Loose-leaf For Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781260190083

Author: Jacqueline L. Reck James E. Rooks Distinguished Professor, Suzanne Lowensohn, Daniel Neely

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 26EP

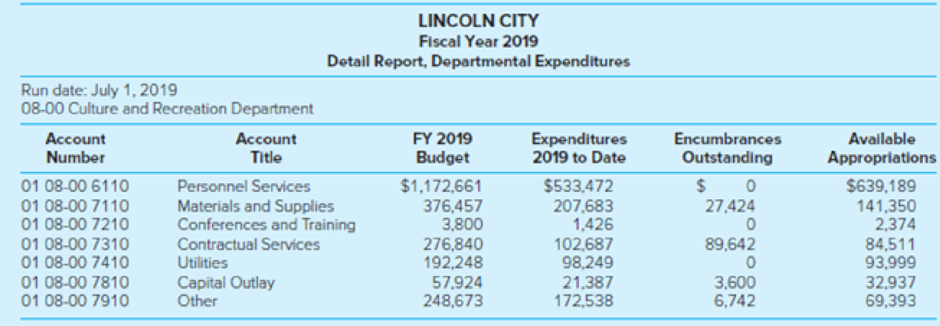

Review the computer-generated budgetary comparison report presented below for the Lincoln City Culture and Recreation Department as of July 1 of its fiscal year ending December 31, and respond to the questions that follow.

Required

- a. What is the likely reason there are no outstanding encumbrances for the Personnel Services, Conferences and Training, and Utilities accounts?

- b. Does it appear that the Culture and Recreation Department may overexpend its appropriation for any accounts before the end of the fiscal year? If so, which accounts may run short?

- c. Does it appear that the Culture and Recreation Department may underexpend any of its appropriations for the fiscal year? If so, which accounts may have excessive spending authority?

- d. What factors may explain the expenditure patterns observed in parts b and c?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The general ledger of the County of Konstantin contains the following selected account balances:

$91400

$35600

$16500

$5700

Appropriations

Outstanding Encumbrances

Expenditures

Vouchers Payable

Konstantin wants to order additional goods and services before the fiscal year end.

What is the unencumbered balance (i.e., the remaining authority) of the budget that may be expended by

Konstantin?

BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF

$1,000.

"The City of Lakeview adopts its budget on a basis of accounting that permits outstanding purchase

commitments to be charged against the budget in the year that the goods are ordered instead of in the year

they are received. During the year the city ordered and received $4,000 of supplies (of which $3,000 had been

paid and $1,000 was unpaid) and had $500 of outstanding purchase commitments for supplies at year-end. In

the budget-to-actual comparison, the expenditures for supplies would be:

""$3,000"

"$3,500"

"$4,000 "

"$4,500"

Record the entry for the annual budget at the beginning of the year. (General Fund)

Record the end-of-year removal of budget entry. (General Fund)

Chapter 3 Solutions

Loose-leaf For Accounting For Governmental & Nonprofit Entities

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In approving the budget of the City of Troy, the city council appropriated an amount less than expected revenues, what will be the result of this action .a An increase in outstanding encumbrances by the of the fiscal year .b A credit to budgetary fund balance .C A debit to budgetary fund balance .d A necessity for compensatory offsetting action in the debt service fundarrow_forwardWhich of the following statements is true concerning the recording of a budget? Choose the correct.a. At the beginning of the year, debit Appropriations.b. A debit to the Budgetary Fund Balance account indicates an expected surplus.c. At the beginning of the year, debit Estimated Revenues.d. At the end of the year, credit Appropriations.arrow_forwardAssume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands. Prepare, in summary form, the appropriate journal entries. (a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785. (b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20. (c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash. (d) The city received the supplies at an actual cost of $23. (e) The city collected revenues of $795.arrow_forward

- Which of the following statements is true concerning the recording of a budget? At the beginning of the year, debit Appropriations. A debit to the Budgetary Fund Balance account indicates an expected surplus. At the beginning of the year, debit Estimated Revenues. At the end of the year, credit Appropriations.arrow_forwardThe City of Portland has the following budget data for one of its Special Revenue Funds for the upcoming fiscal year: Estimated Revenues: $7,900,000 Appropriations: $8,900,000 Estimated Other Financing Sources: $1,100,000 The city just approved the budget and these amounts. Prepare the necessary budgetary journal entry in the General Ledger to record the budget.arrow_forwardHow do the following terms relate to the end of the budget year or the end of the grant period? Carryover Cash reconciliation Drawdown of fundsarrow_forward

- In an organization that plans by using comprehensive budgeting, the master budget is The booklet containing budget guidelines, policies, and forms to use in the budgeting process. The current budget updated for operations for part of the current year. A compilation of all the separate operational and financial budget schedules of the organization. A budget of a not-for-profit organization after it is approved by the appropriate authoritative body.arrow_forwardShepherd City's original budget included a credit to fund balance of $20,000. During the year, the City recorded an additional entry that debited budgetary fund balance and credited estimated revenues. Which of the following accurately describes what happened? The estimated revenues decreased, reducing the City's projected surplus for the year. The estimated revenues decreased, improving the City's projected surplus for the year. The estimated revenues increased, reducing the City's projected surplus for the year. The estimated revenues increased, improving the City's projected surplus for the year.arrow_forwardConsider the following June actual ending balances and July 31, 2024 budgeted amounts for Octovios: 1(Click the icon to view the information.) Prepare a budgeted balance sheet for July 31, 2024. (Hint: It may be helpful to trace the effects of each transaction on the accounting equation to determine the ending balance of each account.) Complete the accounting equation for the July operating information. (Use a minus sign or parentheses to enter account reductions and contra asset balances and activity. If an input field is not used in the equation leave it empty; do not enter a zero. Abbreviations used: A/P = Accounts Payable, A/R = Accounts Receivable, Accum. Deprec. = Accumulated Depreciation, Merch. = Merchandise.) Stock- Merch. (Accum. Accounts holders' Cash + A/R + Inventory + Furniture + Deprec.) = Payable + equity…arrow_forward

- Consider the following June actual ending balances and July 31, 2024 budgeted amounts for Octovios: 1(Click the icon to view the information.) Prepare a budgeted balance sheet for July 31, 2024. (Hint: It may be helpful to trace the effects of each transaction on the accounting equation to determine the ending balance of each account.) Complete the accounting equation for the July operating information. (Use a minus sign or parentheses to enter account reductions and contra asset balances and activity. If an input field is not used in the equation leave it empty; do not enter a zero. Abbreviations used: A/P = Accounts Payable, A/R = Accounts Receivable, Accum. Deprec. = Accumulated Depreciation, Merch. = Merchandise.) Stock- Merch. (Accum. Accounts holders' Cash + A/R + Inventory + Furniture + Deprec.) = Payable + equity…arrow_forwardThe general fund pays rent for two months. Which of the following is not correct? Choose the correct.a. Rent expense should be reported in the government-wide financial statements.b. Rent expense should be reported in the general fund.c. An expenditure should be reported in the fund financial statements.d. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forwardEdwards City has the following information for its general fund for the upcoming fiscal year. Which of the following would be the appropriate effect to budgetary fund balance when the budget is recorded? Estimated revenue Appropriations Property tax 3,500,000 Salaries 2,690,000 Sales tax 490,000 Capital items 1,320,000 Other 50,000 Other 15,000 None of these Credit budgetary fund balance $30,000 Credit budgetary fund balance $15,000 Debit budgetary fund balance $30,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY