Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 22, Problem 22.5CP

Integrity and evaluating budgeting systems

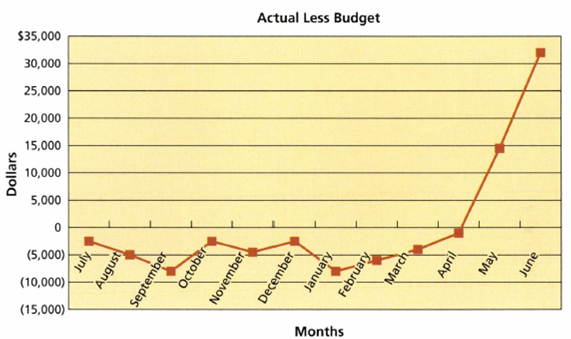

The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided by 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be "returned" to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for the recent fiscal year. The chart was as follows:

- a. Interpret the chart.

- b. Suggest an improvement in the budget system.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Indicate why these are Internal Control Strengths.

Example:

INTERNAL CONTROL STRENGTH: Central Chicago has an annual capital budgeting process where all capital expenditures are pre-approved prior to the beginning of the fiscal year.

EXPLANATION: All the departments’ heads are actively participated in the annual budget process. This ensures the collect of proper PPE information is passed along to the Capital Committee and all dept. heads understand their PPE budget allocations.

Internal control Strengths are listed below, EXPLAIN WHY THESE ARE CONSIDERED INTERNAL STRENGTH CONTROLS.

1. The budgeting process begins in the first week of February and begins with a meeting of finance with departmental leaders. At the meeting, Arlene (Finance Dept. personnel) communicates to the leaders the total funds that have been allotted to fixed assets.

2. The Senior VP of the departments will fill out a budget form itemizing planned expenditures for the upcoming fiscal year. This form is submitted to…

Evaluating a Company’s Budget Procedures

Springfield Corporation operates on a calendar-year basis. It begins the annual budgeting process in late August, when the president establishes targets for total sales dollars and net operating income before taxes for the next year.

The sales target is given to the Marketing Department, where the marketing manager formulates a sales budget by product line in both units and dollars. From this budget, sales quotas by product line in units and dollars are established for each of the corporation’s sales districts.

The marketing manager also estimates the cost of the marketing activities required to support the target sales volume and prepares a tentative marketing expense budget.

The executive vice president uses the sales and profit targets, the sales budget by product line, and the tentative marketing expense budget to determine the dollar amounts that can be devoted to manufacturing and corporate office expense. The executive vice president…

TOPIC: BUDGETARY PLANNING/MASTER BUDGETING

Palmer Corporation operates on a calendar-year basis. It begins the annual budgeting process in late August when the president establishes targets for the total dollar sales and net income before taxes for the next year.

The sales target is given first to the marketing department. The marketing manager formulates a sales budget by product line in both units and dollars. From this budget, sales quotas by product line in units and dollars are established for each of the corporation's sales districts. The marketing manager also estimates the cost of the marketing activities required to support the target sales volume and prepares a tentative marketing expense budget.

The executive vice president uses the sales and profit targets, the sales budget by product line, and the tentative marketing expense budget to determine the dollar amounts that can be devoted to manufacturing and corporate office expense.

The executive vice president prepares…

Chapter 22 Solutions

Accounting (Text Only)

Ch. 22 - Prob. 22.1DQCh. 22 - Briefly describe the type of human behavior...Ch. 22 - What behavioral problems are associated with...Ch. 22 - What behavioral problems are associated with...Ch. 22 - Under what circumstances is a static budget...Ch. 22 - How do computerized budgeting systems aid firms in...Ch. 22 - Why should the production requirements set forth...Ch. 22 - Why should the timing of direct materials...Ch. 22 - a. Discuss the purpose of the cash budget. b. If...Ch. 22 - Prob. 22.10DQ

Ch. 22 - Prob. 22.1APECh. 22 - Flexible budgeting At the beginning of the period,...Ch. 22 - Prob. 22.2APECh. 22 - Production budget Magnolia Candle Inc. projected...Ch. 22 - Direct materials purchases budget MyLife...Ch. 22 - Direct materials purchases budget Magnolia Candle...Ch. 22 - Prob. 22.4APECh. 22 - Direct labor cost budget Magnolia Candle Inc....Ch. 22 - Prob. 22.5APECh. 22 - Cost of goods sold budget Prepare a cost of goods...Ch. 22 - Prob. 22.6APECh. 22 - Cash budget Magnolia Candle Inc. pays 10% of its...Ch. 22 - Personal budget At the beginning of the school...Ch. 22 - Flexible budget for selling and administrative...Ch. 22 - Static budget versus flexible budget The...Ch. 22 - Flexible budget for Assembly Department Steelcase...Ch. 22 - Production budget True Tab Inc. produces a small...Ch. 22 - Sales and production budgets SoundLab Inc....Ch. 22 - Professional fees earned budget for a service...Ch. 22 - Prob. 22.8EXCh. 22 - Direct materials purchases budget Romano's Frozen...Ch. 22 - Prob. 22.10EXCh. 22 - Prob. 22.11EXCh. 22 - Prob. 22.12EXCh. 22 - Direct labor budget for a service business...Ch. 22 - Production and direct labor cost budgets Levi...Ch. 22 - Factory overhead cost budget Sweet Tooth Candy...Ch. 22 - Cost of goods sold budget Delaware Chemical...Ch. 22 - Cost of goods sold budget The controller of...Ch. 22 - Schedule of cash collections of accounts...Ch. 22 - Schedule of cash collections of accounts...Ch. 22 - Schedule of cash payments for a service company...Ch. 22 - Schedule of cash payments for a service company...Ch. 22 - Capital expenditures budget On January 1, 2016,...Ch. 22 - Forecast sales volume and sales budget For 2016,...Ch. 22 - Sales, production, direct materials purchases, and...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Cash budget The controller of Sonoma Housewares...Ch. 22 - Budgeted income statement and balance sheet As a...Ch. 22 - Forecast sales volume and sales budget Sentinel...Ch. 22 - Sales, production, direct materials purchases, and...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Cash budget The controller of Mercury Shoes Inc....Ch. 22 - Budgeted income statement and balance sheet As a...Ch. 22 - Prob. 22.1CPCh. 22 - Prob. 22.2CPCh. 22 - Static budget for a service company A bank manager...Ch. 22 - Objectives of the master budget Dominos Pizza...Ch. 22 - Integrity and evaluating budgeting systems The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A. Discuss the purpose of the cash budget. B. If the cash for the first quarter of the fiscal year indicates excess cash at the end of each of the first two months, how might the excess cash be used?arrow_forwardIntegrity and evaluating budgeting systems The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided by 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be returned to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for the recent fiscal year. The chart was as follows: a. Interpret the chart. b. Suggest an improvement in the budget system.arrow_forwardCapital expenditures budget On January 1, 20Y6, the controller of Omicron Inc. is planning capital expenditures for the years 20Y6-20Y9. The following interviews helped the controller collect the necessary information for the capital expenditures budget: Director of Facilities: A construction contract was signed in late 20Y5 for the construction of a new factory building at a contract cost of 10,000,000. The construction is scheduled to begin in 20Y6 and be completed in 20Y9. Vice President of Manufacturing: Once the new factory building is finished, we plan to purchase 1.5 million in equipment in late 20Y7. I expect that an additional 200,000 will be needed early in the following year (20Y8) to test and install the equipment before we can begin production. If sales continue to grow, I expect we'll need to invest another 1,000,000 in equipment in 20Y9. Chief Operating Officer: We have really been growing lately. I wouldn't be surprised if we need to expand the size of our new factory building in 20Y9 by at least 35%. Fortunately, we expect inflation to have minimal impact on construction costs over the next four years. Additionally, I would expect the cost of the expansion to be proportional to the size of the expansion. Director of Information Systems: We need to upgrade our information systems to wireless network technology. It doesn't make sense to do this until after the new factory building is completed and producing product. During 20Y8, once the factory is up and running, we should equip the whole facility with wireless technology. I think it would cost us 800,000 today to install the technology. However, prices have been dropping by 25% per year, so it should be less expensive at a later date. Chief Financial Officer: I am excited about our long-term prospects. My only short-term concern is managing our cash flow while we expend the 4,000,000 of construction costs in 20Y6 and 6,000,000 in 20Y7 on the portion of the new factory building scheduled to be completed in 20Y9. Use this interview information to prepare a capital expenditures budget for Omicron Inc. for the years 20Y6-20Y9.arrow_forward

- Communication The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided by 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be returned to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for the recent fiscal year. The chart was as follows: Write a memo to Stacy Collins, the city manager, interpreting the chart and suggesting improvements to the budgeting system.arrow_forwardBudgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March: Estimated sales for March: Estimated inventories at March 1: Desired inventories at March 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for March: Estimated operating expenses for March: Estimated other revenue and expense for March: Estimated tax rate: 30% Instructions Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be 14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March.arrow_forwardBudgeted income statement and supporting budgets The budget director of Birding Homes Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January: Estimated sales for January: Estimated inventories at January 1: Desired inventories at January 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for January: Estimated operating expenses for January: Estimated other revenue and expense for January: Estimated tax rate: 25% Instructions Prepare a sales budget for January. Prepare a production budget for January. Prepare a direct materials purchases budget for January. Prepare a direct labor cost budget for January. Prepare a factory overhead cost budget for January. Prepare a cost of goods sold budget for January. Work in process at the beginning of January is estimated to be 9,000, and work in process at the end of January is estimated to be 10,500. Prepare a selling and administrative expenses budget for January. Prepare a budgeted income statement for January.arrow_forward

- Relevant data from the operating budget of The Framers are: Other data: Capital assets were sold in quarter 1 and $8,000 was collected in quarter 1 and $500 collected in quarter 2. Dividends of $500 will be paid in May The beginning cash balance was $50,000 and a required minimum cash balance is $10,000. Prepare a cash budget for the first two quarters of the year.arrow_forwardBudgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Mesa Publishing Co.: Factory output and sales for 20Y9 are expected to total 3,800 units of product, which are to be sold at 120 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 35,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.20 per share are expected to be declared and paid in March, June, September, and December on 20,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 22,000 cash in May. Instructions Prepare a budgeted income statement for 20Y9. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.arrow_forwardA companys controller is adjusting next years budget to reflect the impact of an expected 3 percent inflation rate. Listed below are selected items from next years budget before the adjustment. After adjusting for the 3 percent inflation rate, what is the companys total budget for the selected items before taxes for next year? a. 858,150 b. 860,412 c. 810,971 d. 858,971arrow_forward

- Relevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardCASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forward1 The city in which you live provides its budget information in monthly budgetary control reports with each month representing 1/12th of the overall budget. You overhear several managers discussing the budget at a community meeting. You were surprised to hear that half of the managers liked this process and that the other half felt that it did not adequately match their expenses. Discuss the issues regarding the preparation of the budgets and why half of the departments liked the process and why the other half did not like the process. Complete the following: Give examples of 1 department on each side of this controversy. Can the budgeting process be made more reflective of the work actually being completed? Explain your answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY