EBK AUDITING AND ASSURANCE SERVICES

16th Edition

ISBN: 9780134067117

Author: Hogan

Publisher: VST

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 22DQP

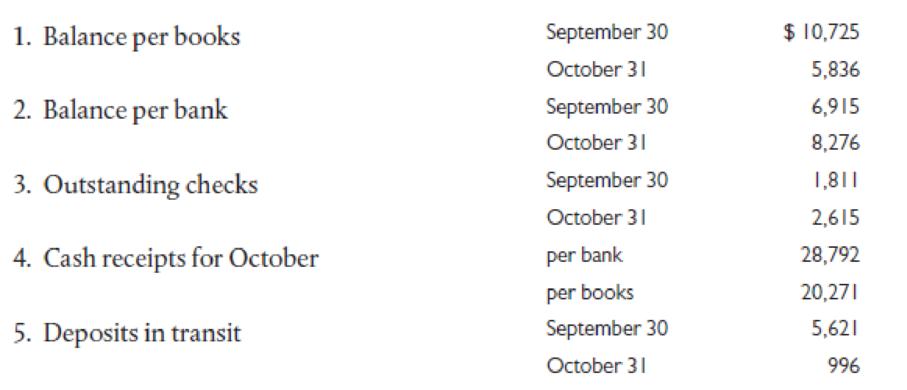

You are doing the first-year audit of Sherman School District and have been assigned responsibility for doing a four-column proof of cash for the month of October 2019. You obtain the following information:

- 6. Interest on a bank loan for the month of October, charged by the bank but not recorded, was $596.

- 7. Proceeds on a note of the Jones Company were collected by the bank on October 28 but were not entered on the books:

- 8. On October 26, a $1,144 check of the Billings Company was charged to Sherman School District’s account by the bank in error.

- 9. Dishonored checks are not recorded on the books unless they permanently fail to clear the bank. The bank treats them as disbursements when they are dishonored and as deposits when they are redeposited. Checks totaling $1,335 were dishonored in October; $600 was redeposited in October and $735 in November.

Required

- a. Prepare a four-column proof of cash for the month ended October 31. It should show both adjusted and unadjusted cash.

- b. Prepare all

adjusting entries .

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

can you help me answer these questions please...

The accounting records for Delta Driving School shows a cash balance of $14,134 on February 28, 2019. On the evening of February 28, company receipts of $1,250 were placed in the bank's night deposit drop box. The deposit was processed by the bank on March 1. The February 28 bank statement shows a balance of $18,877, including collection of a $6,000 note receivable plus $55 of interest earned, a service charge of $40, and a $1,550 debit memo for the payment of the company's utility bill. All of the checks that the company had written were listed on the bank statement except for check #1908 in the amount of $1,528.

Prepare a bank reconciliation to calculate the company’s adjusted cash balance at February 28, 2019.

Prepare the journal entries needed to adjust the cash records as a result of the bank reconciliation.

Circle the number that will appear as Cash on Delta’s Balance Sheet at February 28, 2019.

You are the bookkeeper of Holmes Renovations. You undertake a bank reconciliation at the end of every month. Holmes Renovations received its bank statement for the month ending 31 July 2021. The bank reconciliation at the end of last month showed a deposit in transit of $14,040 and two outstanding cheques (no. 363 for $3,672 and no. 371 for $7,560). The adjusted cash balance in the entity’s records was $127,566 debit at the end of June.

Below are the entity’s July bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of July:

AU Bank - Bank Statement

For the period 01/03/2021 – 31/03/2021

Holmes Traders, NSW

Dr

Cr

Balance $

Balance brought forward

124,758

CR

1

July

Deposit

14,040

138,798

CR

3

July

Deposit

12,744

151,542

CR

July

Cheque # 382

5,616

145,926

CR

6

July

Deposit

7,344

153,270

CR

8…

Roper Electronics received its bank statement for the month of August with an ending balance of $11,775. Roper determined that Check No. 613 for $155 and Check No. 601 for $420 were both outstanding. A $6,900 deposit for August 30 was in transit as of the end of the month. Northern Regional Bank also collected $5,250 on a note receivable, which included interest of $250. The bank statement reveals a bank service charge of $20. A customer check for $68 was returned with the bank statement marked “NSF.” The ending balance of the Roper cash account is $12,938.

Question Content Area

a. Prepare a bank reconciliation as of August 31.

Cash balance according to bank statement

Add bank service chargeAdd collection feeAdd deposit in transitDeduct collection feeDeduct deposit in transit

Deduct outstanding checks:

No. 600No. 601No. 603No. 604No. 605

No. 611No. 612No. 613No. 614No. 615

Adjusted balance

Cash balance according to Roper Electronics

Add deposit in transitAdd note and…

Chapter 23 Solutions

EBK AUDITING AND ASSURANCE SERVICES

Ch. 23 - Explain the relationships among the initial...Ch. 23 - Prob. 2RQCh. 23 - Prob. 3RQCh. 23 - Prob. 4RQCh. 23 - Prob. 5RQCh. 23 - Prob. 6RQCh. 23 - Prob. 7RQCh. 23 - Prob. 8RQCh. 23 - Prob. 9RQCh. 23 - Prob. 10RQ

Ch. 23 - Prob. 11RQCh. 23 - Prob. 12RQCh. 23 - Prob. 13RQCh. 23 - Prob. 14.1MCQCh. 23 - Prob. 14.2MCQCh. 23 - Prob. 14.3MCQCh. 23 - Prob. 15.1MCQCh. 23 - Prob. 15.2MCQCh. 23 - Prob. 15.3MCQCh. 23 - Prob. 16.1MCQCh. 23 - Prob. 16.2MCQCh. 23 - Prob. 16.3MCQCh. 23 - Prob. 17DQPCh. 23 - Prob. 18DQPCh. 23 - Prob. 19DQPCh. 23 - Prob. 20DQPCh. 23 - Prob. 21DQPCh. 23 - You are doing the first-year audit of Sherman...Ch. 23 - Prob. 23DQPCh. 23 - McNeil Company, a medium-sized manufacturer of...Ch. 23 - The amount of subjectivity involved in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Western Flyers received its bank statement for the month of July 2019 with an ending balance of $11,065.00 whereas the cash book balance for Western Flyers is $12875. Western Flyers determined that check #598 for $125.00 and check #601 for $375.00 were both outstanding. Also, a $7,500.00 deposit for July 30th was in transit as of the end of the month. Big Bucks Bank also collected an amount of $5,300 from a client of Western Flyer as payment of a note ($5,000) and interest ($300) earned on a note. Big Bucks Bank charged Flyers a $15.00 fee for the collection service and $20 for issuance of 10 check books. 5. A check for $75.00 from Colin Abraham, a client, was returned with the bank statement marked “NSF”.arrow_forwardAt the end of September 2021, Bigelow’s accounting records show a cash balance of $5,000. The September bank statement reports a cash balance of $3,900. After investigation, there was an NSF check of $1,300, service fee of $200, interest earned of $70, outstanding checks of $1,900, and a deposit in transit of $1,600. A check to Ameren correctly cleared the bank for $220 but was incorrectly recorded by Bigelow as $250. Complete a bank reconciliation and the entries for the Bigelow Company.arrow_forwardUsing the following information, prepare a bank reconciliation for Young Co. for August 31, 2019, and prepare the journal entries: (a) The bank statement balance is $4,095 (b) The cash account balance is $4,205. (c) Outstanding checks amounted to $517. (d) Deposits in transit are $655. (e) The bank service charge is $45. (f) A check for $84 for supplies was recorded as $48 in the ledger. (g) NSF check for $649.00 (h) EFT collected $715.00 (i) Bank error processed a check for $53 as $35arrow_forward

- You are the bookkeeper of Holmes Traders. You undertake a bank reconciliation at the end of every month. Holmes Traders received its bank statement for the month ending 31 March 2021. The bank reconciliation at the end of February showed a deposit in transit of $780 and two outstanding cheques (no. 563 for $204 and no. 571 for $420). The adjusted cash balance in the entity’s records was $7087 debit at the end of February. Below are the entity’s March bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of March: AU Bank - Bank Statement For the period 01/03/2021 – 31/03/2021 Holmes Traders, NSW Dr Cr Balance $ Balance brought forward 6931 CR 1 March Deposit 780 7711 CR 3 March Deposit 708 8419 CR March Cheque # 582 312 8107 CR 6 March Deposit 408 8515 CR 8 March # 571 420 8095 CR…arrow_forwardYou are the bookkeeper of Mel Traders. You undertake a bank reconciliation at the end of every month. Mel Traders received its bank statement for the month ending 31 May 2021. The bank reconciliation at the end of April showed a deposit in transit of $11,700 and two outstanding cheques (no. 663 for $3,060 and no. 671 for $6,300). The adjusted cash balance in the entity’s records was $106,305 debit at the end of April. Below are the entity’s May bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of May: AU Bank - Bank Statement For the period 01/05/2021 – 31/05/2021 Mel Traders Dr Cr Balance $ Balance brought forward 103,965 CR 1 May Deposit 11,700 115,665 CR 3 May Deposit 10,620 126,285 CR May Cheque # 682 4,680 121,605 CR 6 May Deposit 6,120 127,725 CR 8 May # 671 6,300 121,425 CR 9 May Deposit…arrow_forwardYou are the bookkeeper of Mel Traders. You undertake a bank reconciliation at the end of every month. Mel Traders received its bank statement for the month ending 31 May 2021. The bank reconciliation at the end of April showed a deposit in transit of $11,700 and two outstanding cheques (no. 663 for $3,060and no. 671 for $6,300). The adjusted cash balance in the entity’s records was $106,305 debit at the end of April. Below are theentity’s May bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of May: AU Bank - Bank Statement For the period 01/05/2021 – 31/05/2021 Mel Traders Dr Cr Balance $ Balance brought forward 103,965 CR 1 May Deposit 11,700 115,665 CR 3 May Deposit 10,620 126,285 CR May Cheque # 682 4,680 121,605 CR 6 May Deposit 6,120 127,725 CR 8 May # 671 6,300 121,425 CR…arrow_forward

- The accountant of Jonathan Manufacturing Company was tasked to perform monthly bank reconciliation. She downloaded the company’s April 30, 2019 bank statement that showed a balance of P32,400. She also printed the cash ledger from the company’s computerized accounting system. It contains the ending balance of P8,350. She also found the following reconciling items:a. The bank statement showed bank service fee of P800.b. The bank collected P1,500 from a note receivable for Jonathan Manufacturing. Also, a collection fee of P250.00 was charged.c. Deposit in transit, P51,000.d. Checks outstanding on April 30, P79,100.e. The accountant found a check issued to Rhys Corp. for P4,500 that cleared the bank but was not in the cash ledger. Requirement:a. Prepare the bank reconciliation statement.b. Journalize the adjusting entries.arrow_forwardYou are the bookkeeper of Mel Traders. You undertake a bank reconciliation at the end of every month. Mel Traders received its bank statement for the month ending 31 May 2021. The bank reconciliation at the end of April showed a deposit in transit of $11,700 and two outstanding cheques (no. 663 for $3,060and no. 671 for $6,300). The adjusted cash balance in the entity’s records was $106,305 debit at the end of April. Below are theentity’s May bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of May: AU Bank - Bank Statement For the period 01/05/2021 – 31/05/2021 Mel Traders Dr Cr Balance $ Balance brought forward 103,965 CR 1 May Deposit 11,700 115,665 CR 3 May Deposit 10,620 126,285 CR May Cheque # 682 4,680 121,605 CR 6 May Deposit 6,120 127,725 CR 8 May # 671 6,300 121,425 CR…arrow_forwardAssume that you have audited accounts receivable as of 12/31/2020 and are confident that the ending balance should be $7,188,000. Further, you know that the audited balance as of 12/31/2019 was $8,462,000. You also verified cash deposits from customers through a review of the bank account. Based on that review you believe that cash receipts from customers ranges from an amount of $40,000,000 to $41,000,000. Which amount below would represent an overstatement of revenue for the year ending 12/31/2020, based on the facts above? 1. $38,500,000 2. $41,000,000 3. $39,762,000 4. $39,100,000arrow_forward

- You have been appointed as Davis college accountant and, the May 31 bank statement of Davis college has just arrived from bank of America. To prepare the bank reconciliation, you gather the following data:A. The May 31 bank balance is $ 19,209,820B. The bank statement includes two returned checks received from students as payment of tuition fees. One is a $67,500 NSF ( non sufficient fund) check received from Mr johnson and deposited on May 19. The other is $ 195,030 check received from Mr Jonathan and deposited on May 21 that was returned due to "unathorized signature".C. Davis college collects some operating funds from East¢ral-africa division (ECD) by EFT(electronic fund transfer). The May bank statement lists a $ 333,190 deposit for a collection from ECD that Davis college did not know until the bank statement of the month was received.D. The bank statement includes one special deposit of $ 916,000 interest revenue that Davis college earned on its bank balance during May.E.…arrow_forwardAs the new accountant of Villain Corn, you were assigned to prepare the bank reconciliation statement for the year-end of 2020. The following are the given: Cash on book records before reconciliation was P 900.000 Cash per bank statements before reconciliation was P 762,000 Money to deposit on December 31 amounting to P 130,000 was sent to the bank late. This was reflected in the books but not on the bank Outstanding checks totaled P41,000 as of December 31. Bank service charges for December of P 110,000. A customer paid directly to the bank without informing the corporation, P 68,000. Villain made a payment using cash from the bank amounting to P 18,000 but it was recorded in the book as 14,000. The bank erroneously charged 3.000 to Villain Corp but actually is should be charged to Enemy Corp. Here's your guide to accomplish this output. Step 1. Locate the beginning Cash balance of the company. Note all information is given in the problem. Your task is to identify and arrange them…arrow_forwardPrepare a reconciliation of the bank and book balances to the correct cash balance and provide the journal entries to adjust and correct Yingying's books. Yingying Company's books show a cash balance at the Ojibway National Bank on November 30, 2020, of $20,502. The bank statement covering the month of November shows an ending balance of $22,190. An examination of Yingying's accounting records and the November bank statement identified the following reconciling items. 1. A deposit of $3,680 was taken to the bank late on November 30 but does not appear on the November bank statement. 2. Cheques written in November but not charged to (deducted from) the November bank statement are: Cheque #7327 = $150 #7348 = 4,820 #7349 = 31 3. Yingyinghas not yet recorded the $600 of interest collected by the bank on November 20 on Sequoia Co. bonds held by the bank for Yingying. 4. Bank service charges of $18 are not yet recorded on Yingying s books. 5. A $220 cheque for Yingying from a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY