CengageNOWv2, 1 term Printed Access Card for Warren's Survey of Accounting, 8th

8th Edition

ISBN: 9781305961982

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.24E

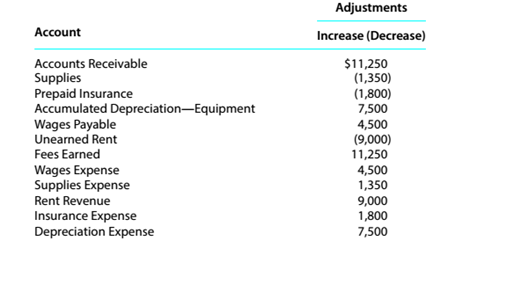

Adjustments

Clean Air Company is a consulting firm specializing in pollution control. The following adjustments were made for Clean Air Company:

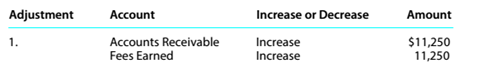

Identify each of the six pairs of adjustments. For each adjustment, indicate the account, whether the account is increased or decreased, and the amount of the adjustment. No account is affected by more than one adjustment. Use the following format. The first adjustment is shown as an example.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Olney Cleaning Company had the following items that require adjustment at year end.

For one cleaning contract, $11,100 cash was received in advance. The cash was credited to Unearned Service Revenue upon receipt. At year end, $260 of the service revenue was still unearned.

For another cleaning contract, $8,700 cash was received in advance and credited to Unearned Service Revenue upon receipt. At year end, $3,000 of the services had been provided.

Required:

1. Prepare the adjusting journal entries needed at December 31. If an amount box does not require an entry, leave it blank.

Dec. 31

Unearned Service Revenue

fill in the blank 02e1a8f7d03afe9_2

fill in the blank 02e1a8f7d03afe9_3

Service Revenue

fill in the blank 02e1a8f7d03afe9_5

fill in the blank 02e1a8f7d03afe9_6

Dec. 31

Unearned Service Revenue

fill in the blank 02e1a8f7d03afe9_8

fill in the blank 02e1a8f7d03afe9_9

Service Revenue

fill in the blank 02e1a8f7d03afe9_11

fill in the blank 02e1a8f7d03afe9_12…

GIVE A DETAILED ANSWER

Describe the effect on the financial statements when an adjustment is prepared that records (a) unrecorded revenue and (b) unrecorded expense. On the basis of what you have learned about adjustments, why do you think that adjusting entries are made on the last day of the accounting period rather than at several times during the accounting period?

“I don’t understand,” complained Chris, who responded to your bulletin board posting in your responsibilities asa tutor. The complaint was in response to your statements that recording adjusting entries is a critical step in theaccounting processing cycle, and the two major classifications of adjusting entries are prepayments and accruals.Required:Respond to Chris.1. When do prepayments occur? Accruals?2. Describe the appropriate adjusting entry for prepaid expenses and for deferred revenues. What is the effecton net income, assets, liabilities, and shareholders’ equity of not recording a required adjusting entry forprepayments?3. Describe the required adjusting entry for accrued liabilities and for accrued receivables. What is the effect onnet income, assets, liabilities, and shareholders’ equity of not recording a required adjusting entry for accruals?

Chapter 3 Solutions

CengageNOWv2, 1 term Printed Access Card for Warren's Survey of Accounting, 8th

Ch. 3 - Assume that a lawyer bills her clients $15000 on...Ch. 3 - On January 24, 20Y8, Niche Consulting collected...Ch. 3 - Prob. 3SEQCh. 3 - If the supplies account indicated a balance of...Ch. 3 - The balance in the unearned rent account for Jones...Ch. 3 - Would AT&T and Microsoft Use the cash basis or the...Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Fees for services provided are billed to a...Ch. 3 - Employees performed services in 20Y8, but the...Ch. 3 - Prob. 5CDQ

Ch. 3 - Is the Land balance before the accounts have been...Ch. 3 - Is the Supplies balance before the accounts have...Ch. 3 - Prob. 8CDQCh. 3 - Prob. 9CDQCh. 3 - Prob. 10CDQCh. 3 - If the effect of an adjustment is to increase the...Ch. 3 - Prob. 12CDQCh. 3 - (a) Explain the purpose of the accounts...Ch. 3 - Prob. 14CDQCh. 3 - Transactions using accrual accounting Terry Mason...Ch. 3 - Adjustment process Using the data from Exercise...Ch. 3 - Financial statements Using the data from Exercises...Ch. 3 - Prob. 3.4ECh. 3 - Accrual basis of accounting Margie Van Epps...Ch. 3 - Classify accruals and deferrals Classify the...Ch. 3 - Classify adjustments The following accounts were...Ch. 3 - Adjustment for supplies Answer each of the...Ch. 3 - Adjustment for prepaid insurance The prepaid...Ch. 3 - Adjustment for unearned fees The balance in the...Ch. 3 - Adjustment for unearned revenue For a recent year....Ch. 3 - Effect of omitting adjustment At the end of...Ch. 3 - Adjustment for accrued salaries Laguna Realty Co....Ch. 3 - Determine wages paid The balances of the two...Ch. 3 - Effect of omitting adjustment Accrued salaries of...Ch. 3 - Effect of omitting adjustment Assume that the...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements The...Ch. 3 - Effects of errors on financial statements If the...Ch. 3 - Adjustment for accrued fees At the end of the...Ch. 3 - Adjustments for unearned and accrued fees The...Ch. 3 - Effect on financial statements of omitting...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Adjustments Clean Air Company is a consulting firm...Ch. 3 - Book value of fixed assets For a recent year....Ch. 3 - Classify assets Identify each of the following as...Ch. 3 - Balance sheet classification At the balance sheet...Ch. 3 - Classified balance sheet Pounds-Away Services Co....Ch. 3 - Prob. 3.29ECh. 3 - Balance sheet List any errors you can find in the...Ch. 3 - Accrual basis accounting San Mateo Health Care...Ch. 3 - Prob. 3.2PCh. 3 - Financial statements Data for San Mateo Health...Ch. 3 - Statement of cash flows Data for San Mateo Health...Ch. 3 - Statement of cash flows Data for San Mateo Health...Ch. 3 - Adjustments and errors At the end of May, the...Ch. 3 - Adjustment process and financial statements...Ch. 3 - Adjustment process and financial statements...Ch. 3 - Adjustment process and financial statements...Ch. 3 - Adjustment process and financial statements...Ch. 3 - Prob. 3.1MBACh. 3 - Prob. 3.2MBACh. 3 - Prob. 3.3MBACh. 3 - Prob. 3.4MBACh. 3 - Prob. 3.5.1MBACh. 3 - Prob. 3.5.2MBACh. 3 - Prob. 3.5.3MBACh. 3 - Prob. 3.5.4MBACh. 3 - Quick ratio The Gap Inc. (GPS)operates specialty...Ch. 3 - Prob. 3.6.2MBACh. 3 - Quick ratio The Gap Inc. (GPs)operates specialty...Ch. 3 - Quick ratio American Eagle Outfitters Inc. (AEO)...Ch. 3 - Quick ratio American Eagle Outfitters Inc. (AEO)...Ch. 3 - Prob. 3.7.3MBACh. 3 - Prob. 3.8MBACh. 3 - Prob. 3.9.1MBACh. 3 - Prob. 3.9.2MBACh. 3 - Prob. 3.9.3MBACh. 3 - Prob. 3.1CCh. 3 - Adjustments for financial statements Several years...Ch. 3 - Prob. 3.3.1CCh. 3 - Prob. 3.3.2CCh. 3 - Prob. 3.4.1CCh. 3 - Prob. 3.4.2CCh. 3 - Accrual versus cash net income. Cigna Corp. (CI)...Ch. 3 - Prob. 3.5.1CCh. 3 - Prob. 3.5.2C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardList the following steps in preparing a work sheet in their proper order. a. Total the statement columns, compute net income (loss), and complete the work sheet. b. Extend adjusted balances to appropriate financial statement columns. c. Prepare an unadjusted trial balance on the work sheet. d. Prepare an adjusted trial balance on the work sheet. e. Enter adjustments data on the work sheet.arrow_forward

- I want to solve the income statement and the statement of financial position for this question after the trial balance and adjustments The data needed to determine year-end adjustments are as follows:a. Supplies on hand at March 31 are $7,500.b. Insurance premiums expired during the year are $1,800.c. Depreciation of equipment during the year is $8,350.d. Depreciation of trucks during the year is $6,200.e. Wages accrued but not paid at March 31 are $600.Instructions1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from…arrow_forwardI want to solve the income statement and the statement of financial position for this question after the trial balance and adjustments The data needed to determine year-end adjustments are as follows:a. Supplies on hand at March 31 are $7,500.b. Insurance premiums expired during the year are $1,800.c. Depreciation of equipment during the year is $8,350.d. Depreciation of trucks during the year is $6,200.e. Wages accrued but not paid at March 31 are $600. Instructions1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following…arrow_forwardIf the Supplies account had an ending balance of $1,200 and the actual count for the remaining supplies was $400 at the end of the period, what adjustment would be needed?arrow_forward

- shouldn't there also be an adjustment for depreciation of equipment and the insurance? the total of my adjusted trial balance for dr and cr came out to 9,700 with those adjustments included. Please let me know if this is correct.arrow_forwardRequirements 1. and 2. Calculate and enter the adjustment amounts directly in the Adjustments columns. Use letters a through d to label the four adjustments. Calculate and enter the adjusted account balances in the Adjusted Trial Balance columns. The account names and unadjusted trial balance amounts as provided in the question have been entered into the worksheet for you. Finish the partial worksheet by completing the adjustments and adjusted trial balance columns. Complete the Adjustments columns by using the letters a through d to label the four adjustments.arrow_forwardWhich of the following statements related to the adjusted trial balance is INCORRECT? Select one: A. Financial statements can be prepared directly from the adjusted trial balance. B. It is prepared before adjusting entries have been made. C. It shows the adjusted balances of all accounts at the end of the accounting period. D. It proves the equality of the total debit balances and the total credit balances in the ledgers. 39. Ahmad Jelani Enterprise produces ladies’ veils using the brand name ‘Taqwa’, which are specially designed for local market. The main fabrics are imported from Laos. Details of the product costing for the past 3 months are as follow: Quantity produced 3,000 units Actual fabrics price RM2.80/meter Standard fabrics price RM2.50/meter Actual quantity used 5.3 meters/unit Standard quantity used 5 meters/unit Actual labour rate RM4.50/hour Standard labour rate RM4.00/hour Actual…arrow_forward

- At the end of the month, the adjusting journal entry to record the use of supplies should include: A) A debit to supplies inventory and a credit to expenses. B) A credit to supplies inventory and a debit to expenses. C) A debit to supplies inventory and a credit to revenue. D) A credit to supplies inventory and a debit to cash. One major difference between deferral and accrual adjustments is: A) deferral adjustments involve previously recorded transactions and accruals involve new transactions. B) deferral adjustments are made after taxes and accrual adjustments are made before taxes. C) deferral adjustments are made annually and accrual adjustments are made monthly. D) deferral adjustments are influenced by estimates of future events and accrual adjustments are not. One major difference between deferral and accrual adjustments is: A) accrual adjustments are influenced by estimates of future…arrow_forwardAdjustments are: Blair’s Custom Shop performed a count of supplies at the end of the accounting period (June 30, 20XX) and determined that value of supplies "on hand" (not used) was $1,700.00. The value of prepaid insurance coverage "on hand" (not used) at the same time was $750.00. Calculate the adjustment amount for Supplies and Prepaid Insurance and enter those amounts on the worksheet. Remember, for each adjustment you should have one entry in the Adjustments DEBIT column and a matching entry in the Adjustments CREDIT column. Extend the adjusted balances for the Supplies and Prepaid Insurance accounts and their related expense accounts to the appropriate columns on the worksheet. Total the Adjustment columns to ensure the debits equal the credits. Total the Income Statement columns and determine net income or net loss to balance debits/credits. Total the Balance Sheet columns and use net income/net loss amount to balance debits/credits. Single and double rule all totals. SAVE…arrow_forwardHello, I started this and got stuck. Please help! Instructions are below. Thanks. Use the following information to complete the Adjustments and Adjusted Trial Balance columns of the work sheet. Depreciation on equipment, $23 Accrued salaries, $26 The $32 of unearned revenue has been earned Supplies available at December 31, $115 Expired insurance, $35 Extend the balances in the Adjusted Trial Balance columns of the work sheet to the proper financial statement columns. Compute totals for those columns, including net income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY