Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 26, Problem 15P

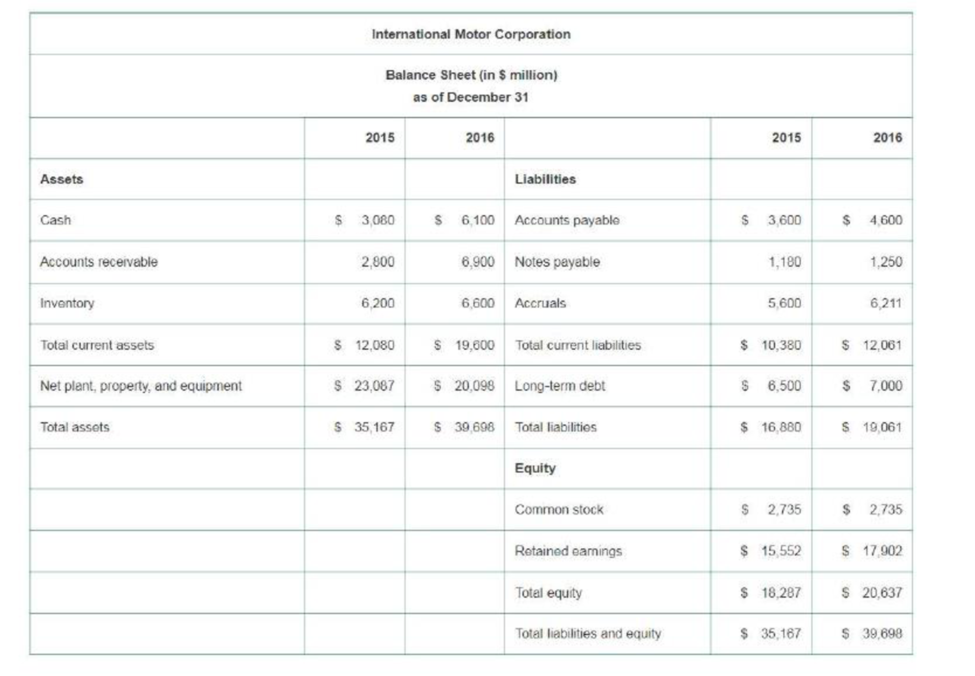

Use the financial statements supplied on the next page for International Motor Corporation (IMC) to answer the following questions.

- a. Calculate the cash conversion cycle for IMC for both 2015 and 2016. What change has occurred, if any? All else being equal, how does this change affect IMC’s need for cash?

- b. IMC’s suppliers offer terms of Net 30. Does it appear that IMC is doing a good job of

managing its accounts payable?

| International Motor Corporation | ||

| Income Statement (in $ million) for the Years Ending December 31 | ||

| 2015 | 2016 | |

| Sales | $ 60,000 | $ 75,000 |

| Cost of goods sold | 52,000 | 61,000 |

| Gross profit | $ 8,000 | $ 14,000 |

| Selling and general and administrative expenses | 6,000 | 8,000 |

| Operating profit | $ 2,000 | $ 6,000 |

| Interest expense | 1,400 | 1,300 |

| Earnings before tax | $ 600 | $ 4,700 |

| Taxes | 300 | 2,350 |

| Earnings after tax | $ 300 | $ 2,350 |

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the financial statements supplied below for International Motor Corporation(IMC) to answer the following questions.

Calculate the cash conversion cycle for IMC for both 2015 and 2016. What change has occurred, if any? All else being equal, how does this change affect IMC’s need for cash?

IMC’s suppliers offer terms of Net 30. Does it appear that IMC is doing a good job of managing its accounts payable?

Andrew Potter is comparing the cash- flow- generating ability of Microsoft with that of Apple Inc. He collects information from the companies’ annual reports and prepares the following table.

Cash Flow from Operating Activities

as a Percentage of Total Net Revenue

2017 (%) 2016 (%) 2015 (%)

Microsoft 43.9 39.1 31.7

Apple Inc. 27.7 30.5 34.8

As a Percentage of Average Total Assets

2017 (%) 2016 (%) 2015 (%)

Microsoft 18.2 18.1 17.1

Apple Inc. 18.2 21.5 31.1

What is Potter likely to conclude about the relative cash- flow- generating ability of these two companies?

Refer to the financial statements and related disclosure notes of The Kroger Company for the fiscal year endingJanuary 30, 2016. You can locate the report online from “investor relations” at www.kroger.com.Notice that Kroger’s net income has increased over the three years reported. To supplement their analysis ofprofitability, many analysts like to look at “free cash flow.” A popular way to measure this metric is “structuralfree cash flow” (or as Warren Buffett calls it, “owner’s earnings”), which is calculated as net income from operations, plus depreciation and amortization, minus capital expenditures.Required:Determine free cash flows for Kroger in each of the three years reported. Compare that amount with net incomeeach year. What pattern do you detect?

Chapter 26 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 26.1 - What is the firms cash cycle? How does it differ...Ch. 26.1 - How does working capital impact a firms value?Ch. 26.2 - Prob. 1CCCh. 26.2 - Prob. 2CCCh. 26.3 - Prob. 1CCCh. 26.3 - Prob. 2CCCh. 26.4 - What is accounts payable days outstanding?Ch. 26.4 - What are the costs of stretching accounts payable?Ch. 26.5 - What are the benefits and costs of holding...Ch. 26.5 - Prob. 2CC

Ch. 26.6 - Prob. 1CCCh. 26.6 - Prob. 2CCCh. 26 - Prob. 1PCh. 26 - Prob. 2PCh. 26 - Aberdeen Outboard Motors is contemplating building...Ch. 26 - Prob. 4PCh. 26 - Prob. 5PCh. 26 - Prob. 6PCh. 26 - The Fast Reader Company supplies bulletin board...Ch. 26 - Prob. 8PCh. 26 - Prob. 9PCh. 26 - Prob. 10PCh. 26 - The Mighty Power Tool Company has the following...Ch. 26 - What is meant by stretching the accounts payable?Ch. 26 - Prob. 13PCh. 26 - Your firm purchases goods from its supplier on...Ch. 26 - Use the financial statements supplied on the next...Ch. 26 - Prob. 16PCh. 26 - Which of the following short-term securities would...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vison software reported the following amounts on its balance sheets at December 31, 2020, 2019, and 2018 *Data table provided* Sales and profits are high. Nevertheless, Vision is experiencing a cash shortage. Perform a vertical analysis of Vision Software's assets at the end of years 2020, 2019, and 2018. Use the analysis to explain the reason for the cash shortage.arrow_forwardBased on the following information for Pinkerly Inc., a fi ctitious company, what arethe total adjustments that the company would make to net income in order to deriveoperating cash fl ow?Year EndedIncome statement item 12/31/2009Net income $30 millionDepreciation $7 millionBalance sheet item 12/31/2008 12/31/2009 ChangeAccounts receivable $15 million $30 million $15 millionInventory $16 million $13 million ($3 million)Accounts payable $10 million $20 million $10 millionA . Add $5 million.B . Add $21 million.C . Subtract $9 million.arrow_forwardPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS 1. La Sorpresa de Ayer, S.A., a leading local company, knows that in order to know the rotations necessary to quantify its cash cycle, it is essential to apply some financial ratios. So how often it pays its suppliers, how often it rotates its inventories, and how often it charges its customers, will have to be calculated with the following data:Total sales of the company..........................$4'586,109.47Proportion of credit sales....................... 65%Average customer balance............................. $ 372,621.40Cost of sales ratio...................... 65%Average inventory balance...................... $ 420,393.37Average supplier balance................... $ 288,004.21Beginning inventory................................................ $ 358,554.55 The company spends about $12.350 million in operating cycle investments. With this data it is necessary to calculate: 1) The operating cycle.2) The cash…arrow_forward

- What was the amount of net cash provided by operating activities for the year ended September 26, 2015? For the year ended September 27, 2014? What was the amount of increase or decrease in cash and cash equivalents for the year ended September 26, 2015? For the year ended September 27, 2014? Which method of computing net cash provided by operating activities does Apple use? From your analysis of the 2015 statement of cash flows, did the change in accounts receivable require or provide cash? Did the change in inventories require or provide cash? Did the change in accounts payable require or provide cash? What was the net outflow or inflow of cash from investing activities for the year ended September 26, 2015? What was the amount of income taxes paid in the year ended September 26, 2015?arrow_forward1. How much cash is received from sales to customers for year 2021? Assume all the sales were made on credit basis . 2. What is the net increase or decrease in the Cash account for year 2021?arrow_forwardI'm able to do the cash flow, but I am confused about the cash received from customers part of this. I am also confused about the right side of the attached spreadsheet with supporting calculations: North Company’s income statement and comparative balance sheets as of December 31 of 2019 and 2018 follow: NORTH COMPANYIncome StatementFor the Year Ended December 31, 2019 Sales Revenue $770,000 Cost of Goods Sold $550,000 Wages Expense 195,000 Advertising Expense 31,000 Depreciation Expense 24,000 Interest Expense 20,000 Gain on Sale of Land (25,000) 795,000 Net Loss $(25,000) NORTH COMPANYBalance Sheets Dec. 31, 2019 Dec. 31, 2018 Assets Cash $80,000 $32,000 Accounts Receivable 42,000 49,000 Inventory 107,000 115,000 Prepaid Advertising 10,000 14,000 Plant Assets 360,000 210,000 Accumulated Depreciation (80,000) (56,000) Total Assets $519,000 $364,000 Liabilities and Stockholders’ Equity Accounts Payable…arrow_forward

- I'm able to do the cash flow, but I am confused about the cash received from customers part of this. I am also confused about the right side of the attached spreadsheet with supporting calculations: North Company’s income statement and comparative balance sheets as of December 31 of 2019 and 2018 follow: NORTH COMPANYIncome StatementFor the Year Ended December 31, 2019 Sales Revenue $770,000 Cost of Goods Sold $550,000 Wages Expense 195,000 Advertising Expense 31,000 Depreciation Expense 24,000 Interest Expense 20,000 Gain on Sale of Land (25,000) 795,000 Net Loss $(25,000) NORTH COMPANYBalance Sheets Dec. 31, 2019 Dec. 31, 2018 Assets Cash $80,000 $32,000 Accounts Receivable 42,000 49,000 Inventory 107,000 115,000 Prepaid Advertising 10,000 14,000 Plant Assets 360,000 210,000 Accumulated Depreciation (80,000) (56,000) Total Assets $519,000 $364,000 Liabilities and Stockholders’ Equity Accounts Payable…arrow_forwardChoose the correct answer and pls provide the formula A Company’s net accounts receivable were P250,000 as of December 31, 2018, and P300,000 as of December 31, 2019. Net cash sales for 2019 were P100,000. The accounts receivable turnover for 2019 was 5.0. What were the Company’s total net sales for 2019? *a. P1,175,000.00b. P1,275,000.00c. P1,375,000.00d. P1,475,000.00e. P1,575,000.00arrow_forwardPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS (Not written.. please) 2) The company La Planetaria, S.A., presents you with the following income statement and additional information, so that you can support it with the calculations to make a decision on the planning of its cash management. La Planetaria, S.A. Income Statement 2020 Sales.................................................... $35'112,356.84 Cost of Sales.................................. 18'960,672.69 Gross Profit....................................... $16'151,684.15 Operating Expenses.......................... 7'258,741.36 Operating Income......................... $ 8'892,942.79 Financial Expenses.............................. 2'940,168.18 UAIR(Integrated Risk Management…arrow_forward

- PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS (Not written.. please) 2) The company La Planetaria, S.A., presents you with the following income statement and additional information, so that you can support it with the calculations to make a decision on the planning of its cash management. La Planetaria, S.A. Income Statement 2020 Sales.................................................... $35'112,356.84 Cost of Sales.................................. 18'960,672.69 Gross Profit....................................... $16'151,684.15 Operating Expenses.......................... 7'258,741.36 Operating Income......................... $ 8'892,942.79 Financial Expenses.............................. 2'940,168.18 UAIR(Integrated Risk Management…arrow_forwardHampton Industries had $50,000 in cash at year-end 2015 and $14,000 in cash at year-end 2016. The firm invested in property, plant, and equipment totaling $280,000. Cash flow from financing activities totaled +$210,000. Round your answers to the nearest dollar, if necessary. What was the cash flow from operating activities? Enter cash outflows with a minus sign.$ If accruals increased by $45,000, receivables and inventories increased by $185,000, and depreciation and amortization totaled $61,000, what was the firm's net income?arrow_forwardRomano Inc. has the following data. What is the firm's cash conversion cycle? Inventory Conversion Period = 59 days Receivables Collection Period = 19 days Payables Deferral Period = 41 days Please explain process and show calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License