a.

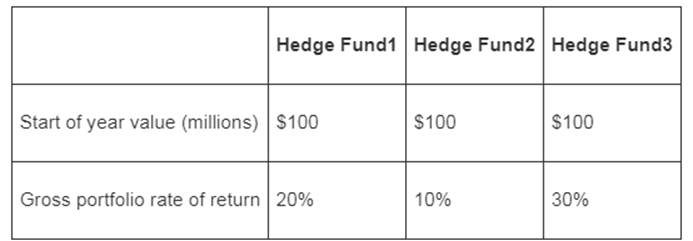

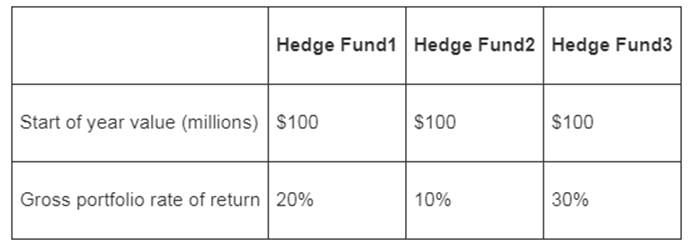

To compute: The

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

b.

Adequate information:

To compute: The value of the investor’s portfolio at the end of the year.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

c.

To evaluate: The investor’s rate of return in SA fund is higher than in FF.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

d.

To compute: The return on the portfolio held by hedge fund.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

e.

Adequate information:

To evaluate: Whether the FF and SA funds will charge incentive fees.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

f.

To evaluate: The reason behind the investor of FF still doing worse than the investor in SA funds.

Introduction:

Hedge Fund: Nowadays, the individual investments of different investors are collected and pooled. Later, this consolidated amount is reinvested in assets. The consolidated amount can be termed as hedge fund.

Want to see the full answer?

Check out a sample textbook solution

- A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 5.4%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (S) 15% 44% Bond fund (B) 8 38 The correlation between the fund returns is 0.15.Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. (Do not round intermediate calculations and round your final answers to 2 decimal places. Omit the "%" sign in your response.)arrow_forwardA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected return Standard Deviation Stock fund 20% 30% Bond Fund 12 15 The correlation between the fund returns is 0.10. Tabulate the investment opportunity set of the two risky funds. (Round your answers to 2 decimal places.) Proportion in Stock fund Proportion in bond fund Expexted return Standard deviation 0% 100% 20% 80% 40% 60% 60% 40% 80% 20% 100% 0%arrow_forwardA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 6%. The probability distribution of the risky funds is as follows: E(r) st. dev. stock fund .24 .33 bond fund .14 .22 The correlation between the fund returns is 0.14. You require that your portfolio yield an expected return of 16%, and that it be efficient, on the best feasible CAL. a. What is the standard deviation of your portfolio? (Round your answer to 2 decimal places.) b. What is the proportion invested in the T-bill fund and each of the two risky funds? (Round your answers to 2 decimal places.)arrow_forward

- [The following information applies to the questions displayed below.] A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Expected Return Standard Deviation Stock fund (S) 16% 40% Bond fund (B) 10% 31% The correlation between the fund returns is 0.11. Required: What is the Sharpe ratio of the best feasible CAL?arrow_forwardSuppose you are the money manager of an Rs.8 million investment fund. The fund consists of 4 stocks with the following investments and betas: Stock Investment Beta A Rs.800,000 1.2 B 1200,000 (0..3) C 2,000,000 1.0 D 4,000,000 0.6 If the market required rate of return is 13.5 percent and the risk-free rate is 5.5 percent, what is the fund's required rate of return? Change the weightages of the investments with your own consent to increase the rate of return and also interpret your answer in a logicaarrow_forwardSuppose you are the money manager of a $4.82 millioninvestment fund. The fund consists of four stocks with the following investments and betas:Stock Investment BetaA $ 460,000 1.50B 500,000 (0.50)C 1,260,000 1.25D 2,600,000 0.75If the market’s required rate of return is 8% and the risk-free rate is 4%, what is the fund’s required rate of return?arrow_forward

- Suppose you are the money manager of a $4.72 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 560,000 1.50 B 600,000 (0.50 ) C 1,160,000 1.25 D 2,400,000 0.75 If the market's required rate of return is 13% and the risk-free rate is 5%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardConsider a no-load mutual fund with $457 million in assets and 12 million shares at the start of the year, and $520 million in assets and 13.21 million shares at the end of the year. During the year investors have received income distributions of $2.25 per share, and capital gains distributions of $1.57 per share. Assume that the fund carries no debt. What is the rate of return on the fund? Group of answer choices 15.33% 13.03% 13.39% 12.31% 11.42%arrow_forwardSuppose that a mutual fund agent approaches you and promote a fund which allows you to withdraw money from your Employment Provident Fund (EPF) to invest. From the analysis of the agent, the fund expected to pay up to 11% return, and you know that EPF paid an average 6% return and treasury’s return fixed at 2.75%. Based on the discussion in this chapter and in your opinion, are you going to take the investment? Justify your answerarrow_forward

- Suppose you are the money manager of a $4.82 millioninvestment fund. The fund consists of four stocks with the following investments and betas:Stock Investment BetaA $ 460,000 1.50B 500,000 (0.50)C 1,260,000 1.25D 2,600,000 0.75 If the market’s required rate of return is 8% and the risk-free rate is 4%, what is the fund’srequired rate of return?8-8 BETA COEFFICIENT Given tarrow_forwardThe following information applies to the questions displayed below A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5% The probability distributions of the risky funds are: Stock fund Bond fund Expected Return 17% 11 Standard Deviation 34% 25 The correlation between the fund returns is 0.15. Required: What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Sharpe ratioarrow_forwardA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 4.5%. The probability distributions of the risky funds are: Expected Return Standard Deviation Stock fund (S) 15% 40% Bond fund (B) 9% 31% The correlation between the fund returns is 0.15. Required: Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. (Do not round intermediate calculations and round your final answers to 2 decimal places.)arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning