CORPORATE FINANCE-ACCESS >CUSTOM<

11th Edition

ISBN: 9781260170016

Author: Ross

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 2QP

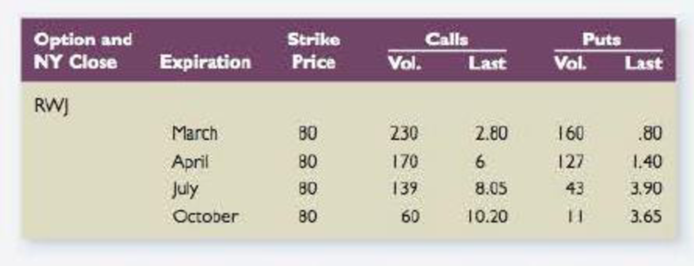

Understanding Option Quotes Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $83.

- a. Are the call options in the money? What is the intrinsic value of an RWJ Corp. call option?

- b. Are the put options in the money? What is the intrinsic value of an RWJ Corp. put option?

- c. Two of the options are clearly mispriced. Which ones? At a minimum, what should the mispriced options sell for? Explain how you could profit from the mispricing in each case.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Select all that are true with respect to the Black Scholes Option Pricing Model (OPM) in practice):

Group of answer choices

BSOPM assumes that the volatility of the underlying stock returns is constant over time.

BSOPM assumes that the underlying stock can be traded continuously.

BSOPM assumes that there are no transaction costs.

There is only one input to the BSOPM that is not observable at the time you are valuing a stock option, and that input is volatility.

Implied volatility is estimated by calculating the daily volatility of the underlying stock’s return that occurred over the prior six months.

The value derived from exercising an option immediately is the exercise value. No rational investor would exercise an option that is out-of-the-money, so the minimum exercise value is zero.

The following table provides information regarding options on ABC Corp. stock. Because the stock’s price is volatile, investors trade options to either hedge their positions or speculate on price movements. Investors can either buy options or “issue” new options, which is called writing options.

Based on your understanding of exercise value and option prices, complete the table with a strike price of $28.00:

Stock Price ($)

Strike Price ($)

Exercise Value ($)

Market Price of Option ($)

Time Value ($)

8.00

28.00

0.00

1.56

16.00

28.00

2.10

2.10

20.00

28.00

2.40

2.40

22.00

28.00

0.00

2.60

24.00

28.00

4.00

4.00

After two weeks, the stock price of ABC Corp. increases to $24.96. Suppose you purchased the shares for $16.00 and then sell the…

The value derived from exercising an option immediately is the exercise value. No rational investor would exercise an option that is out-of-the-money, so the minimum exercise value is zero.

The following table provides information regarding options on ABC Corp. stock. Because the stock’s price is volatile, investors trade options to either hedge their positions or speculate on price movements. Investors can either buy options or “issue” new options, which is called writing options.

Based on your understanding of exercise value and option prices, complete the table with a strike price of $30.00:

Stock Price ($)

Strike Price ($)

Exercise Value ($)

Market Price of Option ($)

Time Value ($)

20.00

30.00

0.00

1.56

40.00

30.00

12.10

2.10

50.00

30.00

22.40

2.40

55.00

30.00

25.00

27.60

60.00

30.00

34.00

4.00

After two weeks, the stock price of ABC Corp. increases to $62.40. Suppose you purchased the shares for $40.00 and then sell…

Chapter 22 Solutions

CORPORATE FINANCE-ACCESS >CUSTOM<

Ch. 22 - Options What is a call option? A put option? Under...Ch. 22 - Options Complete the following sentence for each...Ch. 22 - American and European Options What is the...Ch. 22 - Intrinsic Value What is the intrinsic value of a...Ch. 22 - Option Pricing You notice that shares of stock in...Ch. 22 - Options and Stock Risk If the risk of a stock...Ch. 22 - Option Risk True or false: The unsystematic risk...Ch. 22 - Prob. 8CQCh. 22 - Option Price and Interest Rates Suppose the...Ch. 22 - Contingent Liabilities When you take out an...

Ch. 22 - Options and Expiration Dates What is the impact of...Ch. 22 - Options and Stock Price Volatility What is the...Ch. 22 - Insurance as an Option An insurance policy is...Ch. 22 - Equity as a Call Option It is said that the equity...Ch. 22 - Prob. 15CQCh. 22 - Put Call Parity You find a put and a call with the...Ch. 22 - Put- Call Parity A put and a call have the same...Ch. 22 - Put- Call Parity One thing put-call parity tells...Ch. 22 - Two-State Option Pricing Model T-bills currently...Ch. 22 - Understanding Option Quotes Use the option quote...Ch. 22 - Calculating Payoffs Use the option quote...Ch. 22 - Two-State Option Pricing Model The price of Ervin...Ch. 22 - Two-State Option Pricing Model The price of Tara,...Ch. 22 - Put-Call Parity A stock is currently selling for...Ch. 22 - Put-Call Parity A put option that expires in six...Ch. 22 - Put-Call Parity A put option and a call option...Ch. 22 - Pot-Call Parity A put option and a call option...Ch. 22 - Black-Scholes What are the prices of a call option...Ch. 22 - Black-Scholes What are the prices of a call option...Ch. 22 - Delta What are the deltas of a call option and a...Ch. 22 - Prob. 13QPCh. 22 - Prob. 14QPCh. 22 - Time Value of Options You are given the following...Ch. 22 - Prob. 16QPCh. 22 - Prob. 17QPCh. 22 - Prob. 18QPCh. 22 - Black-Scholes A call option has an exercise price...Ch. 22 - Black-Scholes A stock is currently priced at 35. A...Ch. 22 - Equity as an Option Sunburn Sunscreen has a zero...Ch. 22 - Equity as an Option and NPV Suppose the firm in...Ch. 22 - Equity as an Option Frostbite Thermalwear has a...Ch. 22 - Mergers and Equity as an Option Suppose Sunburn...Ch. 22 - Equity as an Option and NPV A company has a single...Ch. 22 - Two-State Option Pricing Model Ken is interested...Ch. 22 - Two-State Option Pricing Model Rob wishes to buy a...Ch. 22 - Two-State Option Pricing Model Maverick...Ch. 22 - Prob. 29QPCh. 22 - Prob. 30QPCh. 22 - Prob. 31QPCh. 22 - Two-State Option Pricing and Corporate Valuation...Ch. 22 - Black-Scholes and Dividends In addition to the...Ch. 22 - Prob. 34QPCh. 22 - Prob. 35QPCh. 22 - Prob. 36QPCh. 22 - Prob. 37QPCh. 22 - Prob. 38QPCh. 22 - Prob. 1MCCh. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Prob. 5MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Black-Scholes Model Assume that you have been given the following information on Purcell Industries call options: According to the Black-Scholes option pricing model, what is the option’s value?arrow_forwardAssume that you have been given the following information on Purcell Corporations call options: According to the Black-Scholes option pricing model, what is the options value?arrow_forwardBoth call and put options are affected by the following five factors: the exercise price, the underlying stock price, the time to expiration, the stock’s standard deviation, and the risk-free rate. However, the direction of the effects on call and put options could be different. Use the following table to identify whether each statement describes put options or call options. Statement Put Option Call Option 1. When the exercise price increases, option prices increase. 2. An option is more valuable the longer the maturity. 3. The effect of the time to maturity on the option prices is indeterminate. 4. As the risk-free rate increases, the value of the option increases.arrow_forward

- The value derived from exercising an option immediately is the exercise value. No rational investor would exercise an option that is out-of-the-money, so the minimum exercise value is zero. The following table provides information regarding options on ABC Corp. stock. Because the stock’s price is volatile, investors trade options to either hedge their positions or speculate on price movements. Investors can either buy options or “issue” new options, which is called writing options. The following table presents the data on ABC Corp.’s call options at different stock prices. Based on your understanding of exercise value and option prices, complete the table with a strike price of $14.00: Stock Price ($) Strike Price ($) Exercise Value ($) Market Price of Option ($) Time Value ($) 32.00 14.00 18.00 19.56 64.00 14.00 52.10 2.10 80.00 14.00 68.40 2.40 88.00 14.00 74.00 76.60 96.00 14.00 86.00 4.00 After two weeks, the stock…arrow_forwardAssume that you have been given the following information on Purcell Corporation's call options: Inputs Intermediate Calculations Current stock price = $12 d1 = 0.32863 Time to maturity of option = 9 months d2 = 0.05477 Variance of stock return = 0.10 N(d1) = 0.62878 Strike price of option = $12 N(d2) = 0.52184 Risk-free rate = 7% According to the Black-Scholes option pricing model, what is the option's value? Do not round intermediate calculations. Round your answer to the nearest cent. Use only the values provided in the problem statement for your calculations. $arrow_forwardRequired:a)Calculate the price of a call and a put option based on the Black-Scholes option pricing model. b) Steven, an investor who owns 500,000 shares of ABC Berhad, and is expecting the upcoming general election would create greater volatility to the share price of ABC Berhad. Advise Steven on how to protect the value of his shareholding in ABC Berhad by using the option. c)Explain TWO (2) differences of hedging using options and futures with appropriate examples.d)Explain sector rotation with an appropriate example and discuss how to identify the prospects of an industry. e)Explain the term ''private equity" and discuss TWO (2) reasons why a firm needs private equity.arrow_forward

- Both call and put options are affected by the following five factors: the exercise price, the underlying stock price, the time to expiration, the stock’s standard deviation, and the risk-free rate. However, the direction of the effects on call and put options could be different. Use the following table to identify whether each statement describes put options or call options. Statement Put Option Call Option 1. An option is more valuable the longer the maturity. 2. A longer maturity in-the-money option on a risky stock is more valuable than the same shorter maturity option. 3. When the exercise price increases, option prices increase. 4. As the risk-free rate increases, the value of the option increases.arrow_forwardA FinCorp put option with strike price 60 trading on the Acme options exchange sells for $2. To your amazement, a FinCorp put with the same maturity selling on the Apex options exchange but with strike price 62 also sells for $2. If you plan to hold the options positions to expiration, devise a zero-net-investment arbitrage strategy to exploit the pricing anomaly. Draw the profit diagram at expiration for your position.arrow_forwardUse the option quote information shown here to answer the questions that follow. The stock is currently selling for $80. Option Expiration Strike Price Calls Puts Volume Last Volume Last RWJ March 72 250 5.20 180 5.30 April 72 190 11.05 147 10.05 July 72 159 11.90 63 13.85 October 72 80 12.80 31 12.45 a-1. Are the call options in or out of the money? multiple choice 1 In the money Out of the money a-2. What is the intrinsic value of an RWJ Corporation call option? b-1. Are the put options in or out of the money? multiple choice 2 In the money Out of the money b-2. What is the intrinsic value of an RWJ Corporation put option? c-1. Two of the options are clearly mispriced. Which ones? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to…arrow_forward

- A three-step binomial tree with terminal stock prices being 1.103, 0.875, 0.695, and 0.552. At time 0, if you have the insider information that at the maturity the stock price will be 0.875. Then, will the option premium at time 0 still be same as if you don't have this information, please choose from the answers below? a) Option premium is irrelevant to the private information (about the underlying) that option holder possesses. b) As in that case, the risk neutral probability of the impossible sample paths become zero.arrow_forwardConsider two put options on different stocks. The table below reports the relevant information for both options: Put optionTime to maturityCurrent price of underlying stockStrike priceVolatility ( )X1 year$27$1830%Y1 year$25$2030%All else equal, which put option has a lower premium? A.Put option Y B.Put option Xarrow_forwardAn investor makes the following three investments: (i) the purchase of a stock for £38(ii) the purchase of a put option for £0.50 with a strike price of £35 and (iii) the sale ofa call option (ie. writing a call option) for £0.50 with a strike price of £40 .(a) What is the intrinsic value and the time value of the put option.(b) What is the maximum profit and loss for this position? help me with part (b) please.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Accounting for Derivatives Comprehensive Guide; Author: WallStreetMojo;https://www.youtube.com/watch?v=9D-0LoM4dy4;License: Standard YouTube License, CC-BY

Option Trading Basics-Simplest Explanation; Author: Sky View Trading;https://www.youtube.com/watch?v=joJ8mbwuYW8;License: Standard YouTube License, CC-BY