Concept explainers

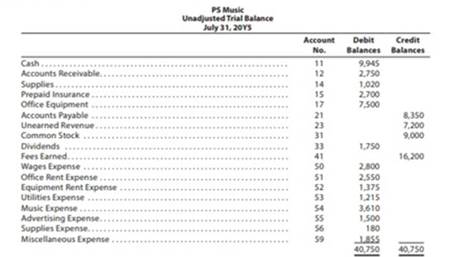

Continuing Problem

✓ 3. Total of Debit column: $42,340

The unadjusted

The data needed to determine adjustments are as follows:

• During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2.

• Supplies on hand at July 31, $275.

• The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2.

•

• The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2.

• Accrued wages as of July 31 were $140.

Instructions

1. Prepare adjusting

18 Accumulated Depreciation—Office Equipment

22 Wages Payable

57 Insurance Expense

58 Depreciation Expense

2. Post the

3. Prepare an adjusted trial balance.

(1)

To prepare: The adjusting entries in the books of Company PS at the end of the July 31, 20Y5

Explanation of Solution

Adjusting entries: Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare adjusting entries.

| Journal Page 18 | ||||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | ||

| 20Y5 | ||||||

| July | 31 | Accounts receivable | 12 | 1,400 | ||

| Fees earned | 41 | 1,400 | ||||

| (To record the fees earned at the end of July) | ||||||

| 31 | Supplies expense | 56 | 745 | |||

| Supplies | 14 | 745 | ||||

| (To record supplies expense incurred at the end of the July) | ||||||

| 31 | Insurance expense | 57 | 225 | |||

| Prepaid insurance | 15 | 225 | ||||

| (To record insurance expense incurred at the end of the July) | ||||||

| 31 | Depreciation expense | 58 | 50 | |||

| Accumulated depreciation-Office equipment | 18 | 50 | ||||

| (To record depreciation expense incurred at the end of the July) | ||||||

| 31 | Unearned revenue | 23 | 3,600 | |||

| Fees earned | 41 | 3,600 | ||||

| (To record the service performed to the customer at the end of the July) | ||||||

| 31 | Wages expense | 50 | 140 | |||

| Wages payable | 22 | 140 | ||||

| (To record wages expense incurred at the end of the July) | ||||||

Table (1)

Working notes:

Calculated the value of accrued fees during the July

Calculate the value of supplies expense

Calculate the value of insurance expense

Calculate the value of unearned fees at the end of the July

(2)

To post: The adjusting entries to the ledger in the books of Company PS.

Explanation of Solution

T-account: T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

Post the adjusting entries to the ledger account as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 3,920 | |||

| 1 | 1 | 5,000 | 8,920 | ||||

| 1 | 1 | 1,750 | 7,170 | ||||

| 1 | 1 | 2,700 | 4,470 | ||||

| 2 | 1 | 1,000 | 5,470 | ||||

| 3 | 1 | 7,200 | 12,670 | ||||

| 3 | 1 | 250 | 12,420 | ||||

| 4 | 1 | 900 | 11,520 | ||||

| 8 | 1 | 200 | 11,320 | ||||

| 11 | 1 | 1,000 | 12,320 | ||||

| 13 | 1 | 700 | 11,620 | ||||

| 14 | 1 | 1,200 | 10,420 | ||||

| 16 | 2 | 2,000 | 12,420 | ||||

| 21 | 2 | 620 | 11,800 | ||||

| 22 | 2 | 800 | 11,000 | ||||

| 23 | 2 | 750 | 11,750 | ||||

| 27 | 2 | 915 | 10,835 | ||||

| 28 | 2 | 1,200 | 9,635 | ||||

| 29 | 2 | 540 | 9,095 | ||||

| 30 | 2 | 500 | 9,595 | ||||

| 31 | 2 | 3,000 | 12,595 | ||||

| 31 | 2 | 1,400 | 11,195 | ||||

| 31 | 2 | 1,250 | 9,945 | ||||

Table (2)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 1,000 | |||

| 2 | 1 | 1,000 | |||||

| 23 | 2 | 1,750 | 1,750 | ||||

| 30 | 2 | 1,000 | 2,750 | ||||

| 31 | Adjusting | 3 | 1,400 | 4,150 | |||

Table (3)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 170 | |||

| 18 | 850 | 1,020 | |||||

| 31 | Adjusting | 745 | 275 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | 1 | 2,700 | 2,700 | |||

| 31 | Adjusting | 3 | 225 | 2,475 | |||

Table (5)

| Account: Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 5 | 1 | 7,500 | 7,500 | |||

Table (6)

| Account: Accumulated Depreciation Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 250 | |||

| 3 | 1 | 250 | |||||

| 5 | 1 | 7,500 | 7,500 | ||||

| 18 | 2 | 850 | 8,350 | ||||

Table (8)

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 31 | Adjusting | 3 | 140 | 140 | ||

Table (9)

| Account: Unearned revenue Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | 1 | 7,200 | 7,200 | |||

| 31 | Adjusting | 3 | 3,600 | 3,600 | |||

Table (10)

| Account: P’s capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 4,000 | |||

| 1 | 1 | 5,000 | 9,000 | ||||

Table (11)

| Account: P’s drawings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 31 | 2 | 1,250 | 1,750 | ||||

Table (12)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 6,200 | |||

| 11 | 1 | 1,000 | 7,200 | ||||

| 16 | 2 | 2,000 | 9,200 | ||||

| 23 | 2 | 2,500 | 11,700 | ||||

| 30 | 2 | 1,500 | 13,200 | ||||

| 31 | 2 | 3,000 | 16,200 | ||||

| 31 | Adjusting | 3 | 1,400 | 17,600 | |||

| 31 | Adjusting | 3 | 3,600 | 21,200 | |||

Table (13)

| Account: Wages expense Account no. 50 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 400 | |||

| 14 | 1 | 1,200 | 1,600 | ||||

| 28 | 2 | 1,200 | 2,800 | ||||

| 31 | Adjusting | 3 | 140 | 2,940 | |||

Table (14)

| Account: Office rent expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 800 | |||

| 1 | 1 | 1,750 | 2,550 | ||||

Table (15)

| Account: Equipment rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 675 | |||

| 13 | 1 | 700 | 1,375 | ||||

Table (16)

| Account: Utilities expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 300 | |||

| 27 | 2 | 915 | 1,215 | ||||

Table (17)

| Account: Music expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 1,590 | |||

| 21 | 2 | 620 | 2,210 | ||||

| 31 | 2 | 1,400 | 3,610 | ||||

Table (18)

| Account: Advertising expense Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 8 | 1 | 200 | 700 | ||||

| 22 | 2 | 800 | 1,500 | ||||

Table (19)

| Account: Supplies expense Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 180 | |||

| 31 | Adjusting | 3 | 745 | 925 | |||

Table (20)

| Account: Insurance expense Account no. 57 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 31 | Adjusting | 3 | 225 | 225 | ||

Table (21)

| Account: Depreciation expense Account no. 58 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (22)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 415 | |||

| 4 | 900 | 1,315 | |||||

| 29 | 540 | 1,855 | |||||

Table (23)

(3)

To prepare: An adjusted trial balance of Company PS at July 31, 20Y5.

Explanation of Solution

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance of Company PS at July 31, 20Y5 as follows:

| Company PS | |||

| Adjusted Trial Balance | |||

| July 31, 20Y5 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 9,945 | |

| Accounts receivable | 12 | 4,150 | |

| Supplies | 14 | 275 | |

| Prepaid insurance | 15 | 2,475 | |

| Office equipment | 17 | 7,500 | |

| Accumulated depreciation-Equipment | 18 | 50 | |

| Accounts payable | 21 | 8,350 | |

| Wages payable | 22 | 140 | |

| Unearned revenue | 23 | 3,600 | |

| P's capital | 31 | 9,000 | |

| P's drawings | 32 | 1750 | |

| Fees earned | 41 | 21,200 | |

| Wages expense | 50 | 2,940 | |

| Office rent expense | 51 | 2,550 | |

| Equipment rent expense | 52 | 1,375 | |

| Utilities expense | 53 | 1,215 | |

| Music expense | 54 | 3,610 | |

| Advertising expense | 55 | 1,500 | |

| Supplies expense | 56 | 925 | |

| Insurance expense | 57 | 225 | |

| Depreciation expense | 58 | 50 | |

| Miscellaneous expense | 59 | 1,855 | |

| $42,340 | $42,340 | ||

Table (24)

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: Corporate Financial Accounting, Loose-leaf Version, 15th + CengageNOWv2, 1 term Printed Access Card

- Exercise 3-40 Revenue and Expense Recognition Electronic Repair Company repaired a high-definition television for Sarah Merrifield in December 2019. Sarah paid $80 at the time of the repair and agreed to pay Electronic Repair $80 each month for 5 months beginning on January 15, 2020. Electronic Repair used $120 of supplies, which were purchased in November 2020, to repair the television. Assume that Electronic Repair uses accrual-basis accounting. Required: In what month or months should revenue from this service be recorded by Electronic Repaid? In what month or months should the expense related to the repair of the television be recorded by Electronic Repair? CONCEPTUAL CONNECTION Describe the accounting principles used to answer the above questions.arrow_forwardExercise 3-47 Revenue Adjustments Sentry Transport Inc. of Atlanta provides in-town parcel delivery services in addition to a full range of passenger services. Sentry engaged in the following activities during the current year: Sentry received $5,000 cash in advance from Richs Department Store for an estimated 250 deliveries during December 2019 and January and February of 2020. The entire amount was recorded as unearned revenue when received. During December 2019, 110 deliveries were made for Richs. Sentry operates several small buses that take commuters from suburban communities to the central downtown area of Atlanta. The commuters purchase, in advance, tickets for 50 one-way rides. Each So-ride ticket costs S500. At the time of purchase, Sentry credits the cash received to unearned revenue. At year end, Sentry determines that 10,160 one-way rides have been taken. Sentry operates buses that provide transportation for the clients of a social agency in Atlanta. Sentry bills the agency quarterly at the end of January, April, July, and October for the that quarter. The contract price is S7,500 per quarter. Sentry follows the practice of recognizing revenue from this contract in the in which the service is On December 23, Delta Airlines chartered a bus to transport its marketing group to a meeting at a resort in southern Georgia. The meeting will be held during the last week in January 2020, and Delta agrees to pay for the entire trip on the day the bus departs. At year end, none Of these arrangements have been recorded by Sentry. Required: Prepare adjusting entries at December 31 for these four activities. CONCEPTUAL CONNECTION What would be the effect on revenue if the adjusting entries were not made?arrow_forwardComprehensive Problem 1, Period 2: The Accounting Cycle During the month of May 20--, The Generals Favorite Fishing Hole engaged in the following transactions. These transactions required an expansion of the chart of accounts as shown below. May 1In order to provide snacks for guests on a 24-hour basis, Night signed a contract with Snack Attack. Snack Attack will install vending machines with food and drinks and pay a 10% commission on all sales. Estimated payments are made at the beginning of each month. Night received a check for 200, the estimated commission on sales for May. 2Night purchased a surround sound system and big screen TV with a digital satellite system for the guest lounge. The surround sound system cost 3,600 and has an estimated useful life of five years and no salvage value. The TV cost 8,000, has an estimated useful life of eight years, and has a salvage value of 800. Night paid cash for both items. 2Paid for Mays programming on the new digital satellite system, 125. 3Nights office manager returned 100 worth of office supplies to Gordon Office Supply. Night received a 100 reduction on the account. 3Deposited registration fees, 52,700. May 3Paid rent for lodge and campgrounds for the month of May, 40,000. 3In preparation for the purchase of a nearby campground, Night invested an additional 600,000. 4Paid Gordon Office Supply on account, 400. 4Purchased the assets of a competing business and paid cash for the following: land, 100,000; lodge, 530,000; and fishing boats, 9,000. The lodge has a remaining useful life of 50 years and a 50,000 salvage value. The boats have remaining lives of five years and no salvage value. 5Paid Mays insurance premium for the new camp, 1,000. (See above transaction.) 5Purchased food supplies from Acme Super Market on account, 22,950. 5Purchased office supplies from Gordon Office Supplies on account, 1,200. 7Night paid 40 each for one-year subscriptions to Fishing Illustrated, Fishing Unlimited, and Fish Master. The magazines are published monthly. 10Deposited registration fees, 62,750. 13Paid wages to fishing guides, 30,000. (Dont forget wages payable.) 14A guest became ill and was unable to stay for the entire week. A refund was issued in the amount of 1,000. 17Deposited registration fees, 63,000. 19Purchased food supplies from Acme Super Market on account, 18,400. 21Deposited registration fees, 63,400. 23Paid 2,500 for advertising spots on National Sports Talk Radio. 25Paid repair fee for damaged boat, 850. 27Paid wages to fishing guides, 30,000. 28Paid 1,800 for advertising spots on billboards. 29Purchased food supplies from Acme Super Market on account, 14,325. 30Paid utilities bill, 3,300. 30Paid phone bill, 1,800. 30Paid Acme Super Market on account, 47,350. 31Bob Night withdrew cash for personal use, 7,500. Adjustment information at the end of May is provided below. (a) Total vending machine sales were 2,300 for the month of May. A 10% commission is earned on these sales. (b) Straight-line depreciation is used for the 10 boats purchased on April 2 for 60,000. The useful life for these assets is five years and there is no salvage value. A full months depreciation was taken in April on these boats. Straight-line depreciation is also used for the two boats purchased in May. Make one adjusting entry for all depreciation on the boats. (c) Straight-line depreciation is used to depreciate the surround sound system. (d) Straight-line depreciation is used to depreciate the big screen TV. (e) Straight-line depreciation is used for the building purchased in May. (f) On April 2, Night paid 9,000 for insurance during the six-month camping season. Mays portion of this premium was used up during this month. (g) Night received his May issues of Fishing Illustrated, Fishing Unlimited, and Fish Master. (h) Office supplies remaining on hand, 150. (i) Food supplies remaining on hand, 5,925. (j) Wages earned, but not yet paid at the end of May, 6,000. REQUIRED 1. Enter the transactions in a general journal. Enter transactions from May 14 on page 5, May 528 on page 6, and the remaining entries on page 7. To save time and space, dont enter descriptions for the journal entries. 2. Post the entries to the general ledger. (If you are not using the working papers that accompany this text, you will need to enter the account titles, account numbers, and balances from April 30 in the general ledger accounts.) 3. Prepare a trial balance on a work sheet. 4. Complete the work sheet. 5. Journalize the adjusting entries on page 8 of the general journal. 6. Post the adjusting entries to the general ledger. 7. Prepare the income statement. 8. Prepare the statement of owners equity. 9. Prepare the balance sheet. 10. Journalize the closing entries on page 9 of the general journal. 11. Post the closing entries to the general ledger. 12. Prepare a post-closing trial balance.arrow_forward

- Adjustments for unearned and accrued fees The balance in the unearned fees account, before adjustment at the end of the year, is $900,000. Of these fees, $775,000 have been earned. In addition, $289,500 of fees have been earned hut not hilled to clients. What are the adjustments (a) to adjust the unearned fees account and (h) to record the accrued fees? Indicate each account affected, whether the account is increased or decreased, and the amount of the increase or decrease.arrow_forwardThe unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: PS Music Unadjusted Trial Balance July 31, 2018 The data needed to determine adjustments are as follows: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2. Supplies on hand at July 31, 275. The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2. Depreciation of the office equipment is 50. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2. Accrued wages as of July 31 were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated DepreciationOffice Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance.arrow_forwardComprehensive problem 1 Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement. 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 1-15; 9,180. 16. Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 1-16, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 16-20, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 17-23, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 26-31, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Paid dividends, 10,500. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two- column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account 34 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forward

- 9.1 From the transaction(in image) you are required to : After completing the Unadjusted trial balance use the below information to prepare the Adjusted Trial Balance. a.Unearned revenue OMR 1000 at the end of the month. b. Rent expense for the month OMR 200 c. The Equipment has useful life 3 years and residual value OMR 500arrow_forwardFE16 From the following transactions as well as additional data, please complete the entire accountingcycle (including of preparing a post-closing trial balance) for Carryon’s Plumbing201X Jan1 Carryon invested $104,900 cash and $82,000 worth of plumbing equipment into the plumbingcompany.1 Paid rent for eight months in advance for garage space. Rent per month is $3,250.4 Purchased office equipment on account from Daisy Corp., $42,610. 6 Purchased supplies for $12,455 cash.8 Collected $39,000 from plumbing local shopping centers.12 Chris withdrew $23,050 from the business for his own personal use.20 Repaired Alton Co. parking lots, payment not to be received until March, $9,200.26 Paid salaries to employees, $10,285.28 Paid Daisy Corp. one-half amount owed for office equipment.29 Advertising bill received from bigtime Co. but will not be paid until May, $3,740.30 Paid telephone bill, $1,030Adjustment Dataa. Supplies on hand, $1,310.b. Rent expired, $3,250.c. Depreciation on office…arrow_forwardFE16 From the following transactions as well as additional data, please complete the entire accountingcycle (including of preparing a post-closing trial balance) for Carryon’s Plumbing201X Jan1 Carryon invested $104,900 cash and $82,000 worth of plumbing equipment into the plumbingcompany.1 Paid rent for eight months in advance for garage space. Rent per month is $3,250.4 Purchased office equipment on account from Daisy Corp., $42,610.arrow_forward

- Q4: The trial balance columns of the worksheet for Acer service Co.LLC, are as follows. Acer service Co.LLC, Worksheet (partial) for the Month Ended January 31, 2020 Account Title/Ledger Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit Debit Credit Cash 4,400 Accounts receivable 2,600 Prepaid Rent 1200 Supplies 900 Equipment 8,400 Notes Payable 2,000 Accounts payable 1,450 Unearned revenue 1,500 Capital 8,600 Drawings 1,400 Service revenue 6,700 Salaries expenses 800 Interest expenses 250 Advertising expenses 300 20,250 20,250 Other data: At the…arrow_forward2. Post the journal to a ledger of four-column accounts.3. Prepare an unadjusted trial balance.4. At the end of June, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).a. Insurance expired during June is $200.b. Supplies on hand on June 30 are $650.c. Depreciation of office equipment for June is $250. d. Accrued receptionist salary on June 30 is $220.e. Rent expired during June is $2,000.f. Unearned fees on June 30 are $1,875.5. Enter the unadjusted trial balance on an end-of-period spreadsheet (work sheet) and complete the spreadsheet.6. Journalize and post the adjusting entries.7. Prepare an adjusted trial balance.8. Prepare an income statement, a statement of owner’s equity, and a balance sheet.9. Prepare and post the closing entries. (Income Summary is account #33 in the chart of accounts.)Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry.10. Prepare a post-closing trial balancearrow_forwardQuestion 8 Which journal entry reflects the adjusting entry needed on December 31?: In November, BOC received a $5,000 cash deposit from a customer for custom-build goods that will be delivered in January (BOC recorded an entry for this $5,000 in November). Now, it is December 31, the end of the fiscal year. a. Dr. Advances from Customers 5,000 Cr. Revenue 5,000 b. Dr. Unearned Revenue 5,000 Cr. Revenue 5,000 c. Dr. Cash 5,000 Cr. Revenue 5,000 d. No entry needed. e. Dr. Unearned Revenue 5,000 Cr. Inventory 5,000arrow_forward

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning