a)

To determine: Average tax rate and marginal tax rate of a single tax payer.

a)

Explanation of Solution

Given information:

The income of the single tax payer is $20,000.

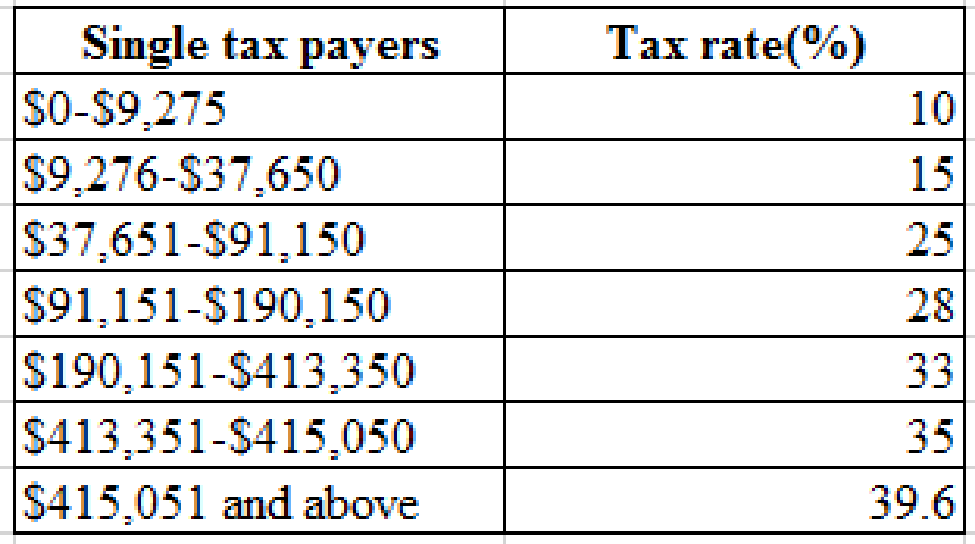

The slab rates of single tax payers are as follows, they are

If the taxable income is $20,000 then up to $9,275 the tax rate is 10% and after that remaining balance is charged under 15% tax rate.

Calculation of taxes:

Hence, taxes are $2,535.95.

Calculation of Average tax rate:

Hence, average tax rate is 12.70%.

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 15% incurred on each additional dollar of his income.

b)

To determine: Average tax rate and marginal tax rate of a single tax payer.

b)

Explanation of Solution

Given information:

The income of the single tax payer is $50,000.

If the taxable income is $50,000 then up to $9,275 the tax rate is 10%, after that tax rate is 15% up to $37,650 then, after remaining balance is charged under 25% tax rate.

Calculation of taxes:

Hence, taxes are $8,270.75.

Calculation of Average tax rate:

Hence, average tax rate is 16.50%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 25% incurred on each additional dollar of his income.

c)

To determine: Average tax rate and marginal tax rate of a single tax payer.

c)

Explanation of Solution

Given information:

The income of the single tax payer is $300,000.

If the taxable income is $300,000 then up to $9,275 the tax rate is 10%, after that tax rate is 15% up to $37,650, up to $91,150 the tax rate is 25% and up to $190,150 the tax rate is 28% and up to $413,350 the tax rate is 33%, then the remaining balance is charged under 35% tax rate.

Calculation of taxes:

Hence, taxes are $82,528.59.

Calculation of Average tax rate:

Hence, average tax rate is 27.50%.

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 33% incurred on each additional dollar of his income.

d)

To determine: Average tax rate and marginal tax rate of a single tax payer.

d)

Explanation of Solution

Given information:

The income of the single tax payer is $3,000,000.

Calculation of taxes:

Hence, taxes are $1,144,170.

Calculation of Average tax rate:

Hence, average tax rate is 38.1%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 39.6% incurred on each additional dollar of his income.

Want to see more full solutions like this?

Chapter 3 Solutions

FUND OF CORPORATE FINANCE LL W/ CONNECT

- PERSONAL TAXES Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was 165,000. a. What is their federal tax liability? b. What is their marginal tax rate? c. What is their average tax rate?arrow_forwardGiven the following tax structure: Taxpayer Salary Total tax Mae $ 14,000 $ 1,260 Pedro $ 52,000 ??? Required: What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? Note: Round your final answer to nearest whole dollar amount. This would result in what type of tax rate structure?arrow_forwardFor the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A man earned a salary of $27,000 and received $1250 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. His total FICA tax is $____.arrow_forward

- (5) Applying the following hypothetical Federal Income Tax Rate Table, for a Single Tax-Filer earning $100,000 annually, calculate the following (Show your Calculations): a) Total Tax Due? b) Marginal Tax Rate? c) Effective Tax Rate?arrow_forwardFor the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A womanearned a salary of $27,000 and received $1000 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. Her income tax is $_____.arrow_forwardCalculate the total tax (FICA and income taxes) owed by each individual in the following pair. Compare their overall tax rates. Assume that each individual is singleand takes the standard deduction. Use the tax rates in the table to the right and the special rates for the dividends and capital gains. Pierre earned $140,000 in wages. Katarina earned $140,000, all from dividends and long-term capital gains. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 For 2017, the FICA tax rates were 7.65% on the first $127,200 of income from wages and 1.45% on any income from wages in excess of $127,200. The tax rates for long-term capital gains and dividends were 0% for income in the 10% and 15% tax…arrow_forward

- Calculate the total tax (FICA and income taxes) owed by each individual in the following pair. Compare their overall tax rates. Assume that each individual is singleand takes the standard deduction. Use the tax rates in the table to the right and the special rates for the dividends and capital gains. Pierre earned $128,000 in wages. Katarina earned $128,000, all from dividends and long-term capital gains. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 For 2017, the FICA tax rates were 7.65% on the first $127,200 of income from wages and 1.45% on any income from wages in excess of $127,200. The tax rates for long-term capital gains and dividends were 0% for income in the 10% and 15% tax…arrow_forwardDividends and Capital Gains. Calculate the total tax (FICA and income taxes) owed by each individual in the following pairs. Compare their overall tax rates. Assume that all individuals are single and take the standard deduction. Use the tax rates in Table 4.9 and the special rates for dividends and capital gains given in the text. Pierre earned $120,000 in wage The answer for Pierre is: FICA $9,180; Income Tax = $23,670; Total tax = $32,850. Tax Rate = 27.4. Thank you. I have included the attachment for the solution the problem.arrow_forwardUsing the following table, calculate the taxes for an individual with taxable income of $25,800. 10% Up to $9,875 12% $9,876–$40,125 22% $40,126–$85,525 24% $85,526–$163,300 32% $163,301–$207,350 35% $207,351–$518,400 37% Over $518,401arrow_forward

- What would be the average tax rate for a person who paid taxes of $6,435 on a taxable income of $40,780? (Enter your answer as a percent rounded to 2 decimal places.)arrow_forward1. Assume that you have 100,000 TL annual income which is subject to a progressive taxation. Calculate your annual tax according to the information given below. Tax brackets Tax Rate 0-9,400TL 15 % 9,400-25,000 25 % 25,000-35,000 35 % 35,000 and above 45 %arrow_forwardIncome Tax rates will be changed to the following Marginal Tax Rates given by: T(I) = 40*I2/ I2+1000 T is the tax rate given as a percentage I is the income of the person in THOUSANDS of dollars What is the Person who makes $20,000 top marginal tax rate? (round the nearest hundredth of a percent)arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning