International Edition---principles Of Corporate Finance, 12th Edition

12th Edition

ISBN: 9781259692178

Author: Richard Brealey And Stewart Myers

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 29, Problem 1PS

Summary Introduction

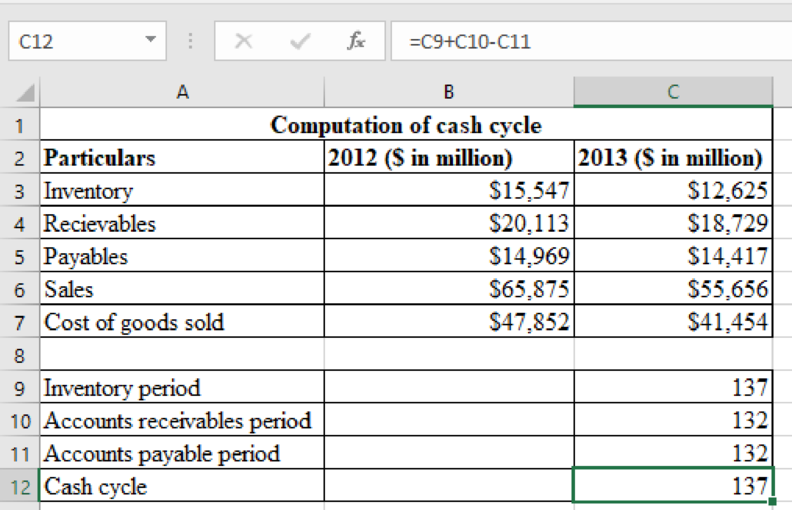

To determine: The cash cycle of company E.

Cash cycle is the overall circulation or cycle of cash commences from the payment of raw materials and ends with receipt of cash on goods sold.

Expert Solution & Answer

Explanation of Solution

Computation of cash cycle is as follows:

Therefore, the cash cycle of the company E is 137 days.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Make a Summary of USES and SOURCES of Cash, then make a CASH FLOW STATEMENT, given the Income Statements and Balance Sheets for 2012 and 2013.

Considering 2012 as the base year, you are required to compute the trend index for the following items:

Revenue, cost of goods sold, total expenses and net earnings. Comment on the trends of each of the items.

Total assets, total liabilities and shareholders’ equity. Comment on the trends of each of the items.

Cash flow from operation, cash flow from investing, cash flow from financing and closing cash balances. Comment on the trends of each of the items.

Calculate the net cash flow from financing activities for 2008.

The following selected account balances were taken from Buckeye Company's general ledger at January 1, 2008, and December 31, 2008:

January 1, 2008 December 31, 2008

Inventory 59,000 41,000

Accounts payable 52,000 71,000

Mortgage payable 120,000 95,000

Salaries payable 9,000 3,000

Investments 75,000 68,000

Accounts receivable 63,000 96,000

Land 58,000 88,000

Common stock 100,000 180,000

Retained earnings 22,000 34,000

The following information was taken from Buckeye Company's 2008 income statement:

Sales Revenue $420,000

Cost of goods sold 300,000

Salaries expense 88,000

Loss on sale of investments 6,000

Net income $26,000

Chapter 29 Solutions

International Edition---principles Of Corporate Finance, 12th Edition

Ch. 29 - Prob. 1PSCh. 29 - Prob. 2PSCh. 29 - Sources and uses of cash and working capital...Ch. 29 - Sources and uses of cash State whether each of the...Ch. 29 - Prob. 5PSCh. 29 - Forecasts of payables Dynamic Futon forecasts the...Ch. 29 - Prob. 8PSCh. 29 - Prob. 9PSCh. 29 - Prob. 10PSCh. 29 - Prob. 11PS

Ch. 29 - Cash cycle A firm is considering several policy...Ch. 29 - Prob. 13PSCh. 29 - Collections on receivables If a firm pays its...Ch. 29 - Short-term financial plans Which items in Table...Ch. 29 - Prob. 16PSCh. 29 - Short-term financial plans Work out a short-term...Ch. 29 - Prob. 18PSCh. 29 - Prob. 19PSCh. 29 - Long-term financial plans Corporate financial...Ch. 29 - Prob. 21PSCh. 29 - Long-term financial plans a. Use the Dynamic...Ch. 29 - Long-term plans The financial statements of Eagle...Ch. 29 - Forecast growth rate a. What is the internal...Ch. 29 - Forecast growth rate Bio-Plasma Corp. is growing...Ch. 29 - Long-term plans Table 29.19 shows the 2016...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Tifton Co. had the following cash transactions during the current year: Prepare the investing activities section of Tiftons statement of cash flows.arrow_forwardn its fiscal 2010 balance sheet, Big Lots, Inc., reported cash and cash equivalents at the start of the year of $283,733 thousand. By the end of the year, the cash and cash equivalents had decreased to $177,539 thousand. The company's statement of cash flows reported cash from operating activities of $315,257 thousand, cash from financing activities of ($306,899) thousand. What amount did the company report for cash from investing activities? Select one: a. $8,358 thousand cash inflow b. $106,194 thousand cash outflow c. $114,552 thousand cash outflow d. $114,552 thousand cash inflow e. None of the above.arrow_forwardMake a Summary of USES and SOURCES of Cash, then make a CASH FLOW STATEMENT, given the Income Statements and Balance Sheets for 2012 and 2013 XYZ Company, Balance Sheet for 12/31/2012 and 12/31/2013. 2012 2013 Cash $15,000 $14,000 Marketable Securities 6,000 6,200 Accounts Receivable 42,000 33,000 Inventory 51,000 84,000 Prepaid Rent 1,200 1,100 Total Current Assets 115,200 138,300 Gross Plant & Equipment 346,000 360,000 Accumulated Depreciation -60,000 -90,000 Total Assets 401,200 408,300 Accounts Payable 48,000 57,000 Notes Payable 15,000 13,000 Accruals 6,000 5,000 Total Current Liabilities 69,000 75,000 Long Term Debt 160,000 150,000 Common Stockholders Equity 172,200 183,300 Total Liabilities & Equity 401,200 408,300 XYZ Company, Income Statement for the Year Ended 12/31/2013 Sales (all credit) $600,000 Less: Cost Of Goods Sold 460,000 Gross Profit 140,000 Less Operating & Interest Expenses…arrow_forward

- Prepare a statement of cash flows for 2012 for Garcia Corporation Presented below is a condensed version of the comparative balance sheets for Garcia Corporation for the last two years at December 31 2014 2013 Cash 442,500 195,000 Accounts Receivable 450,000 462,500 Investments 130,000 185,000 Equipment 745,000 600,000 Less: Accumulated Depreciation (265,000) (222,500) Current Liabilities 377,500 377,500 Capital Stock 400,000 400,000 Retained Earnings 767,500 442,500 Additional Informaiton Investments were sold at a loss (not extraordinary) of $25,000 Cash Dividends were paid $75,000 Net Income was $400,000 Instructions: Prepare a statement of Cash Flows for 2012 for Garcia Corporation Determine Garcia Corporations Free Cash Flowarrow_forwardPrepare a statement of cash flows for the year 2012, following the proper format using following data: OLYMPIC, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2011 Revenue and gains: Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $900,000 Dividend revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,000 Interest revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6,000 Gain on sales of plant assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .31,000 Total revenue and gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..$940,000 Costs, expenses, and losses: Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $500,000 Operating expenses (including depreciation of $40,000) . . . . . . . . . 300,000 Interest expense. . . . . . . . . . . . . . .…arrow_forwardStatement of Cash FlowPresented below are the financial statements for the Amphlett Corporation, as of year-end 2012 and 2013. AMPHLETT CORPORATIONConsolidated Balance Sheets As of Year-End ($ thousands) 2013 2012 Assets Current Cash $18,000 $108,000 Marketable securities 240,000 - Accounts receivable (net) 708,000 528,000 Inventory 720,000 738,000 Total current assets 1,686,000 1,374,000 Noncurrent Long-term investments 372,000 468,000 Property & equipment 2,160,000 1,320,000 Less: Accumulated depreciation (600,000) (600,000) Property & equipment (net) 1,560,000 720,000 Intangibles (net) 114,000 126,000 Total noncurrent assets 2,046,000 1,314,000 Total assets $3,732,000 $2,688,000 Liabilities & Shareholders' Equity Accounts payable $1,080,000 $1,020,000 Short-term bank debt 228,000 - Total liabilities 1,308,000 1,020,000…arrow_forward

- How do you calculate ''Net increase in cash" & "Cash End of the year" for the statement of Cash Flows? I am looking at a balance sheet and income statementarrow_forwardRon Nord and Lisa Smith are examining the following statement of cash fl ows for Carpino Company for the year ended January 31, 2012. CARPINO COMPANY Statement of Cash Flows For the Year Ended January 31, 2012 Sources of cash From sales of merchandise $380,000 From sale of capital stock 420,000 From sale of investment (purchased below) 80,000 From depreciation 55,000 From issuance of note for truck 20,000 From interest on investments 6,000 Total sources of cash 961,000 Uses of cash For purchase of fi xtures and equipment 330,000 For merchandise purchased for resale 258,000 For operating expenses (including depreciation) 160,000 For purchase of investment 75,000 For purchase of truck by issuance of note 20,000 For purchase of treasury stock 10,000 For interest on note payable 3,000 Total uses of cash 856,000 Net increase in cash $105,000 Ron claims that Carpino’s statement of cash fl ows is an excellent portrayal of a superb fi rst year with cash…arrow_forwardForecast the Statement of Cash FlowsFollowing are the income statements and balance sheets of Best Buy Co., Inc. Income Statement,Fiscal Years Ended ($ millions) 2012Estimated Feb. 26,2011 Revenue $52,534 $50,272 Cost of goods sold 39,295 37,611 Restructuring charges - cost of goods sold -- 24 Gross profit 13,239 12,637 Selling, general and administrative expenses 10,769 10,325 Restructuring charges -- 198 Goodwill and tradename impairment -- -- Operating income 2,470 2,114 Other income (expenses) Investment income and other 51 51 Interest expense (87) (87) Earnings before income tax expense and equity in income of affiliates 2,434 2,078 Income tax expense 837 714 Equity in income of affiliates 2 2 Net earnings including noncontrolling interests 1,599 1,366 Net earnings attributable to noncontrolling interests (120) (89) Net earnings attributable to Best Buy Co., Inc. $1,479 $1,277 Balance Sheet($ millions) 2012Estimated Feb. 26,2011…arrow_forward

- Adjust the Cash BalanceWe obtain the following 2018 forecasts of selected financial statement line items for Journey Company. $ millions 2017 Actual 2018 Est. Net Sales $747,442 $779,327 Marketable securities 67,096 62,096 Long-term debt 346,558 308,437 Treasury stock (deducted from equity) 51,174 51,174 Cash generated by operations 57,918 Cash used for investing (15,130) Cash used for financing (54,438) Total net change in cash (11,650) Cash at beginning of period 51,141 Cash at end of period $39,491 a. Does forecasted cash deviate from the normal level for this company?Calculate the company's normal cash level as a percentage of sales.Round answer to one decimal place.Answer% Using the rounded answer above, compute what should be the normal cash balance for FY2018.Round answer to the nearest million. million C. Complete the following statement of cash flows assuming long-term debt is used to adjust the forecasted cash balance. Use…arrow_forwardUse the following financial statements and additional information to prepare the operating, investing, and financing sections of the statement of cash flows for the year ended December 31, 2012 using the indirect method. Derby Company Balance Sheets December 31 2012 2011 Change Assets: Cash $ 85,600 $ 65,200 20,400 Accounts receivable, net 72,850 56,750 16,100 Merchandise inventory 157,750 144,850 12,900 Prepaid expenses 6,080 12,680 (6,600) Equipment 280,600 245,600 35,000 Accumulated depreciation-Equipment (80,600) (97,600) 17,000 Total assets $522,280 $427,480 94,800 Liabilities: Accounts payable $ 52,850 $ 45,450 7,400 Income taxes payable…arrow_forwardHow to prepare a statement of cash flows ? To prepare a statment of cash flows for the year 2014 2014 2013 Cash 177,000 78,000 Accounts recievable 180,000. 185,000 Investments 52,000 74,000 Equipment 298,000 240,000Accoumulated depreciation-- equipment (106,000) (89,000) Current Liabalities 134,000 151,000 Common stock 160,000 160,000 Retained Earnings 307,000 177,000 Additional Infomation : Investments were sold at loss (not extraordinary) of 10,000; no…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License