Concept explainers

The city manager of University City is finalizing the budget proposal that must be submitted to the city council 60 days prior to the July 1 start of the next fiscal year, FY 20X2. An economic recession has significantly reduced the city’s revenues over the past two years, particularly sales taxes and building permit fees. Despite strong political pressures on city council members to sustain current city services, the legal requirement to balance the budget has forced the council to cut certain services and staffing levels over the past two years. Federal financial assistance has prevented even deeper cuts, but will be sharply reduced at the end of FY 20X1. Even though the economy has gradually improved, reduced federal support will make achieving a balanced budget even more difficult in FY 20X2.

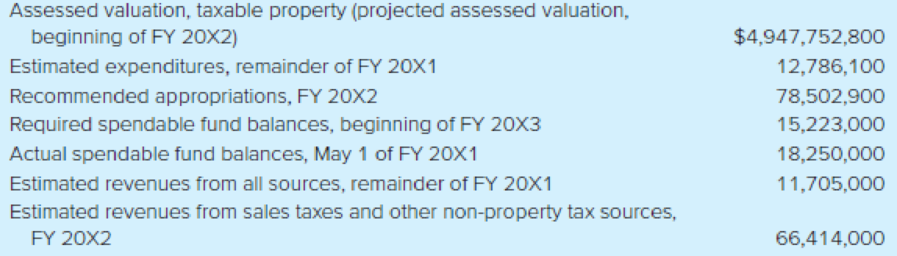

Constraints and planning factors: The city council has mandated that there be no increase in fees and taxes in FY 20X2. Although retail sales and housing starts are projected to increase modestly in FY 20X2, the assessed valuation of taxable property is projected to decrease an additional 5 percent in FY 20X2, reflecting the continuing decline in property values. Moreover, General Fund operating costs, particularly employee health insurance and energy, are expected to outpace revenue growth. Consequently, the city manager is recommending a third consecutive year of no salary and wage increases for city employees. The following financial information is provided as of May 1 of FY 20X1.

General Fund

Analysis and estimation of required property tax rate for FY 20X2: After analyzing the preceding information, constraints, and planning factors, respond to the following questions. (Keep in mind, however, that the city council may impose further changes to the budget as a result of the several budget hearings that will be held over the next two months.)

- a. What amount of estimated revenues is required from property taxes for FY 20X2? (Hint: Make your calculation using the format shown in Illustration 3–6.)

- b. What tax rate will be required in FY 20X2 to generate the amount of revenues from property taxes calculated in question a?

- c. Assuming the property tax rate for FY 20X1 was $0.20 per $100 of assessed valuation of taxable property, will the tax rate calculated in question b violate the city council mandate of no increase in taxes? If so, how would you justify the rate calculated in question b, since the city council will likely be sensitive to adverse public reaction to an increased tax rate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

- Communication The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided equally among the 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be returned to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for all departments in a recent fiscal year. The chart was as follows: Write a memo to Stacy Poindexter, the city manager, interpreting the chart and suggesting improvements to the budgeting system.arrow_forwardShepherd City's original budget included a credit to fund balance of $20,000. During the year, the City recorded an additional entry that debited budgetary fund balance and credited estimated revenues. Which of the following accurately describes what happened? The estimated revenues decreased, reducing the City's projected surplus for the year. The estimated revenues decreased, improving the City's projected surplus for the year. The estimated revenues increased, reducing the City's projected surplus for the year. The estimated revenues increased, improving the City's projected surplus for the year.arrow_forward"The City of Lakeview adopts its budget on a basis of accounting that permits outstanding purchase commitments to be charged against the budget in the year that the goods are ordered instead of in the year they are received. During the year the city ordered and received $4,000 of supplies (of which $3,000 had been paid and $1,000 was unpaid) and had $500 of outstanding purchase commitments for supplies at year-end. In the budget-to-actual comparison, the expenditures for supplies would be: ""$3,000" "$3,500" "$4,000 " "$4,500"arrow_forward

- Salsabella Berhad manufactures and sells an electrical component. The Covid-19 pandemic has affected the company’s operation due to several lockdown in the country. The company is struggling to manage its cash flows. The business’ bank balance at the end of the year is projected to be an overdraft of RM170,000. As an accountant for Salsabella Berhad, you have prepared the following budgetary information to be presented in a board meeting: Sales volumes are projected as follows: Year 1 Year 2 Quarter 4 Quarter 1 Quarter 2 Quarter 3 Quarter 4 100,000 units 100,000 units 80,000 units 60,000 units 140,000 units The selling price of the component is currently RM11.00 per unit and this is expected to increase to RM12.00 per unit from the start of Quarter 2 in Year 2. All sales are on credit and customers settle their debts in the Quarter following sale. Irrecoverable debts of 5% of total sales revenue are anticipated. The company…arrow_forwardThe Franklin Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,818 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.50. The cost driver for meals was attendance, which was expected to be 1,470 individuals. Postage was based on $0.58 per invitation and 3,350 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,700 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,200. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FRANKLIN MANAGEMENT…arrow_forwardThe Finch Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,312 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.40. The cost driver for meals was attendance, which was expected to be 1,460 individuals. Postage was based on $0.56 per invitation and 3,300 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,600 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,100. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FINCH MANAGEMENT ASSOCIATION…arrow_forward

- Tri-County Social Service Agency is a not-for-profit organization in the Midwest. Use the following Information to complete the cash budget for the year ending December 31. The Board of Trustees requires that Tri-County maintain a minimum cash balance of $8,000. If cash is short, the agency may borrow from an endowment fund the amount required to maintain the $8,000 minimum. It is anticipated that the year will begin with an $11,000 cash balance. Contract revenue is received evenly during the year. Mental health Income is expected to grow by $5,000 in the second and third quarters; no change is expected in the fourth quarter. Required: 2. Complete the cash budget for each quarter and the year as a whole. 3. Determine the amount that the agency will owe the endowment fund at year-end. Complete this question by entering your answers in the tabs below. Required 2 Required 3 Complete the cash budget for each quarter and the year as a whole. (Cash deficiency and repayments should be…arrow_forwardWhich of the following cases is an example of (a) rational decision making (b) disjointed incrementalism or ‘incremental decision making’ by Lindblom (c) satisficing . 1. In the face of an anticipated deficit, the governor and his budget bureau are deliberating on possible across the board budget cuts of 4%, 6% or 8% of last year’s allocations to all state agencies and departments. They finally decide on 6% because this will come closest to eliminating the deficit, while not risking as much political criticism/hostility as the 8% cut. 2. You are looking for a good used car, and have a budget of M2,500.00. You make your selection by identifying several reputable dealers and examining and pricing out the models you like. Each model you look at is either too expensive, or it has some critical defects. Eventually you find a car “you can live with”, and though it is priced are M3, 000.00, after bargaining the dealer agrees to sell for M2,750.00, and you buy. 3. A neighbourhood…arrow_forwardLast year the Diamond Manufacturing Company purchased over $10 million worth of of- fice equipment under its “special ordering” system, with individual orders ranging from $5,000 to $30,000. Special orders are for low-volume items that have been included in a department manager’s budget. The budget, which limits the types and dollar amounts of office equipment a department head can requisition, is approved at the beginning of the year by the board of directors. The special ordering system functions as follows.Purchasing A purchase requisition form is prepared and sent to the purchasing de- partment. Upon receiving a purchase requisition, one of the five purchasing agents (buyers) verifies that the requester is indeed a department head. The buyer next se- lects the appropriate supplier by searching the various catalogs on file. The buyer then phones the supplier, requests a price quote, and places a verbal order. A prenumbered purchase order is processed, with the original sent to the…arrow_forward

- Government officials of the City of Jones expect to receive general fund revenues of $400,000 in 2017 but approve spending only $380,000. Later in the year, as they receive more information, they increase the revenue projection to $420,000. Officials also approve the spending of an additional $15,000. For each of the following, indicate whether the statement is true or false and, if false, explain why. In recording this budget, appropriations should be credited initially for $380,000. The city must disclose this budgetary data within the required supplemental information section reported after the notes to the financial statements. When reporting budgetary information for the year, three figures should be reported: amended budget, initial budget, and actual figures. In making the budgetary entry, a debit must be made to some type of Fund Balance account to indicate the projected surplus and its effect on the size of the fund. The reporting of the budget is reflected in the…arrow_forwardAs a consultant to President James Davis at Red Lake State University, you are assigned to assist in performing a 5% across–the-board cut to reduce the budget deficit. He asks you to write a paragraph narrative as to why a budget cut should be implemented. Please prepare your narrative with a clear justification that is supported with examples.arrow_forwardThe city council of Temecula approved the 2013 budget as follows: Budgeted 2013 revenues from: Property taxes $6,000,000 Sales taxes $2,000,000 Appropriations for 2013: Salaries $5,600,000 Materials $2,200,000 Equipment $125,000 Required: Prepare the general journal entry necessary to initially record the budget on 1/1/13 Date Account Debit Creditarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub