EBK FINANCIAL REPORTING, FINANCIAL STAT

8th Edition

ISBN: 9781337003193

Author: WAHLEN

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 27PC

Preparing a Statement of Cash Flows from

REQUIRED

REQUIRED

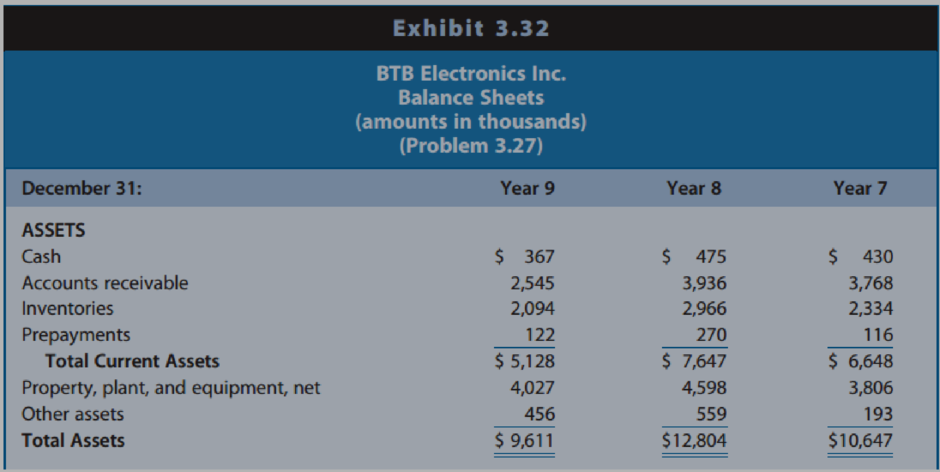

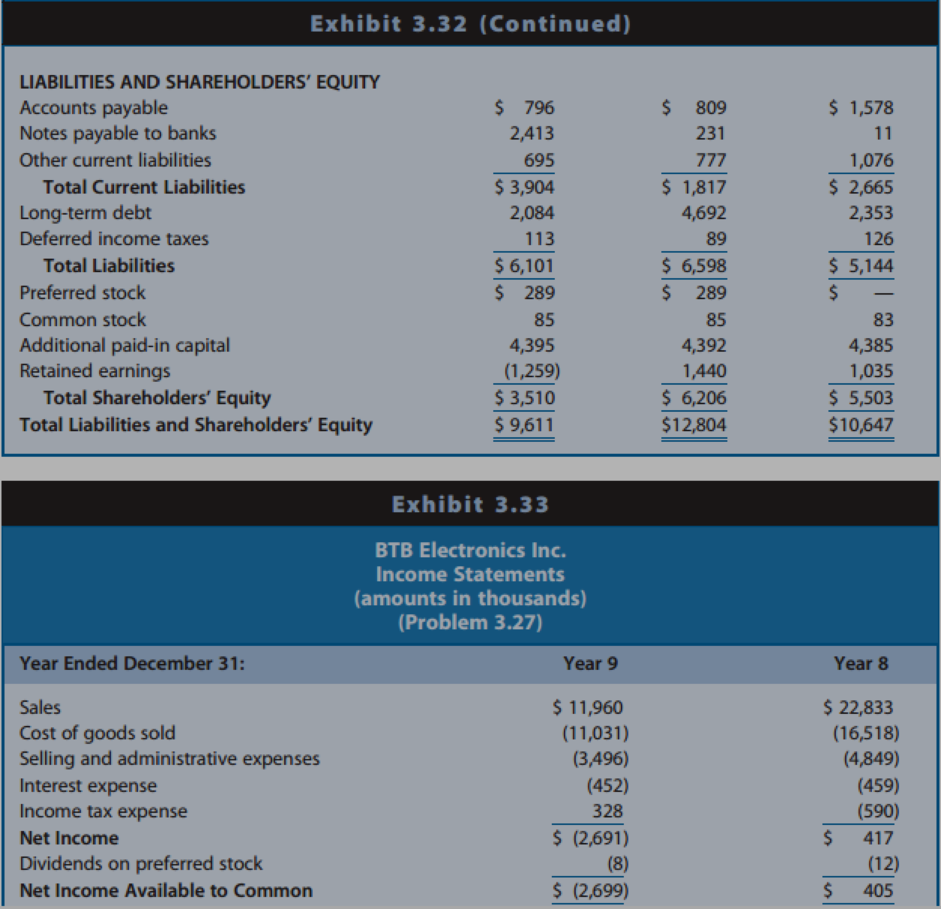

- a. Prepare a worksheet for the preparation of a statement of cash flows for BTB Electronics Inc for Years 8 and 9. Follow the format of Exhibit 3.14 in the text. Notes to the firm’s financial statements reveal the following (amounts in thousands):

- (1)

Depreciation expense was $641 in Year 8 and $625 in Year 9. No fixed assets were sold during these years. - (2) Other Assets represents patents. Patent amortization was $25 in Year 8 and $40 in Year 9. BTB sold a patent during Year 9 at no gain or loss.

- (3) Changes in

Deferred Income Taxes are operating activities.

- (1)

- b. Discuss the relations among net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing activities.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow.

a. Calculate the firm's net operating profit after taxes (NOPAT) for this year.

b. Calculate the firm's operating cash flow (OCF) for the year.

c. Calculate the firm's free cash flow (FCF) for the year.

d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

Data table

(Click on the icon here in order to copy the contents of the data table below into

a spreadsheet.)

Assets

Cash

Marketable securities

Accounts receivable

Inventories

Total current assets

Gross fixed assets

Less: Accumulated depreciation

Net fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Notes payable

Accruals

Keith Corporation Balance Sheets

Total current liabilities

Long-term debt

Total liabilities

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

December 31

Income…

You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets.

Which of the following is true for the statement of cash flows?

It reflects cash generated and used during the reporting period.

It reflects revenues when earned.

Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement.

Operating Activity

Investing Activity

Financing Activity

A company reports a 10% increase in its accounts payable from the last month.

D and W Co. sells its last season’s inventory to a discount store.

Yum Brands distributes dividends to its…

Accounting data are used to analyze cash flows, and this analysis is critical for decision making. Consider the following case:

J&H Corp. recently hired Jeffrey. His immediate mandate was to analyze the company. He has to submit a report on the company's operational

efficiency and estimate potential investment in working capital. He has the income statement from last year and the following information from the

company's financial reports as well as some industry averages.

• Last year, J&H Corp. reported a book value of $400 million in current assets, of which 20% is cash, 22% is short-term investments,

and the rest is accounts receivable and inventory.

• The company reported $340.0 million of current liabilities including accounts payable and accruals. Interestingly, the company had no

notes payable claims last year. There were no changes in the accounts payables during the reporting period.

• The company, however, invested heavily in plant and equipment to support its operations. It…

Chapter 3 Solutions

EBK FINANCIAL REPORTING, FINANCIAL STAT

Ch. 3 - Need for a Statement of Cash Flows. The accrual...Ch. 3 - Articulation of the Statement of Cash Flows with...Ch. 3 - Classification of Interest Expense. Under U.S....Ch. 3 - Prob. 4QECh. 3 - Classification of Changes in Short-Term Financing....Ch. 3 - Classification of Cash Flows Related to...Ch. 3 - Treatment of Non-Cash Exchanges. The acquisition...Ch. 3 - Computing Cash Collections from Customers....Ch. 3 - Computing Cash Payments to Suppliers. Lowes...Ch. 3 - Computing Cash Payments for Income Taxes. Visa...

Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting the Statement of Cash Flows. The...Ch. 3 - Interpreting the Statement of Cash Flows. Texas...Ch. 3 - Interpreting the Statement of Cash Flows. Tesla...Ch. 3 - Interpreting the Statement of Cash Flows. Gap Inc....Ch. 3 - Prob. 19PCCh. 3 - Prob. 20PCCh. 3 - Interpreting the Statement of Cash Flows....Ch. 3 - Extracting Performance Trends from the Statement...Ch. 3 - Interpreting a Direct Method Statement of Cash...Ch. 3 - Prob. 24PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 26PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 1AICCh. 3 - Prob. 1BICCh. 3 - Prob. 1CICCh. 3 - Prob. 1DICCh. 3 - Prob. 1EICCh. 3 - Prob. 1FICCh. 3 - Prob. 1GICCh. 3 - Prob. 1HICCh. 3 - Prob. 2AICCh. 3 - Prob. 2BICCh. 3 - Prob. 2CICCh. 3 - Prob. 2DICCh. 3 - Prob. 2EICCh. 3 - Prob. 2FICCh. 3 - Prob. 3IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- “Cash Is King” for all businesses You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects cash generated and used during the reporting period. It reflects revenues when earned. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity Yum Co. uses cash to repurchase 10% of its common stock. A pharmaceutical company buys marketing rights to sell a drug exclusively in East Asian markets.…arrow_forwardFor the past two years, Monroe Corporation’s statement of cash flows has shown net cash provided by financing activities. Which of the following choices could explain this result? a. Collection of accounts receivable balances. b. Sales of factory equipment. c. Issuance of long-term debt. d. Receipt of cash dividends from investments in other company’s stock.arrow_forwardQuestion Statement of Cash flows Analysis Analyze the statement of cash flows of the companies and find the answers of the followings 1. Are cash flows from operations positive? What is the trend for three years? 2. Is operating cash flows smaller or larger than net income?arrow_forward

- Salus Mea Inc., is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows: Balance sheet at December 31 Cash Accounts receivable Merchandise inventory Property and equipment Less: Accumulated depreciation Accounts payable Wages payable Note payable, long-term Common stock and additional paid-in capital Retained earnings Income statement for current year Sales Cost of goods sold Depreciation expense Other expenses Net income Additional Data: 1. Bought equipment for cash, $48,900. 2. Paid $14,700 on the long-term note payable. Current Year $ 73,250 15,250 23,450 209,250 (57.450) $263,750 $ 16,500 2,000 56,300 103,950 $5,000 $263.750 $205,000 (123,500) (11,700) (4),000) $26.800 3. Issued new shares of stock for $38,050 cash. 4. Dividends of S650 were declared and paid. 5. Other expenses all relate to wages. 6.…arrow_forwardUpon reviewing Myert Company's statement of cash flows, the following was noted: Cash flows from operating activities $60,000 Cash flows from investing activities (125,000) Cash flows from financing activities 115,000 From this information, the most likely explanation is that this company is a using cash from operations and borrowing to purchase long-term assets. b using cash from operations and selling long-term assets to pay back debt. c using its profits to expand growth. d using cash from investors to provide for operations.arrow_forward“Cash Is King” for all businesses You can determine a company’s cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects revenues when earned. It reflects cash generated and used during the reporting period. A. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity A company records a loss of $70,000 on the sale of its outdated inventory. D and W Co. sells its last season’s inventory to a discount store. Yum…arrow_forward

- You are researching Time Manufacturing and have found the following accounting statement of cash flows for the most recent year. You also know that the company paid $98.1 million in current taxes and had an interest expense of $48.1 million. Operations Net income Depreciation TIME MANUFACTURING Statement of Cash Flows (in millions) Deferred taxes Changes in assets and liabilities Accounts receivable Inventories Accounts payable Accrued expenses Other Total cash flow from operations Investing activities Acquisition of fixed assets Sale of fixed assets Total cash flow from investing activities Financing activities Retirement of long-term debt Proceeds from long-term debt sales Dividends Repurchase of stock Proceeds from new stock issue Total cash flow from financing activities Change in cash (on balance sheet) a. Calculate the operating cash flow. b. Calculate the net capital spending. c. Calculate the change in net working capital. d. Calculate the cash flow to creditors. e. Calculate…arrow_forwardThe following is the balance sheet and income statement for Metro Eagle Outfitters, in condensed form, plus some information from the cash flow statement. Balance Sheet Cash and short-term investments Accounts receivable Inventory Other current assets Total current assets Long-lived assets Total assets Current liabilities Total liabilities Shareholders' equity Total liabilities and equity Income Statement Sales Cost of sales Gross margin Operating expenses Earnings before interest and taxes Net income Interest paid in cash Taxes paid in cash Cash Flows Cash flow from operations Capital expenditures Dividends 2022 $ 649,992 48,221 351, 452 111,135 1,160,800 573,332 $ 1,734, 132 $ 480,402 511,045 1,223,087 $ 1,734, 132 1. Inventory turnover. 2. Current ratio. 3. Quick ratio. 4. Cash flow ratio. $ 3,479,602 2,104,480 $ 1,375,122 971, 184 $ 403,938 $ 251,108 99 143,909 $ 604,171 95,839 87,492 Required: Calculate the following liquidity ratios for Metro Eagle in 2021 and 2022: 2021 $…arrow_forwardConsider the following balance sheet and income statement for Mmm Good Foods Incorporated (the company that operates Tasty Fried Chicken and Pizza Party), in condensed form, including some information from the cash flow statement: (amounts are in millions) Balance Sheet Cash and short-term Investments Accounts receivable Inventory Other current assets Long-lived assets Total assets Current liabilities Total liabilities Noncontrolling interest Shareholders equity Total liabilities and equity Income Statement. Sales Cost of sales Gross margin Earnings before interest and taxes Interest Taxes Income from discontinued operations Net income. Share price Earnings per share. Number of outstanding shares (millions) Cash Flows Cash flow from operations Capital expenditures Dividends Mmm Good Foods Incorporated 2019 $ 716 382 48 432 4,068 $5,646 $1,429 11,158 (5,512) $5,646 $ 6,486 3,558 $ 2,928 $1,637 319 336 613 $1,595 $75 5.31 356.2 $1,216 416 754arrow_forward

- Interpreting the Statement of Cash Flows. The Coca-Cola Company (Coca-Cola) manufactures and markets a variety of beverages. Exhibit 3.16 presents a statement of cash flows for Coca-Cola for three years. Required Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm over the three-year period. Identify characteristics of Coca-Cola’s cash flows that you would expect for a mature company. The answer is in the book and I need a different answer. Please explain without copying from another source! It would be nice if you use your words. Thanks!arrow_forwardInterpreting the Statement of Cash Flows. The Coca-Cola Company (Coca-Cola) manufactures and markets a variety of beverages. Exhibit 3.16 presents a statement of cash flows for Coca-Cola for three years. Required Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm over the three-year period. Identify characteristics of Coca-Cola’s cash flows that you would expect for a mature company. Please explain without copying from another source!arrow_forwardPreparing the statement of cash flows—direct method The income statement and additional data of Value Corporation follow: a. Collections from customers are $13,000 more than sales. b. Dividend revenue, interest expense, and income tax expense equal their cash amounts. c. Payments to suppliers are the sum of cost of goods sold plus advertising expense. d. Payments to employees are $3,000 more than salaries expense. e. Cash payment for the acquisition of plant assets is $102,000. f. Cash receipts from sale of land total $29,000. g. Cash receipts from issuance of common stock total $38,000. h. Payment of long-term notes payable is $10,000. i. Payment of dividends is $9,000. j Cash balance at June 30, 2017, was $21,000; at June 30, 2018, it was $43,000. Prepare Value Corporations statement of cash flows for the year ended June 30, 2018. Use the direct method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License