Spreadsheet Modeling & Decision Analysis: A Practical Introduction To Business Analytics, Loose-leaf Version

8th Edition

ISBN: 9781337274852

Author: Ragsdale, Cliff

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 3, Problem 2.5C

Summary Introduction

Case summary:

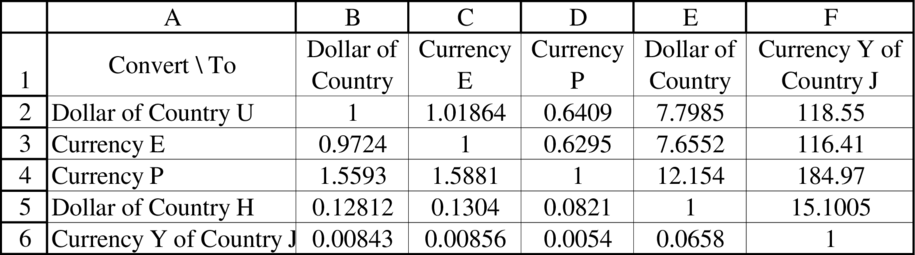

The case deals with the foreign exchange trading at Company B. The following information are given:

To determine: Whether the given scenario lower the transaction cost.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Santander Bank, formerly Sovereign Bank, is a wholly-owned subsidiary of the Spanish Santander Group. It is based in Boston and its principal market is the northeastern United States. It has $57.5 billion in deposits, operates about 650 retail banking offices and over 2,000 ATMs, and employs approximately 9,800 people. It offers an array of financial services and products including retail banking, mortgages, corporate banking, cash management, credit card, capital markets, trust and wealth management, and insurance. Santander Bank has decided to enter the UAE market.

1. What resources and competencies does Santander Bank need to compete in the UAE market?

The Reserve Bank of South Africa requires you to employ a business analyst to implement a new Enterprise Resources Planning (ERP) system. What are the advantages and disadvantages of hiring a business analyst with an IT background rather than a business management background?

The banks that are permitted in the conduct of foreign exchange operations are included in the __________ association of banks.

What are the foreign assets of the BSP held, mostly as an investment in foreign issuing facilities, monetary gold, and foreign exchange $2,000

The amount of funds that the bank holds to ensure that it is able to meet liabilities in case of sudden withdrawal, influences the decrease or increase of money supply and interest rate. So whatever the amount involved, what do you call that? It influenced the increase or decrease of the money supply and interest rate

It is the process of consolidating the control and coordination of cash flows across different business units, rotations, currencies, and banks accounts

It refers to the collection of laws, processes, and regulations that prevent legally obtain money from entering the financial system, it sets limits on how much cash an individual can hold

Who is the new BSP Government/

Chapter 3 Solutions

Spreadsheet Modeling & Decision Analysis: A Practical Introduction To Business Analytics, Loose-leaf Version

Ch. 3 - Prob. 1QPCh. 3 - Prob. 2QPCh. 3 - Prob. 3QPCh. 3 - Prob. 4QPCh. 3 - Prob. 5QPCh. 3 - Prob. 6QPCh. 3 - Refer to question 19 at the end of Chapter 2....Ch. 3 - Prob. 8QPCh. 3 - Prob. 9QPCh. 3 - Prob. 10QP

Ch. 3 - Prob. 11QPCh. 3 - Prob. 12QPCh. 3 - Prob. 13QPCh. 3 - Prob. 14QPCh. 3 - Prob. 15QPCh. 3 - Prob. 16QPCh. 3 - Prob. 17QPCh. 3 - Tuckered Outfitters plans to market a custom brand...Ch. 3 - Prob. 19QPCh. 3 - Prob. 20QPCh. 3 - Prob. 21QPCh. 3 - Prob. 22QPCh. 3 - Prob. 23QPCh. 3 - Prob. 24QPCh. 3 - Prob. 25QPCh. 3 - Prob. 26QPCh. 3 - A manufacturer of prefabricated homes has decided...Ch. 3 - Prob. 28QPCh. 3 - Prob. 29QPCh. 3 - Prob. 30QPCh. 3 - Prob. 31QPCh. 3 - Prob. 32QPCh. 3 - Prob. 33QPCh. 3 - Prob. 34QPCh. 3 - Prob. 35QPCh. 3 - Prob. 36QPCh. 3 - Prob. 37QPCh. 3 - Prob. 38QPCh. 3 - Prob. 39QPCh. 3 - Prob. 40QPCh. 3 - Prob. 41QPCh. 3 - Prob. 42QPCh. 3 - Prob. 43QPCh. 3 - Prob. 44QPCh. 3 - A natural gas trading company wants to develop an...Ch. 3 - Prob. 46QPCh. 3 - The CFO for Eagle Beach Wear and Gift Shop is in...Ch. 3 - Prob. 48QPCh. 3 - Prob. 1.1CCh. 3 - Prob. 1.2CCh. 3 - Prob. 1.3CCh. 3 - Prob. 1.4CCh. 3 - Prob. 2.1CCh. 3 - Prob. 2.2CCh. 3 - Prob. 2.3CCh. 3 - Prob. 2.4CCh. 3 - Prob. 2.5CCh. 3 - Kelly Jones is a financial analyst for Wolverine...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Similar questions

- Bank Dhofar and Bank Oman jointly provide large term loans to the borrower against a common security. Such loans are called: a. Non participation loan b. Individual loan c. Corporate loan d. Participation loanarrow_forwardAssume that the Bank of Ecoville has the following balance sheet and the Fed has a 10% reserve requirement in place: Balance Sheet for Ecoville International Bank ASSETS LIABILITIES Cash $33,000 Demand Deposits $99,000 Loans 66,000 Now assume that the Fed lowers the reserve requirement to 8%. If the money multiplier is 5, how much money will ultimately be created by this event?arrow_forwardBased in Mauritius and employing around 80 employees, ABG Ltd. is involved in the import, sale, repairs and maintenance of passenger vehicles. The shares of the company are held by twenty persons and it is managed by a Board of Directors comprising of six members. The Chairperson of the Board is also the Chief Executive Officer (CEO). Other Board members include the Financial Manager (being part of executive management) and four Non-Executive Directors who had been appointed by the Chairperson/CEO on the basis of past relationships. The Chairperson/ CEO sets the Board agenda, distributes Board papers in advance of meetings and briefs Board members in relation to each agenda item. At each meeting of the Board, the financial performance of ABG Ltd. is reviewed in detail and the Financial Manager is expected to provide additional information as and when required. Other issues that regularly appear as agenda items include new legislation (laws). The Board seldom discusses about operational…arrow_forward

- In 1983, MGMT eCash Inc. developed a type of cryptographic electronic currency, ecash, which was later used in 1995, as digicash for cryptographic electronic payments. This early form of cryptographic electronic payments, led to the conception of Bitcoin, a well-known cryptocurrency. Thereafter, many forms of cryptocurrencies were developed where you can buy, sell or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euros. Basically, an exchange is where buyers and sellers conduct their business.“Crypto-currencies have the potential to transform fundamental aspects of industry and society and make a considerable difference to the activities of government bodies and policy-making. They are perhaps the truest form of digital economy technology that has yet emerged – sitting at the crossroads of technology, economics, social sciences and business – where cryptography has managed to disrupt our established practices and notions of trust,…arrow_forwardIn 1983, MGMT eCash Inc. developed a type of cryptographic electronic currency, ecash, which was later used in 1995, as digicash for cryptographic electronic payments. This early form of cryptographic electronic payments, led to the conception of Bitcoin, a well-known cryptocurrency. Thereafter, many forms of cryptocurrencies were developed where you can buy, sell or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euros. Basically, an exchange is where buyers and sellers conduct their business.“Crypto-currencies have the potential to transform fundamental aspects of industry and society and make a considerable difference to the activities of government bodies and policy-making. They are perhaps the truest form of digital economy technology that has yet emerged – sitting at the crossroads of technology, economics, social sciences and business – where cryptography has managed to disrupt our established practices and notions of trust,…arrow_forwardIn 1983, MGMT eCash Inc. developed a type of cryptographic electronic currency, ecash, which was later used in 1995, as digicash for cryptographic electronic payments. This early form of cryptographic electronic payments, led to the conception of Bitcoin, a well-known cryptocurrency. Thereafter, many forms of cryptocurrencies were developed where you can buy, sell or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euros. Basically, an exchange is where buyers and sellers conduct their business.“Crypto-currencies have the potential to transform fundamental aspects of industry and society and make a considerable difference to the activities of government bodies and policy-making. They are perhaps the truest form of digital economy technology that has yet emerged – sitting at the crossroads of technology, economics, social sciences and business – where cryptography has managed to disrupt our established practices and notions of trust,…arrow_forward

- BDO is a universal bank that offers a wide range of services. Lending (corporate, middle market, SME, and consumer), Deposit-taking, Foreign Exchange, Brokering, Trust and Investments, Credit Cards, Corporate Cash Management, and Remittances are just a few of the industry-leading products and services it can provide to the retail and corporate markets. The Bank provides Leasing and Financing, Investment Banking, Private Banking, Bancassurance, Insurance Brokerage, and Stock Brokerage services through its subsidiaries. When it comes to engaging employees in a way that results in a better customer experience, there are five things you must do. From the top, lead the initiative. Employee engagement efforts can begin at the bottom or within a division, but true organisational impact requires the support of senior management. Segment your employees the same way you would your customers. Working with key business and functional heads, as well as HR, is critical to understanding the…arrow_forwardLester Field Insurance (LFI) offers insurance products covering individual and organisational assets. LFI allows individuals and organisations to transfer the risk or chance of loss to the insurance company. For example, LFI accepts the risk or probability of loss through a written contract and agrees to pay out a certain amount of money to restore your valuables. The type of insurance offered includes property insurance, car insurance, travel insurance, household insurance and income protection plan. The company is rated to have one of the lowest rates of fraud claims in the industry. Due to COVID-19, staff had to go on a rotational basis to accommodate social distancing. LFI IT team designed a website that assists customers to log their claims online. This solution has a significant impact on different stakeholders in the organisation. The business problem that LFI is currently facing is that the claims process is too slow. LFI project manager seeks to implement a strategy that…arrow_forwardLester Field Insurance (LFI) offers insurance products covering individual and organisational assets. LFI allows individuals and organisations to transfer the risk or chance of loss to the insurance company. For example, LFI accepts the risk or probability of loss through a written contract and agrees to pay out a certain amount of money to restore your valuables. The type of insurance offered includes property insurance, car insurance, travel insurance, household insurance and income protection plan. The company is rated to have one of the lowest rates of fraud claims in the industry. Due to COVID-19, staff had to go on a rotational basis to accommodate social distancing. LFI IT team designed a website that assists customers to log their claims online. This solution has a significant impact on different stakeholders in the organisation. The business problem that LFI is currently facing is that the claims process is too slow. LFI project manager seeks to implement a strategy that…arrow_forward

- Assume that you recently graduated with a degree in finance and have just reported to work as financial adviser at the brokerage firm of Capital Asas Berhad, Your first assignment is to explain nature of the Malaysian financial markets to Martin Johnson, a potential investor. He expects to invest substantial amounts of money through Capital Asas Berhad. He is very optimistic; therefore, he would like to understand in general terms what will happen to her money. Your supervisor has developed the following questions that you must use to explain the Malaysian financial system to Johnson. A) Describe the different ways in which capital can be transferred from suppliers of capital to those who are demanding capital.arrow_forwardBadwin Ltd is a rapidly growing company presently owned by the Badwin family. It sells designer clothing and accessories that it sourced from around the world and the trading result are exceeding expectations. The family is looking to cash in on the success of the business and also provide some capital for expansion, so they have decided to float the company on the stock exchange. At present, the board of directors consists of Mark Badwin who is the Chairman and Managing Director, and his two sons David and John who are Sales and Buying Directors respectively. They are going to appoint Bill Struter who is presently the Chief Accountant, as Financial Director just before flotation. The Auditor, T & R are a little concerned that the Stock Exchange will find the level of Corporate Governance unacceptably low, if not actually non-existence, and they think they should tell Mark Badwin, who is dogmatic and not a man who like others interfering in his business, what he need to do to…arrow_forwardDiscuss the existing Anti Money Laundering Policy of BNY Mellon Bank (The Bank of New York Mellon Corporation). Identify at least three loopholes of the policy. Recommend changes to prevent especially Bitcoin and Cryptocurrency money laundering.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON