Concept explainers

The city manager of University City is finalizing the budget proposal that must be submitted to the city council 60 days prior to the July 1 start of the next fiscal year, FY 20X2. An economic recession has significantly reduced the city’s revenues over the past two years, particularly sales taxes and building permit fees. Despite strong political pressures on city council members to sustain current city services, the legal requirement to balance the budget has forced the council to cut certain services and staffing levels over the past two years. Federal financial assistance has prevented even deeper cuts, but will be sharply reduced at the end of FY 20X1. Even though the economy has gradually improved, reduced federal support will make achieving a balanced budget even more difficult in FY 20X2.

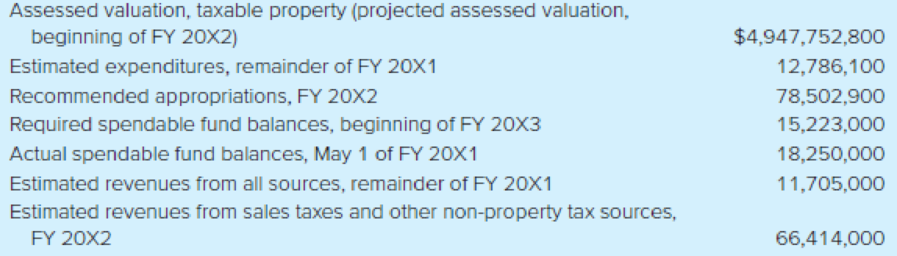

Constraints and planning factors: The city council has mandated that there be no increase in fees and taxes in FY 20X2. Although retail sales and housing starts are projected to increase modestly in FY 20X2, the assessed valuation of taxable property is projected to decrease an additional 5 percent in FY 20X2, reflecting the continuing decline in property values. Moreover, General Fund operating costs, particularly employee health insurance and energy, are expected to outpace revenue growth. Consequently, the city manager is recommending a third consecutive year of no salary and wage increases for city employees. The following financial information is provided as of May 1 of FY 20X1.

General Fund

Analysis and estimation of required property tax rate for FY 20X2: After analyzing the preceding information, constraints, and planning factors, respond to the following questions. (Keep in mind, however, that the city council may impose further changes to the budget as a result of the several budget hearings that will be held over the next two months.)

- a. What amount of estimated revenues is required from property taxes for FY 20X2? (Hint: Make your calculation using the format shown in Illustration 3–6.)

- b. What tax rate will be required in FY 20X2 to generate the amount of revenues from property taxes calculated in question a?

- c. Assuming the property tax rate for FY 20X1 was $0.20 per $100 of assessed valuation of taxable property, will the tax rate calculated in question b violate the city council mandate of no increase in taxes? If so, how would you justify the rate calculated in question b, since the city council will likely be sensitive to adverse public reaction to an increased tax rate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Accounting For Governmental & Nonprofit Entities

- The City of Bainland has been undergoing financial difficulties because of a decrease in its tax base caused by corporations leaving the area. On January 1, 2017, the city has a fund balance of only $400,000 in its governmental funds. In 2016, the city had revenues of $1.4 million and expenditures of $1.48 million. The city's treasurer has forecast that, unless something is done, revenues will decrease at 2 percent per year while expenditures will increase at 3 percent per year. Required Create a spreadsheet to predict in what year the government will have a zero fund balance. One proposal is that the city slash its expenditures by laying off government workers. That will lead to a 3 percent decrease in expenditures each year rather than a 3 percent increase. However, because of the unemployment, the city will receive less tax revenue. Thus, instead of a 2 percent decrease in revenues, the city expects a 5 percent decrease per year. Adapt the spreadsheet created in requirement (1) to…arrow_forwardGovernment officials of the City of Jones expect to receive general fund revenues of $400,000 in 2017 but approve spending only $380,000. Later in the year, as they receive more information, they increase the revenue projection to $420,000. Officials also approve the spending of an additional $15,000. For each of the following, indicate whether the statement is true or false and, if false, explain why. In recording this budget, appropriations should be credited initially for $380,000. The city must disclose this budgetary data within the required supplemental information section reported after the notes to the financial statements. When reporting budgetary information for the year, three figures should be reported: amended budget, initial budget, and actual figures. In making the budgetary entry, a debit must be made to some type of Fund Balance account to indicate the projected surplus and its effect on the size of the fund. The reporting of the budget is reflected in the…arrow_forwardGovernment officials of the City of Jones expect to receive general fund revenues of $400,000 in 2017 but approve spending only $380,000. Later in the year, as they receive more information, they increase the revenue projection to $420,000. Officials also approve the spending of an additional $15,000. For each of the following, indicate whether the statement is true or false and, if false, explain why.a. In recording this budget, appropriations should be credited initially for $380,000.b. The city must disclose this budgetary data within the required supplemental information section reported after the notes to the financial statements.c. When reporting budgetary information for the year, three figures should be reported: amended budget, initial budget, and actual figures.d. In making the budgetary entry, a debit must be made to some type of Fund Balance account to indicate the projected surplus and its effect on the size of the fund.e. The reporting of the budget is reflected in the…arrow_forward

- The Finch Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,312 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.40. The cost driver for meals was attendance, which was expected to be 1,460 individuals. Postage was based on $0.56 per invitation and 3,300 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,600 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,100. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FINCH MANAGEMENT ASSOCIATION…arrow_forwardThe Franklin Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,818 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.50. The cost driver for meals was attendance, which was expected to be 1,470 individuals. Postage was based on $0.58 per invitation and 3,350 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,700 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,200. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FRANKLIN MANAGEMENT…arrow_forwardLast year the Diamond Manufacturing Company purchased over $10 million worth of of- fice equipment under its “special ordering” system, with individual orders ranging from $5,000 to $30,000. Special orders are for low-volume items that have been included in a department manager’s budget. The budget, which limits the types and dollar amounts of office equipment a department head can requisition, is approved at the beginning of the year by the board of directors. The special ordering system functions as follows.Purchasing A purchase requisition form is prepared and sent to the purchasing de- partment. Upon receiving a purchase requisition, one of the five purchasing agents (buyers) verifies that the requester is indeed a department head. The buyer next se- lects the appropriate supplier by searching the various catalogs on file. The buyer then phones the supplier, requests a price quote, and places a verbal order. A prenumbered purchase order is processed, with the original sent to the…arrow_forward

- The finance director of the Bethandy Independent School District is making preliminary estimates of the budget outlook for the General Fund for the 20x8 fiscal year. These estimates will permit the superintendent to advise the department heads properly when budget instructions and forms are distributed. She has assembled the following information: Estimated 20X7 Expected Change- 20X8 1. Revenues Property Taxes............................................................................ $2,000,000 +6% State aid....................................................................................... 1,000,000 +3% Federal grants.............................................................................. 500,000 -$40,000 Other............................................................................................ 300,000 +$10,000 $3,800,000 2. Expenditures Salaries and…arrow_forward1 The city in which you live provides its budget information in monthly budgetary control reports with each month representing 1/12th of the overall budget. You overhear several managers discussing the budget at a community meeting. You were surprised to hear that half of the managers liked this process and that the other half felt that it did not adequately match their expenses. Discuss the issues regarding the preparation of the budgets and why half of the departments liked the process and why the other half did not like the process. Complete the following: Give examples of 1 department on each side of this controversy. Can the budgeting process be made more reflective of the work actually being completed? Explain your answer.arrow_forwardA city maintains an internal audit department and accounts for it in its general fund. In the coming year, the department will purchase $300,000 of computer and other office equipment, all of which will be paid for out of current resources (i.e., not with debt).City officials have given top priority to reducing general fund expenditures. To that end, the city comptroller has proposed accounting for the internal audit department in an internal service fund rather than in the general fund. As envisioned by the comptroller, the audit department would bill each of the units (all of which are accounted for in the general fund) for each audit performed. Fees would be established so that they would cover all audit department costs. The fund would be established by a transfer of $300,000 from the general fund to cover the cost of the new equipment.The city estimates that for the coming year the audit department's operating costs, excluding any costs relating to the new equipment, will be…arrow_forward

- A city maintains an internal audit department and accounts for it in its general fund. In the coming year, the department will purchase $300,000 of computer and other office equipment, all of which will be paid for out of current resources (i.e., not with debt).City officials have given top priority to reducing general fund expenditures. To that end, the city comptroller has proposed accounting for the internal audit department in an internal service fund rather than in the general fund. As envisioned by the comptroller, the audit department would bill each of the units (all of which are accounted for in the general fund) for each audit performed. Fees would be established so that they would cover all audit department costs. The fund would be established by a transfer of $300,000 from the general fund to cover the cost of the new equipment.The city estimates that for the coming year the audit department's operating costs, excluding any costs relating to the new equipment, will be…arrow_forwardScenario: A city ordinance provides that “no money shall be spent for any purpose without the prior approval of the city council.” In approving the budget for the year, the council had authorized spending $1,300,000 for road maintenance. Late in the year, after the city had spent virtually the entire $1,300,000, a major storm washed out portions of several roads leading to the elementary school. The school was inaccessible, and the mayor wanted to enter into an emergency contract to repair the roads. City engineers estimated that the cost of the repairs would be about $350,000. If the city entered into such a contract, the total amount spent on road maintenance for the year would be higher than the amount authorized. Recognizing the need for prompt action, the mayor immediately entered into the contract without seeking prior city council approval. What are the legal, financial, and accounting systems implications of this scenario?arrow_forwardThe directors of Hamble Ltd have asked you, as a recently employed assistant management accountant, to prepare and review their cash budget. The bookkeeper started the cash budget but was unable to complete it due to ill health. In addition, Hamble Ltd requires you to evaluate the different funding options for its expansion plans. Estimated sales and purchases for each of the nine months to September are given below: Jan £,000 Feb £,000 Mar £,000 April £,000 May £,000 June £,000 July £,000 Aug £,000 Sept £,000 Credit sales 9,500 8,000 6,000 11,000 12,350 14,000 13,250 4,500 12,500 Cash sales 250 350 800 600 620 900 500 350 800 Credit purchases 6,000 5,200 5,800 8,000 8,700 6,300 5,200 5,000 5,100 Trade Receivables: Credit sales are to be collected two months after the date they have been sold. Trade Payables: Credit purchases are to be paid one month after the date they have been…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub