RU-N PRINCIPLE OF CORPORATE FINANCE & C

13th Edition

ISBN: 9781264189229

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1SQ

(PRICE) In February 2009, Treasury 8.5s of 2020 yielded 3.2976%. What was their price? If the yield rose to 4%, what would happen to the price?

Expert Solution

Summary Introduction

To determine: The price of bond at a yield of 3.2976%.

Answer to Problem 1SQ

The price of bond at a yield of 3.2976% is $147.67.

Explanation of Solution

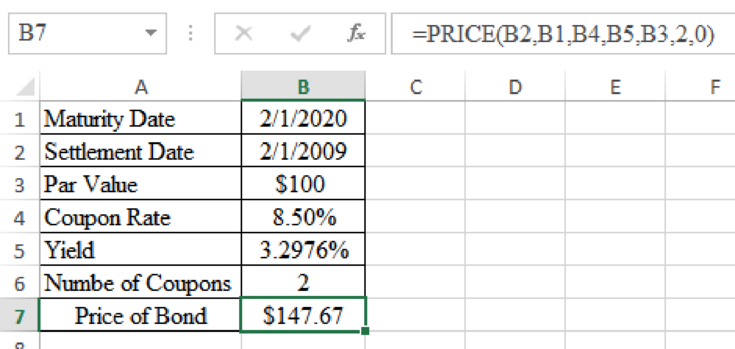

Determine the price of bond at a yield of 3.2976%

Excel Spreadsheet:

Therefore the price of bond at a yield of 3.2976% is $147.67.

Expert Solution

Summary Introduction

To determine: The price of bond at a yield of 4%.

Answer to Problem 1SQ

The price of bond at a yield of 4% is $139.73.

Explanation of Solution

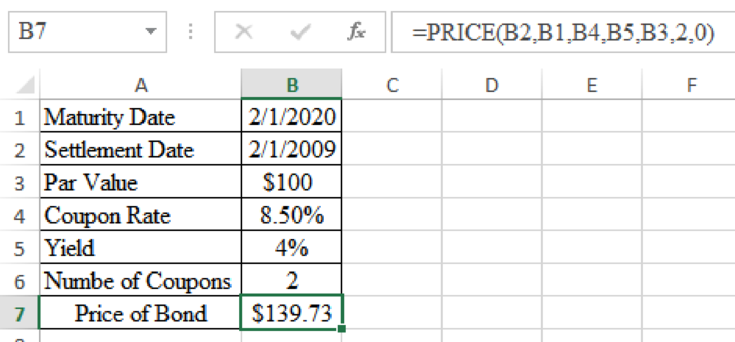

Determine the price of bond at a yield of 4%

Excel Spreadsheet:

Therefore the price of bond at a yield of 4% is $139.73.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

4 -

Based on economistsAc€?c forecasts and analysis, 1-year Treasury

bill rates and liquidity premiums for the next four years are

expected to be as follows:

R1

=

.90%

E(2r1)

=

2.05%

L2

=

0.09%

E(3r1)

=

2.15%

L3

=

0.12%

E(4r1)

=

2.45%

L4

=

0.14%

Using the liquidity premium theory, plot the current yield

curve. Make sure you label the axes on the graph and identify the

four annual rates on the curve both on the axes and on the yield

curve itself. (Do not round intermediate calculations.

Round your answers to 2 decimal places.)

Year

Current (Long-term) Rates

1

%

2

%

3

%

4

%

6 - On March 11, 20XX, the existing or current (spot) 1-, 2-,

3-, and 4-year zero coupon Treasury security rates were as

follows:

1R1 = 0.90%,

1R2 =

1.50%, 1R3

=

1.90%, 1R4

= 2.05%

Using the unbiased…

Treasury bill yield is 10%, ABC company’s expected return for the next year is 18%, beta of ABC company is 2. If everything is in equilibrium as required by CAPM, what is the market’s expected return for the next year?

a. 14%

b. 8.5%

c. 11%

d. 21%

Treasury bill yield is 10%, ABC company’s expected return for the next year is 18%, beta of ABC company is 2. If everything is in equilibrium as required by CAPM, what is the market’s expected return for the next year?

14%

8.5%

11%

21%

Chapter 3 Solutions

RU-N PRINCIPLE OF CORPORATE FINANCE & C

Ch. 3 - (PRICE) In February 2009, Treasury 8.5s of 2020...Ch. 3 - (YLD) On the same day, Treasury 3.5s of 2018 were...Ch. 3 - (DURATION) What was the duration of the Treasury...Ch. 3 - (MDURATION) What was the modified duration of the...Ch. 3 - Bond prices and yields A 10-year bond is issued...Ch. 3 - Bond prices and yields The following statements...Ch. 3 - Bond prices and yields Construct some simple...Ch. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields A 10-year U.S. Treasury...

Ch. 3 - Bond returns If a bonds yield to maturity does not...Ch. 3 - Bond returns a. An 8%, five-year bond yields 6%....Ch. 3 - Prob. 10PSCh. 3 - Duration True or false? Explain. a....Ch. 3 - Duration Here are the prices of three bonds with...Ch. 3 - Duration Calculate the durations and volatilities...Ch. 3 - Prob. 14PSCh. 3 - Duration Find the spreadsheet for Table 3.4 in...Ch. 3 - Prob. 16PSCh. 3 - Spot interest rates and yields Which comes first...Ch. 3 - Prob. 18PSCh. 3 - Spot interest rates and yields Look again at Table...Ch. 3 - Prob. 20PSCh. 3 - Spot interest rates and yields Assume annual...Ch. 3 - Spot interest rates and yields A 6% six-year bond...Ch. 3 - Spot interest rates and yields Is the yield on...Ch. 3 - Prob. 24PSCh. 3 - Measuring term structure The following table shows...Ch. 3 - Term-structure theories The one-year spot interest...Ch. 3 - Term-structure theories Look again at the spot...Ch. 3 - Real interest rates The two-year interest rate is...Ch. 3 - Prob. 30PSCh. 3 - Bond ratings A bonds credit rating provides a...Ch. 3 - Prob. 32PSCh. 3 - Price and spot interest rates Find the arbitrage...Ch. 3 - Prob. 34PSCh. 3 - Prices and spot interest rates What spot interest...Ch. 3 - Prices and spot interest rates Look one more time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Consumer Price Index (CPI) was recently forecast to be 3.3%., implying that 3.3% will be the annual inflation rate. What is the minimum rate of return that a Treasury bill must earn to reach your investment goal of a 2% real rate of return? also, if Major Company pays a $2.10 annual cash dividend (D0) and it plans to keep the dividend at $2,10 for the future since no future growth is anticipated. If the stockholders require a rate of return of 12 percent, what is the price of the common stock?arrow_forwardThe S&P500 is trading at 4,200, and the expected dividend over the next year is $63.00. You expect the economy to grow by 3% annually, and the annual inflation rate will be 5% over the long term. The yield to maturity on 10-year US Treasuries is 6.0% What is the long-term expected return on the S&P500? 3.500% 9.500% 1.500% 7.500%.arrow_forwardThe level of the Syldavia market index is 21,900 at the start of the year and 26,400 at the end. The dividend yield on the index is 4.7%. What is the return on the index over the year? If the interest rate is 6%, what is the risk premium over the year? If the inflation rate is 8%, what is the real return on the index over the year? Note: For all requirements, do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places.arrow_forward

- One-year Treasury bills yield 6 percent, while Treasury notes with 2-year maturities yield 6.7 percent. If the expectations theory holds (that is, the maturity risk premium is zero), what is the market’s forecast of what 1-year T-bills will be yielding one year from now?arrow_forwardThe graph (attached) depicts yield curves for 5 November 2021, 5 November, 2022, and 5 November, 2019. The yield rates are given for each of those in the graph. a) As of today, what is the one-year interest rate expected by financial market participants for November 5, 2023? Does it appear that financial market participants are currently expecting changes in monetary policy within the next two years?arrow_forwardThe level of the Syldavian market index is 23,000 at the start of the year and 27,500 at the end. The dividend yield on the index is 5.5%. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) If the interest rate is 8%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) If the inflation rate is 9%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- Suppose 1-year T-bills currently yield 7.40% and the future inflation rate is expected to be constant at 3.00% per year. What is the real risk-free rate of return, r*? Disregard any cross-product terms, i.e., if averaging is required, use the arithmetic average. a. 4.40% b. 7.40% c. 10.40% d. 7.62% e. 5.20%arrow_forwardAssume that between 2005 and 2015 the price level doubled. What is the approximate average annual rate of inflation over this ten-year period? a. 7% b. 10% c. 5% d. 2% e. 1%arrow_forwardThe yield on a one-year Treasury security is 5.6100%, and the two-year Treasury security has a 6.7320% yield. Assuming that the pure expectations theory is correct, what is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) a 9.9897% b 8.9671% c 7.8659% d 6.686%arrow_forward

- The graph (attached) depicts yield curves for 5 November 2021, 5 November, 2022, and 5 November, 2019. The yield rates are given for each of those in the graph (attached). a) As of 5 November 2021, what is the one-month interest rate expected by market participants in 5 January, 2022? Are they expecting a change in monetary policy within that time frame?arrow_forwardA commercial bill with a face value of P50 000 has a current price of P49291. Thisbill is trading at a yield of 7.5% which necessarily implies a time to maturity ofhow many days? (Just give the number)arrow_forwardSuppose GE plans to issue a note that matures in 2 years and has a 3.67% coupon rate. If the market yield is 4.91%, what is the market price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License