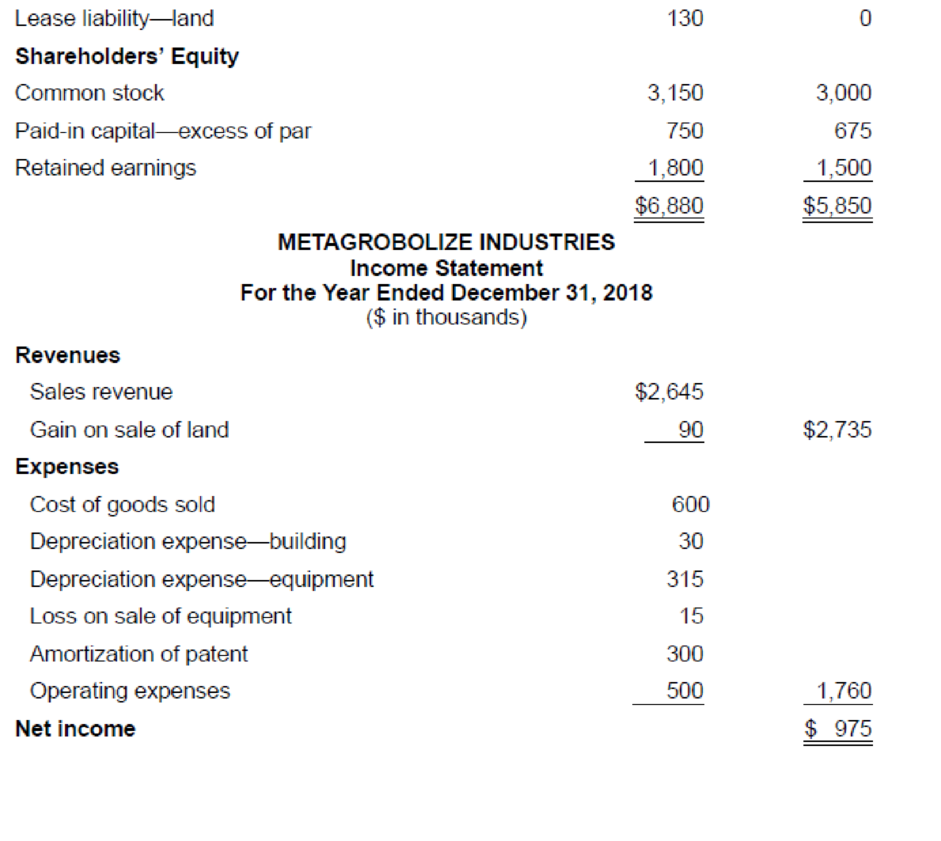

Comparative balance sheets for 2018 and 2017 and a statement of income for 2018 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided.

Additional information from the accounting records:

a. Annual payments of $20,000 on the finance lease liability are paid each January 1, beginning in 2018.

b. During 2018, equipment with a cost of $300,000 (90%

c. The statement of shareholders’ equity reveals reductions of $225,000 and $450,000 for stock dividends and cash dividends, respectively.

Required:

Prepare the statement of cash flows of Metagrobolize for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Intermediate Accounting

- Statement of cash flows direct method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: Dec. 31, 20Y4 Dec. 31, 20Y3 Assets Cash 661,920 683,100 Accounts receivable (net) 992,640 914,400 Inventories 1,394,400 1,363,800 Investments 0 432,000 Land 960,000 0 Equipment 1,224,000 984,000 Accumulated depreciationequipment (481,500) (368,400) Total assets 4,751,460 4,008,900 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) 1,080,000 966,600 Accrued expenses payable (operating expenses) 67,800 79,200 Dividends payable 100,800 91,200 Common stock, 5 par 130,000 30,000 Paid in capital: Excess of issue price over parcommon stock 950,000 450,000 Retained earnings 2,422,860 2,391,900 Total liabilities and stockholders' equity 4,751,460 4,008,900 The income Statement for the year ended December 51. 20Y3. is as follows: Sales 4,512,000 Cost of goods sold 2,352,000 Gross profit 2,160,000 Operating expenses: Depredation expense 113,100 Other operating expenses 1,344,840 Total operating expenses 1,457,940 Operating income 702,060 Other income: Gain on sale of investments 156,000 Income before income tax 858,060 Income tax expense 299,100 Net income 558,960 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 588,000 cash. D. The common stock was issued for cash. E. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardStatement of cash flowsdirect method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: Dec 31, 20Y4 Dec. 31,20Y3 Assets Cash.................................. 661,920 683,100 Accounts receivable (net).................................. 992,640 0 914,400 Inventories............................................... 1,394,40 1,363,800 Investments.............................................. 0 432,000 Land..................................................... 960,000 0 Equipment................................................ 1,224,000 984,000 Accumulated depreciationequipment.................... (481,500) (368,400) Total assets............................................ 4,751,460 4,008,900 Liabilities and Stockholders' Equity Accounts payable......................................... 1,080,000 966,600 Accrued expenses payable................................ 67,800 79,200 Dividends payable.................................. 100,800 91,200 Common stock. S par .................................... 130,000 30,000 Paid in capital: Excess of issue price over parcommon stock...... 950,000 450,000 Retained earnings......................................... 2,422,860 2,391,900 Total liabilities and stockholders' equity.................. 4,751,460 4,008,900 The income statement for the year ended December 31, 20Y4, is as follows: Sales.......................................... 4,512,000 Cost of merchandise sold....................... 2,352,000 Gross profit.................................... 2,160,000 Operating expenses: Depreciation expense....................... 113,100 Other operating expenses................... 1,344,840 Total operating expenses................. 1,457,940 Operating income.............................. 702,060 Other income: Gain on sale of investments.................. 156,000 Income before income tax...................... 858,060 Income tax expense............................ 299,100 Net income.................................... 558,960 Additional data obtained from an examination of the accounts in the ledger for 20Y4 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for 588,000 cash. d. The common stock was issued for cash. e. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardCP 14–8 Assume the following income statement and balance sheet information: Service revenue (all cash) $175 Operating expenses Salaries (all cash)$ 85 Net income $90 2020 2019 Current assets Cash $1,250 $1,600 Short‐term invest. 100 200 $1,350 $1,800 Liabilities Borrowings 600 1,000 Stockholders’ equity Common stock 200 300 Retained earnings 550 500 750 800 $1,350 $1,800 Other information: The short‐term investments are riskless and will be converted to a known amount of cash in 60 days. Borrowings are non‐ current. No gain or loss occurred when common stock was repurchased. Required: Calculate cash flow from operating activities .2.Prepare…arrow_forward

- Question 24 The following information was taken from the 2021 financial statements of Dunlop Corporation: Bonds payable, January 1, 2021 $ 800,000 Bonds payable, December 31, 2021 4,800,000 During 2021 • A $720,000 payment was made to retire bonds payable with a face amount of $800,000. • Bonds payable with a face amount of $320,000 were issued in exchange for equipment. In its statement of cash flows for the year ended December 31, 2021, what amount should Dunlop report as proceeds from issuance of bonds payable? $5,120,000 $4,400,000 $4,000,000 $4,480,000arrow_forwardTB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…arrow_forwardTB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…arrow_forward

- Q 23.21: Last year, Alpha Corporation spent $250,000 to repurchase 15,000 shares of its own outstanding common stock. The company also paid $40,000 in interest on a construction loan that it had obtained from its bank. How should these transactions be reflected on Alpha’s annual statement of cash flows, and why? A : The two transactions should be reported in separate sections of the statement because one involves long-term assets while the other involves long-term liability. Specifically, Alpha should record a $250,000 cash outflow in the investing section and a $40,000 cash outflow in the financing section. B : The two transactions should be reported in separate sections of the statement because one involves a change in equity while the other involves a change in income. Specifically, Alpha should record a $250,000 cash outflow in the financing section and a $40,000 cash outflow in the operating section. C : Both transactions should be reported in the…arrow_forwardProblem 11-4A Prepare a statement of cash flows—indirect method (LO11-2, 11-3, 11-4, 11-5) The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. VIDEO PHONES, INC. Income Statement For the Year Ended December 31, 2021 Net sales $ 2,636,000 Expenses: Cost of goods sold $ 1,600,000 Operating expenses 788,000 Depreciation expense 20,000 Loss on sale of land 7,300 Interest expense 11,500 Income tax expense 41,000 Total expenses 2,467,800 Net income $ 168,200 VIDEO PHONES, INC. Balance Sheets December 31 2021 2020 Assets Current assets: Cash $ 159,180 $ 85,940 Accounts receivable 73,300 53,000 Inventory 105,000 128,000 Prepaid rent 9,120 4,560 Long-term assets: Investments 98,000…arrow_forward#202 Which of the following is true concerning the statement of cash flows? Question 202 options: a When pension expense exceeds cash funding, the difference is deducted from investing activities on the statement of cash flows. b Under GAAP, the purchase of land by issuing stock will be shown as a cash outflow under investing activities and a cash inflow under financing activities. c The FASB requires companies to classify all income taxes paid as operating cash outflows. d All of these are true concerning the statement of cash flows.arrow_forward

- Breakdown 3/30/2022 3/30/2021 3/30/2020 Operating Cash Flow 90,480,000.00 91,630,000.00 76,230,000.00 Investing Cash Flow (17,280,000.00) (15,280,000.00) 17,910,000.00 Financing Cash Flow (80,150,000.00) (93,090,000.00) (68,190,000.00) End Cash Position 11,470,000.00 18,420,000.00 32,160,000.00 Changes in Cash (6,950,000.00) (16,740,000.00) 25,950,000.00 Beginning Cash Position 18,420,000.00 32,160,000.00 6,210,000.00 Other Cash Adjustment Outside Change in Cash - 3,000,000.00 - Capital Expenditure (12,280,000.00) (41,630,000.00) (8,620,000.00) Issuance of Capital Stock - - - Issuance of Debt - 1,880,000.00 - Repayment of Debt - (1,880,000.00) - Free Cash Flow 78,200,000.00 50,000,000.00 67,610,000.00 Can you make this indirect method of cash flow into a direct method of cash flow? Please donot provide solution in image format and it should be in step by step format and asaparrow_forwardProblem 21-4 (Algo) Statement of cash flows; direct method [LO21-3, 21-8] The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux's accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 49 $ 24 Accounts receivable 46 53 Less: Allowance for uncollectible accounts (3 ) (2 ) Dividends receivable 3 2 Inventory 65 60 Long-term investment 21 18 Land 85 60 Buildings and equipment 273 290 Less: Accumulated depreciation (70 ) (90 ) $ 469 $ 415 Liabilities Accounts payable $ 35 $ 43 Salaries payable 3 7 Interest payable 7 2 Income tax payable 8 9 Notes payable 25 0 Bonds payable…arrow_forwardRequired information Exercise 21-13 (Static) Identifying cash flows from investing activities and financing activities [LO21-5, 21-6] Skip to question [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2023 40 Exercise 21-13 (Static) Part 2 2. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2024? Note: Cash outflows should be indicated…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning