Case summary:

Person X works for SA Company. He is bit confused on which investment option he must choose. Later, with the help of AS, financial service representative advice, X had decided to invest on diversified portfolio. He decided to invest 70% of his investment in equities, 5% in the

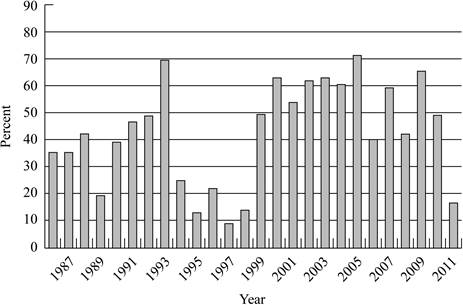

The graph represents the percentage of managed equity mutual funds beating the Vanguard 500 Index funds:

To determine: What investment decision would person X make for the equity portion of 401(k) account.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

FUND.OF CORP.FINANCE-CONNECT+ >CUSTOM<

- Assume that you are a portfolio manager for a large insurance company. The majority of the moneyyou manage is from retired school teachers who depend on the income you earn on their investments. You have invested a significant amount of money in the bonds of a large corporation andhave just received news released by the company’s president explaining that it is unable to meetits current interest obligations because of deteriorating business operations related to increasedinternational competition. The president has a recovery plan that will take at least two years. During that time, the company will not be able to pay interest on the bonds and, she admits, if the plandoes not work, bondholders will probably lose more than half of their money. As a creditor, youcan force the company into immediate bankruptcy and probably get back at least 90 percent of thebondholders’ money. You also know that your decision will cause at least 10,000 people to losetheir jobs if the company ceases…arrow_forwardDuring an interview with her investment adviser, a retired investor made the following two statements:a. “I have been very pleased with the returns I’ve earned on Petrie stock over the past two years and I am certain that it will be a superior performer in the future.”b. “I am pleased with the returns from the Petrie stock because I have specific uses for that money. For that reason, I certainly want my retirement fund to continue owning the Petrie stock.”Identify which principle of behavioral finance is most consistent with each of the investor’s two statements.arrow_forwardAfter successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of Schenkel Enterprises. Unfortunately, you will be the only person voting for you. If the company has 425,000 shares outstanding, and the stock currently sells for $50, how much will it cost you to buy a seat if the company uses straight voting?arrow_forward

- You are a newly employed finance manager for Finance Adventure Ltd. The following data is available for the company as of 31 June 2020: Current assets of $293,950 Current liabilities $68,700 Total assets $765,600 Equity $305,890 Required: The company’s Management Board required you to evaluate two alternative options of debt funding and equity funding for a new project. What is the job are you doing to complete the task? (referring to one out of 3 important questions of corporate finance for your answer) Calculate non-current assets, non-current liabilities and build a balance sheet for the company? Calculate the return on assets (ROA) of the company given that return on equity (ROE) is 35%? What is the price earnings ratio (PE) of the company, given total number of outstanding ordinary shares is 57,000 and market price of each share is $22?arrow_forwardYour broker Luke works for a major bank that is working on the merger between ABC Inc. and XYZ Corp. The news is going to be released to the public next week. If you decide to buy some stocks now and split the profits with Luke, your actions should be categorized as ______. Question 27 options: A) It is not possible to tell from the information given B) ethical but illegal C) unethical but legal D) unethical and illegal E) ethical and legalarrow_forwardIn late December you decide to sell a losing position that you hold on Twitter so you can capture the loss and use it to offset some capital gains, thus reducing your taxes for the current year. However, since you believe that Twitter is a good long-term investment, you wish to buy back your position in February next year. You call your Charles Schwab brokerage account manager and request that he sell your 1,600 shares of Twitter and buy them back in February. Charles Schwab charges a commission of $25 for broker-assisted trades. a. Suppose that your total transaction costs for selling the 1,600 shares of Twitter in December were $45.00. What was the bid/ask spread for Twitter at the time your trade was executed? b. Given that Twitter is listed on the NYSE, do your total transaction costs for December seem reasonable? Explain why or why not. c. When your February statement arrives in the mail, you see that your total transaction costs for buying the 1,600 shares of Twitter…arrow_forward

- Mini CaseDavid Lyons, CEO of Lyons Solar Technologies, is concerned about his firm’s level of debt financing. The company uses short-term debt to finance its temporary working capital needs, but it does not use any permanent (long-term) debt. Other solar technology companies average about 30% debt, and Mr. Lyons wonders why they use so much more debt and how it affects stock prices. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant. Assume that Firms U and L are in the same risk class and that both have EBIT=$500,000. Firm U uses no debt financing, and its cost of equity is rsU=14%. Firm L has $1 million of debt outstanding at a cost of rd=8%. There are no taxes. Assume that the MM assumptions hold. Find V, S, rs, and WACC for Firms U and L.arrow_forwardIdentify information used in an investment decision Look forward to the daywhen you will have accumulated $5,000, and assume that you have decided to investthat hard-earned money in the common stock of a publicly owned corporation. Whatdata about that company will you be most interested in, and how will you arrangethose data so they are most meaningful to you? What information about the company will you want on a weekly basis, on a quarterly basis, and on an annual basis?How will you decide whether to sell, hold, or buy some more of the firm’s stock?arrow_forwardDwayne sat at his desk wondering what he should do. Having opted for early retirement, six months ago, he knew that he needed to make some changes the way his investment portfolio was structured. However, being primarily focused on science during his career, he had a fairly limited knowledge of stock selection and portfolio management. One thing was certain, though, Dwayne had an eagerness to learn and that's exactly what he planned to do during his appointment with his broker, Jonathan Price. Dwayne Stevenson, aged 58, had joined the Pharmacopia Company approximately thirty years ago, as a post-doctoral researcher in the field of immunology. His strong work ethic and knowledge of science enabled him to progress steadily along the research track of the company. He won a number of awards and earned many promotions along the way. Five years ago, Dwayne earned the coveted title of "Research 5 Scientist" enjoyed by only 4 other individuals in the corporation. One of the ain…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning