FUNDAMENTAL ACCT PRIN TEXT+CONNECT CODE

15th Edition

ISBN: 9781265564483

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 24, Problem 4APSA

Problem 24-4A

Departmental contribution to income

P3

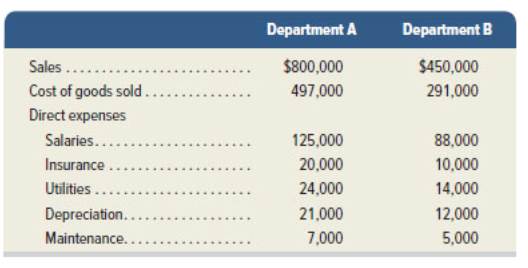

Vortex Company operates a retail Store with two departments. Information about those departments follows.

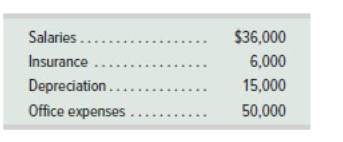

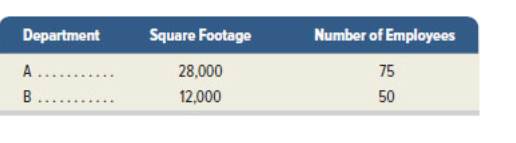

The company also incurred the following indirect costs.

Indirect costs are allocated as follows: salaries on the basis of sales; insurance and

Required

1. For each department, determine the departmental contribution to overhead and the departmental net income.

2. Should Department B be eliminated? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Interdepartmental Services: Step Method

O'Brian's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. O'Brian's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows:

Personnel

Payroll

Housewares

Clothing

Furniture

Direct department cost

$ 7,800

$ 3,200

$ 12,200

$ 20,000

$ 16,750

Number of employees

5

4

8

16

4

Gross payroll

$ 6,000

$ 3,300

$ 10,600

$ 17,400

$ 8,100

(a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.)

%

(b) Determine the percentage of total Payroll Department services that was provided to the…

Interdepartment Services: Step Method

O'Brian's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales

departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments,

Personnel and Payroll provide services to each other. O'Brian's allocates Personnel Department costs on the basis

of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation

information for June is as follows:

Direct department cost

Number of employees

Gross payroll

Personnel Payroll Housewares Clothing Furniture

$7,300 $3,800

$12,300 $20,000

$15,650

5

Total costs $

2

$6,100 $2,800

Payroll

0

(a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department.

(Round your answer to one decimal place.)

12.5

X%

(b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department.

(Round your answer…

e Preview

4)

F3

$

R

01-

Arctic Air Inc. manufactures cooling units for commercial buildings. The price and cost of goods sold for

each unit are as follows:

Category

Price

Cost of goods sold

Gross profit

F4

Customer service

Project bidding

Engineering support

Total costs

In addition, the company incurs selling and administrative expenses of $226,250. The company wishes

to assign these costs to its three major customers, Gough Industries, Breen Inc., and The Martin Group.

These expenses are related to three major nonmanufacturing activities: customer service, project

bidding, and engineering support. The engineering support is in the form of engineering changes that

are placed by the customer to change the design of a product. The budgeted activity costs and activity

bases associated with these activities are:

S⁰5

Activity

Number of service requests

Number of bids

Number of customer design changes

Unit volume

%

Activity

3:0

F5

T

Activity-base usage and unit volume information for the…

Chapter 24 Solutions

FUNDAMENTAL ACCT PRIN TEXT+CONNECT CODE

Ch. 24 - Prob. 1DQCh. 24 - What is the difference between operating...Ch. 24 - What are controllable costs?Ch. 24 - Prob. 4DQCh. 24 - Prob. 5DQCh. 24 - Prob. 6DQCh. 24 - Prob. 7DQCh. 24 - What is the difference between direct and indirect...Ch. 24 - Prob. 9DQCh. 24 - Prob. 10DQ

Ch. 24 - Prob. 11DQCh. 24 - Prob. 12DQCh. 24 - Prob. 13DQCh. 24 - Prob. 14DQCh. 24 - Prob. 15DQCh. 24 - Prob. 16DQCh. 24 - Prob. 17DQCh. 24 - Prob. 18DQCh. 24 - Prob. 19DQCh. 24 - Prob. 20DQCh. 24 - Prob. 1QSCh. 24 - Prob. 2QSCh. 24 - Prob. 3QSCh. 24 - Allocation and measurement terms C1 In each blank...Ch. 24 - Basis for cost allocation C1 For each of the...Ch. 24 - Prob. 6QSCh. 24 - Prob. 7QSCh. 24 - Prob. 8QSCh. 24 - Prob. 9QSCh. 24 - Prob. 10QSCh. 24 - Prob. 11QSCh. 24 - Prob. 12QSCh. 24 - Prob. 13QSCh. 24 - Prob. 14QSCh. 24 - Prob. 15QSCh. 24 - Prob. 16QSCh. 24 - Prob. 17QSCh. 24 - Prob. 18QSCh. 24 - Prob. 19QSCh. 24 - Prob. 1ECh. 24 - Prob. 2ECh. 24 - Exercise 24-3 Service department expenses...Ch. 24 - Prob. 4ECh. 24 - Prob. 5ECh. 24 - Prob. 6ECh. 24 - Prob. 7ECh. 24 - Prob. 8ECh. 24 - Prob. 9ECh. 24 - Prob. 10ECh. 24 - Prob. 11ECh. 24 - Prob. 12ECh. 24 - Prob. 13ECh. 24 - Prob. 14ECh. 24 - Prob. 15ECh. 24 - Prob. 16ECh. 24 - Prob. 17ECh. 24 - Prob. 18ECh. 24 - Prob. 19ECh. 24 - Prob. 20ECh. 24 - Prob. 21ECh. 24 - Problem WA

Responsibility according perfortmance...Ch. 24 - Prob. 2APSACh. 24 - Prob. 3APSACh. 24 - Problem 24-4A Departmental contribution to income...Ch. 24 - Prob. 5APSACh. 24 - Prob. 1BPSBCh. 24 - Prob. 2BPSBCh. 24 - Prob. 3BPSBCh. 24 - Prob. 4BPSBCh. 24 - Prob. 5BPSBCh. 24 - Prob. 24SPCh. 24 - Prob. 1BTNCh. 24 - Prob. 2BTNCh. 24 - Prob. 3BTNCh. 24 - Prob. 4BTNCh. 24 - Prob. 5BTNCh. 24 - Prob. 6BTNCh. 24 - Prob. 7BTNCh. 24 - Prob. 8BTNCh. 24 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- COMPUTING OPERATING INCOME The sales, cost of goods sold, and total operating expenses of departments A and B of Ash Company are as follows: Compute the departmental operating income for each department.arrow_forward(Appendix 4B) Sequential Method of Support Department Cost Allocation Refer to Exercise 4-51 for data. Now assume that Stevenson uses the sequential method to allocate support department costs to the operating divisions. General Factory is allocated first in the sequential method for the company. Required: 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places.) 2. Allocate the support service costs to the operating divisions. (Note: Round all amounts to the nearest dollar.) 3. Assume divisional overhead rates are based on direct labor hours. Calculate the overhead rate for the Battery Division and for the Small Motors Division. (Note: Round overhead rates to the nearest cent.)arrow_forwardUse the following information to compute each department's contribution to overhead. Which department contributes the largest amount toward total overhead? Sales Cost of goods sold Gross profit Total direct expenses Department A $ 54,000 34,020 19,980 4,980 Department B $ 201,000 104,520 96,480 37,480 Department C $ 81,000 42,930 38,070 8,926 Complete this question by entering your answers in the tabs below. Contribution to Departmental Overhead Overhead Compute each department's contribution to overhead. Department A Department B Department C Contribution to overhead Use the following information to compute each department's contribution to overhead. Which department contributes the largest amount toward total overhead? Department A $ 54,000 34,020 Department B $ 201,000 104,520 96,480 37,480 Department C $ 81,000 Sales Cost of goods sold Gross profit Total direct expenses 19,980 4,980 42,930 38,070 8,926 Complete this question by entering your answers in the tabs below. Contribution…arrow_forward

- Interdepartment Services: Step Method Jane Cooper's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. Copper's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows: Direct department cost Number of employees Gross payroll Personnel Payroll Housewares Clothing Furniture $15,600 $6,400 15 $ 33,500 $ 24,400 $40,000 24 12 12 $ 12,000 $6,600 $ 21,200 $26,100 $ 16,200 (a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.) 0 % % (b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department.…arrow_forwardQuestion A6 In a process to calculate full cost for a product or service, what is the correct order of the following steps? A Apportion general overheads between departments Allocate specific departmental overheads to the relevant department Apportion service department costs to production cost centres Total product department overheads B Allocate specific departmental overheads to the relevant department Apportion general overheads between departments Total product department overheads Apportion service department costs to production cost centres C Allocate specific departmental overheads to the relevant department Apportion general overheads between departments Apportion service department costs to production cost centres Total product department overheads D Allocate specific departmental overheads to the relevant department Apportion service department costs to production cost centres Apportion general overheads between departments Total product department overheadsarrow_forwardAccounting Question 3 Barns Ltd. has three production departments: A, B, and C, and two service departments: Stores and Maintenance. The company absorbs its overhead costs on a machine hour basis in depts. A and B, and a labour hour basis in department C. The entity apportions indirect wages using labour hours worked in each department. The company has budgeted its production overhead costs for the forthcoming year as follows: Indirect wages Depreciation of plant Rent Power Canteen costs Plant insurance The following information is also available: Labour Hours Plant value Floor area (sq. m) Machine hours Employees Stores requisitions KWH ('000) A 9,000 $130,000 40,000 Material Direct Labour A Direct Labour B Direct Labour C 12,000 75 10,000 Machine hours A Machine hours B $ 96,000 376,000 147,000 72,000 123,000 117,500 100 B C 7,000 16,000 $70,000 $20,000 30,000 20,000 15,000 60 8,000 60 5,000 50 2,000 60 Stores Main. 4,000 4,000 $5,000 $10,000 10,000 5,000 nil 8 nil 40 kilos @ $5 per…arrow_forward

- Use the following information to compute each department's contribution to overhead. Which department contributes the largest amount toward total overhead? Sales Cost of goods sold Gross profit Total direct expenses Contribution to overhead Department A $ 53,000 Department B $ 180,000 Department C $ 84,000 34,185 103,700 49,560 18,815 76,300 34,440 3,660 37,060 7,386 $ $ $ Complete this question by entering your answers in the tabs below. Contribution to Departmental Overhead Overhead Compute each department's contribution to overhead. Department A Department B Department C Contribution to overhead Contribution to Overhead Departmental Overhead >arrow_forwardUse the following information to compute each department's contribution to overhead. Which department contributes the largest amount toward total overhead? Sales Cost of goods sold Gross profit Total direct expenses Contribution to overhead Department A $ 54,000 Department B $ 184,000 Department C $ 80,000 34,020 95,680 42,400 19,980 88,320 37,600 5,340 37,060 8,486 $ $ $ Complete this question by entering your answers in the tabs below. Contribution to Departmental Overhead Overhead Compute each department's contribution to overhead. Contribution to overhead Department A Department B Department Carrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Thomas and Hill Distributors has divided its business into two departments: commercial sales and industrial sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forward

- Construct and interpret a product profitability report, allocating selling and administrative expenses Naper Inc. manufactures power equipment. Naper has two primary productsgenerators and air compressors. The following report was prepared by the controller for Napers senior marketing management for the year ended December 31: Generators Air Compressors Total Revenue 4,200,000 3,000,000 7,200,000 Cost of goods sold 2,940,000 2,100,000 5,040,000 Gross profit 1,260,000 900,000 2,160,000 Selling and administrative expenses 610,000 Income from operations 1,550,000 The marketing management team was concerned that the selling and administrative expenses were not traced to the products. Marketing management believed that some products consumed larger amounts of selling and administrative expense than did other products. To verify this, the controller was asked to prepare a complete product profitability report, using activity-based costing. The controller determined that selling and administrative expenses consisted of two activities: sales order processing and post-sale customer service. The controller was able to determine the activity base and activity rate for each activity, as follows: Activity Activity Base Activity Rate Sales order processing Sales orders 65 per sales order Post-sale customer service Service requests 200 per customer service request The controller determined the following activity-base usage information about each product: Generators Air Compressors Number of sales orders 3,000 4,000 Number of service requests 225 550 A. Determine the activity cost of each product for sales order processing and post-sale customer service activities. B. Use the information in (A) to prepare a complete product profitability report dated for the year ended December 31. Compute the gross profit to sales and the income from operations to sales percentages for each product. (Round to two decimal places.) C. Interpret the product profitability report. How should management respond to the report?arrow_forwardINCOME STATE MENT WITH DEPARTMENTAL OPERATING INCOME AND TOTAL OPERATING INCOME Alexa Cole owns a business called Alexas Bakery. She has divided her business into two departments: breads and pastries. The following information is provided for the fiscal year ended June 30, 20--: REQUIRED 1. Prepare an income statement showing departmental operating income and total operating income. 2. Calculate departmental operating expense and operating income percentages.arrow_forwardIdentifying activity bases in an activity-based cost system Select Foods Inc. uses activity-based costing to determine product costs. For each activity listed in the left column, match an appropriate activity base from the right column. You may use items in the activity-base list more than once or not at all. Activity Activity Base Accounting reports Engineering change orders Customer return processing Kilowatt hours used Electric power Number of accounting reports Human resources Number of customers Inventory control Number of customer orders Invoice and collecting Number of customer returns Machine depreciation Number of employees Materials handling Number of inspections Order shipping Number of inventory transactions Payroll Number of machine hours Production control Number of material moves Production setup Number of payroll checks processed Purchasing Number of production orders Quality control Number of purchase orders Sales order processing Number of sales orders Number of setupsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License