INTERMEDIATE FINANCIAL MGMT.(LOOSE)

14th Edition

ISBN: 9780357516676

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 15MC

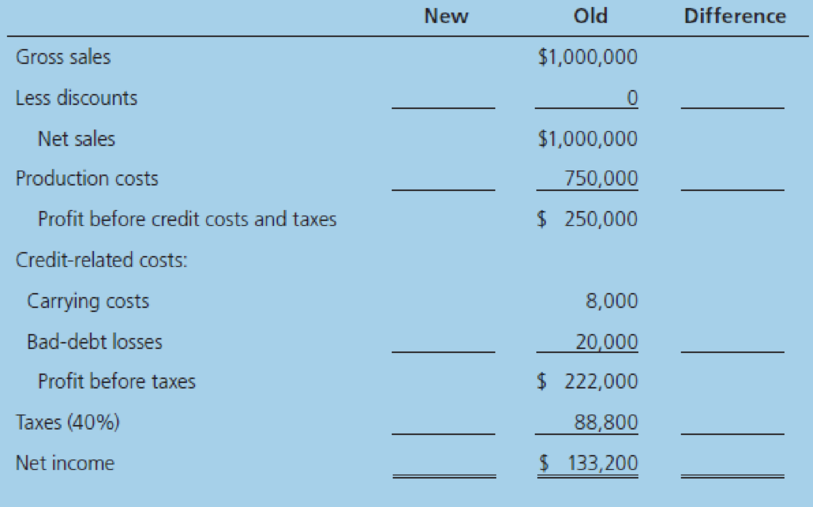

Suppose the firm makes the change but its competitors react by making similar changes to their own credit terms, with the net result being that gross sales remain at the current $1,000,000 level. What would be the impact on the firm’s after-tax profitability?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following statements is CORRECT?

O The more depreciation a firm reports, the higher its tax bill, other things held constant.

O People sometimes talk about the firm's net cash flow, which is shown as the lowest entry on the income

statement, hence it is often called "the bottom line."

O Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported

profits.

O Net cash flow (NCF) is often defined as follows: Net Cash Flow = Net Income + Depreciation and

Amortization Charges.

O Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a

reduction in the firm's net cash flow.

You observe that a firm?s

profit margin is below the

industry average, while its

return on equity and debt

ratio exceed the industry

average. What can you

conclude?

If the firm is in a very competitive, mature industry, what effect will the competitive conditions have on residual income for the firm and others in the industry? Now suppose the firm holds a competitive advantage in its industry, but the advantage is not likely to be sustainable for more than a few years. As the firm’s competitive advantage diminishes, what effect will that have on that firm’s residual income? and If a firm’s residual income for a particular year is positive, does that mean the firm was profitable? Explain. If a firm’s residual income for a particular year is negative, does that mean the firm necessarily reported a loss on the income statement? Explain. What does it mean when a firm’s residual income is zero?

Chapter 22 Solutions

INTERMEDIATE FINANCIAL MGMT.(LOOSE)

Ch. 22 - Prob. 1QCh. 22 - Prob. 2QCh. 22 - Is it true that if a firm calculates its days...Ch. 22 - Firm A had no credit losses last year, but 1% of...Ch. 22 - Indicate by a (+), (), or (0) whether each of the...Ch. 22 - Cost of Bank Loan On March 1, Minnerly Motors...Ch. 22 - Cost of Bank Loan Mary Jones recently obtained an...Ch. 22 - Del Hawley, owner of Hawleys Hardware, is...Ch. 22 - Gifts Galore Inc. borrowed 1.5 million from...Ch. 22 - Relaxing Collection Efforts The Boyd Corporation...

Ch. 22 - Tightening Credit Terms Kim Mitchell, the new...Ch. 22 - Effective Cost of Short-Term Credit Yonge...Ch. 22 - Monitoring of Receivables

The Russ Fogler Company,...Ch. 22 - Prob. 10PCh. 22 - Prob. 1MCCh. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Prob. 5MCCh. 22 - Prob. 6MCCh. 22 - Prob. 7MCCh. 22 - Assume that it is now July of Year 1 and that the...Ch. 22 - Now assume that it is several years later. The...Ch. 22 - Prob. 10MCCh. 22 - Prob. 11MCCh. 22 - Prob. 12MCCh. 22 - Prob. 13MCCh. 22 - Prob. 14MCCh. 22 - Suppose the firm makes the change but its...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What would be a reason a company would want to understate income? A. to help nudge its stock price higher B. to lower its tax bill C. to show an increase in overall profits D. to increase investor confidencearrow_forwardWhich one of the following will decrease the net working capital of a firm? Assume the current ratio is greater than 1.0. A. selling inventory at cost B. collecting payment from a customer C. paying a payment on a long-term debt D. selling a fixed asset for book value E. paying a supplier for the purchase of an inventory itemarrow_forwardHow would each of the following factors affectratio analysis? (a) The firm’s sales are highly seasonal. (b) The firm uses some type of windowdressing. (c) The firm issues more debt and usesthe proceeds to repurchase stock. (d) The firmleases more of its fixed assets than most firmsin its industry. (e) In an effort to stimulate sales,the firm eases its credit policy by offering 60-daycredit terms rather than the current 30-day terms.How might one use sensitivity analysis to helpquantify the answers?arrow_forward

- Jones Group has been generating stable after-tax return on equity (ROE) despite declining operating income. Explain how it might be able to maintain its stable after-tax ROE.arrow_forwardWhy do companies accelerate depreciation on their tax return but often use slower depreciation rates on their financial statements? a. to avoid taxes b. to postpone taxes c. to improve earnings d. to improve long term cashflowarrow_forwardCalculating the margin of safety (MOS) measure will help a firm answer which of the following questions? How much will operating profit (πB) change if sales change? Are we using our debt wisely? Will we break even? How much revenue can we lose before we drop below the breakeven point? How much operating profit (πB) will we earn?arrow_forward

- Which of the following would indicate an improvement in a company's financial position, holding other things constant? The profit margin declines. O The MV/BV ratio increases. The ROA decreases. The TIE increases. O The liability-to-asset ratio increases.arrow_forwardCan you identify a possible explanation for the company’s declining profits? If so, what is it?arrow_forward1. What is the Internal Growth rate for Cafes Richard ? What is the sustainable growth rate for Cafes Richard ? If sales grow at SGR, how much External Financing will be needed for the year 2021 using Percentage of sales approach, assuming that the firm is operating at full capacity? Interest expense and tax rate will not change. Calculate the tax rate (hint: tax rate = tax/taxable income). Please create pro forma statements as well. What's the impact in the new Debt to equity ratio, if any?arrow_forward

- Making changes to a firm’s credit policy involves trade-offs. Assuming that all other factors remain constant, which of the following are outcomes expected to result from an increase in a firm’s cash discount? Check all that apply. An increase in the cost of the discounts given An increase in the firm’s bad-debt expenses An increase in the firm’s credit sales, a speeding up of customer payments, and a reduction in the firm’s receivables investment An increase in the creditworthiness of the firm’s customersarrow_forwardWhich of the following is true regarding a company assuming more debt? Select one: a. Assuming more debt is always bad for the company b. Assuming more debt reduces leverage c. Assuming more debt can be good for the company as long as they earn a return in excess of the rate charged on the borrowed funds d. Assuming more debt is always good for the companyarrow_forwardIf a sales increase is forecasted, how will it affect expenses on the pro forma income statement if market conditions are expected to remain stablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Debits and credits explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=n-lCd3TZA8M;License: Standard Youtube License